EUR/USD - Weekly Report EUR/USD" width="1356" height="661">

EUR/USD" width="1356" height="661">

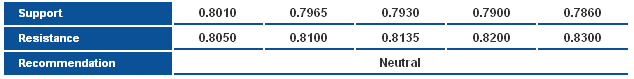

The pair declined again and is currently flirting with Fibonacci 23.6% of the entire upside wave from 1.2040 to 1.3710 as seen on the provided daily chart. Risk versus reward ratio became high for bulls, as the pivotal technical resistance is near, while RSI continues to show signs of weakness close to overbought regions. In the interim, MACD attempts to confirm a slant negative divergence and thus staying aside could be the best technical choice until we get clearer signs to affirm the next big move.

The trading range for this week is among the key support at 1.3080 and key resistance at 1.3550.

The general trend over short term basis is sideways as trading is between 1.2775 and 1.3600 with daily-closing.

GBP/USD GBP/USD" width="1356" height="661">

GBP/USD" width="1356" height="661">

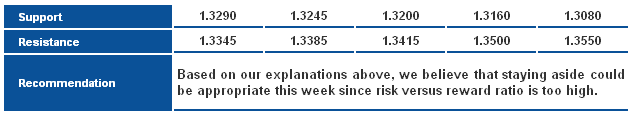

New technical signs appearing on the daily chart prevent us from chasing the sharp rebound started at 1.5200 territories as follows:

- RSI 14 is close to overbought areas.

- MACD may confirm the slant negative divergence.

- Stoppage by 76.4% Fibonacci may prove the efficiency of potential harmonic Gartley pattern.

- Trading close to the short-term downtrend line connecting the movements from 1.6380.

Accordingly, we prefer to stay aside to see the price behaviors around the aforementioned trend line and to see how traders will react with the recently caught bearish signs.

USD/JPY USD/JPY" width="1356" height="661">

USD/JPY" width="1356" height="661">

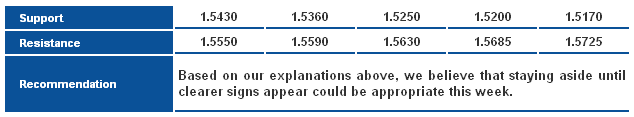

Prices continued to move lower after re-experiencing the short-term falling trend line connecting the movements from the significant high of 103.70 as seen on the provided daily chart. The recently established descending channel in addition to stability below major broken support levels argue us to predicate further weakness this week. Stability below Ribbons lines (EMA 10 to 80) and the bearishness on RSI 14 reinforce our constructive bearish overview with targets 93.80.

The trading range for this week is among key support at 93.80 and key resistance at 99.15.

The general trend over short term basis is to the downside as far as areas of 103.50 remain intact targeting 93.50.

USD/CHF USD/CHF" width="1356" height="661">

USD/CHF" width="1356" height="661">

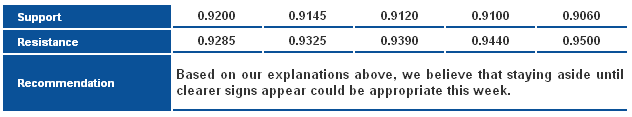

The strong downtrend started at 0.9750 zones has found some kind of support around 0.9190 level, while RSI 14 also has found momentum support close to oversold regions. The contradiction between stability below moving averages and the slant positive divergence appearing on MACD forces us to stand aside this week to see how the pair will react with the recent formed divergence drawn despite the strength of the downtrend. Traders should conquer 0.9390 to bring the positive picture back into focus.

The trading range for this week is among key support at 0.9060 and key resistance at 0.9520.

The general trend over short term basis is to the downside stable at levels 0.9775 targeting 0.8860.

USD/CAD USD/CAD" width="1596" height="762">

USD/CAD" width="1596" height="762">

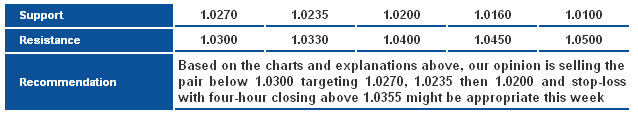

The pair maintains stability below 1.0300 that represents the main factor of extending the intraday expectations of a downtrend, while momentum indicators are gradually losing the positive momentum. Therefore, the downside move remains favored and valid, while the initial targets starts at 1.0200 then 1.0160 levels.

The trading range for this week is between the key support at 1.0100 and the key resistance at 1.0400.

The general trend over short term basis is to the upside with steady daily closing above levels 1.0100 targeting 1.0775.

AUD/USD AUD/CAD" width="1596" height="746">

AUD/CAD" width="1596" height="746">

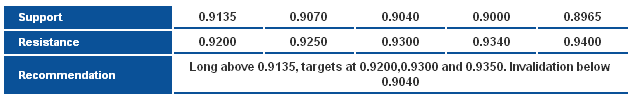

The AUDUSD pushes higher towards the 50-days SMA, and the top of the sideways range at 0.9300-0.9350. A break above this resistance is required to confirm a more prolonged bullish move. Accordingly, we are cautiously bullish for the week.

NZD/USD NZD/USD" width="1596" height="746">

NZD/USD" width="1596" height="746">

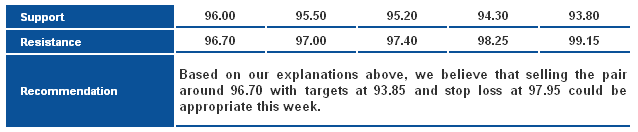

The price maintains the bullish rebound, approaching the top of the sideways range at 0.8100-0.8135. A break above this key resistance may confirm a major bottom and signal a bullish rebound. For now, the sideways range continues to be intact.