Yesterday’s candlestick was bearish and it was formed after approaching 115.00 psychological as seen on the provided daily graph.

However, the positive divergence formed on RSI14 didn’t reach its targets yet.

We still believe that the pair may inch higher to re-test the previous broken resistance line at 115.90, but we need to witness a break above 114.30 to weaken 114.80 on the way towards targets.

ADX could be fixed with the above-mentioned breakout, while 113.00 should act as a floor for intraday traders.

Support: 113.60-113.00-112.50

Resistance: 114.30-114.80-115.00

Direction: Bullish

The pair has inched higher yesterday where it succeeded in re-experiencing the key Fibonacci resistance level of 0.9900 as seen on the provided daily chart.

It remains covered by moving averages 20 and 50, but the continuous upside actions suggests that the bullishness may continue.

Nevertheless, risk versus reward ratio is inappropriate to suggest potential position.

Of note, we see some kind of recovery weakness on ADX that could be fixed with a break above 0.9900 and also RSI may turn into positivity with this breakout, but for now, we will watch the price behaviors.

Support: 0.-9805- 0.9760-0.97200

Resistance: 0.9890-0.9925-1.0000

Direction: Bullish, but we will avoid trading the pair now.

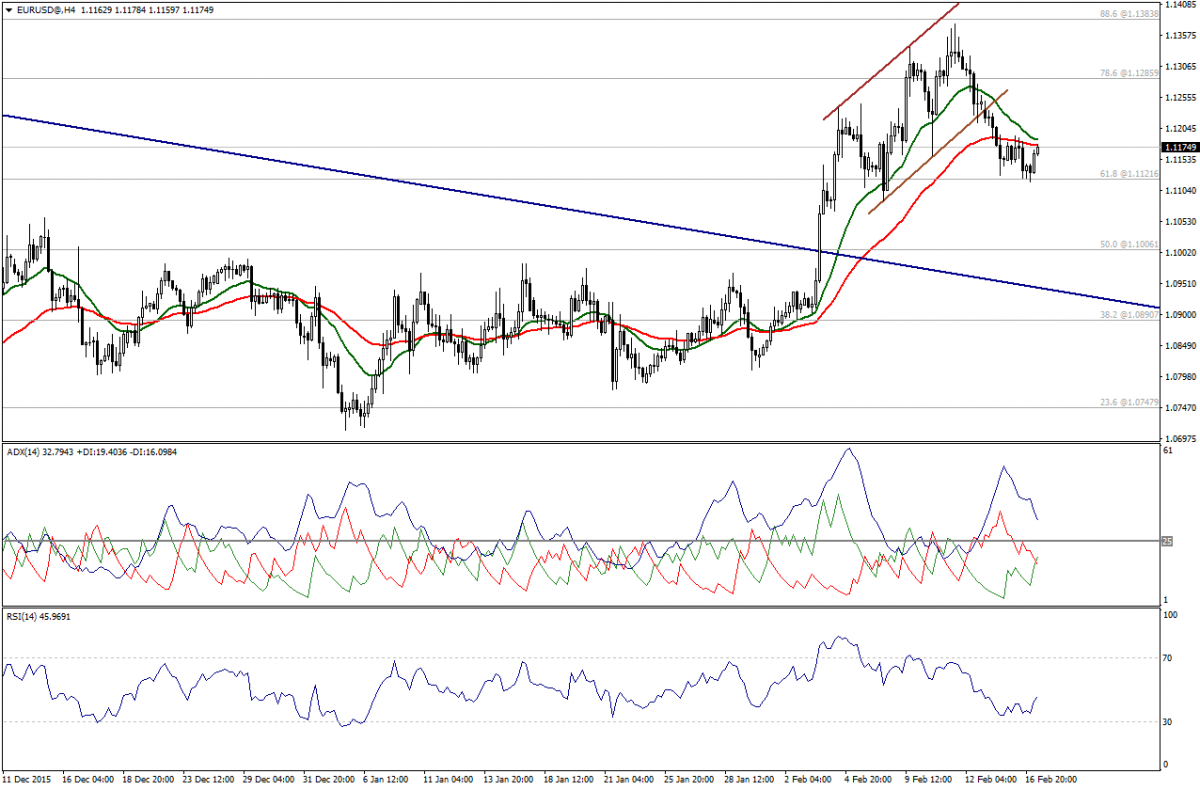

Euro inclined from 61.8% Fibonacci at 1.1120, but still capped by moving averages at 1.1190, stabilizing below 1.1225.

Trading above 1.1225 forces us to be neutral, but the positivity on ADX suggests waiting to confirm moving above moving averages.

We will be bullish with a break above 1.1225.

Support: 1.1120 – 1.1080 – 1.1005

Resistance: 1.1190 –1.1225 – 1.1285

Direction: Neutral

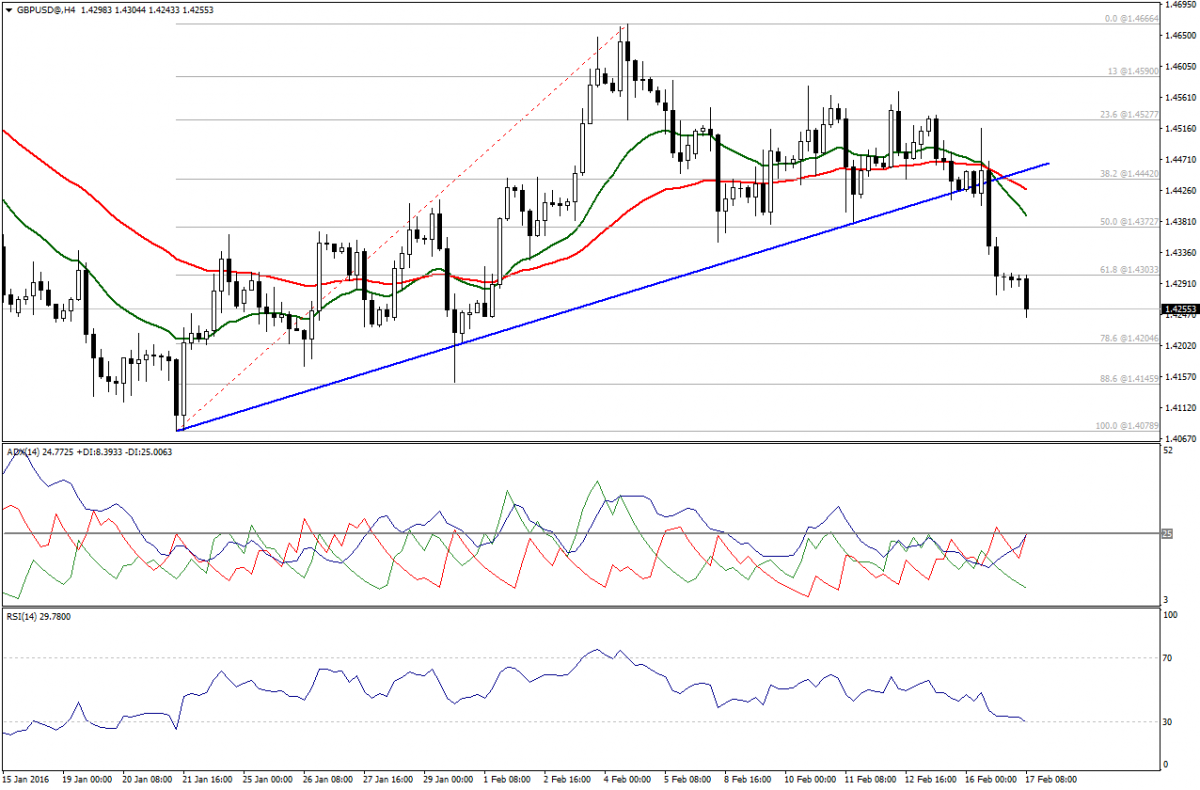

GBP/USD has declined to trade below 61.8% Fibonacci at 1.4305, which suggests further debasement today.

Targets reside at 1.4205, while coming below 78.6% Fibonacci at 1.4145 will accelerate.

ADX supports the bearishness, although RSI touches 30.00 levels, but it remains bearish.

Support: 1.4205 – 1.4180 – 1.4145

Resistance: 1.4305 – 1.4375 – 1.4445

Direction: Bearish