EUR/USD - European Session EUR/USD" width="1596" height="746">

EUR/USD" width="1596" height="746">

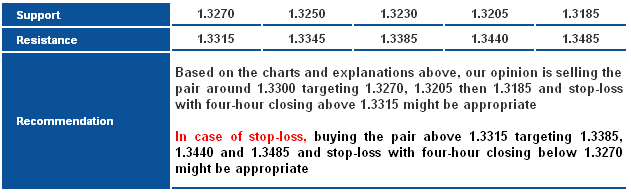

The pair moved to the upside and is currently trading at very sensitive levels represented in key resistance level and close to 23.6% correction at 1.3315. The current upside move which is limited below 1.3315 forces us to keep our negative expectations today. In case the pair stabilizes above the referred to level, we will move immediately to positivity.

The trading range for today is among the key support at 1.3185 and key resistance at 1.3485.

The general trend over short term basis is sideways targeting 1.2775 as far as 1.3600 is daily-closing.

GBP/USD GBP/USD" width="1596" height="746">

GBP/USD" width="1596" height="746">

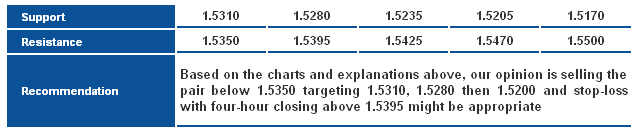

The pair failed to stabilize above 1.5395 keeping negativity, especially with weak signals showing on momentum indicators. The pair has also stabilized below Linear Regression Indicator 34 so we think that we are in front of a new bearish attempt. The possible negativity remains valid unless a four-hour closing above 1.5395 represented in 61.8% correction shown on graph was achieved.

The trading range for today is among key support at 1.5170 and key resistance at 1.5500.

The general trend over short term basis is to the downside as far as areas of 1.5605 remains intact targeting 1.4550.

USD/JPY USD/JPY" width="1596" height="746">

USD/JPY" width="1596" height="746">

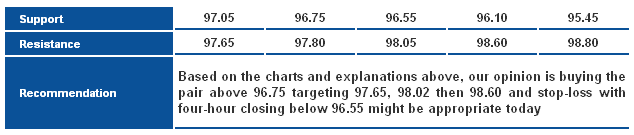

The pair dropped yesterday and the downside move extended today approaching 96.70 represented in 61.8% correction shown on graph. The referred to level represents a potential reversal zone that might form a bullish harmonic Three Drives Pattern. The suggested harmonic pattern does not have a long bearish wave before forming point (1), at the same time we find that Fibonacci measures are very appropriate to suggest the pattern now. We suggest today a bullish correctional move after touching levels close 96.75 – 96.70. Because the pattern isn’t perfect, we will set the stop-loss close to 96.55 and four-hour closing below this level cancel the bullish correction possibility.

The trading range for today is among key support at 95.45 and key resistance at 98.80.

The general trend over short term basis is to the downside as far as areas of 103.50 remain intact targeting 93.50.

USD/CHF USD/CHF" width="1596" height="746">

USD/CHF" width="1596" height="746">

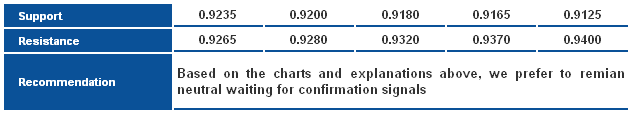

The pair dropped and is trading below 0.9265 which might cause further bearishness. Meanwhile, we cannot bet on extending the downside move in light of being in levels above 88.6% correction at 0.9200. On the other hand, the possibility of a bullish correction again is related to stabilizing above 0.9265 and above Linear Regression Indicators that are trading negatively. Therefore, we prefer to remain intraday neutral today.

The trading range for today is among key support at 0.9165 and key resistance at 0.9370.

The general trend over short term basis is to the downside stable at levels 0.9775 targeting 0.8860.

USD/CAD USD/CAD" width="1596" height="719">

USD/CAD" width="1596" height="719">

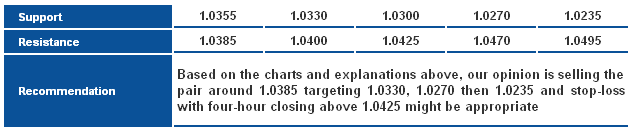

By examining the four-hour graph, we find that the pair is stable around 38.2% correction at 1.0385 and is also stable below Linear Regression Indicators. Linear Regression Indicators are positive but trading below it weakens it, as RSI is showing a negative bias forcing us to expect a downside move today. Breaching 1.0425 levels cancels this possibility.

The trading range for today is between the key support at 1.0215 and the key resistance at 1.0470.

The general trend over short term basis is to the upside with steady daily closing above levels 1.0100 targeting 1.0775.

AUD/USD AUD/CAD" width="1676" height="908">

AUD/CAD" width="1676" height="908">

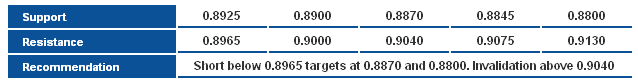

AUDUSD completed a minor double top pattern over the hourly chart, after testing 0.9000 twice before failing and breaking lower. The bearish resumption scenario will probably continue, only a break above 0.9000-0.9040 will threaten for further upside.

NZD/USD NZD/USD" width="1676" height="908">

NZD/USD" width="1676" height="908">

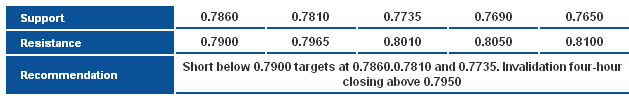

The pair is fluctuating at 0.7900 resistance level and the 50-days SMA, where we expect the bearish bias to resume from this key resistance area and 0.7935. A break and stability above this resistance may open the door for further upside, towards 0.8010.

GBP/JPY GBP/JPY" width="1596" height="762">

GBP/JPY" width="1596" height="762">

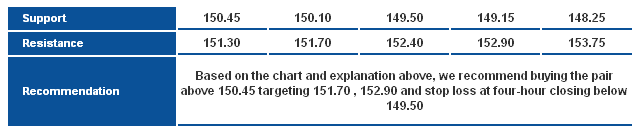

The pair is biased negatively still approaching 150.45; our positive expectations however remain valid above the mentioned 150.45. The MA 50 is attempting to halt negativity and protect the expected bullish scenario.

**Trading range expected today is between the main support at 150.00 and the main resistance 153.45.

**Short-term trend is upside targeting 163.00 if 147.65 remains intact.

EUR/JPY EUR/JPY" width="1596" height="762">

EUR/JPY" width="1596" height="762">

The pair remains limited between the levels mentioned in the previous report as shown on graph and accordingly we remain neutral until we have a confirmed breakout. The conflicting signals between the negativity on MA 50 and positivity on Stochastic further supports our neutral stance.

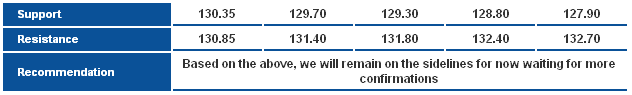

**Trading range expected today is between the main support at 129.30 and the main resistance at 132.00.

**Short-term trend is upside, targeting 140.00 if 124.95 remains intact.

EUR/GBP EUR/GBP" width="1676" height="908">

EUR/GBP" width="1676" height="908">

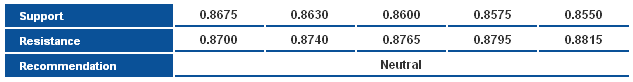

The pair bounced higher yesterday, above our first target at 0.8675. At the current levels, we prefer to move to the sidelines and monitor the price action for a confirmation of the continuation of the ongoing rebound.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Daily Technical Report: EUR/USD Moves To The Upside

Published 08/07/2013, 04:45 AM

Updated 07/09/2023, 06:31 AM

Daily Technical Report: EUR/USD Moves To The Upside

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.