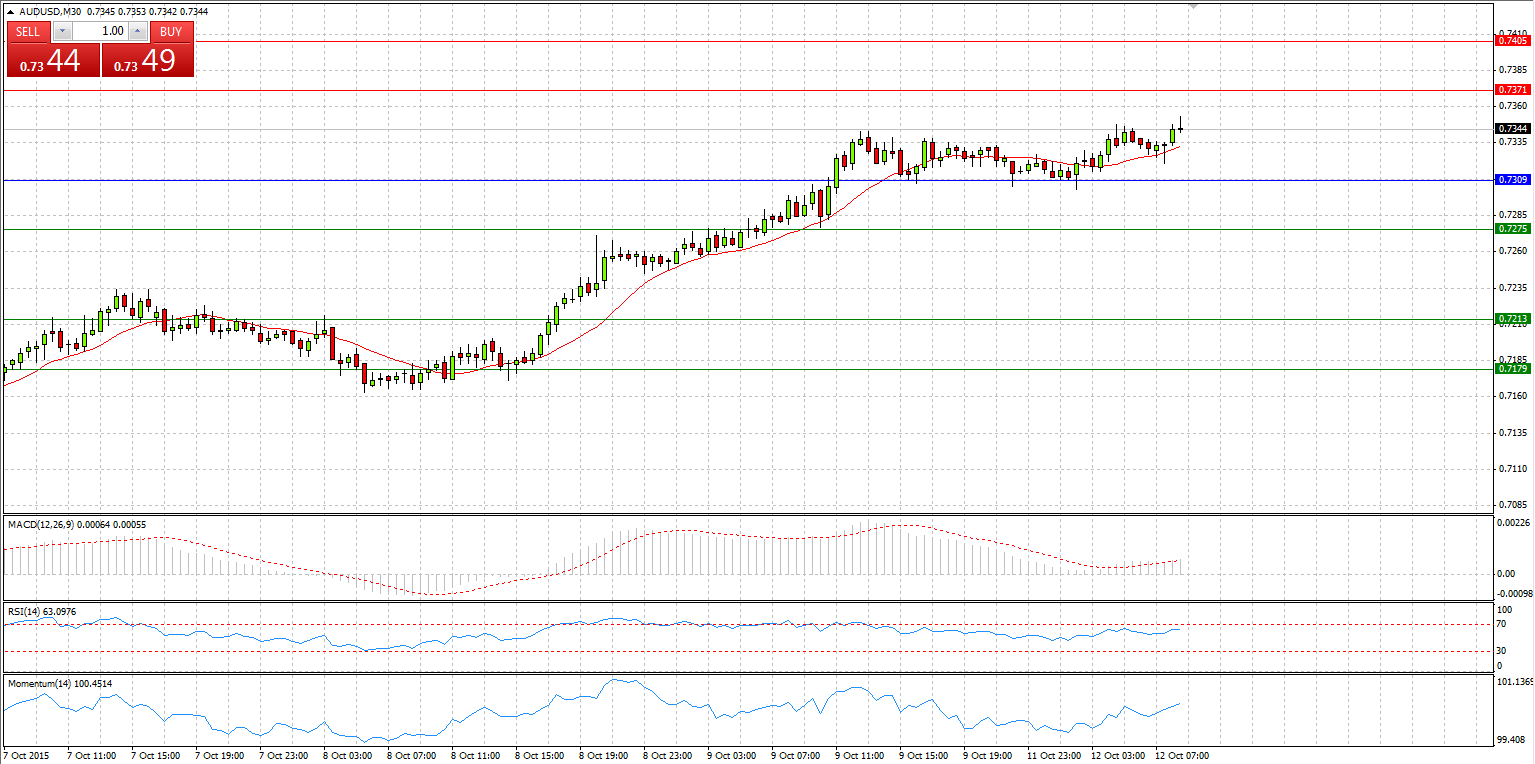

Market Scenario 1: Long positions above 0.7309 with targets at 0.7371 and 0.7405.

Market Scenario 2: Short positions below 0.7309 with targets at 0.7275 and 0.72130

Comment: Aussie continues appreciating against US dollar for the 5th day in a row. On Friday, Aussie managed to break through the high of 17th and 18th of September and is now heading towards R1 and R2. R2 was the high of 11 of August. At this level, Aussie might encounter with strong selling pressure.

Supports and Resistances:

R3 0.7467

R2 0.7405

R1 0.7371

PP 0.7309

S1 0.7275

S2 0.7213

S3 0.7179

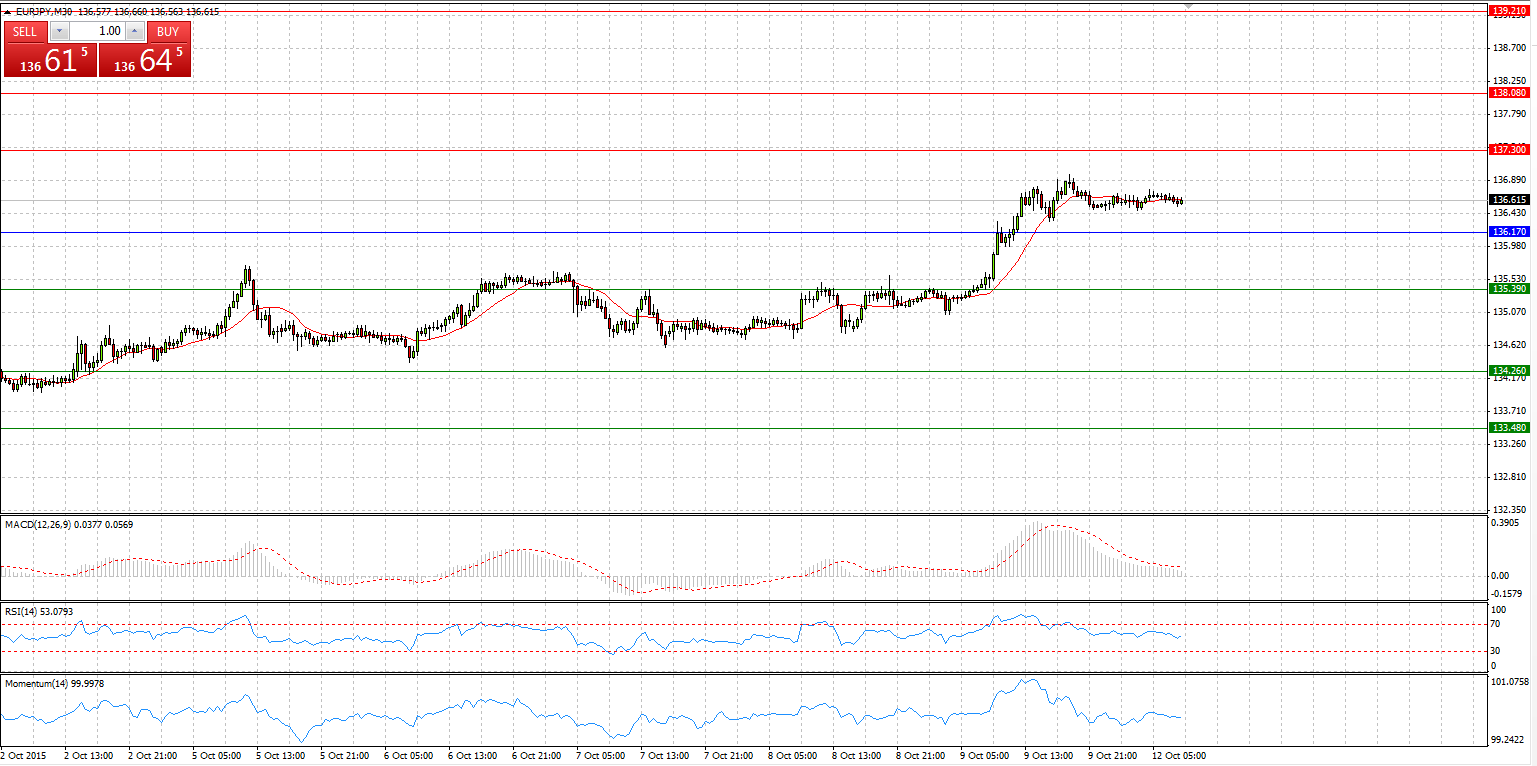

EUR/JPY

Market Scenario 1: Long positions above 138.08 with targets at 137.30 and 136.17

Market Scenario 2: Short positions below 135.39 with targets at 136.17 and 137.30

Comment: EUR/JPY is currently trading in a range between S3 and R3. In this respect, Range bound strategy can be applied.

R3 139.21

R2 138.08

R1 137.30

PP 136.17

S1 135.39

S2 134.26

S3 133.48

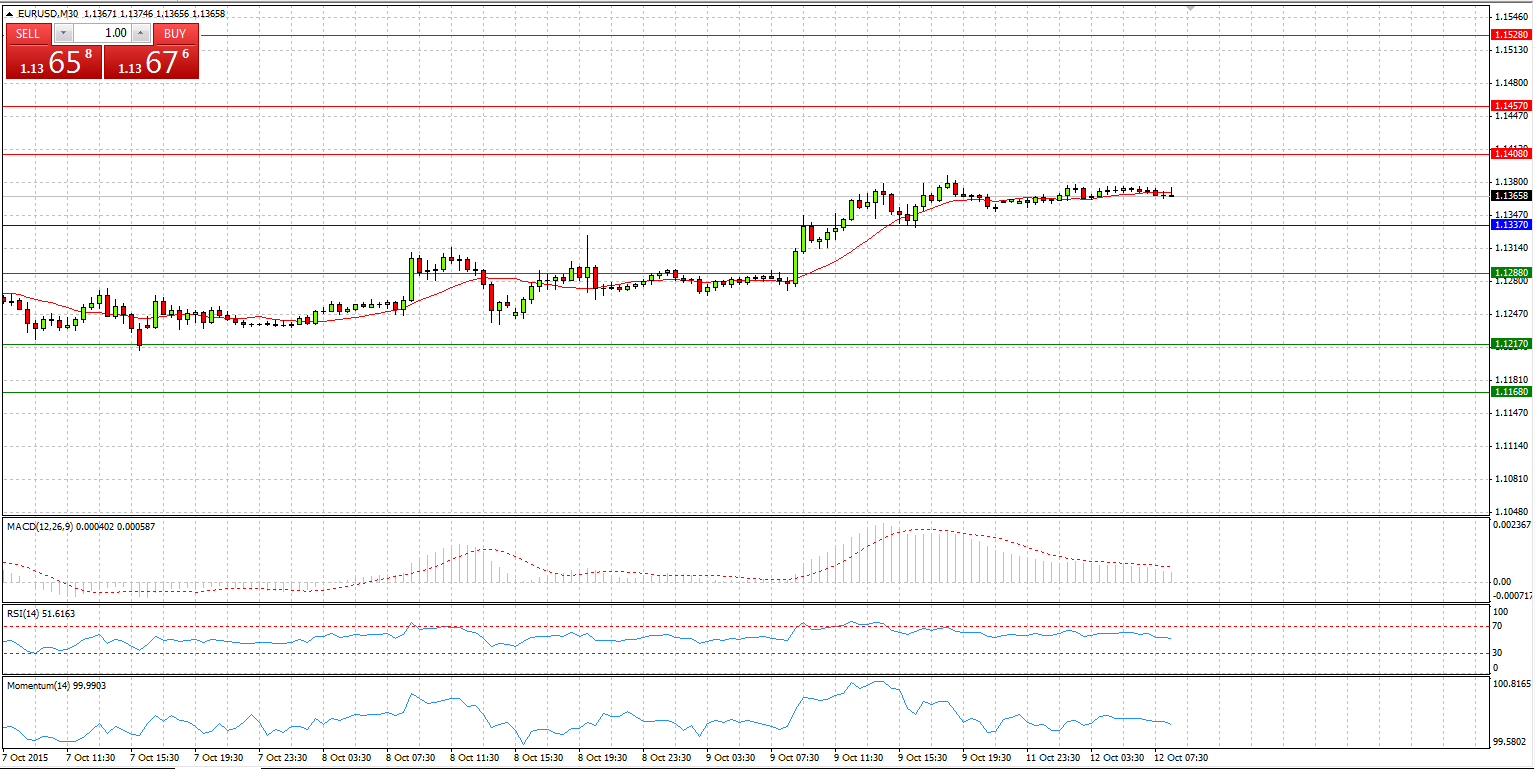

Market Scenario 1: Long positions above 1.1337 with targets at 1.1408 and 1.1457

Market Scenario 2: Short positions below 1.1337 with targets at 1.1288 and 1.1217

Comment: European currency continues strengthening its position against the US dollar amid uncertainty about when Federal Reserve will eventually increase interest rates.

Supports and Resistances:

R3 1.1528

R2 1.1457

R1 1.1408

PP 1.1337

S1 1.1288

S2 1.1217

S3 1.1168

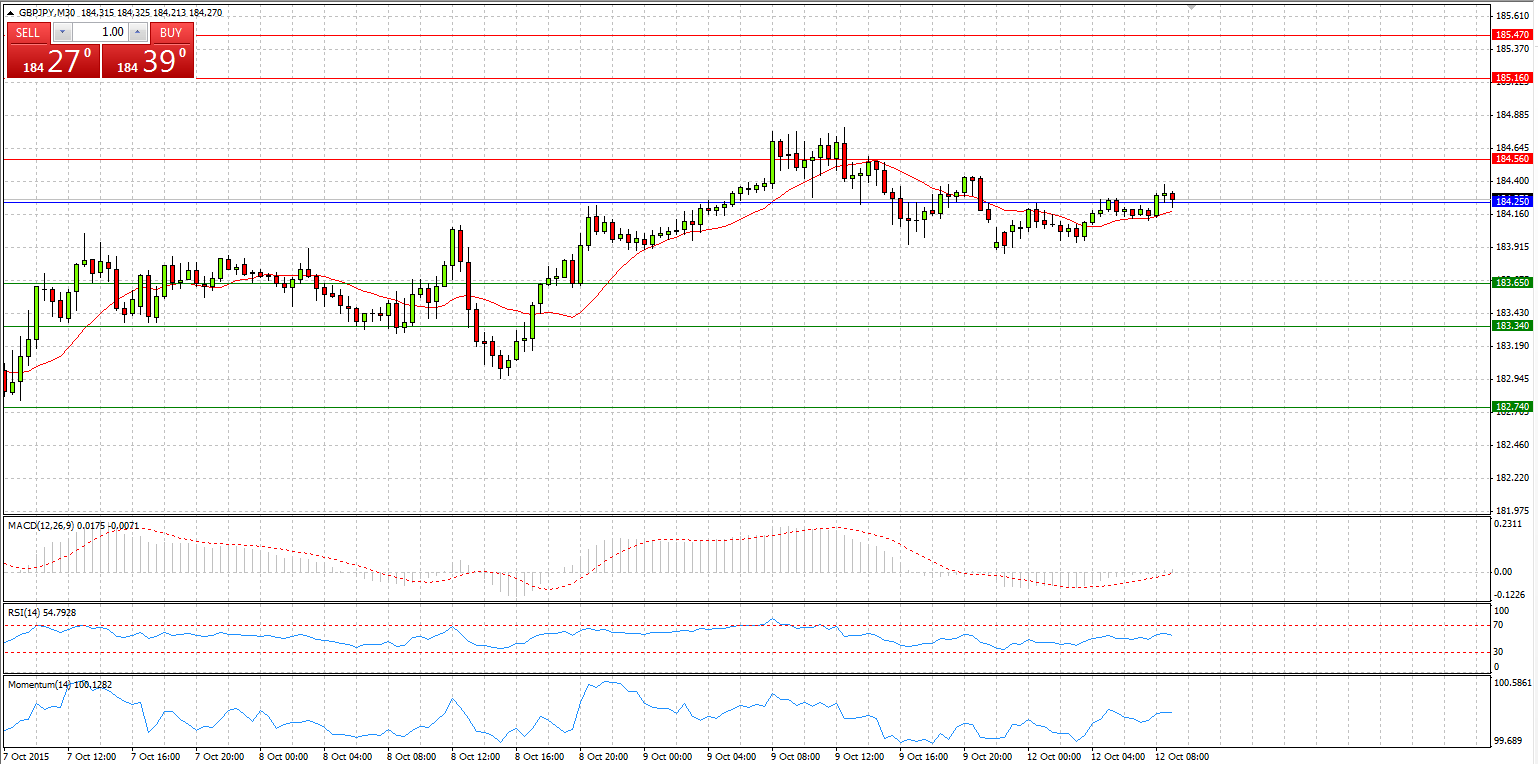

Market Scenario 1: Long positions above 184.25 with targets at 184.56 and 185.47

Market Scenario 2: Short positions below 184.25 with targets at 183.65 and 183.34

Comment: The sterling continues strengthening against Japanese yen for the 5th day in a row. Currently, GBP managed to break through Pivot Point resistance level and testing it as a support level. Next targets are R1 and R2.

Supports and Resistances:

R3 185.47

R2 185.16

R1 184.56

PP 184.25

S1 183.65

S2 183.34

S3 182.74

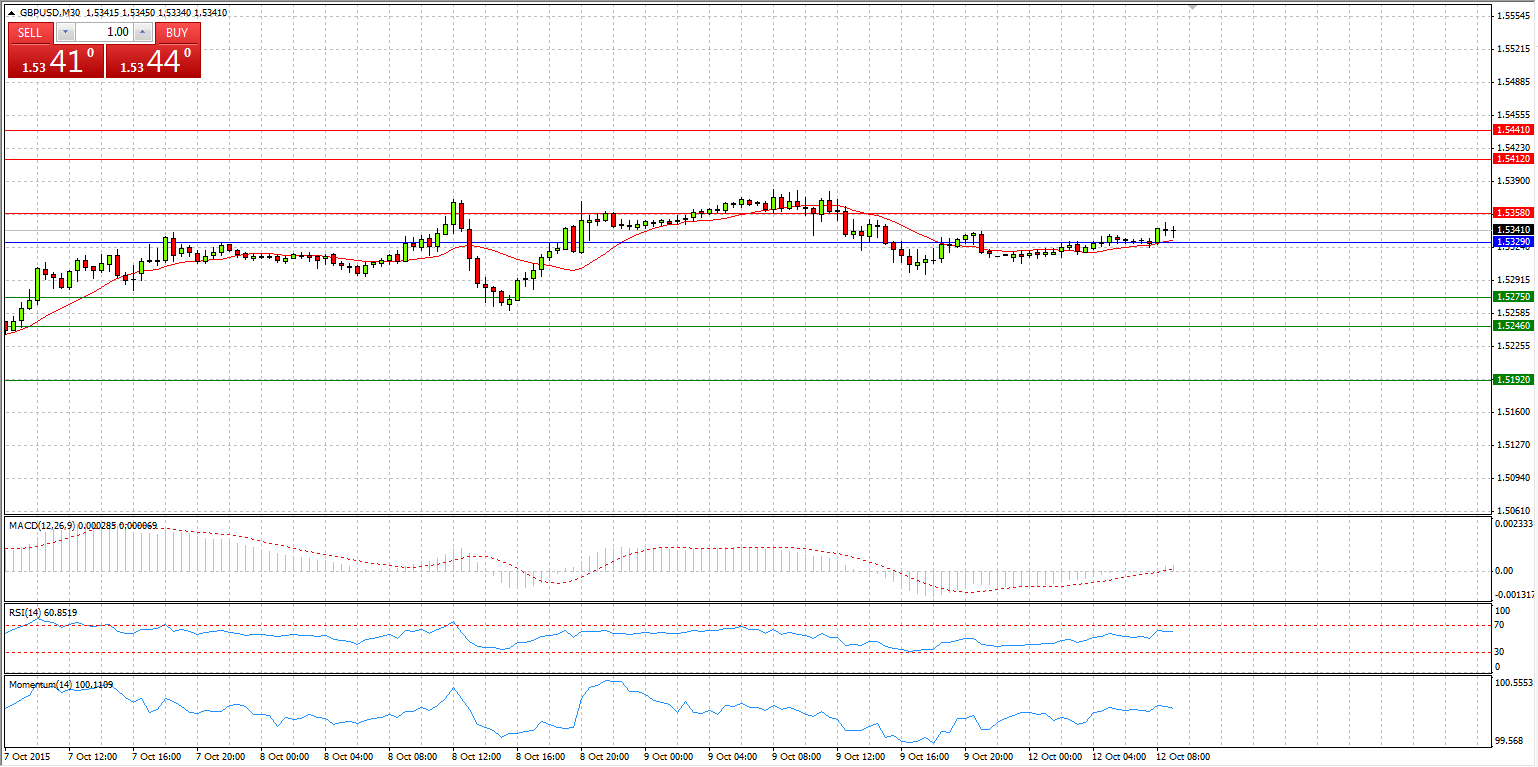

GBP/USD

Market Scenario 1: Long positions above 1.5291 with targets at 1.5364 and 1.5412

Market Scenario 2: Short positions below 1.5291 with targets at 1.5243 and 1.5170

Comment: GBP/USD is currently trading above Pivot Point level aiming to test first resistance level at 1.5358. Last two attempts on 8th and 9th of October were unsuccessful and by the end of each day, the currency pair was pushed below. Successful break out through R1 will open the way to R2 and R3.

Supports and Resistances:

R3 1.5441

R2 1.541

R1 1.5358

PP 1.5329

S1 1.5275

S2 1.5246

S3 1.5192

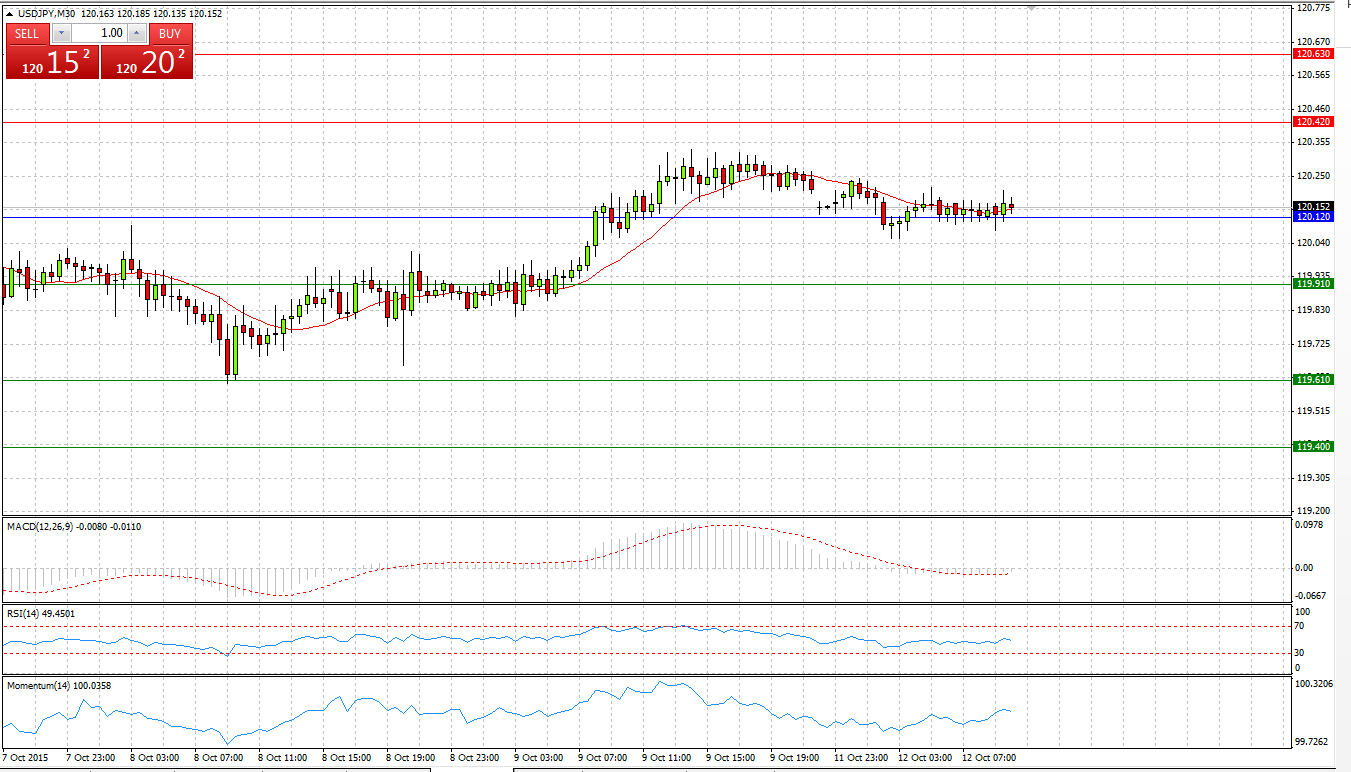

Market Scenario 1: Long positions above 120.12 with targets at 120.42 and 120.63

Market Scenario 2: Short positions below 120.63 with targets at 120.42 and 120.12

Comment: The pair broke through Pivot point Level and now is getting support. However, in the bigger picture, the pair continues trading in the range. Hence, Range – Bound strategy can be applied.

Supports and Resistances:

R3 120.93

R2 120.63

R1 120.42

PP 120.12

S1 119.91

S2 119.61

S3 119.40

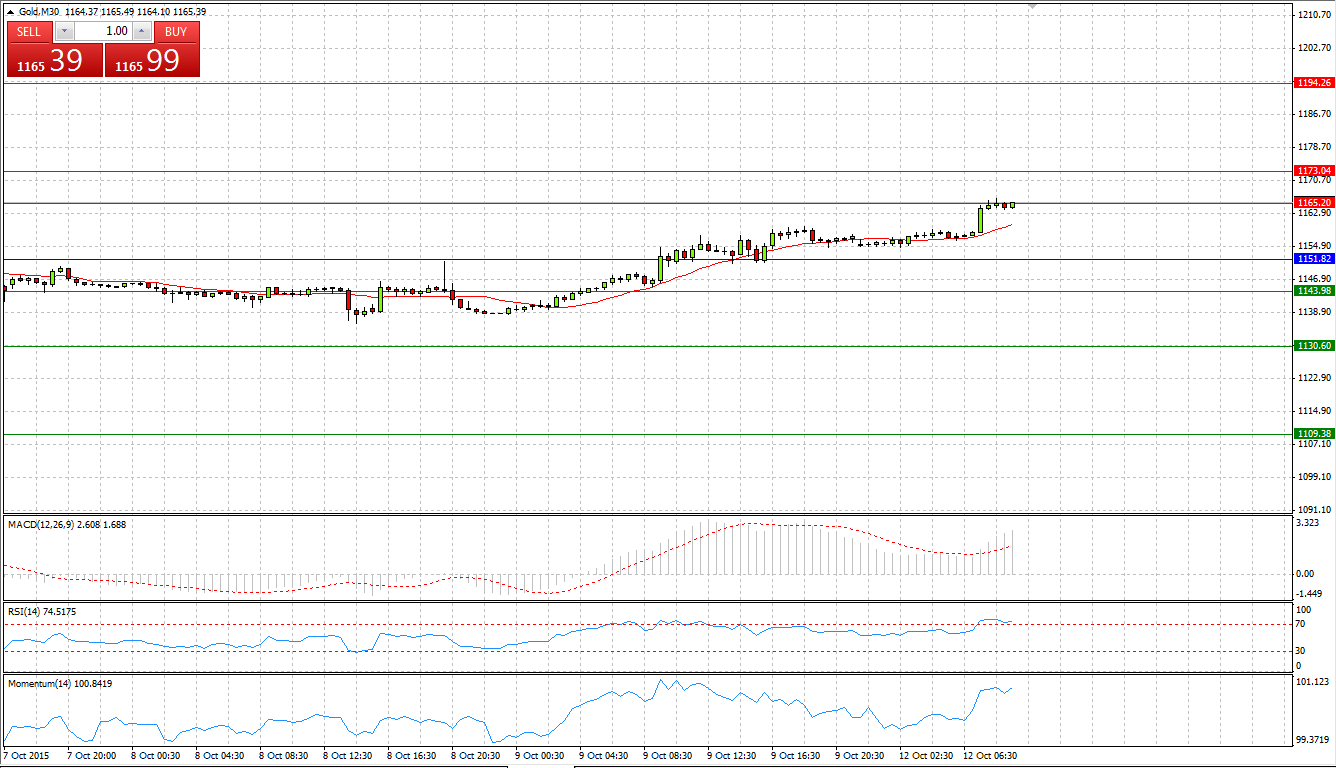

GOLD

Market Scenario 1: Long positions above 1151.82 with targets at 1173.04 and 1194.26

Market Scenario 2: Short positions below 1151.82 with targets at 1143.98 and 1130.60

Comment: Gold continues appreciating against US dollar amid postponed increase of interest rates. Gold managed to break through Pivot point level and not trading close to R1. Successful break through this level will open the way to R2 and R3

Supports and Resistances:

R3 1194.26

R2 1173.04

R1 1165.20

PP 1151.82

S1 1143.98

S2 1130.60

S3 1109.38

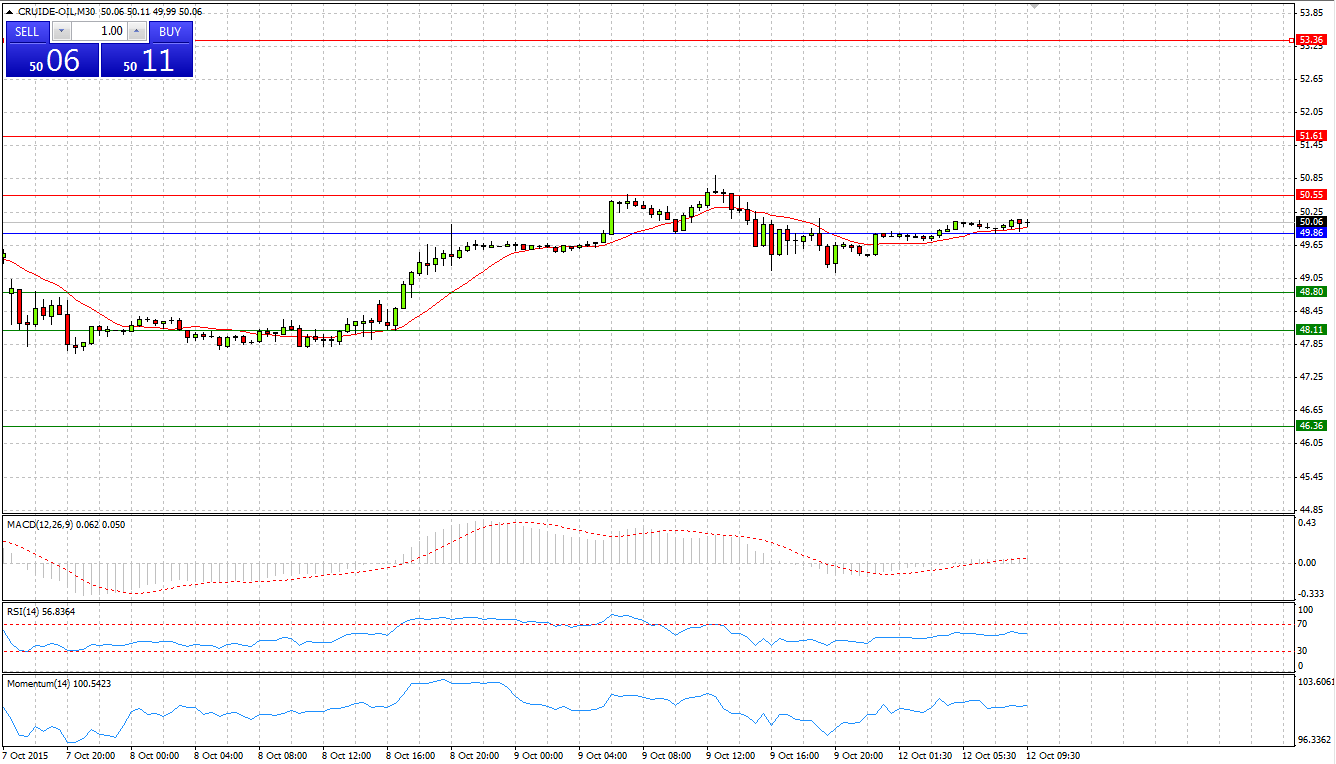

CRUDE OIL

Market Scenario 1: Long positions above 49.86 with targets at 50.55 and 51.61

Market Scenario 2: Short positions below 49.86 with targets at 48.80 and 48.11

Comment: Crude is trading close to 50 USD per barrel above Pivot Point level, which currently acting as a support level. If crude will not be sent below 50 USD per barrel, further apparition will take place.

Supports and Resistances:

R3 53.36

R2 51.61

R1 50.55

PP 49.86

S1 48.80

S2 48.11

S3 46.36

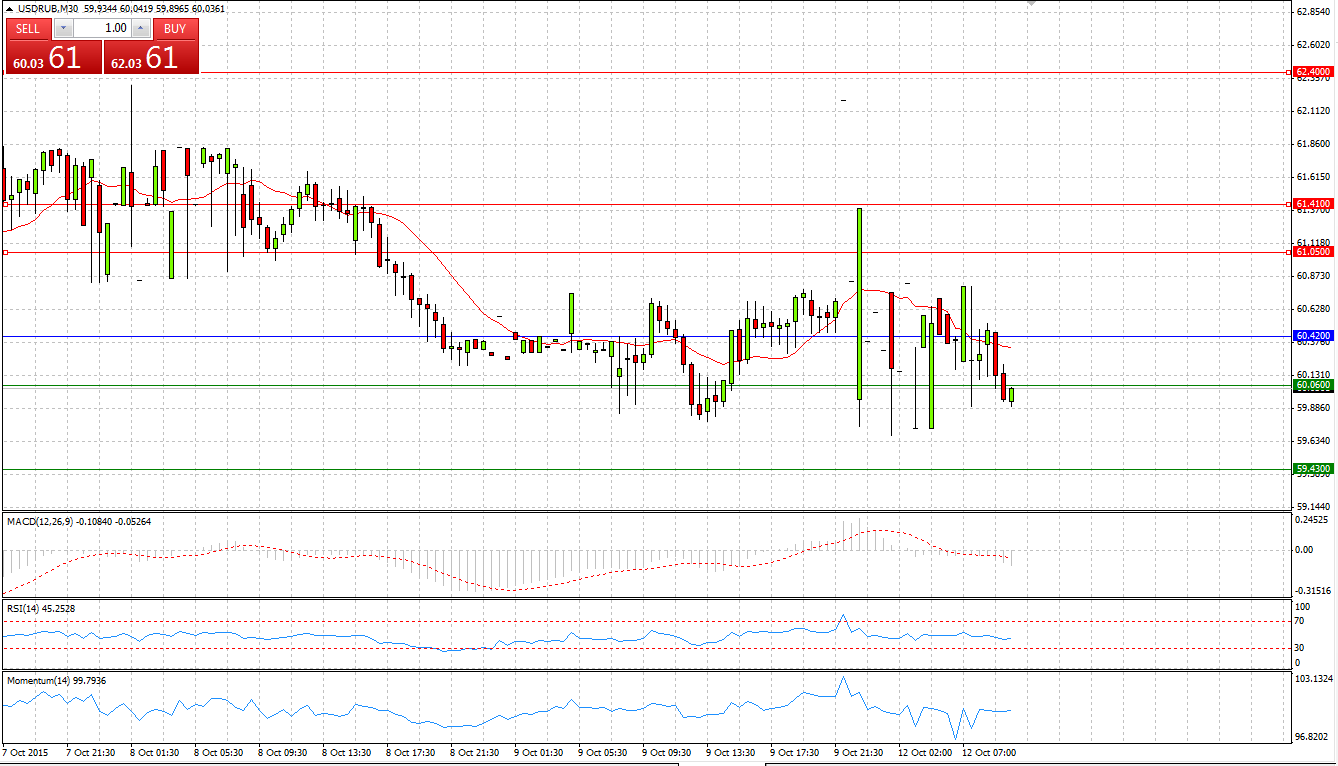

Market Scenario 1: Long positions above 60.42 with targets at 61.05 and 61.41

Market Scenario 2: Short positions below 60.42 with targets at 60.06 and 59.43.

Comment: The pair is trading in a range between R2 and S1 with a downside shift.

Supports and Resistances:

R3 62.40

R2 61.41

R1 61.05

PP 60.42

S1 60.06

S2 59.43

S3 58.43