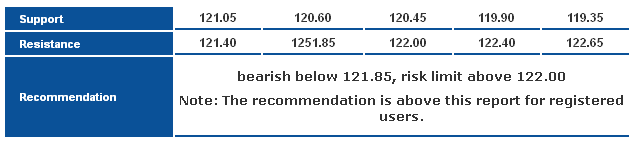

EUR/USD - Technical Report

The pair has respected our suggested recovery scenario and soared beyond the defined technical objective at 1.0650. These areas has limited the bullishness and started to pressure the EUR/USD pair negatively; however, stability above Linear Regression forces us to be patient before selling the pair to resume the major downtrend. Accordingly, we see chances for further weakness today with a break below 1.0525 zones where 224% Fibonacci projection exists.

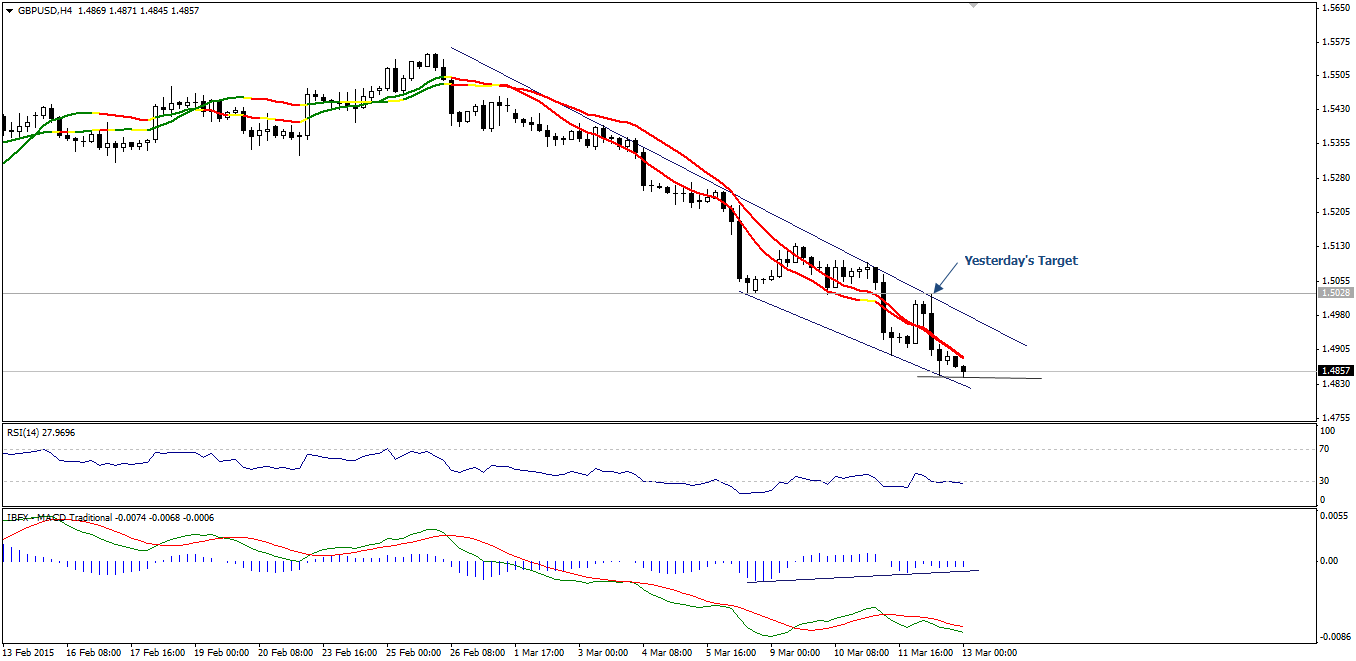

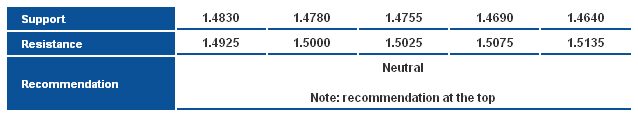

GBP/USD - Technical Report

In line with our yesterday’s proposed corrective scenario, the GBP/USD has moved upwards reaching our defined technical target at 1.5025 where the pair has collapsed towards 1.4850 regions. Stability below Linear Regression contradicts with the positive divergence appearing on MACD traditional, while RSI14 offers oversold sign. Hence, we will be neutral over intraday basis due to the inappropriate risk versus reward ratio.

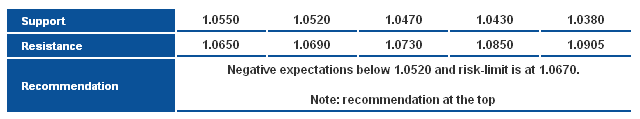

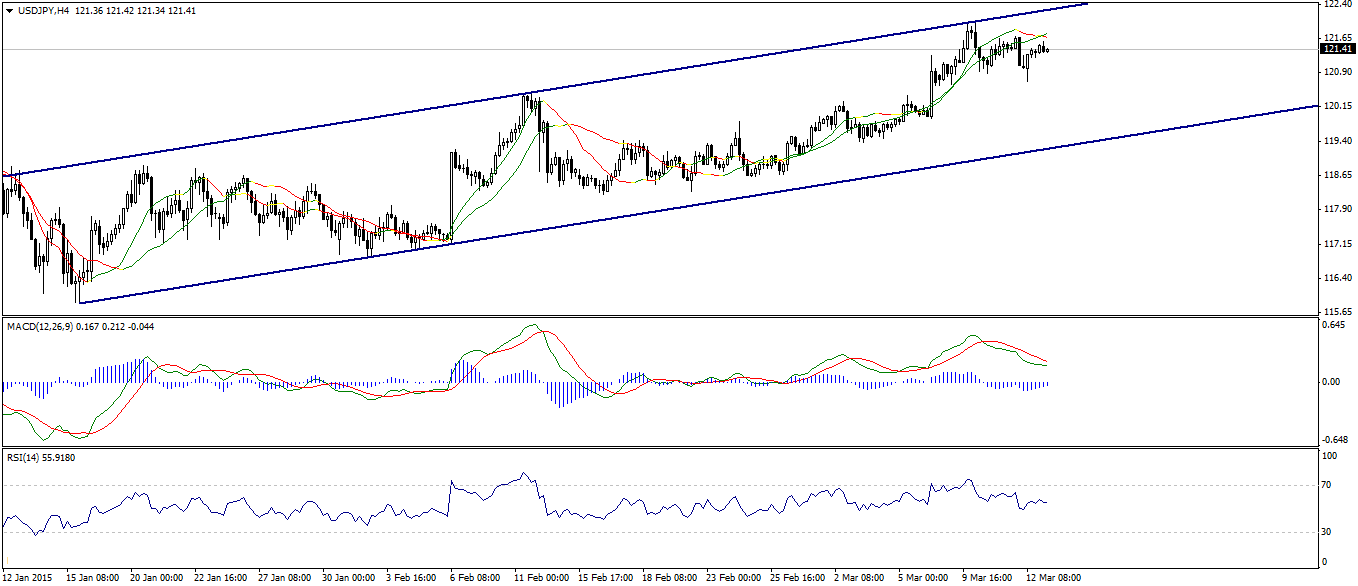

USD/JPY - Technical Report

USD/JPY pair traded within a tight range; with bearish tendency. Looking at the H4 chart shown on the image above, we can notice the clear negativity on the indicators, especially linear regression indicators that covers price movement. Therefore, we believe that the pair will collapse as long as trading remains below 121.85 resistance. On the other hand, breaching 120.60 is needed to accelerate bearishness.