EUR/USD

EUR/USD" title="EUR/USD" width="631" height="365">

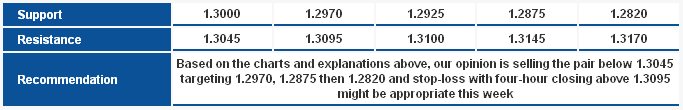

EUR/USD" title="EUR/USD" width="631" height="365">The pair stabilized below the second target of the bearish technical harmonic formation at the beginning of this week, stability below the mentioned 61.8% level at 1.3045 might extend the bearish move to 1.2970 then 1.2925 levels. Breaking 1.2925 levels might clearly extend the downside move toward 1.2760. Trading below 1.3145 levels this week will be considered negative.

The trading range for this week is among the key support at 1.2975 and key resistance at 1.3480.

The general trend over the short-term is negative targeting 1.1865 as far as areas of 1.3550 remains intact.  EUR/USD_S&R" title="EUR/USD_S&R" width="683" height="110">

EUR/USD_S&R" title="EUR/USD_S&R" width="683" height="110">

GBP/USD GBP/USD" title="GBP/USD" width="631" height="365">

GBP/USD" title="GBP/USD" width="631" height="365">

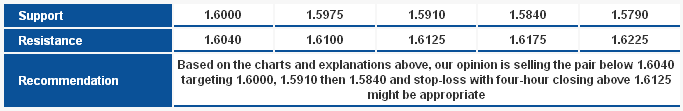

The pair is trading below 1.6065 as shown on the graph, which might push the pair toward 1.5915-0 levels this week. If the pair managed to break 1.5910 levels we might see a stronger bearish move. Relative Strength Index (RSI) is still negative and Linear Regression Indicator 34 is trading to the downside, which might support the downside move this week.

The trading range for this week is among key support at 1.5790 and key resistance at 1.6265.

The general trend over the short-term is to the downside targeting 1.6875 as far as areas of 1.4225 remains intact.  GBP/USD_S&R" title="GBP/USD_S&R" width="683" height="111">

GBP/USD_S&R" title="GBP/USD_S&R" width="683" height="111">

USD/JPY USD/JPY" title="USD/JPY" width="631" height="365">

USD/JPY" title="USD/JPY" width="631" height="365">

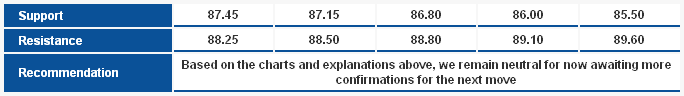

The pair failed to stabilize above 88.25 area accompanied by heavy overbought signals on momentum indicators. Despite that, we cannot bet on a downside move while the pair is stable above 86.80 levels, therefore we remain neutral in our weekly report waiting for confirmation signals.

The trading range for this week is among key support at 85.50 and key resistance at 90.00.

The general trend over the short-term is to the upside targeting 91.70 as far as areas of 83.40 remain intact.  USD/JPY_S&R" title="USD/JPY_S&R" width="684" height="96">

USD/JPY_S&R" title="USD/JPY_S&R" width="684" height="96">

USD/CHF USD/CHF" title="USD/CHF" width="631" height="365">

USD/CHF" title="USD/CHF" width="631" height="365">

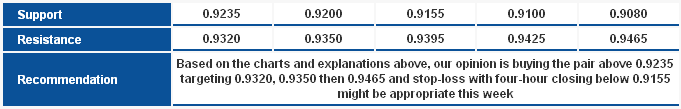

The pair kicked off trading this week positively and stable above the second target of the bullish Harmonic AB=CD Pattern which might support the move toward extended targets at 0.9320 levels and maybe 0.9350 levels. Breaching the latter might push the pair to the upside. Overbought signals might cause heavy fluctuation and downside correction, but trading above 0.9155 levels will be considered positive this week.

The trading range for this week is among key support at 0.9080 and key resistance at 0.9465.

The general trend over the short-term is to the downside stable at levels 0.9775 targeting 0.8860.  USD/CHF_S&R" title="USD/CHF_S&R" width="681" height="109">

USD/CHF_S&R" title="USD/CHF_S&R" width="681" height="109">

USD/CAD USD/CAD" title="USD/CAD" width="631" height="365">

USD/CAD" title="USD/CAD" width="631" height="365">

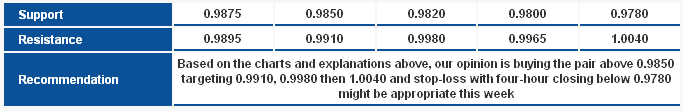

Support area at 0.9850 proved its strength again and Stochastic offers a positive crossover after rebounding to the upside from levels around 20. Therefore, we think that the pair might attempt to move to the upside, and a breach of 0.9910 levels with stability above it will extend the bullish move this week. The positive expectations require stability above 0.9800 levels.

The trading range for this week is between the key support at 0.9690 and the key resistance at 1.0040.

The general trend over the short-term is to the downside below levels 1.0125 targeting 0.9400.  USD/CAD_S&R" title="USD/CAD_S&R" width="683" height="111">

USD/CAD_S&R" title="USD/CAD_S&R" width="683" height="111">

AUD/USD AUD/USD" title="AUD/USD" width="631" height="365">

AUD/USD" title="AUD/USD" width="631" height="365">

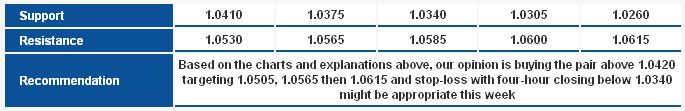

The pair is stable above Linear Regression Indicators and still trading within the ascending channel which means that the upside move might dominate this week’s trading unless 1.0344 levels shown on the graph are breached. We don’t see any negative signals on momentum indicators despite trading near overbought levels.

The trading range for this week is among key support at 1.0260 and key resistance at 1.0615.

The general trend over the short-term is to the downside below levels 1.0710 targeting 0.9400.  AUD/USD_S&R" title="AUD/USD_S&R" width="685" height="111">

AUD/USD_S&R" title="AUD/USD_S&R" width="685" height="111">

NZD/USD NZD/USD" title="NZD/USD" width="631" height="365">

NZD/USD" title="NZD/USD" width="631" height="365">

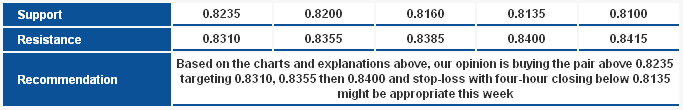

Momentum indicators offer overbought signals but the pair is trading above significant levels such as 0.8435 and 0.8355 levels. Therefore, the upside move is still available due to stability above the mentioned levels, but heavy fluctuation is likely due to overbought signals mentioned. Breaking 0.8305 levels might weaken the positivity.

The trading range for this week might be among key support at 0.8050 and key resistance at 0.8480.

The general trend over the short-term is to the upside with steady daily closing above 0.8130 targeting 0.8845.  NZD/USD_S&R" title="NZD/USD_S&R" width="683" height="110">

NZD/USD_S&R" title="NZD/USD_S&R" width="683" height="110">

Technical Crosses

GBP/JPY GBP/JPY" title="GBP/JPY" width="631" height="365">

GBP/JPY" title="GBP/JPY" width="631" height="365">

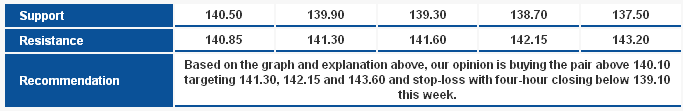

Biased to the downside at this week's inception, the pair trades in a stable range above 140.00; stability above this level is seen positive because it revokes a potential test to the main ascending support. Hereon, we believe this week will carry an uptrend provided that the pair stays above 140.00.

The trading range expected for this week is between the key support at 137.50 and the key resistance at 144.90.

The short-term trend is to the downside targeting 112.00 as far as 150.00 remains intact.  GBP/JPY_S&R" title="GBP/JPY_S&R" width="683" height="111">

GBP/JPY_S&R" title="GBP/JPY_S&R" width="683" height="111">

EUR/JPY EUR/JPY" title="EUR/JPY" width="631" height="365">

EUR/JPY" title="EUR/JPY" width="631" height="365">

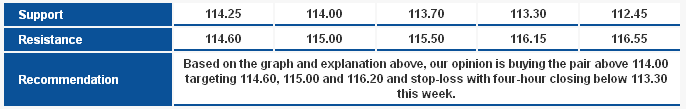

The pair's bearishness this week hasn't affected overall uptrend. Although the pair settles now above 111.55, we find that stability above 113.70 boosts positivity in which the pair trades in. Stability above the latter will thwart any response by the pair to negative sign beamed by momentum indicators, whereas a breach of 116.15 could deliver a sharp upside wave over the period ahead.

The trading range for this week is between the key support at 112.45 and the key resistance at 118.00.

The short-term trend is to the upside targeting 109.15 as far as 98.75 remains intact at week's closing.  EUR/JPY_S&R" title="EUR/JPY_S&R" width="686" height="109">

EUR/JPY_S&R" title="EUR/JPY_S&R" width="686" height="109">

EUR/GBP EUR/GBP" title="EUR/GBP" width="631" height="365">

EUR/GBP" title="EUR/GBP" width="631" height="365">

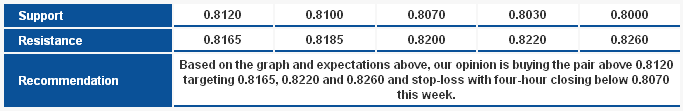

Most of last week's trading remained stable above support 0.8100, this week the pair stabilizes above the Exponential Moving Average (EMA) 50. We believe trading above 0.8070 will safeguard potential uptrend backed by the ascending channel (shown on the graph).

The trading range expected for this week is between the key support at 0.8010 and the key resistance 0.8260.

The short-term trend is to the upside targeting 1.0370 as far as 0.7785 remains intact.  EUR/GBP_S&R" title="EUR/GBP_S&R" width="683" height="111">

EUR/GBP_S&R" title="EUR/GBP_S&R" width="683" height="111">