EUR/USD" width="1596" height="746">

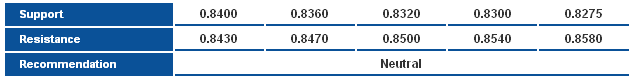

EUR/USD" width="1596" height="746">The pair moved to the upside last Friday, but remained limited below key resistance level of the sideways range showing on graph which started from top 1.3711. Linear Regression Indicators are still negative. Therefore, the possibility of extending bearishness is valid this week if the pair stabilized below 23.6% correction at 1.3290. Breaking 1.3105 levels will confirm our negative expectations.

The trading range for this week is among the key support at 1.2905 and key resistance at 1.3385.

The general trend over short term basis is sideways targeting 1.2775 as far as 1.3600 is daily-closing.

GBP/USD GBP/USD" width="1596" height="746">

GBP/USD" width="1596" height="746">

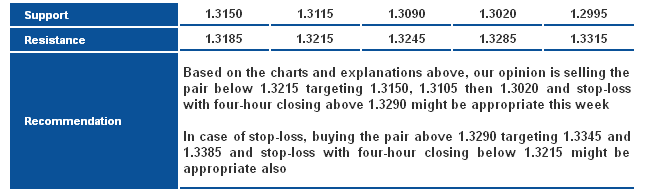

The pair managed to move to the upside, whereas stabilizing above 1.5550 levels during last week with daily closing forces us to suggest a minor ascending channel shown on graph. The pair is still stable below Linear Regression Indicators and momentum indicators are close to levels reflecting overbought signals, and 1.5645 levels is strong in front of the daily closings. Therefore, we prefer to remain intraday neutral whereas we need to see how the pair would react at 1.5645 levels represented in 88.6% correction before taking any decisions.

The trading range for this week is among the key support at 1.5425 and key resistance at 1.5770.

The general trend over short term basis is to the upside as far as areas of 1.5100 remains intact targeting 1.6010.

USD/JPY USD/JPY" width="1596" height="746">

USD/JPY" width="1596" height="746">

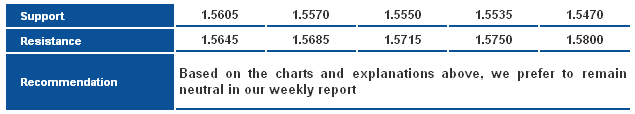

The pair opened marginally higher on Monday’s trading session but remained limited below key resistance level of the ascending channel and below 78.6% correction. Trading below the referred to correction at 100.30 keeps the possibility of extending bearishness. Breaking 99.35 will confirm the return of the negative momentum.

The trading range for this week is among key support at 97.15 and key resistance at 101.55.

The general trend over short term basis is to the downside as far as areas of 103.50 remain intact targeting 93.50.

USD/CHF USD/CHF" width="1596" height="746">

USD/CHF" width="1596" height="746">

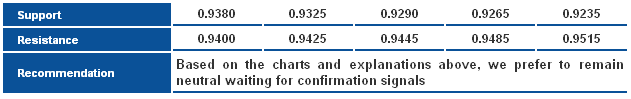

By examining the daily graph, we notice that the pair is stable above the bullish key support level shown on graph. But the negative candle seen last Friday in addition to the negative signals showing on Stochastic halts the extension of the current bullish wave. The pair also consolidated between 50% correction from the upside and 23.6% correction from the downside, and the candle formed on Friday resides between these correctional levels at 0.9450 and 0.9380 respectively. We prefer to remain neutral in our weekly report because we need new confirmation signals before determining the pair’s next move.

The trading range for this week is among key support at 0.9205 and key resistance at 0.9565.

The general trend over short term basis is to the downside stable at levels 0.9775 targeting 0.8860.

USD/CAD USD/CAD" width="1596" height="719">

USD/CAD" width="1596" height="719">

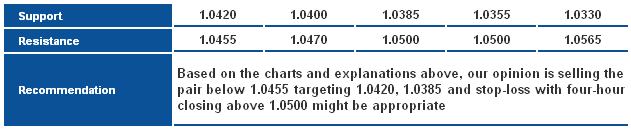

The pair stabilized below 38.2% correction at 1.0455 represented in the first target of the technical harmonic pattern. As per technical harmonic analysis rules, it is possible to witness further bearishness towards 61.8% correction at 1.0385 passing by 50% correction at 1.0420. All these negative expectations require stabilizing below 1.0500 levels.

The trading range for today is between the key support at 1.0385 and the key resistance at 1.0565.

The general trend over short term basis is to the upside with steady daily closing above levels 1.0100 targeting 1.0775.

AUD/USD AUD/CAD" width="1596" height="746">

AUD/CAD" width="1596" height="746">

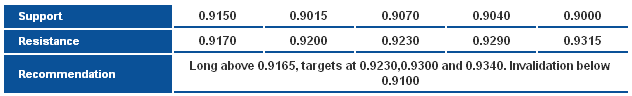

As shown on the daily chart above, the pair settled above the descending resistance for consolidation phase, and above 50-days SMA. Accordingly, we maintain our bullish view, eying 0.9300-0.9350 key resistance area, 0.9115-support should remain intact for the bullish bias to remains dominant.

NZD/USD NZD/USD" width="1596" height="746">

NZD/USD" width="1596" height="746">

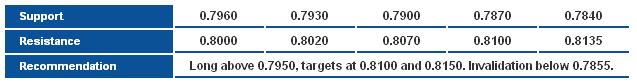

The pair extended the upside move, settling well above the 50-days SMA and 0.7930 horizontal resistance. Accordingly, the bullish bias is likely to continue, targeting the top of the sideways range near 0.8100, then 0.8160 key resistance levels. Overall, 0.7855 should limit downside.

GBP/JPY GBP/JPY H4" width="1596" height="762">

GBP/JPY H4" width="1596" height="762">

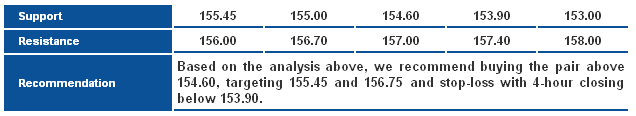

The GBP/JPY pair maintained stability above 154.60 and rebounded to the upside, approaching targets around 156.75. That helped the pair to continue trading within the bullish channel as we will maintain our positive expectations over intraday and short-term trends. Targets extend to 160.00.

**Trading range expected this week is between the main support at 154.00 and the main resistance 159.00

**Short-term trend is to the upside, targeting 163.00 if 147.65 remains intact

EUR/JPY EUR/JPY H4" width="1596" height="762">

EUR/JPY H4" width="1596" height="762">

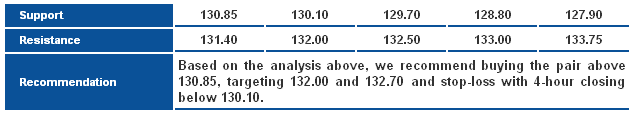

The EUR/JPY pair kicked off the week with a bullish price gap, trading as of this writing above 130.85. That supports our overall positive expectations, as we anticipate bullish targets reaching zones of 132.70. Note that breaking 130.85 will thwart our positive outlook temporarily until the price takes over 129.70.

**Trading range expected this week is between the main support at 129.70 and the main resistance at 134.00

**Short-term trend is to the upside, targeting 140.00 if 124.95 remains intact

EUR/GBP EUR/GBP" width="1596" height="746">

EUR/GBP" width="1596" height="746">

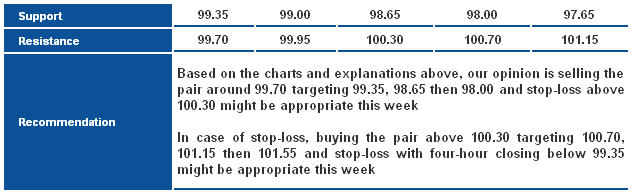

As expected, 0.8400- key neckline for the double top pattern formed a strong support and managed to reject price on Friday. Overall, we still need to see a clear break with stability below this level to confirm a move lower. The technical position of price between the main broken ascending trend line and the 200-days SMA from one side, and the neckline for the major double top pattern from the other side keeps the neutral stance necessary.