GBP/JPY Daily Outlook

Daily Pivots: (S1) 141.25; (P) 141.81; (R1) 142.89;

GBP/JPY's fall from 148.09 resumed after brief consolidation and reaches as low as 142.44 so far. Now that 61.8% retracement of 135.58 to 148.09 at 140.35 is broken and there is no clear sign of bottoming yet. Intraday bias stays on the downside for 135.58 key support next. On the upside, break of 142.75 resistance is needed to indicate completion of fall from 148.09. Otherwise, near term outlook will say mildly bearish in case of recovery.

In the bigger picture, rise from 122.36 medium term bottom is still expected to extend to of 195.86 to 122.36 at 150.42. And decisive break there could pave the way to 61.8% retracement at 167.78. However, as the cross is starting to lose upside momentum, rejection below 150.42 and break of 135.58 support will indicate reversal and bring deeper fall back to retest 122.36 instead.

EUR/JPY Daily Outlook

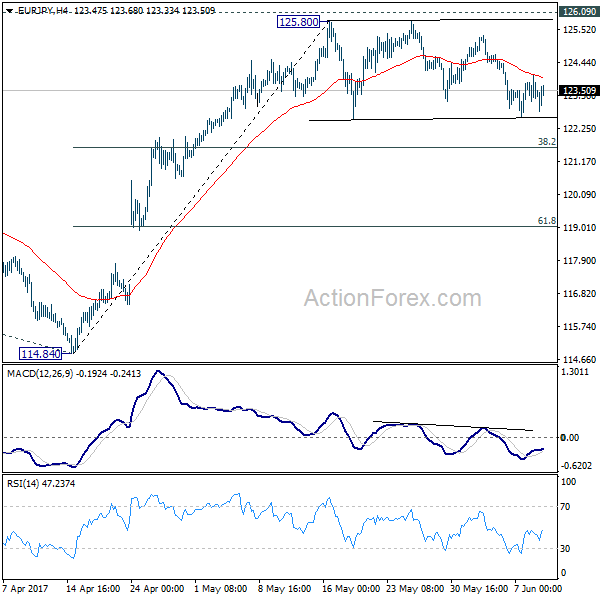

Daily Pivots: (S1) 123.01; (P) 123.51; (R1) 123.87;

No change in EUR/JPY's outlook as consolidation from 125.80 is still in progress. In case of deeper pull back, downside should be contained by 38.2% retracement of 114.84 to 125.80 at 121.61 to bring rise resumption. We're staying mildly bullish in the cross. And, break of 126.09 key resistance will extend the whole rebound from 109.03 to 100% projection of 109.03 to 124.08 from 114.84 at 129.89. Nonetheless, firm break of 121.61 will dampen our bullish view and bring deeper fall to 61.8% retracement at 119.02.

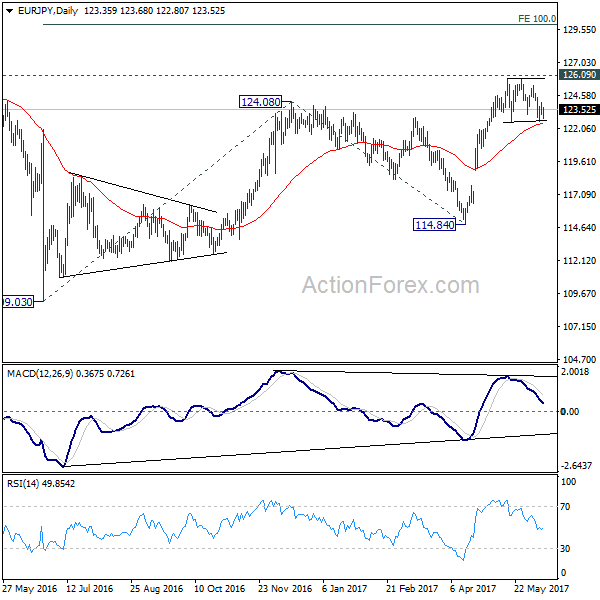

In the bigger picture, focus is staying on 126.09 support turned resistance. Decisive break there will confirm completion of the down trend from 149.76. And in such case, rise from 109.20 is at the same degree and should target 141.04 resistance and above. Meanwhile, rejection from 126.09 and break of 114.84 will extend the fall from 149.76 through 109.20 low.