EUR/USD

EUR/USD" width="1596" height="786">

EUR/USD" width="1596" height="786">The pair dropped as shown on graph breaking the bullish key support of the ascending channel in addition to breaking 1.3290 represented in 23.6% correction. Trading below 1.3290 levels now will extend the downside move.

It is possible to short the pair below 1.3290 in line with the same previous recommendation. EUR/USD 2" width="1596" height="740">

EUR/USD 2" width="1596" height="740">

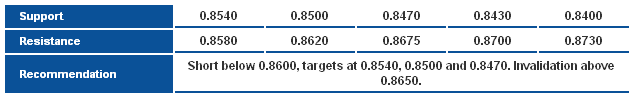

The pair moved to the downside yesterday and in the early trading today, we see that is approaching 23.6% correction at 1.3285. This level which represents key support level of the ascending channel and likely to see a breakout below it, whereas the pair is giving the impression that the bullish bias is very weak by trading below Linear Regression Indicators and stability below 1.3400. There is a strong possibility of a downside move today, but the pair has to break 1.3285 to confirm this move.

The trading range for today is among the key support at 1.3205 and key resistance at 1.3400.

The general trend over short term basis is sideways targeting 1.2775 as far as 1.3600 is daily-closing.

GBP/USD GBP/USD" width="1596" height="740">

GBP/USD" width="1596" height="740">

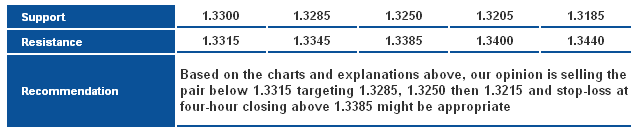

The pair attempted to move to the upside yesterday after it dropped but remained limited below 1.5550 keeping the general negativity of the pair. RSI is showing a negative bias, as stability below the referred to level represented in 78.6% correction keeps the possibility of extending the downside move.

The trading range for today is among the key support at 1.5390 and key resistance at 1.5605.

The general trend over short term basis is to the upside as far as areas of 1.5100 remains intact targeting 1.6010.

USD/JPY USD/JPY" width="1596" height="740">

USD/JPY" width="1596" height="740">

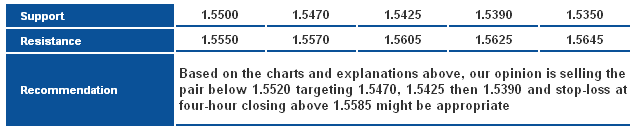

The pair is moving to the upside but is still limited below the key resistance level of the downside move and below 38.2% correction at 98.60 shown on graph. Therefore, the possibility of a downside move is valid today especially that Stochastic is showing intraday overbought signals, as Linear Regression Indicators are still negative. It is significant to consolidate again below 97.65 to prove this technical outlook.

The trading range for today is among key support at 96.75 and key resistance at 98.60.

The general trend over short term basis is to the downside as far as areas of 103.50 remain intact targeting 93.50.

USD/CHF USD/CHF" width="1596" height="740">

USD/CHF" width="1596" height="740">

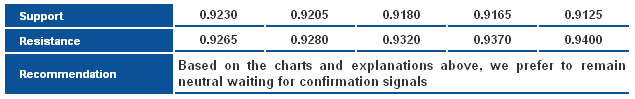

The downside move that was suggested yesterday became weak due to stabilizing above 0.9205 despite that the pair failed to stabilize above 0.9265 till now. The pair is trading again within the sideways range between 0.9205 and 0.9265, so we will be intraday neutral in the European session report waiting for confirmation signals.

The trading range for today is among key support at 0.9050 and key resistance at 0.9400.

The general trend over short term basis is to the downside stable at levels 0.9775 targeting 0.8860.

USD/CAD USD/CAD" width="1596" height="719">

USD/CAD" width="1596" height="719">

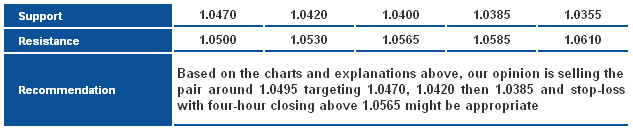

The volatility and the bullish attempts in yesterday and today’s trading remained limited below 23.6% correction of CD Leg of the bearish harmonic Bat Pattern, whereas the four-hour candles failed to stabilize above the referred to correction at 1.0500. Trading below 1.0500 keeps the possibility of extending the downside move valid, and the downside move based on the harmonic expectations remains valid by stabilizing below 1.0565 represented in top D of the harmonic pattern.

The trading range for today is between the key support at 1.0385 and the key resistance at 1.0565.

The general trend over short term basis is to the upside with steady daily closing above levels 1.0100 targeting 1.0775.

AUD/USD AUD/CAD" width="1596" height="746">

AUD/CAD" width="1596" height="746">

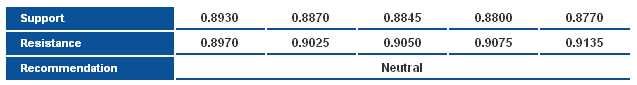

The pair bounced higher, while RSI is showing a bullish divergence over the four-hour time interval, threatening for further upside, meanwhile price approaches the minor descending trend line for the latest bearish , and 0.8995 horizontal resistance, which should be broken to confirm further upside. For now, we prefer to move to the sidelines.

NZD/USD NZD/USD" width="1596" height="746">

NZD/USD" width="1596" height="746">

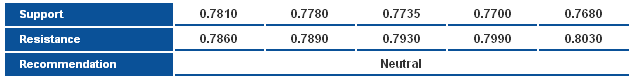

The pair rebounded after testing levels at the 0.7735 horizontal support, supported by the bullish divergence on RSI, further upside is possible, however we will maintain our neutral stance, and look for further confirmation signs.

GBP/JPY GBP/JPY" width="1596" height="762">

GBP/JPY" width="1596" height="762">

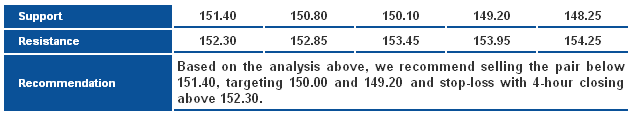

The GBP/JPY pair traded positively on Wednesday above 151.40 while the price remains below the Moving Average 50. That makes us maintain our intraday outlook for downtrend that targets preliminarily areas of 150.00. Stochastic is supporting the suggested bearishness which stands intact if the pair steadies below 152.30.

**Trading range expected today is between the main support at 149.20 and the main resistance 152.40

**Short-term trend is to the upside, targeting 163.00 if 147.65 remains intact

EUR/JPY EUR/JPY" width="1596" height="762">

EUR/JPY" width="1596" height="762">

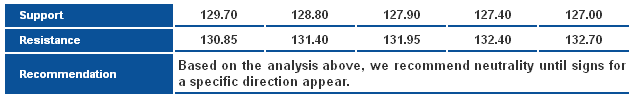

The EUR/JPY pair continues to fluctuate, confined however, between 129.70 and 130.85, as delivered in our previous reports. The price is required to breach one of these levels in order to confirm a certain direction therefore, we will maintain a neutral position.

**Trading range expected today is between the main support at 128.80 and the main resistance at 131.40

**Short-term trend is to the upside, targeting 140.00 if 124.95 remains intact

EUR/GBP EUR/GBP" width="1596" height="746">

EUR/GBP" width="1596" height="746">

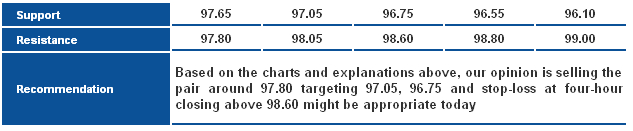

After breaking above 0.8615 resistance level the price failed at 0.8650 to retreat sharply suggested the breakout was a false one. Price is trading back below 0.8580 support, and that turns the bias to bearish again.