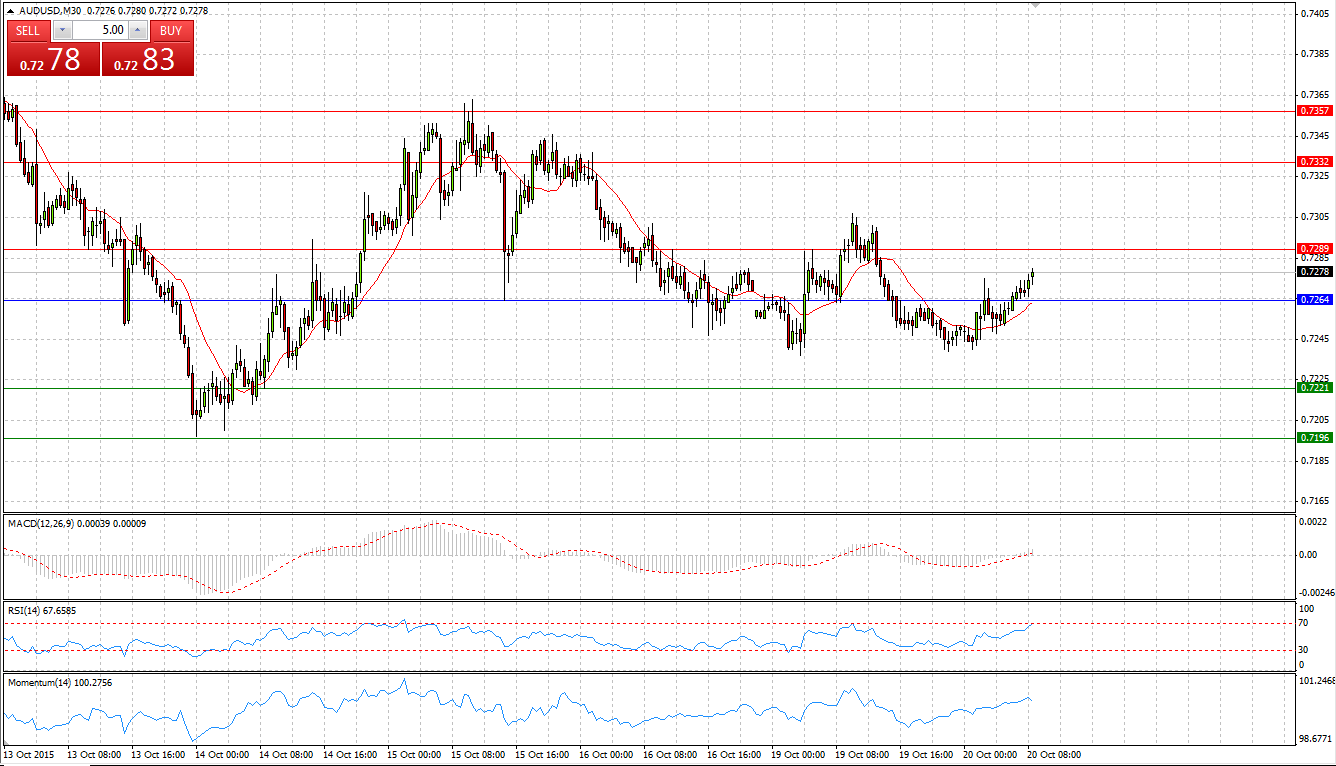

Market Scenario 1: Long positions above 0.7264 with targets at 0.7289 and 0.7332

Market Scenario 2: Short positions below 0.7264 with targets at 0.7221 and 0.7196

Comment: Aussie found strength against the US dollar during early Asian Session amid promising news from Reserve Bank of Australia signaling in this month’s meeting minutes that ultra-low official interest rates are helping the economy adjust to the end of the resources boom, giving power the labor market. In view of this, according to RBA, there is no need to cut the benchmark cash rate below 2 per cent any time soon. AUD/USD managed to break through Pivot Point level aiming to test R1 and R2.

Supports and Resistances:

R3 0.7357

R2 0.7332

R1 0.7289

PP 0.7264

S1 0.7221

S2 0.7196

S3 0.7153

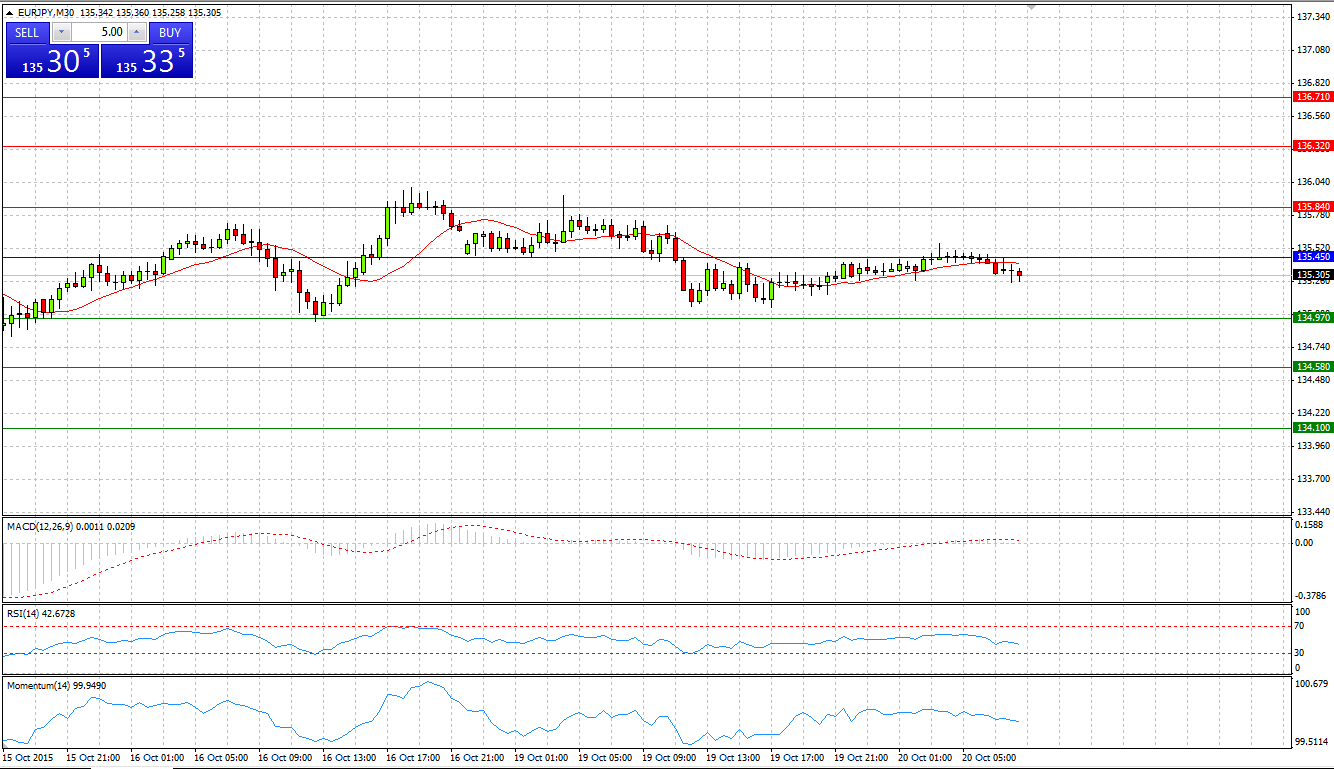

EUR/JPY

Market Scenario 1: Long positions above 135.45 with targets at 135.84 and 136.32

Market Scenario 2: Short positions below 135.45 with targets at 134.97 and 134.58

Comment: EUR/JPY is trading in the range since Thursday’s sell-off between R1 and S1. At the time being, EUR/JPY was pushed slightly below Pivot Point level.

Supports and Resistances:

R3 136.71

R2 136.32

R1 135.84

PP 135.45

S1 134.97

S2 134.58

S3 134.10

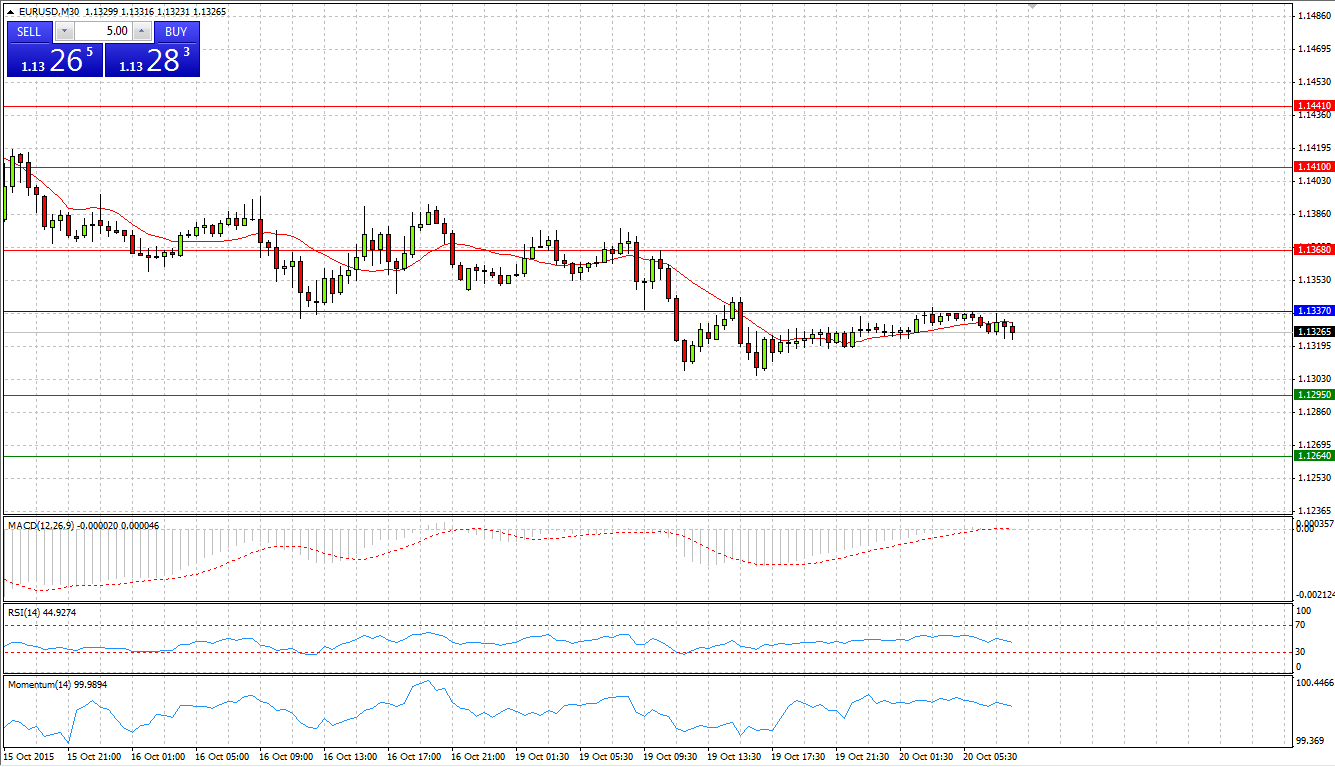

EUR/USD

Market Scenario 1: Long positions above 1.1359 with targets at 1.1383 and 1.1419

Market Scenario 2: Short positions below 1.1359 with targets at 1.1323 and 1.1323

Comment: The European Currency continues to depreciate against US dollar amid positive news from United States. During yesterday’s session, EUR/USD touched its 2nd of October highs at 1.13049. Currently, the currency is struggling without success to gain back the Pivot Point level.

Supports and Resistances:

R3 1.1441

R2 1.1410

R1 1.1368

PP 1.1337

S1 1.1295

S2 1.1264

S3 1.1222

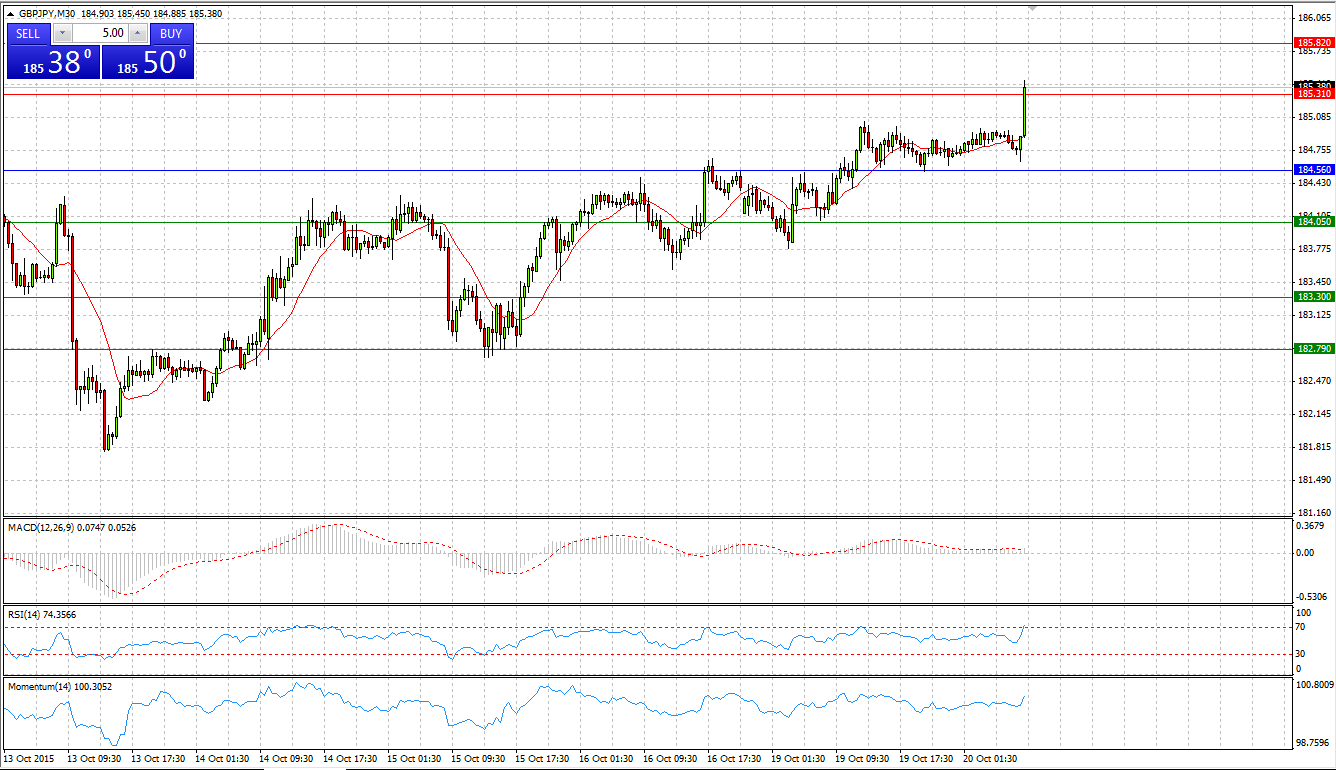

GBP/JPY

Market Scenario 1: Long positions above 184.56 with targets at 185.31 and 185.82

Market Scenario 2: Short positions below 184.56 with targets at 184.05 and 183.30

Comment: Bulls regained control of the pair and GBP/JPY managed to break through the high level it reached on 9th of October at 184.80. Now, GBP/USD is testing the strength of First Resistance Level at 185.3. If it breaks through the level successfully, it will open the way to R2 and R3.

Supports and Resistances:

R3 186.57

R2 185.82

R1 185.31

PP 184.56

S1 184.05

S2 183.30

S3 182.79

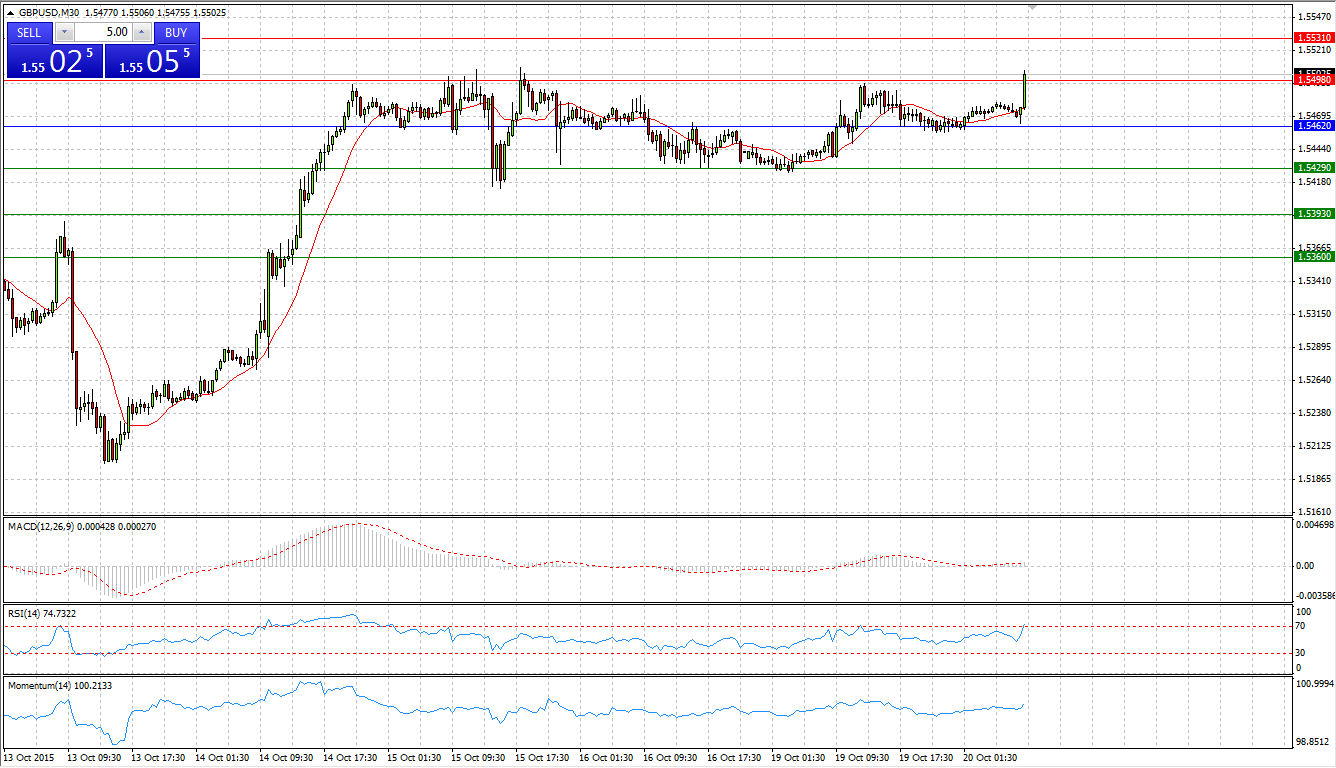

GBP/USD

Market Scenario 1: Long positions above 1.5462 with targets at 1.5498 and 1.5531

Market Scenario 2: Short positions below 1.5462 with targets at 1.5429 and 1.5393

Comment: Sterling was supported by the positive economic data from UK, and expectations of interest rate hike heading towards its recent highs at 155.08. The 1.55 US dollar per sterling is a crucial psychological level that managed to withhold appreciation of the sterling for a number of days. Successfully breaking through this level will open the way to R2 and R3.

Supports and Resistances:

R3 1.5567

R2 1.5531

R1 1.5498

PP 1.5462

S1 1.5429

S2 1.5393

S3 1.5360

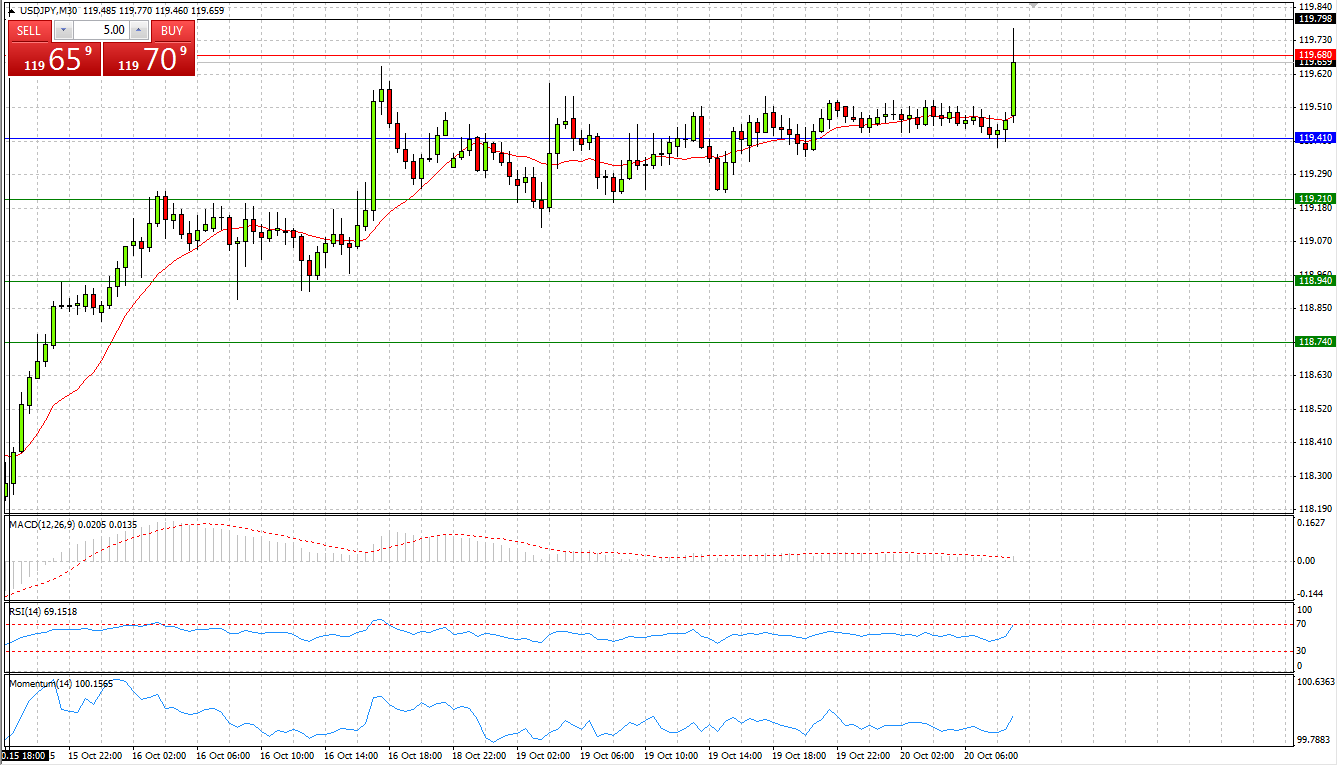

USD/JPY

Market Scenario 1: Long positions above 119.41 with targets at 119.68 and 119.88

Market Scenario 2: Short positions below 119.41 with targets at 119.21 and 118.94

Comment: USD/JPY managed to break through Pivot Point Level and entered to its recent consolidation area. Now, USD/JPY is testing the First Resistance level at 119.68.

Supports and Resistances:

R3 120.15

R2 119.88

R1 119.68

PP 119.41

S1 119.21

S2 118.94

S3 118.74

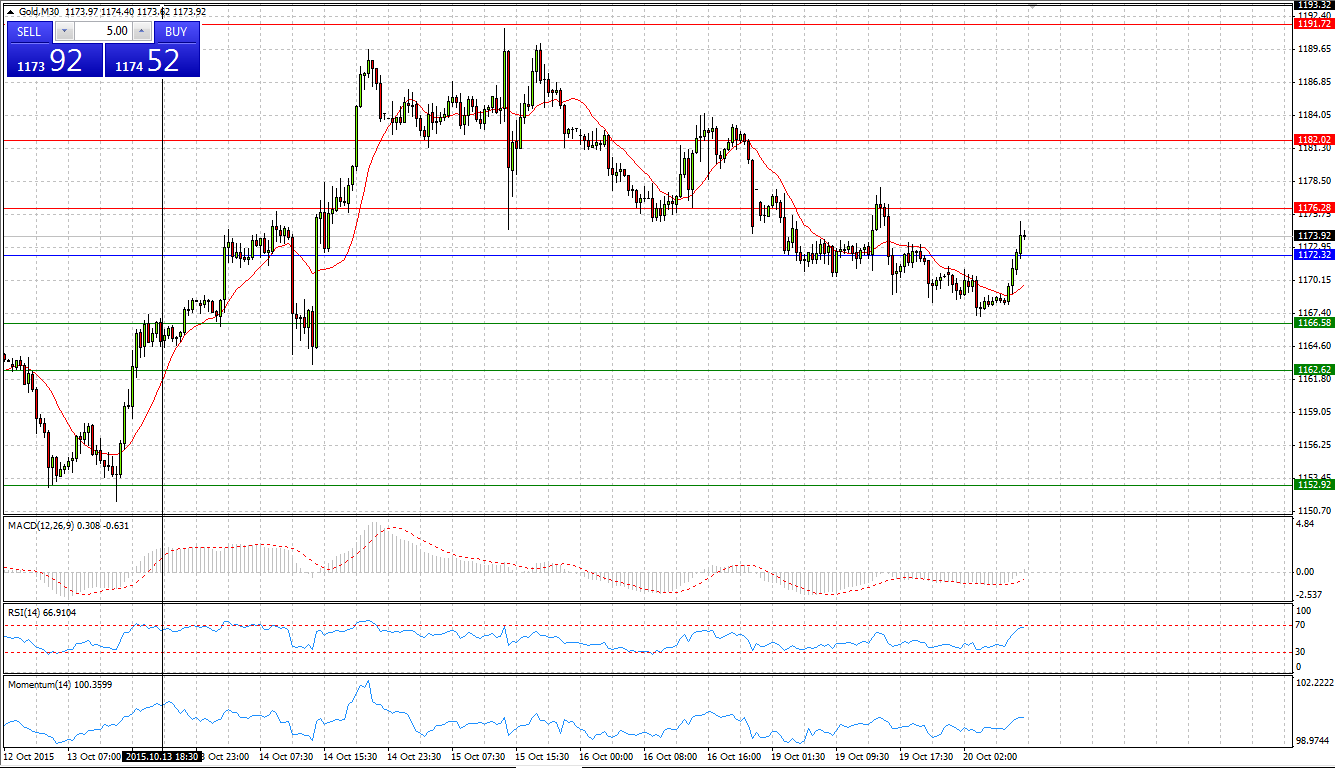

GOLD

Market Scenario 1: Long positions above 1172.32 with targets at 1176.28 and 1182.02

Market Scenario 2: Short positions below 1172.32 with targets at 1166.58 and 1162.62

Comment: Having dropped to 24th of August highs, gold found support and managed to recover some of the losses during yesterday’s trading session. The bullion is trading slightly above Pivot Point level aiming to test First Resistance level.

Supports and Resistances:

R3 1191.72

R2 1182.02

R1 1176.28

PP 1172.32

S1 1166.58

S2 1162.62

S3 1152.92

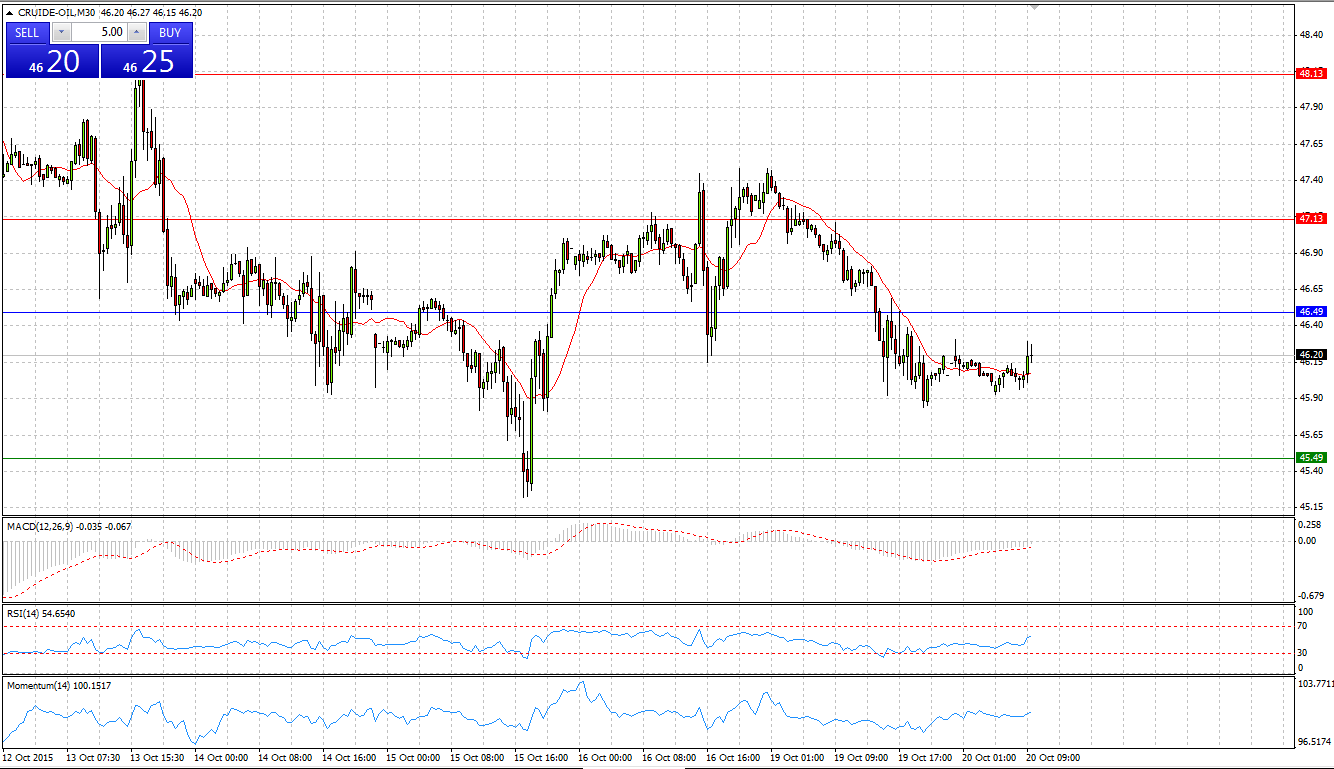

CRUDE OIL

Market Scenario 1: Long positions above 46.49 with targets at 47.13 and 48.13

Market Scenario 2: Short positions below 46.49 with targets at 45.49 and 44.85

Comment: Crude continues trading at its lowest levels ahead of OPEC meeting on October 21, 2015. The Organization of Petroleum Exporting Countries (OPEC) and other crude oil producers will hold a meeting on October 21st, which aims to address issues with oversupply of crude oil and unprecedented low prices.

Supports and Resistances:

R3 49.77

R2 48.13

R1 47.13

PP 46.49

S1 45.49

S2 44.85

S3 43.21

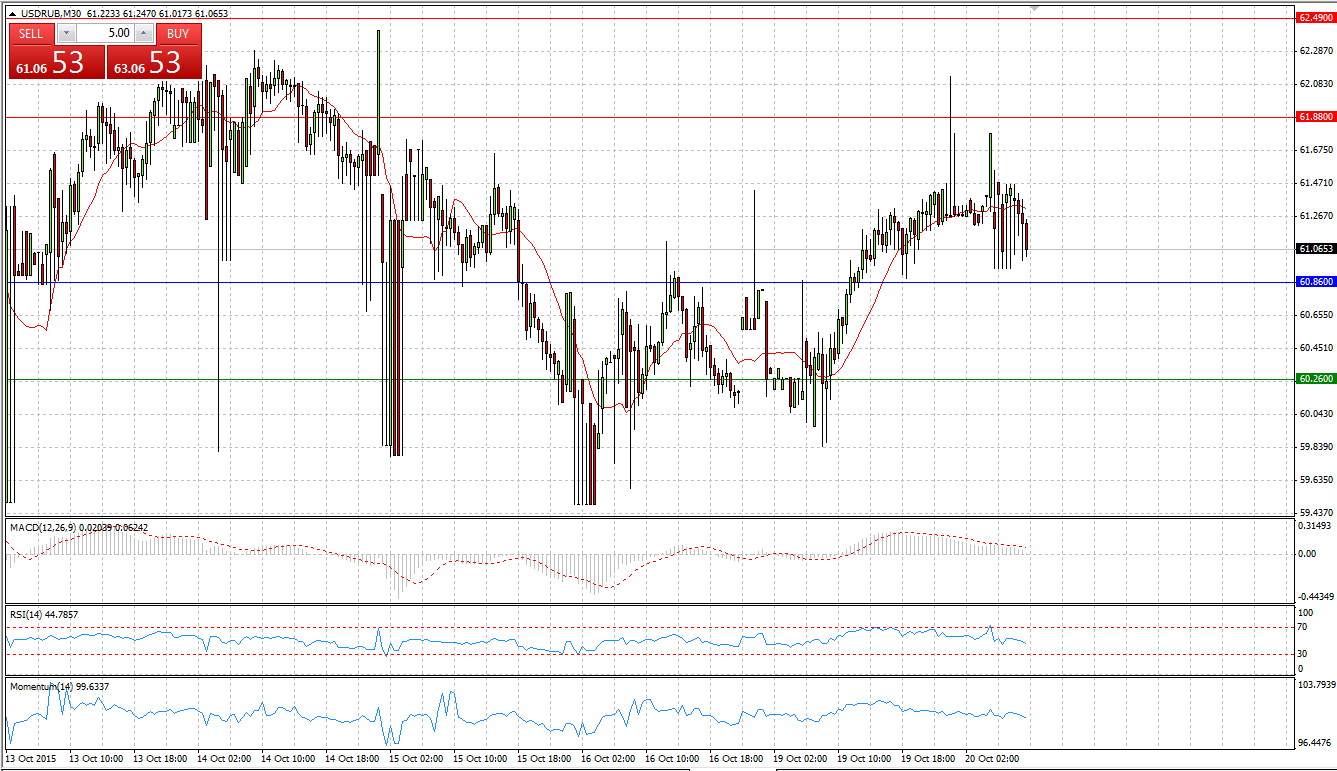

USD/RUB

Market Scenario 1: Long positions above 60.86 with targets at 61.88 and 62.49

Market Scenario 2: Short positions below 60.86 with targets at 60.26 and 59.24

Comment: USD/RUB continues trading in the range between S1 and R1 slightly higher Pivot Point level. Tomorrow the OPEC meeting will take place, aiming to address issues with oversupply of crude oil and unprecedented low prices. If all parties find a consensus and agree on a threshold of 70 – 100 USD per barrel, Russian ruble will witness some positive effects, allowing the pair to drop under 60 ruble per US dollar.

Supports and Resistances:

R3 64.11

R2 62.49

R1 61.88

PP 60.86

S1 60.26

S2 59.24

S3 57.62