EUR/USD

EUR/USD" title="EUR/USD" width="570" height="482">

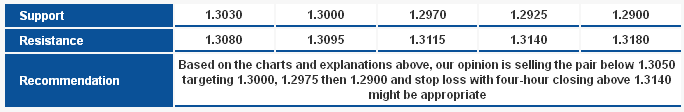

EUR/USD" title="EUR/USD" width="570" height="482">Over a four-hour basis, the pair is trading below the EMA 20 and 50, signaling the possible extension of the downside move to test the main ascending support. Trading below 1.3140 will support the negativity and coming below 1.3080 further supports the bearishness.

The trading range for today is among the key support at 1.2900 and key resistance at 1.3185.

The general trend over the short-term is negative targeting 1.1865 as far as areas of 1.3550 remains intact.  EUR/USD_S&R" title="EUR/USD_S&R" width="684" height="112">

EUR/USD_S&R" title="EUR/USD_S&R" width="684" height="112">

GBP/USD GBP/USD" title="GBP/USD" width="570" height="482">

GBP/USD" title="GBP/USD" width="570" height="482">

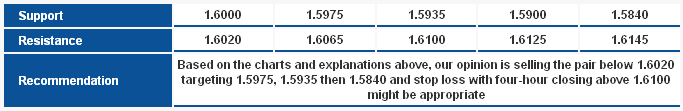

The pair is affected by the negative Double Top technical formations, and the breach of 61.8% correction at 1.6020 might extend the downside move today. RSI is trading to downside and that revives the bearish outlook eying a test of 78.6% correction areas at 1.5935 at least.

The trading range for today is among key support at 1.5840 and key resistance at 1.6260.

The general trend over the short-term is to the downside targeting 1.6875 as far as areas of 1.4225 remains intact. GBP/USD_S&R" title="GBP/USD_S&R" width="683" height="111">

GBP/USD_S&R" title="GBP/USD_S&R" width="683" height="111">

USD/JPY USD/JPY" title="USD/JPY" width="570" height="482">

USD/JPY" title="USD/JPY" width="570" height="482">

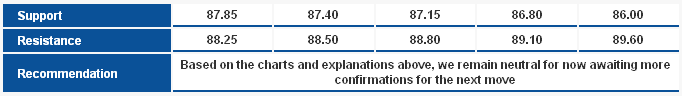

The pair turned to the upside and trading positively above Parabolic SAR. Stochastic offers overbought signals and the pair is also below the ascending channel’s support and accordingly we remain neutral for now. Areas of 88.25 are very critical as mentioned in the weekly report and can define the trend for the pair.

The trading range for today is among key support at 86.00 and key resistance at 89.60.

The general trend over the short-term is to the upside targeting 91.70 as far as areas of 83.40 remain intact.  USD/JPY_S&R" title="USD/JPY_S&R" width="682" height="96">

USD/JPY_S&R" title="USD/JPY_S&R" width="682" height="96">

USD/CHF USD/CHF" title="USD/CHF" width="570" height="482">

USD/CHF" title="USD/CHF" width="570" height="482">

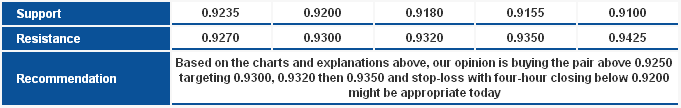

The pair turned higher once again affected by the bullish AB=CD pattern and currently hovering around the second target at 61.8% correction around 0.9270. The breach of the mentioned level might extend the upside move toward 0.9320 and maybe 0.9350. In general, trading above 0.9235 today is considered positive.

The trading range for today is among key support at 0.9100 and key resistance at 0.9425.

The general trend over the short-term basis is to the downside stable at levels 0.9775 targeting 0.8860.  USD/CHF_S&R" title="USD/CHF_S&R" width="681" height="108">

USD/CHF_S&R" title="USD/CHF_S&R" width="681" height="108">

USD/CAD USD/CAD" title="USD/CAD" width="570" height="482">

USD/CAD" title="USD/CAD" width="570" height="482">

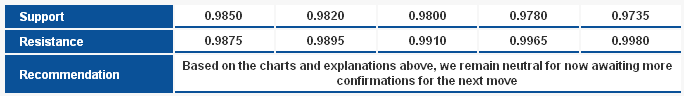

The pair failed to hold above 0.9875 once again which threatens to fail the positive scenario, as we can see Stochastic is turning negative. We still cannot favor the downside move with trading above 78.6% correction at 0.9850. Therefore, we remain neutral for now, awaiting further confirmations.

The trading range for today is between the key support at 0.9780 and the key resistance at 0.9965.

The general trend over the short-term basis is to the downside below levels 1.0125 targeting 0.9400.  USD/CAD_S&R" title="USD/CAD_S&R" width="684" height="96">

USD/CAD_S&R" title="USD/CAD_S&R" width="684" height="96">

AUD/USD AUD/USD" title="AUD/USD" width="570" height="482">

AUD/USD" title="AUD/USD" width="570" height="482">

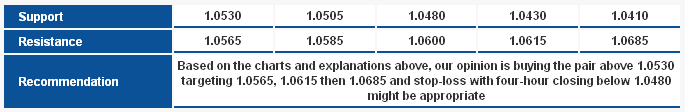

The pair turned to the upside benefiting from stability above the EMAs and trading within the ascending channel. Stability above 1.0505 is positive and might extend the upside move and that is ideal trading within price channels, eying the channel’s resistance.

The trading range for today is among key support at 1.0410 and key resistance at 1.0685.

The general trend over the short-term basis is to the downside below levels 1.0710 targeting 0.9400.  AUD/USD_S&R" title="AUD/USD_S&R" width="685" height="112">

AUD/USD_S&R" title="AUD/USD_S&R" width="685" height="112">

NZD/USD NZD/USD" title="NZD/USD" width="570" height="482">

NZD/USD" title="NZD/USD" width="570" height="482">

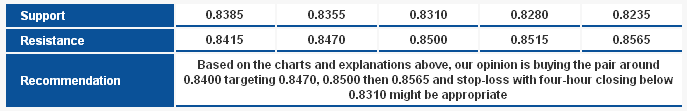

The pair is trading in a clear direction based on stability above the EMAs and trading within the ascending channel. Stability above 0.8355 is enough to expect the extension of the upside move. Despite overbought signals on Stochastic we expect stability above the mentioned levels to limit the downside correction and uphold the bullish bias.

The trading range for today might be among key support at 0.8285 and key resistance at 0.8565.

The general trend over the short-term is to the upside with steady daily closing above 0.8130 targeting 0.8845.  NZD/USD_S&R" title="NZD/USD_S&R" width="687" height="111">

NZD/USD_S&R" title="NZD/USD_S&R" width="687" height="111">

Technical Crosses

GBP/JPY GBP/JPY" title="GBP/JPY" width="570" height="482">

GBP/JPY" title="GBP/JPY" width="570" height="482">

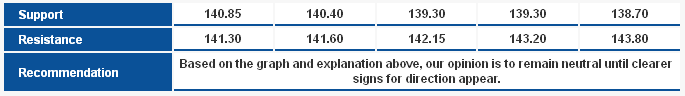

The pair is gradually trading higher and stable above the EMAs 20 and 50 and trading within a correctional formation for the previous upside wave, and is a continuation formation. The breach of the main resistance for the formation at 141.60 might trigger a strong upside wave. We expect a new upside wave but due to inappropriate risk-reward ratio we remain neutral.

The trading range expected for today is between the key support at 138.70 and the key resistance at 143.80.

The short-term trend is to the downside targeting 112.00 as far as 150.00 remains intact.  GBP/JPY_S&R" title="GBP/JPY_S&R" width="685" height="96">

GBP/JPY_S&R" title="GBP/JPY_S&R" width="685" height="96">

EUR/JPY EUR/JPY" title="EUR/JPY" width="570" height="482">

EUR/JPY" title="EUR/JPY" width="570" height="482">

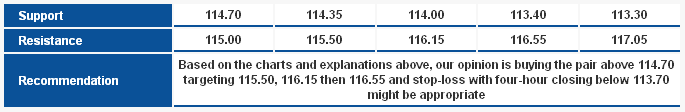

The upside move prevails and trading within the ascending channel and above 113.70 makes us expect the extension of the upside move eying a test of 116.15 areas. A breach of 116.15 might extend the upside move.

The trading range for today is between the key support at 112.15 and the key resistance at 116.55.

The short-term trend is to the upside targeting 122.15 as far as 107.70 remains intact at week's closing.  EUR/JPY_S&R" title="EUR/JPY_S&R" width="685" height="112">

EUR/JPY_S&R" title="EUR/JPY_S&R" width="685" height="112">

EUR/GBP EUR/GBP" title="EUR/GBP" width="570" height="482">

EUR/GBP" title="EUR/GBP" width="570" height="482">

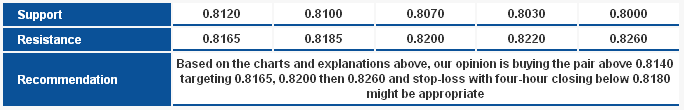

Thin trading yesterday was biased to the downside, yet the daily closing again was above the EMA 20. The general positivity remains intact despite negative signals on Stochastic; trading above 0.8100 makes us hold onto our positive intraday outlook and what threatens the upside wave is a breach of 0.8070.

The trading range expected for today is between the key support at 0.8070 and the key resistance 0.8225.

The short-term trend is to the upside targeting 1.0370 as far as 0.7785 remains intact.  EUR/GBP_S&R" title="EUR/GBP_S&R" width="684" height="110">

EUR/GBP_S&R" title="EUR/GBP_S&R" width="684" height="110">