EUR/USD" width="1596" height="746">

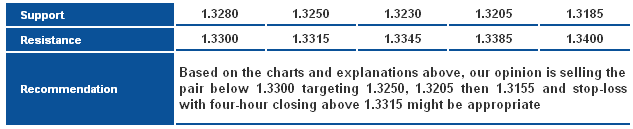

EUR/USD" width="1596" height="746">The pair’s attempt to the upside was halted below key support level of the technical formation which is the Rising Wedge, as the current trading resides below Linear Regression Indicators. These circumstances force us to hold on to our negative expectations where they tend to show a bearish correction unless the pair stabilizes today above 1.3315. Breaking 1.3250 levels later and stabilizing below it is necessary to prove extending the correction.

The trading range for today is among the key support at 1.3155 and key resistance at 1.3400.

The general trend over short term basis is sideways targeting 1.2775 as far as 1.3600 is daily-closing.

GBP/USD GBP/USD" width="1596" height="746">

GBP/USD" width="1596" height="746">

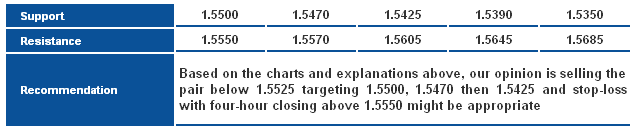

The pair is attempting to the upside but stopped again at 78.6% correction at 1.5550. This level represents an intraday interval and we will benefit from being close to it to suggest some bearish correction during the European session especially that Stochastic is still negative. The resistance level shown on graph and the correctional level referred to support our expectations.

The trading range for today is among key support at 1.5395 and key resistance at 1.5605.

The general trend over short term basis is to the downside as far as areas of 1.5605 remains intact targeting 1.4550.

USD/JPY USD/JPY" width="1596" height="746">

USD/JPY" width="1596" height="746">

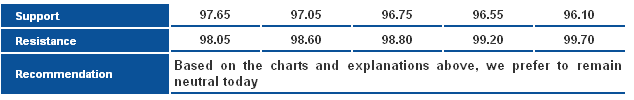

The pair is trading around 50% correction at 97.65 today as shown on graph, which is a significant intraday interval. Stochastic is showing a negative cross over attempt at overbought areas, as RSI and Linear Regression Indicator 55 are trading negatively. The pair is stable above 97.65 but we cannot be negative now, so we will be intraday neutral today.

The trading range for today is among key support at 96.75 and key resistance at 99.20

The general trend over short term basis is to the downside as far as areas of 103.50 remain intact targeting 93.50.

USD/CHF USD/CHF" width="1596" height="746">

USD/CHF" width="1596" height="746">

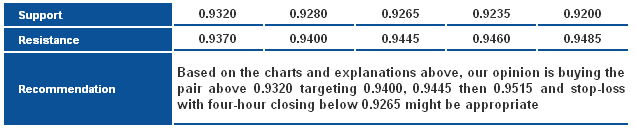

The pair dropped again due to failing to achieve a four-hour closing above 61.8% correction at 0.9370. The pair remained positive due to trading above key resistance level of the intraday descending channel that was breached and turned to support around 0.9290; the pair is also trading above 0.9265. Therefore, we suggest today an upside move without excluding volatility and perhaps some bearish correction, whereas if the corrections were limited within 0.9265 it will remain within the possible bullish bias.

The trading range for today is among key support at 0.9235 and key resistance at 0.9515.

The general trend over short term basis is to the downside stable at levels 0.9775 targeting 0.8860.

USD/CAD USD/CAD" width="1596" height="719">

USD/CAD" width="1596" height="719">

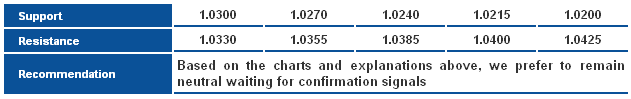

The pair is trading below 1.0330 so we will be neutral again. We cannot be negative now while trading in an ascending channel, Stochastic also tends to be positive. Meanwhile, the current positive situation is inappropriate in light of the negative Linear Regression Indicators and RSI trading below line 50.

The trading range for today is between the key support at 1.0200 and the key resistance at 1.0425.

The general trend over short term basis is to the upside with steady daily closing above levels 1.0100 targeting 1.0775.

AUD/USD AUD/CAD" width="1596" height="746">

AUD/CAD" width="1596" height="746">

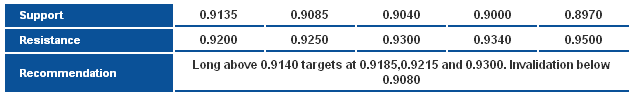

The AUDUSD bounced higher after testing 0.9080 support level, and the ascending trend line that carries the bullish wave. Extending the move to 0.9170 level, and approaching the 50-days SMA and previous high at 0.9215, accordingly, the bullish scenario remains favored.

NZD/USD NZD/USD" width="1596" height="746">

NZD/USD" width="1596" height="746">

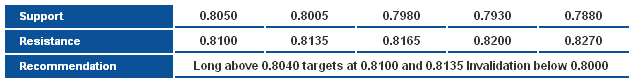

The pair extended the bullish rebound after testing 0.7930 support level, approaching the top of the sideway range at 0.8100-0.8135 area, accordingly, the bullish scenario remains favored, where a break above 0.8135 may confirm a major bullish reversal.