EUR/USD" width="1596" height="746">

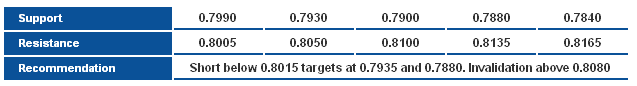

EUR/USD" width="1596" height="746">The pair is trading with an upside bias benefiting from stability above 1.3315 levels. The bullish bias extended despite its weakness, and Linear Regression Indicator 55 represents good support. Breaching Linear Regression Indicator 34 at 1.3380 is significant to prove the extension of the current bullish wave.

The trading range for today is among the key support at 1.3230 and key resistance at 1.3545.

The general trend over short term basis is sideways targeting 1.2775 as far as 1.3600 is daily-closing.

GBP/USD GBP/USD" width="1596" height="746">

GBP/USD" width="1596" height="746">

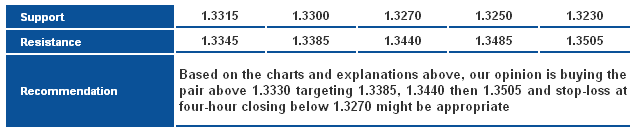

A daily closing above 88.6% correction at 1.5645 was achieved supporting the extension of the upside move and forcing us to ignore any negative signals shown on momentum indicators. Linear Regression Indicators support the possibility of extending bullishness and the next suggested target is the previous top at 1.5751.

The trading range for today is among key support at 1.5500 and key resistance at 1.5800.

The general trend over short term basis is to the upside as far as areas of 1.5100 remains intact targeting 1.6010.

USD/JPY USD/JPY" width="1596" height="746">

USD/JPY" width="1596" height="746">

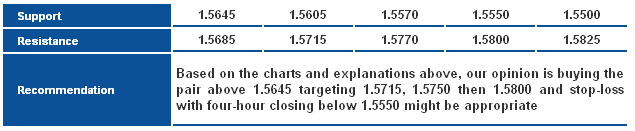

The pair is trading slightly to the downside after touching Linear Regression Indicator 55 yesterday then rebounding to the downside. The pair is also stabilizing below 50% correction at 97.65 forcing us to expect negativity in today’s session. Breaking 96.75 is very important to prove extending the downside move.

The trading range for today is among key support at 95.40 and key resistance at 98.80

The general trend over short term basis is to the downside as far as areas of 103.50 remain intact targeting 93.50.

USD/CHF USD/CHF" width="1596" height="746">

USD/CHF" width="1596" height="746">

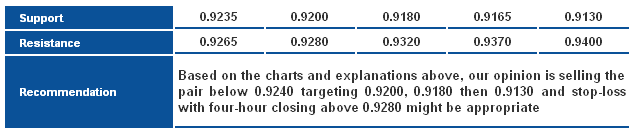

The pair consolidated below 0.9265 which is negative and might extend the downside move. Linear Regression Indicators are covering the downside move despite the oversold signals shown on momentum indicators. The pair is also trading within the descending channel shown on graph supporting this negative outlook. Of note, breaking 0.9200 levels is significant to push the pair further to the downside.

The trading range for today is among key support at 0.9130 and key resistance at 0.9370.

The general trend over short term basis is to the downside stable at levels 0.9775 targeting 0.8860.

USD/CAD USD/CAD" width="1596" height="719">

USD/CAD" width="1596" height="719">

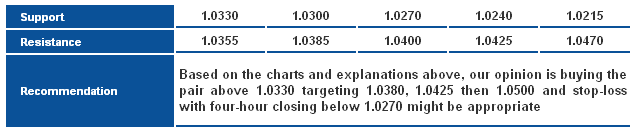

The pair moved to the upside stabilizing above 1.0330 represented in 23.6% correction, as we see a possibility of forming a bullish setup if the pair stabilizes above 1.0425 represented in 50% correction. Stabilizing above 1.0330 today will be considered positive, but breaching 1.0385 and stabilizing above it is required to better support this level.

The trading range for today is between the key support at 1.0240 and the key resistance at 1.0500.

The general trend over short term basis is to the upside with steady daily closing above levels 1.0100 targeting 1.0775.

AUD/USD AUD/CAD" width="1596" height="746">

AUD/CAD" width="1596" height="746">

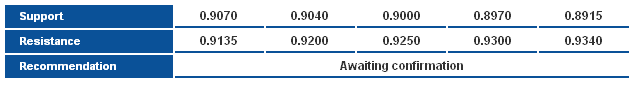

The pair dips sharply lower and breaks below 0.9070 pivotal support, however the break remains tentative, we would like to see further stability below it to confirm a move lower, and accordingly, we will wait for our next update within hours to suggest the next potential scenario.

NZD/USD NZD/USD" width="1596" height="746">

NZD/USD" width="1596" height="746">

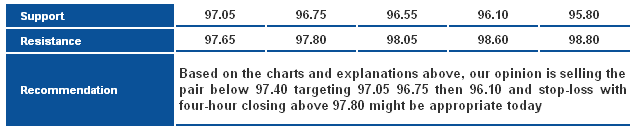

The price failed at 0.8135-0.8100 key resistance, forming a bearish shooting start pattern, suggesting a potential bearish reversal. The bearish scenario is favored today, eying initially the 50-days SMA.