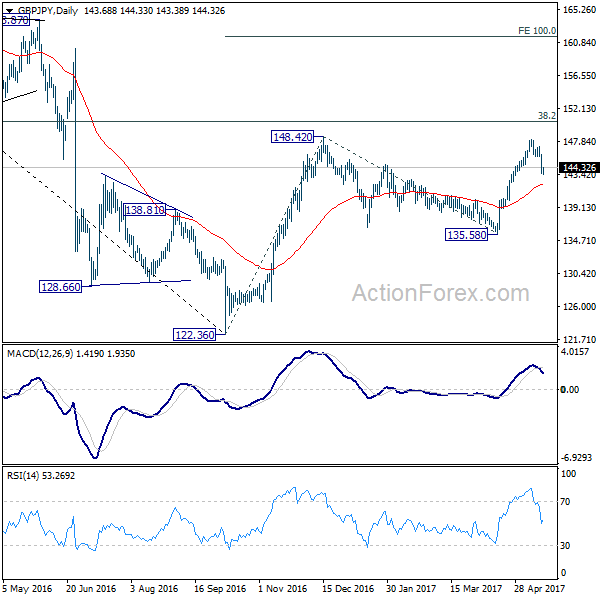

GBP/JPY Daily Outlook

Daily Pivots: (S1) 142.85; (P) 144.48; (R1) 145.34;

GBP/JPY's correction from 148.09 extended sharply lower. Based on downside acceleration, the fall might extend through 38.2% retracement of 135.58 to 148.09 at 143.31 to 61.8% retracement at 140.35. On the upside, above 145.78 minor resistance will turn bias back to the upside for 148.09 first. Overall, we'd still expect the rise from 122.36 to resume after to 150.42 long term fibonacci level.

In the bigger picture, based on current momentum, rise from 122.36 bottom should be developing into a medium term move. Break of 38.2% retracement of 195.86 to 122.36 at 150.42 should pave the way to 61.8% retracement at 167.78. This will now be the favored case as long as 135.58 support holds.

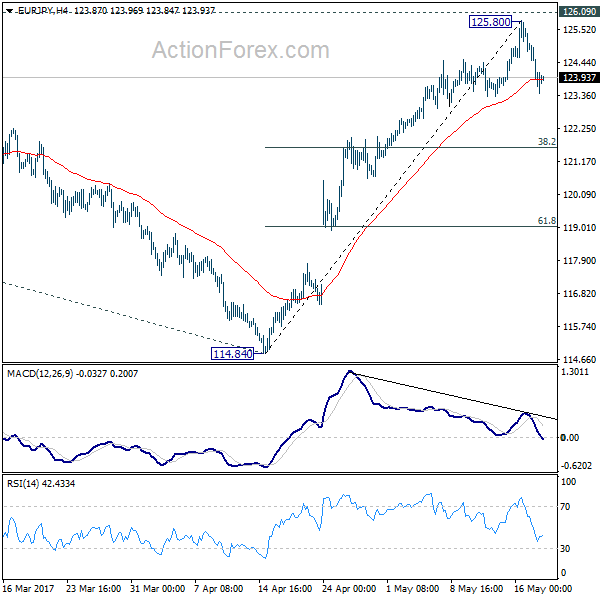

EUR/JPY Daily Outlook

Daily Pivots: (S1) 123.06; (P) 124.22; (R1) 124.82;

The sharp fall from 125.80 suggests short term topping in EUR/JPY, ahead of 126.09 key resistance, on bearish divergence condition in 4 hour MACD. Deeper pull back is now mildly in favor back to 38.2% retracement of 114.84 to 125.80 at 121.61 and possibly below. But overall, we're still staying mildly bullish in the cross and expect another rise. Break of 126.09 will extend the whole rebound from 109.03 to 100% projection of 109.03 to 124.08 from 114.84 at 129.89.

In the bigger picture, focus is back on 126.09 support turned resistance. Decisive break there will confirm completion of the down trend from 149.76. And in such case, rise from 109.20 is at the same degree and should target 141.04 resistance and above. Meanwhile, rejection from 126.09 and break of 114.84 will extend the fall from 149.76 through 109.20 low.