EUR/USD

EUR/USD" title="EUR/USD" width="662" height="412">

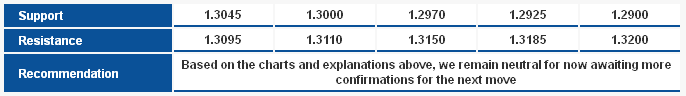

EUR/USD" title="EUR/USD" width="662" height="412">Trading was limited between the EMA 20 from above and the EMA 50 from below, noting the pair failed to maintain stability above 1.3095 and accordingly we return to the negative bias. Stochastic is now approaching 20 levels and that keeps us worried and accordingly we prefer to stay aside for now.

The trading range for today is among the key support at 1.2925 and key resistance at 1.3185.

The general trend over the short-term is negative targeting 1.1865 as far as areas of 1.3550 remains intact. EUR/USD_S&R" title="EUR/USD_S&R" width="686" height="96">

EUR/USD_S&R" title="EUR/USD_S&R" width="686" height="96">

GBP/USD GBP/USD" title="GBP/USD" width="694" height="432">

GBP/USD" title="GBP/USD" width="694" height="432">

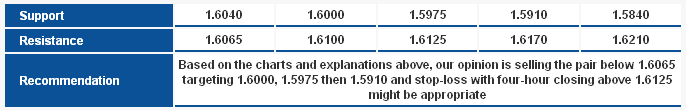

The pair returned to the downside once again after it failed to hold above 1.6125 and 1.6065 failing our expectations yesterday. We might see the extension of the downside move due to a possible Double Top formation, and the bearishness requires stability below 1.6125 to remain valid. RSI is trending negatively supporting the return to the downside.

The trading range for today is among key support at 1.5840 and key resistance at 1.6260.

The general trend over the short-term is to the downside targeting 1.6875 as far as areas of 1.4225 remains intact.  GBP/USD_S&R" title="GBP/USD_S&R" width="686" height="110">

GBP/USD_S&R" title="GBP/USD_S&R" width="686" height="110">

USD/JPY USD/JPY" title="USD/JPY" width="686" height="427">

USD/JPY" title="USD/JPY" width="686" height="427">

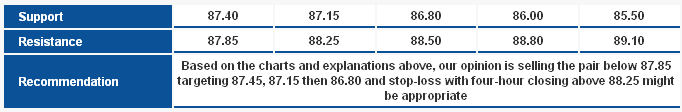

Trading is biased to the upside but remains stable below the main support for the ascending channel. Trading below 87.85 might trigger a new downside attempt to complete the bearish correction; breaching 88.25 mentioned in the weekly report cancels the possible downside correction.

The trading range for today is among key support at 86.00 and key resistance at 89.60.

The general trend over the short-term is to the upside targeting 91.70 as far as areas of 83.40 remain intact.  USD/JPY_S&R" title="USD/JPY_S&R" width="682" height="112">

USD/JPY_S&R" title="USD/JPY_S&R" width="682" height="112">

USD/CHF USD/CHF" title="USD/CHF" width="681" height="424">

USD/CHF" title="USD/CHF" width="681" height="424">

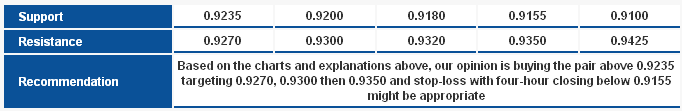

The downside move was halted above the first target of the AB=CD bullish harmonic pattern, the 38.2% correction target at 0.9200. The effect of the bullish pattern remains valid and might extend the upside move today. Breaching 0.9155 areas might limit the expected positivity. RSI is trading above 50 supporting the positive expectations.

The trading range for today is among key support at 0.9100 and key resistance at 0.9350.

The general trend over the short-term is to the downside stable at levels 0.9775 targeting 0.8860.  USD/CHF_S&R" title="USD/CHF_S&R" width="682" height="111">

USD/CHF_S&R" title="USD/CHF_S&R" width="682" height="111">

USD/CAD USD/CAD" title="USD/CAD" width="689" height="429">

USD/CAD" title="USD/CAD" width="689" height="429">

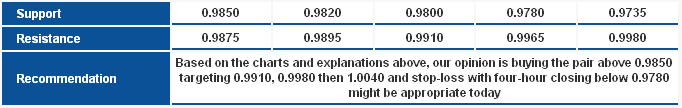

The pair rebounded to the upside confirming the strength of 78.6% and 88.6% correction levels and their capability to halt the downside move. Trading above 0.9850 is considered positive and a breach of 0.9880 is further upside confirmation.

The trading range for today is between the key support at 0.9780 and the key resistance at 0.9965.

The general trend over the short-term is to the downside below levels 1.0125 targeting 0.9400.  USD/CAD_S&R" title="USD/CAD_S&R" width="682" height="108">

USD/CAD_S&R" title="USD/CAD_S&R" width="682" height="108">

AUD/USD AUD/USD" title="AUD/USD" width="695" height="432">

AUD/USD" title="AUD/USD" width="695" height="432">

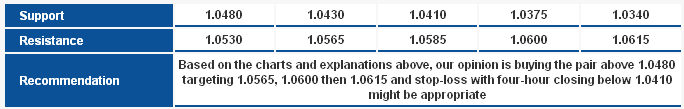

The pair is hovering around 1.0505 resistance and trading within the ascending channel and above the EMAs 20 and 50. The pair might extend the upside move and stability above 1.0505 resistance will support the positive bias today. In general, stability above 1.0410 is required for our expectations to remain valid.

The trading range for today is among key support at 1.0340 and key resistance at 1.0615.

The general trend over the short-term is to the downside below levels 1.0710 targeting 0.9400.  AUD/USD_S&R" title="AUD/USD_S&R" width="684" height="109">

AUD/USD_S&R" title="AUD/USD_S&R" width="684" height="109">

NZD/USD NZD/USD" title="NZD/USD" width="713" height="444">

NZD/USD" title="NZD/USD" width="713" height="444">

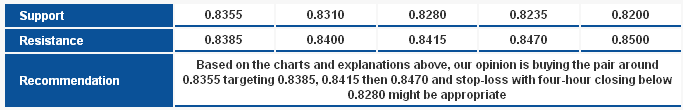

The positive bias is still seen benefiting from the ascending channel provided on the graph and stability above 0.8355. Stability above the mentioned level might extend the upside move, especially as the pair is stable above the EMA 20 and 50. Holding above 0.8280 is required for the positive outlook to remain valid.

The trading range for today might be among key support at 0.8225 and key resistance at 0.8535.

The general trend over the short-term basis is to the upside with steady daily closing above 0.8130 targeting 0.8845.  NZD/USD_S&R" title="NZD/USD_S&R" width="683" height="110">

NZD/USD_S&R" title="NZD/USD_S&R" width="683" height="110">

Technical Crosses

GBP/JPY GBP/JPY" title="GBP/JPY" width="715" height="445">

GBP/JPY" title="GBP/JPY" width="715" height="445">

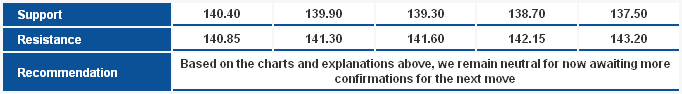

Despite attempts to hold below 140.00 yesterday, the pair returned once again to trade above this level. MACD turned negative while RSI is trading with a slight upside bias. We require more confirmations to ensure stability above or below 140.00 psychological areas and accordingly we remain neutral today.

The trading range expected for today is between the key support at 137.50 and the key resistance at 143.80.

The short-term trend is to the downside targeting 112.00 as far as 150.00 remains intact.  GBP/JPY_S&R" title="GBP/JPY_S&R" width="682" height="94">

GBP/JPY_S&R" title="GBP/JPY_S&R" width="682" height="94">

EUR/JPY EUR/JPY" title="EUR/JPY" width="757" height="471">

EUR/JPY" title="EUR/JPY" width="757" height="471">

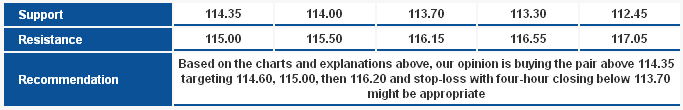

The pair reached the minor 113% Fibonacci correction at 113.70 and rebounded to the upside, confirming the positive bias. Stability above the mentioned level might extend the upside move toward 127.2% correction at 116.15. The breach of 113.70 will trigger a downside correction and negate the intraday positivity.

The trading range for today is between the key support at 112.15 and the key resistance at 116.55.

The short-term trend is to the upside targeting 122.15 as far as 107.70 remains intact at week's closing.  EUR/JPY_S&R" title="EUR/JPY_S&R" width="683" height="110">

EUR/JPY_S&R" title="EUR/JPY_S&R" width="683" height="110">

EUR/GBP

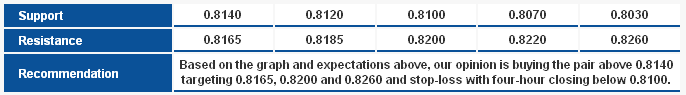

The pair consolidated above the EMA 50 and MA 100, and the ascending channel continues to organize trading. Trading above 0.8070 might extend the upside move while stability above 0.8100 is more positive. The breach of 0.8165 might extend the upside move.

The trading range expected for today is between the key support at 0.8070 and the key resistance 0.8225.

The short-term trend is to the upside targeting 1.0370 as far as 0.7785 remains intact.  EUR/GBP_S&R" title="EUR/GBP_S&R" width="686" height="95">

EUR/GBP_S&R" title="EUR/GBP_S&R" width="686" height="95">