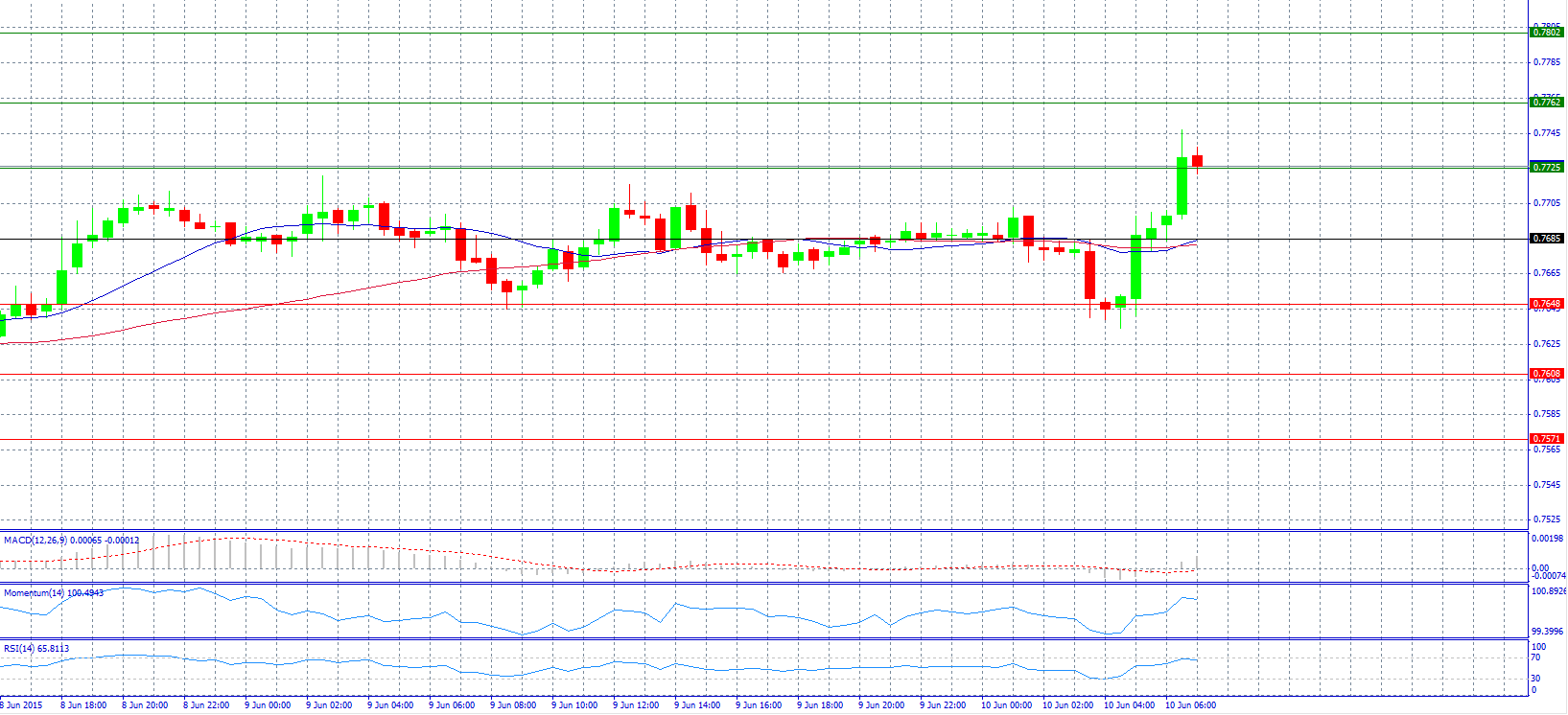

Market Scenario 1: Long positions above 0.7725 with target at 0.7762.

Market Scenario 2: Short positions below 0.7725 with target at 0.7685.

Comment: The pair rose, broke resistance level 0.7725 and tried to stay above it.

Supports and Resistances:

R3 0.7802

R2 0.7762

R1 0.7725

PP 0.7685

S1 0.7648

S2 0.7608

S3 0.7571

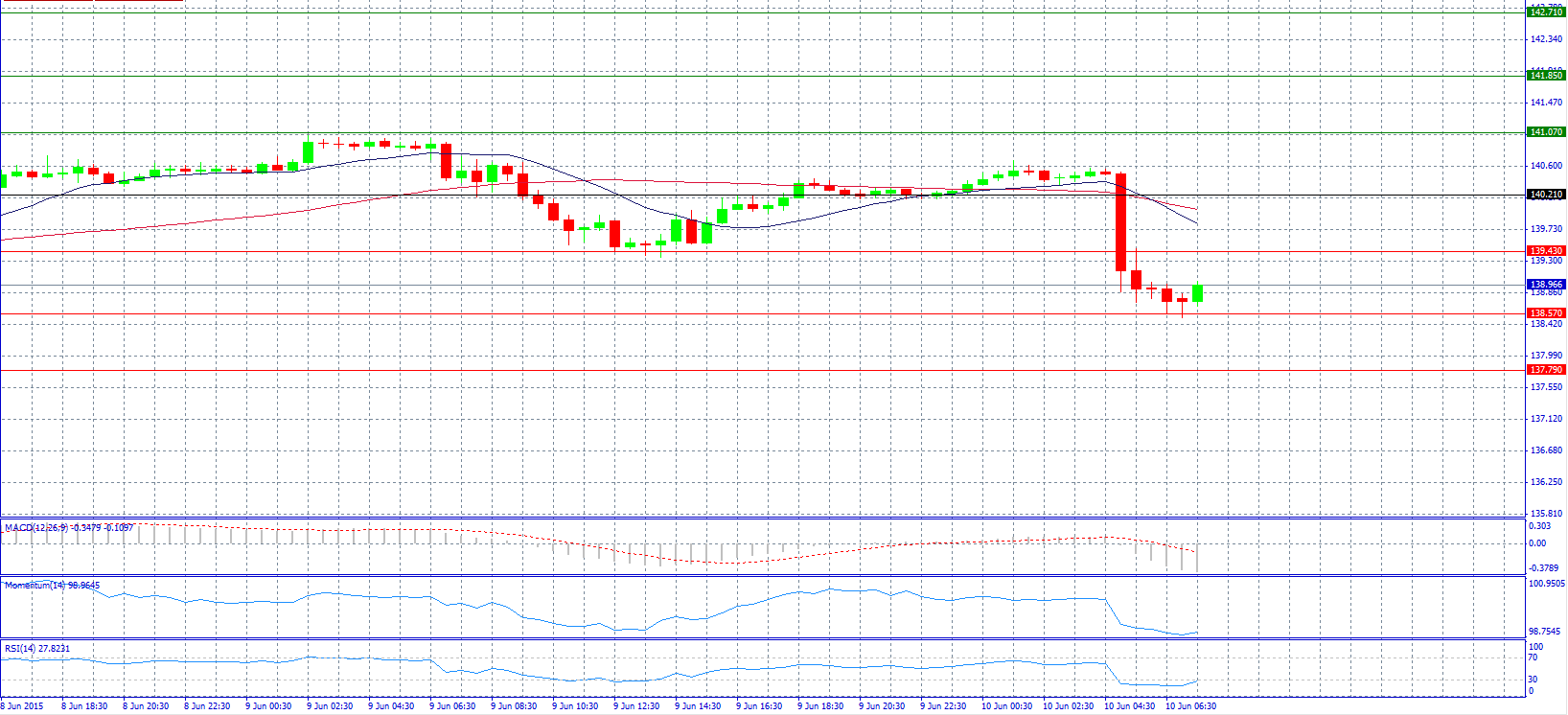

Market Scenario 1: Long positions above 138.57 with target at 139.43.

Market Scenario 2: Short positions below 138.57 with target at 137.79.

Comment: The pair made a sharp fall near 138.50 level and currently trades near 139.00 level.

Supports and Resistances:

R3 142.71

R2 141.85

R1 141.07

PP 140.21

S1 139.43

S2 138.57

S3 137.79

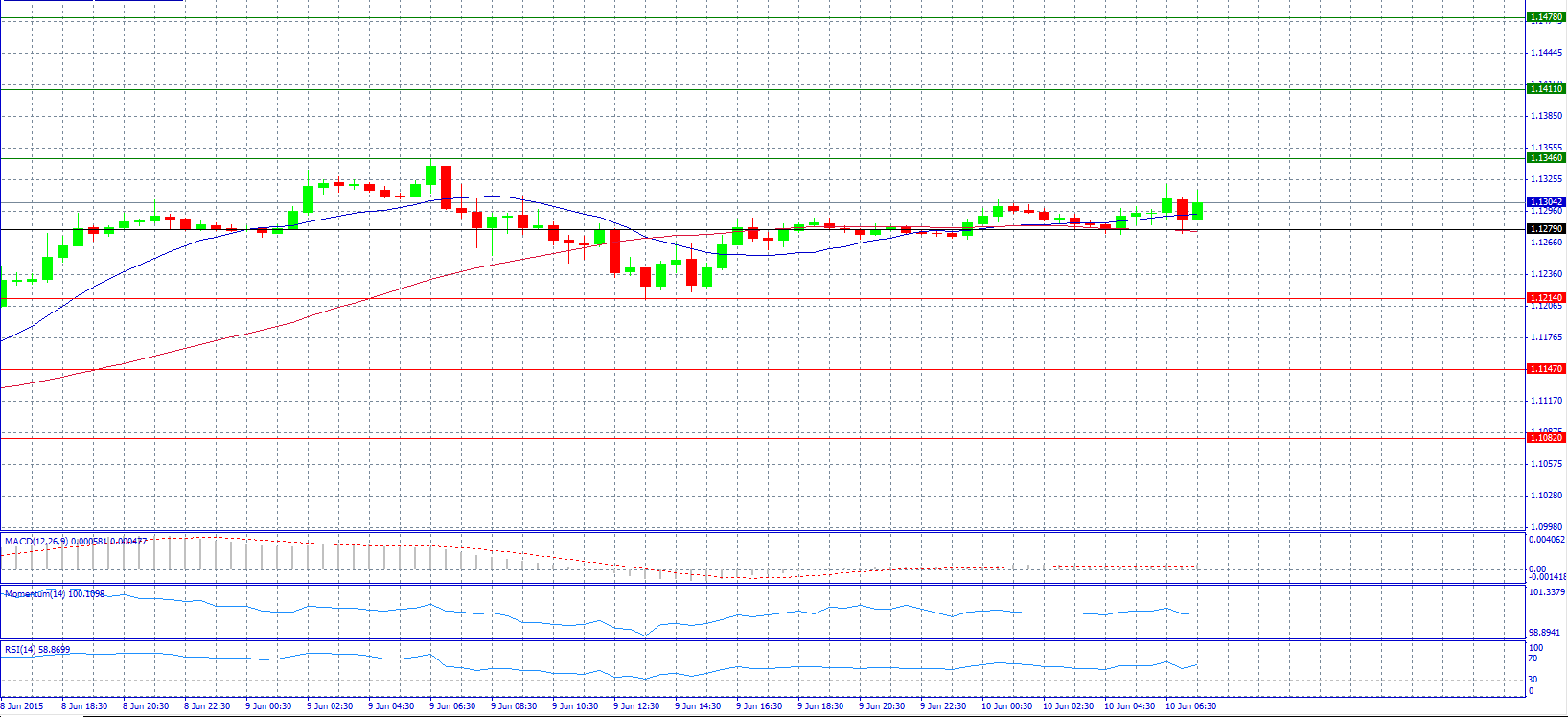

Market Scenario 1: Long positions above 1.1346 with target at 1.1411.

Market Scenario 2: Short positions below 1.1279 with target at 1.1214.

Comment: The pair advanced above 1.1300 level due to the weaker tone around the dollar following BoJ headlines.

Supports and Resistances:

R3 1.1478

R2 1.1411

R1 1.1346

PP 1.1279

S1 1.1214

S2 1.1147

S3 1.1082

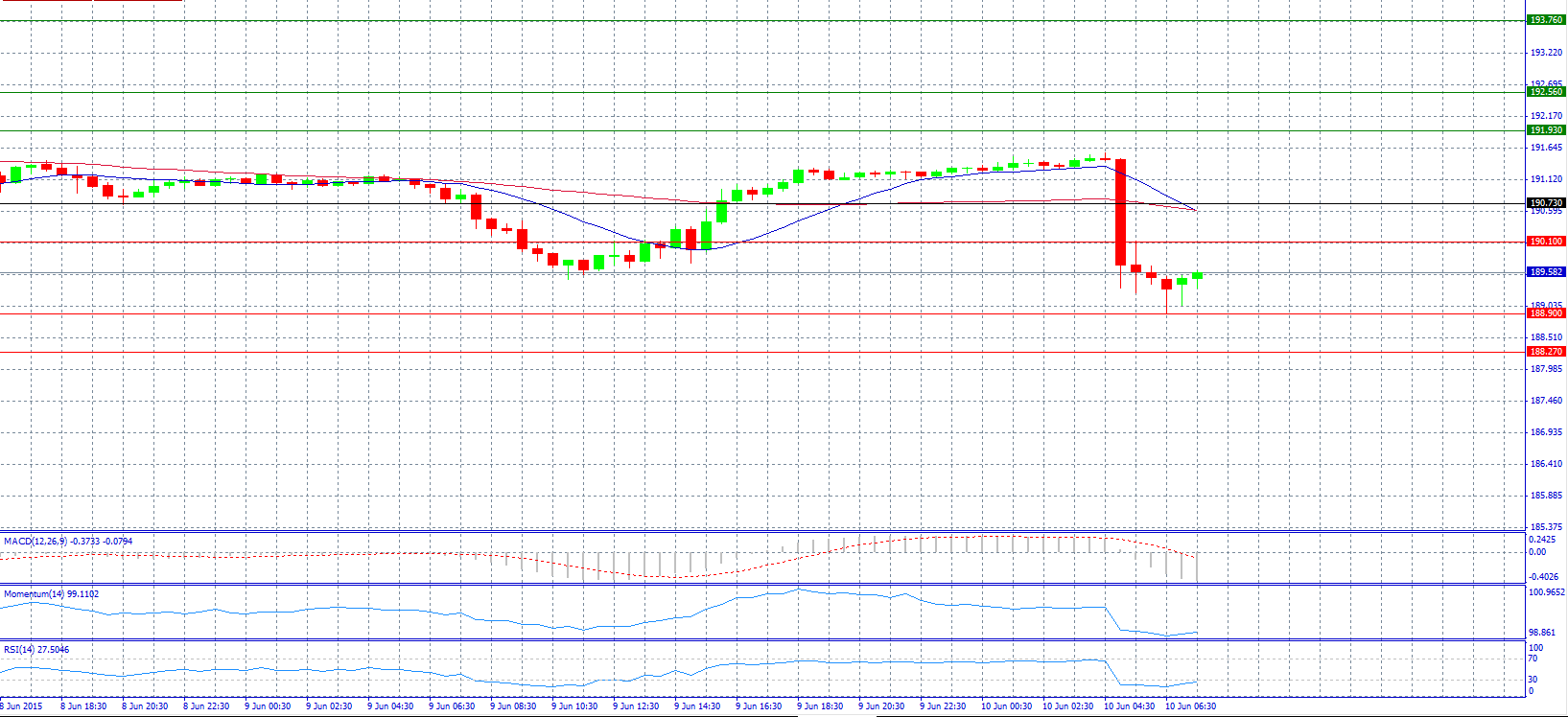

Market Scenario 1: Long positions above 190.10 with target at 190.73.

Market Scenario 2: Short positions below 188.90 with target at 188.27.

Comment: The pair reached the session low of 188.95 level, after BOJ’s Kuroda expressed a low possibility of further depreciation in the yen real effective exchange rate.

Supports and Resistances:

R3 193.76

R2 192.56

R1 191.93

PP 190.73

S1 190.10

S2 188.90

S3 188.27

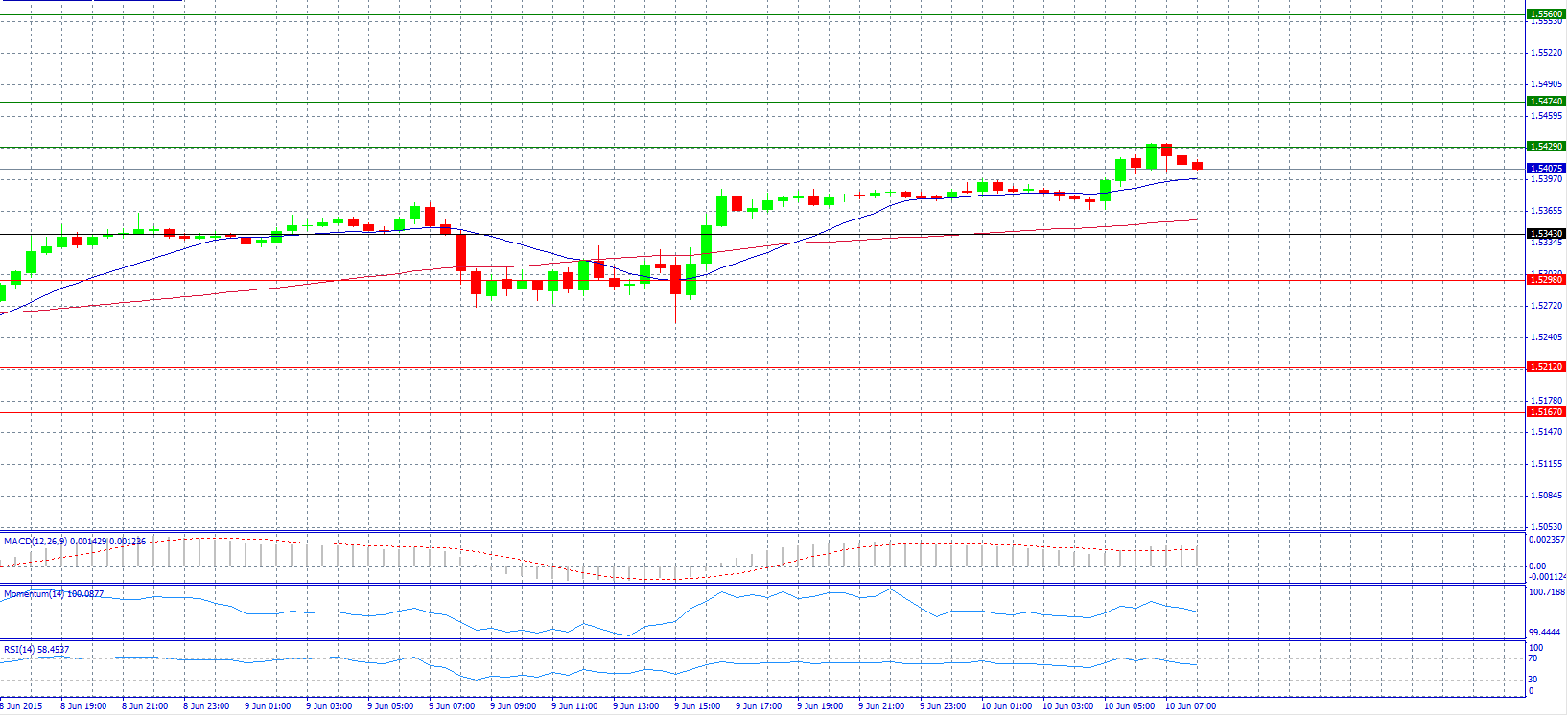

Market Scenario 1: Long positions above 1.5429 with target at 1.5474.

Market Scenario 2: Short positions below 1.5429 with target at 1.5343.

Comment: The pair extends its upward trend for the third straight session in the European morning, with the profits mainly fueled by broad dollar weakness. Traders now turn focus towards manufacturing and industrial production data from the UK due later shortly.

Supports and Resistances:

R3 1.5560

R2 1.5474

R1 1.5429

PP 1.5343

S1 1.5298

S2 1.5212

S3 1.5167

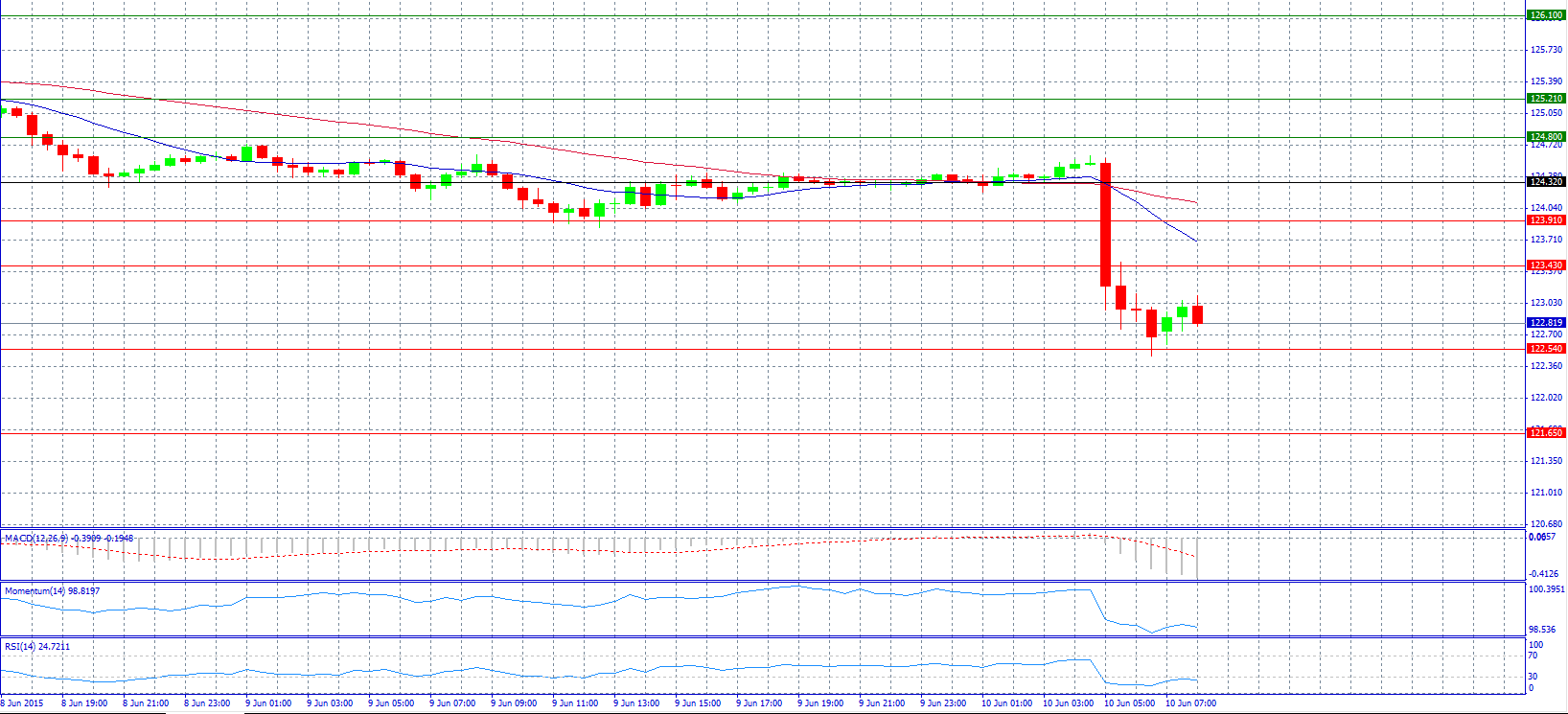

Market Scenario 1: Long positions above 123.43 with target at 123.91.

Market Scenario 2: Short positions below 122.54 with target at 121.65.

Comment: The pair could retreat to the 120.85/75 area prior to another leg higher according to analysts.

Supports and Resistances:

R3 126.10

R2 125.21

R1 124.80

PP 124.32

S1 123.91

S2 123.43

S3 122.54

S4 121.65

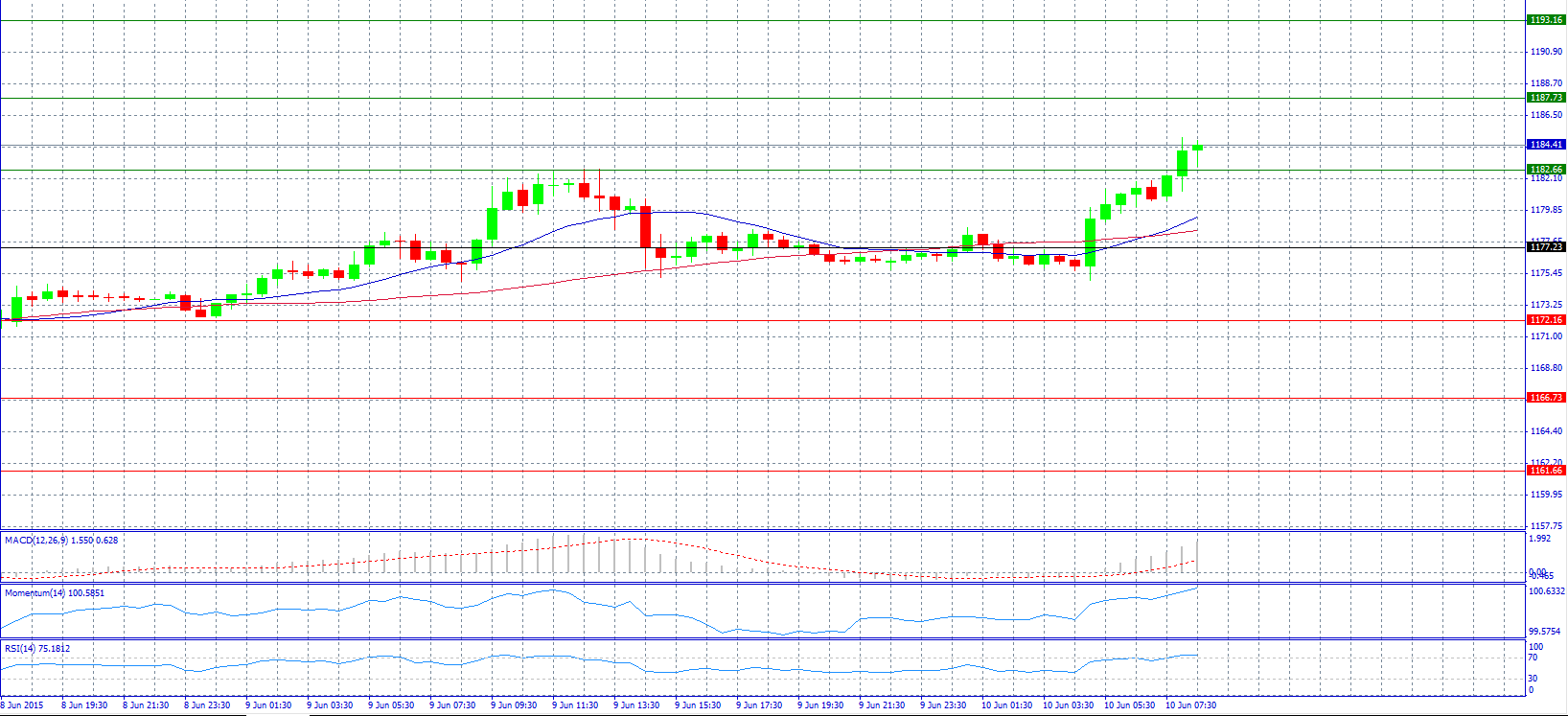

Market Scenario 1: Long positions above 1187.73 with target at 1193.16.

Market Scenario 2: Short positions below 1182.66 with target at 1177.23.

Comment: Gold prices snapped losses from Asia and climbed higher during the European morning, extending its 3-day rally, largely driven by US dollar weakness across the board backed by USD/JPY sell-off.

Supports and Resistances:

R3 1193.16

R2 1187.73

R1 1182.66

PP 1177.23

S1 1172.16

S2 1166.73

S3 1161.66

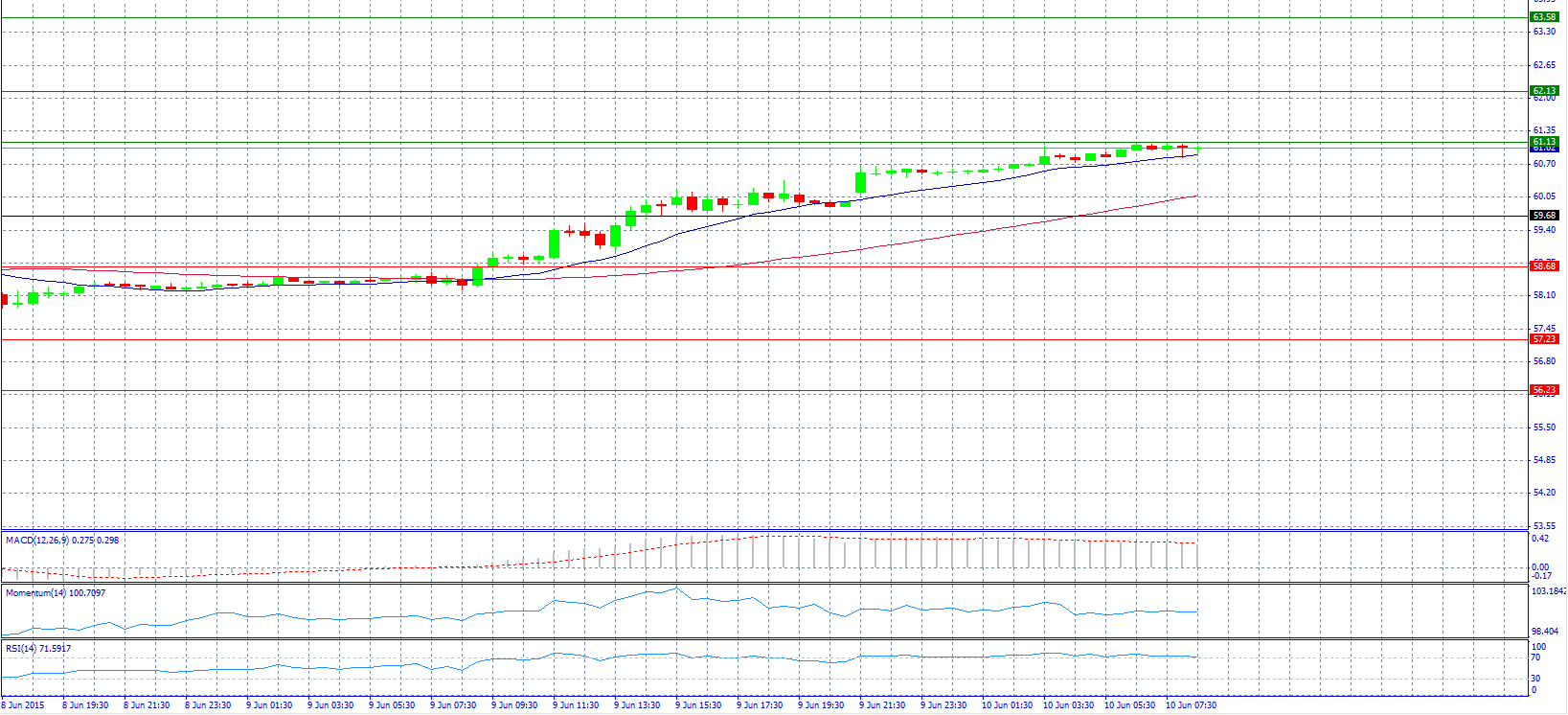

Market Scenario 1: Long positions above 61.13 with target at 62.13.

Market Scenario 2: Short positions below 61.13 with target at 59.68.

Comment: Crude oil prices trade neutral near resistance level 61.13.

Supports and Resistances:

R3 63.58

R2 62.13

R1 61.13

PP 59.68

S1 58.68

S2 57.23

S3 56.23

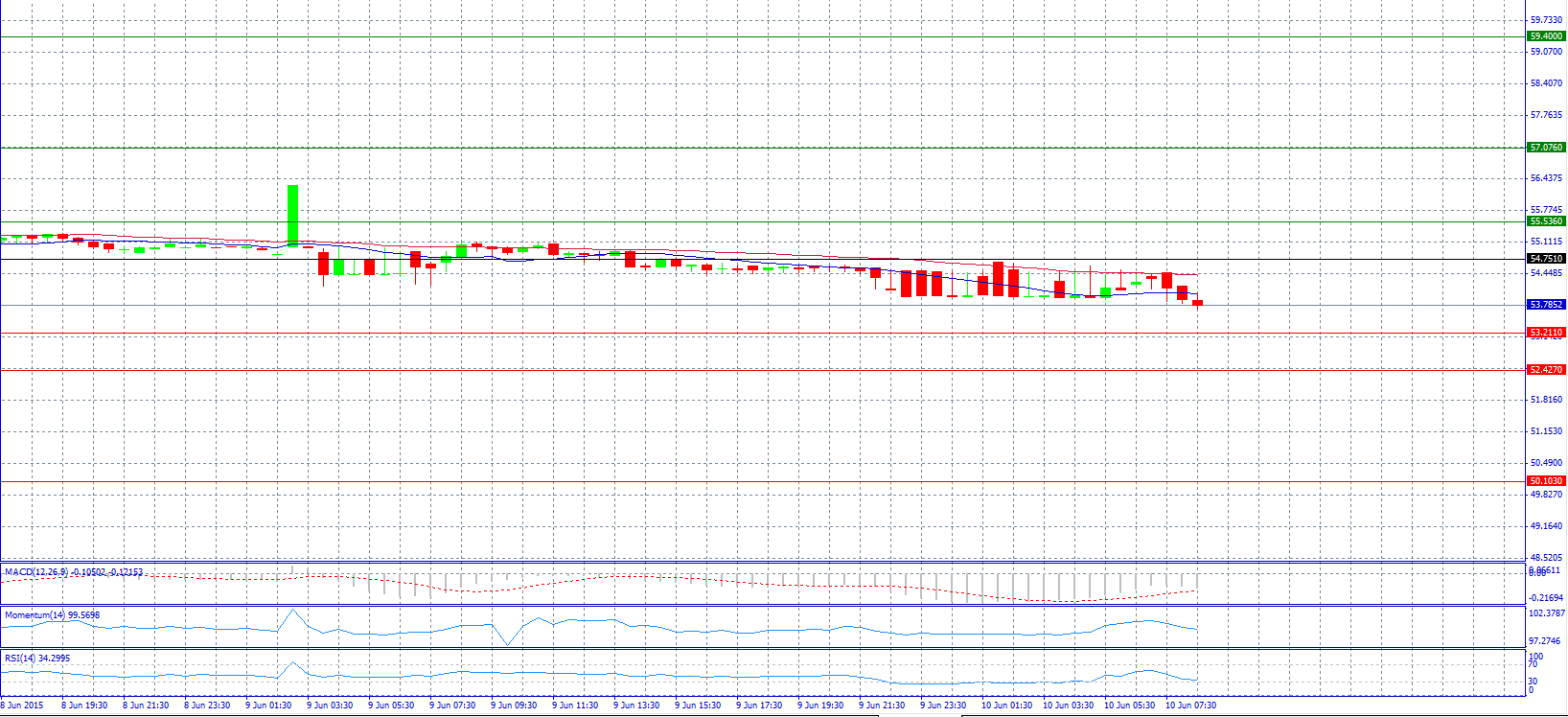

Market Scenario 1: Long positions above 54.751 with target at 55.536.

Market Scenario 2: Short positions below 53.211 with target at 52.427.

Comment: The pair weakened and trades below 54.000 level.

Supports and Resistances:

R3 59.400

R2 57.076

R1 55.536

PP 54.751

S1 53.211

S2 52.427

S3 50.103