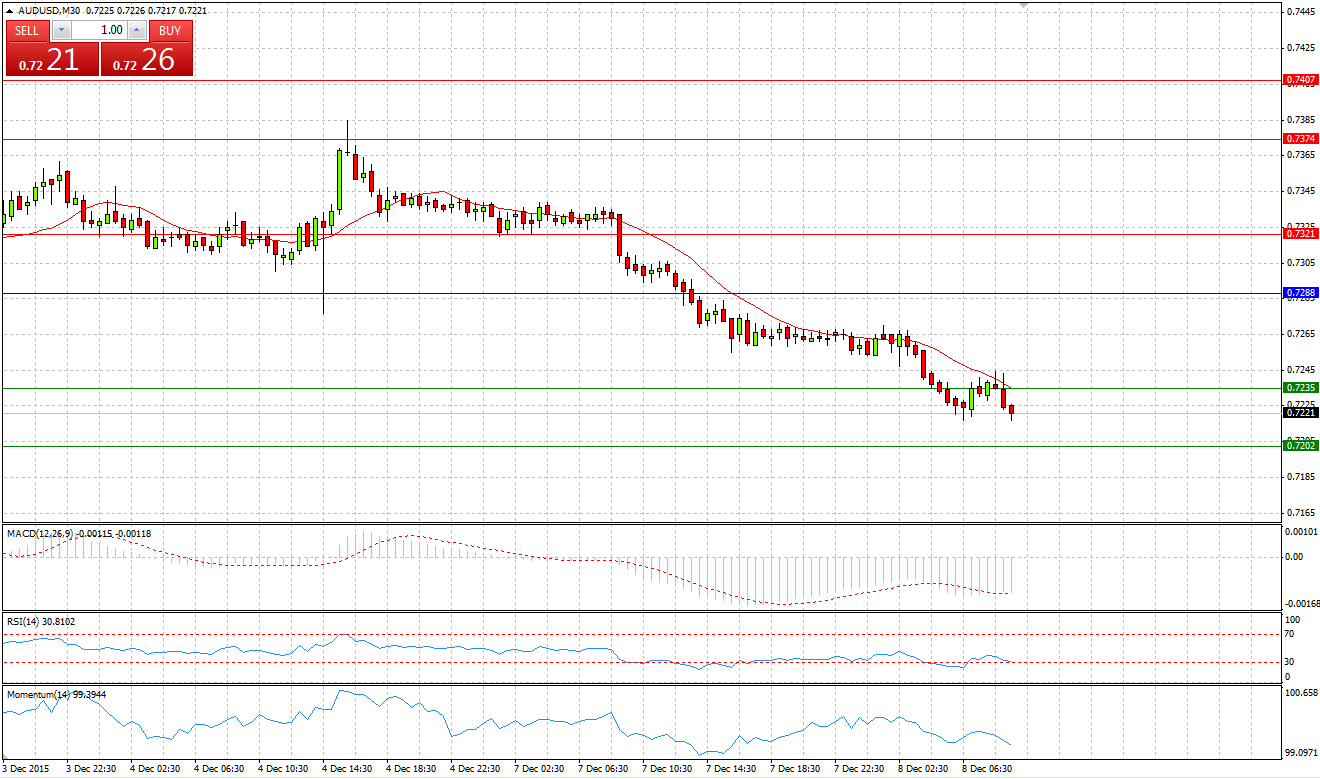

Market Scenario 1: Long positions above 0.7288 with targets at 0.7321 and 0.7374

Market Scenario 2: Short positions below 0.7288 with targets at 0.7235 and 0.7202

Comment: Aussie came under selling pressure during yesterday’s session and lost more than 80 pips in one day against the US dollar. Today Aussie continues trading under pressure, having broken through the First Support level and heading towards the Second one.

Supports and Resistances:

R3 0.7407

R2 0.7374

R1 0.7321

PP 0.7288

S1 0.7235

S2 0.7202

S3 0.7149

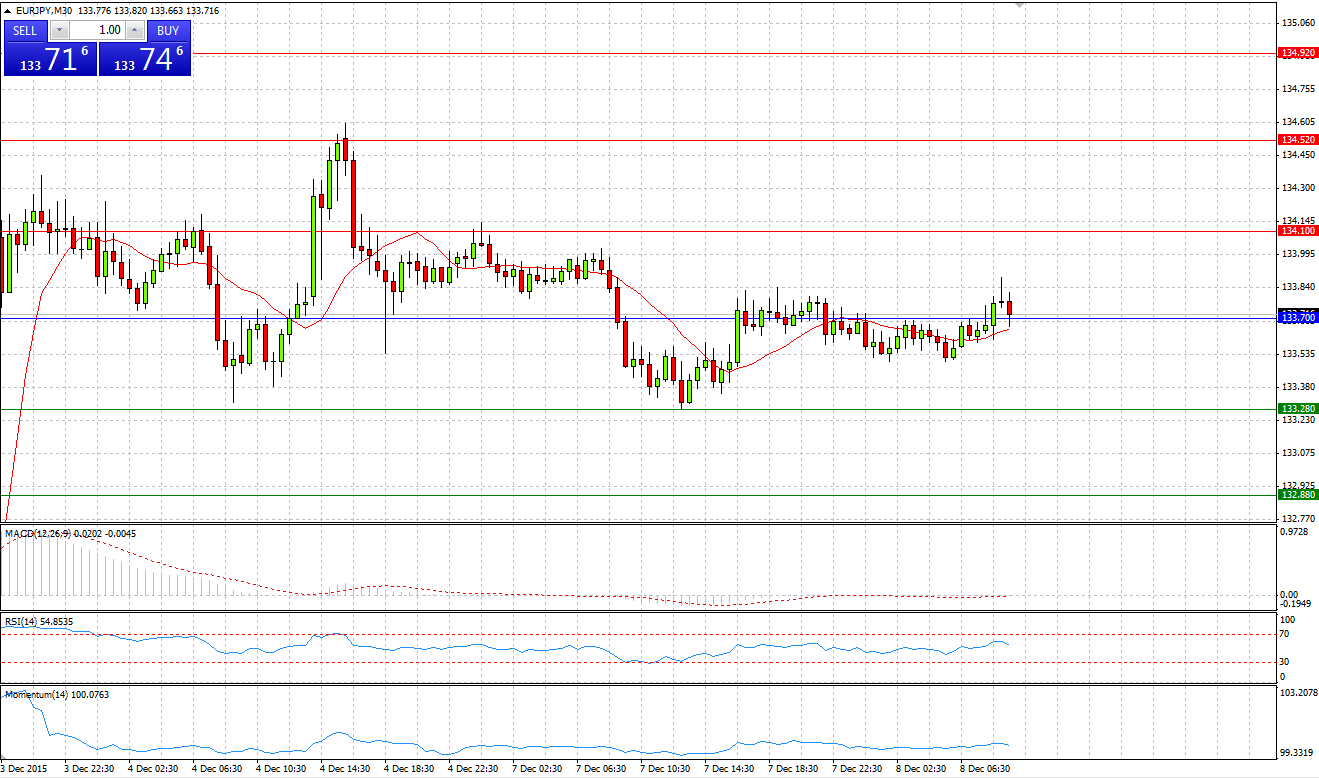

Market Scenario 1: Long positions above 133.70 with targets at 134.10 and 134.52

Market Scenario 2: Short positions below 133.70 with targets at 133.28 and 132.88

Comment: European currency closed yesterday’s session with small loss against Japanese yen. Today the pair is trading flat slightly below Pivot Point level.

Supports and Resistances:

R3 134.92

R2 134.52

R1 134.10

PP 133.70

S1 133.28

S2 132.88

S3 132.46

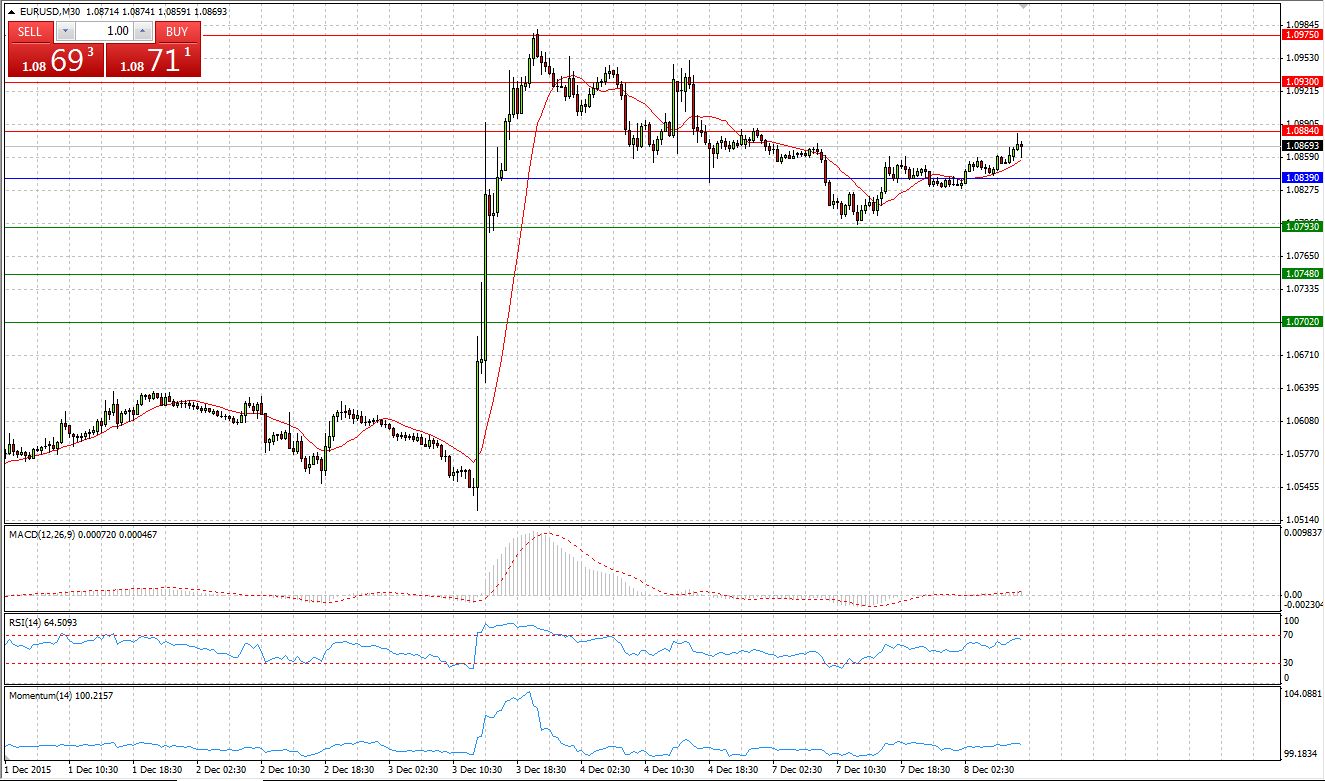

Market Scenario 1: Long positions above 1.0839 with targets at 1.0884 and 1.0930

Market Scenario 2: Short positions below 1.0839 with targets at 1.0793 and 1.0748

Comment: After Thursday’s rally, when European currency appreciated for more than 3 pips, the pair is trading in the range between R3 and S1

Supports and Resistances:

R3 1.0975

R2 1.0930

R1 1.0884

PP 1.0839

S1 1.0793

S2 1.0748

S3 1.0702

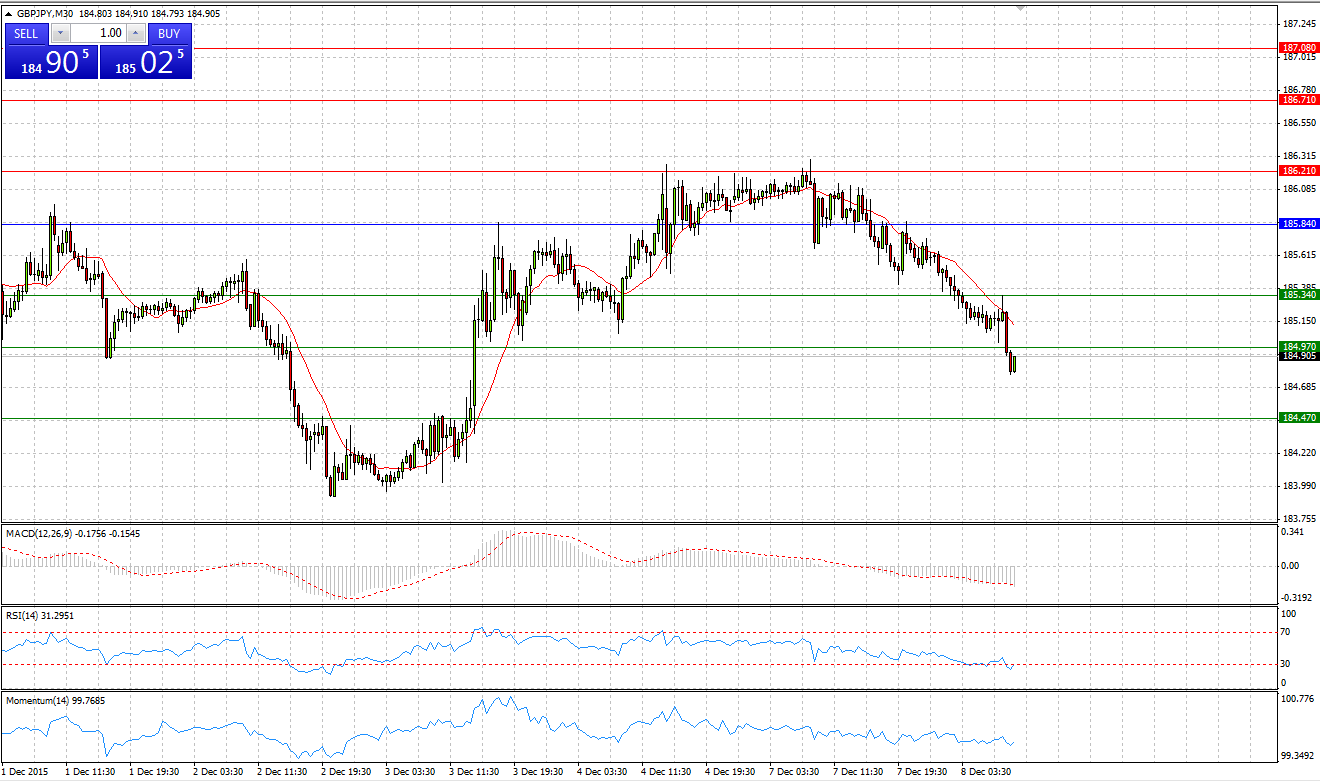

GBP/JPY

Market Scenario 1: Long positions above 185.84 with targets at 186.21 and 186.71

Market Scenario 2: Short positions below 185.84 with targets at 185.34 and 184.97

Comment: Sterling is trading under pressure against Japanese yen, closing yesterday’s session with a 30 pips loss. Today GBP/JPY continues sliding down and breaking through the First and Second Support levels.

Supports and Resistances:

R3 187.08

R2 186.71

R1 186.21

PP 185.84

S1 185.34

S2 184.97

S3 184.47

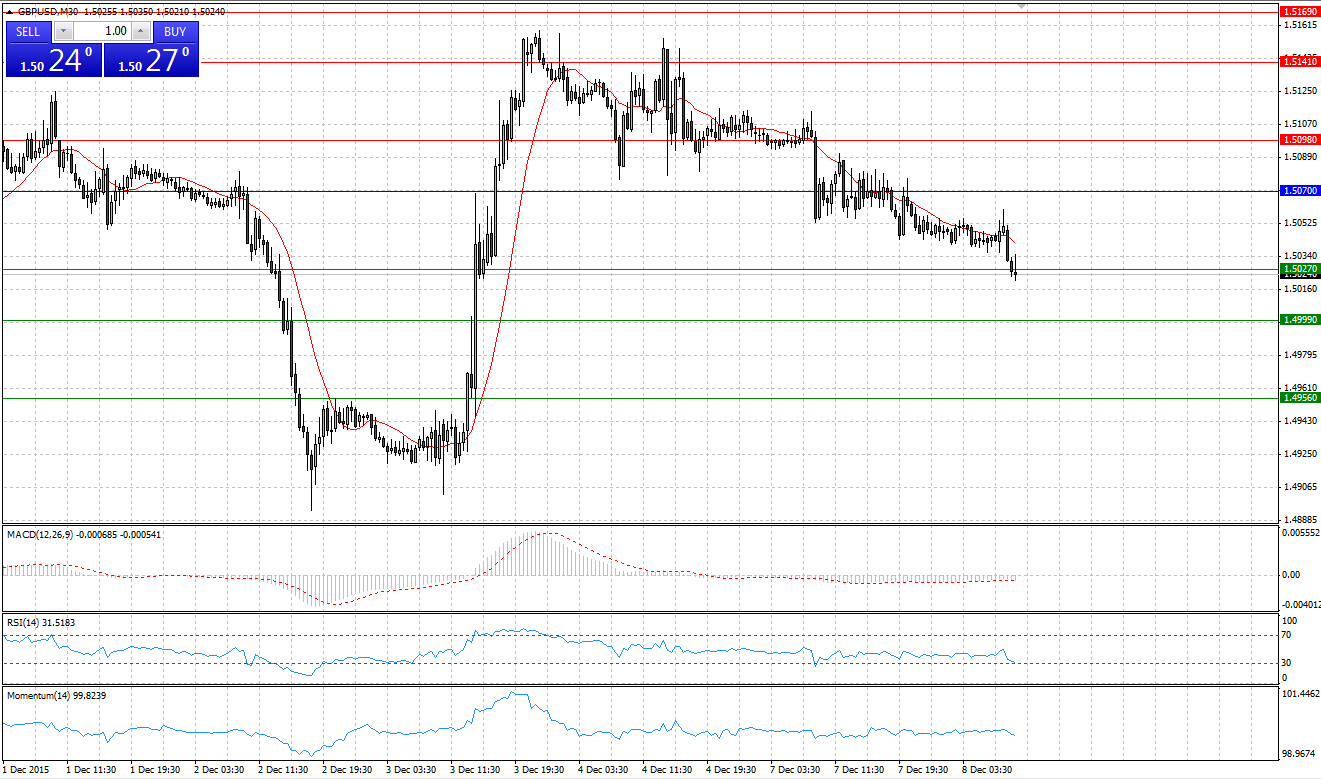

Market Scenario 1: Long positions above 1.5070 with targets at 1.5098 and 1.5141

Market Scenario 2: Short positions below 1.5070 with targets at 1.5027 and 1.4999

Comment: Sterling recorded second day in the row of consecutive losses against US dollar, giving back half of the gains earned during Thursday’s session. Today the pair continues its downward move.

Supports and Resistances:

R3 1.5169

R2 1.5141

R1 1.5098

PP 1.5070

S1 1.5027

S2 1.4999

S3 1.4956

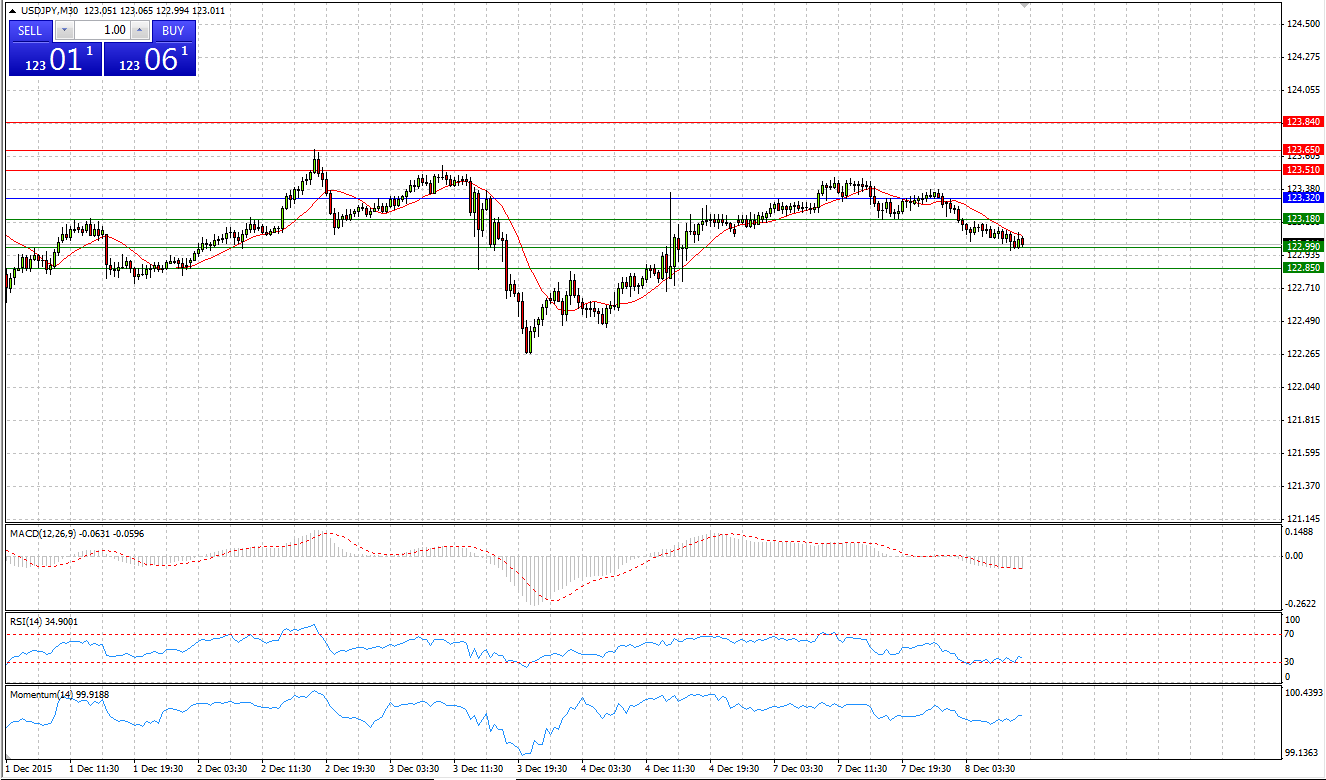

Market Scenario 1: Long positions above 123.32 with targets at 123.51 and 123.65

Market Scenario 2: Short positions below 123.32 with targets at 123.18 and 122.99

Comment: US dollar continue trading in the range close to its highs against Japanese yen. Currently the pair is trading close to the first Support Level.

Supports and Resistances:

R3 123.84

R2 123.65

R1 123.51

PP 123.32

S1 123.18

S2 122.99

S3 122.85

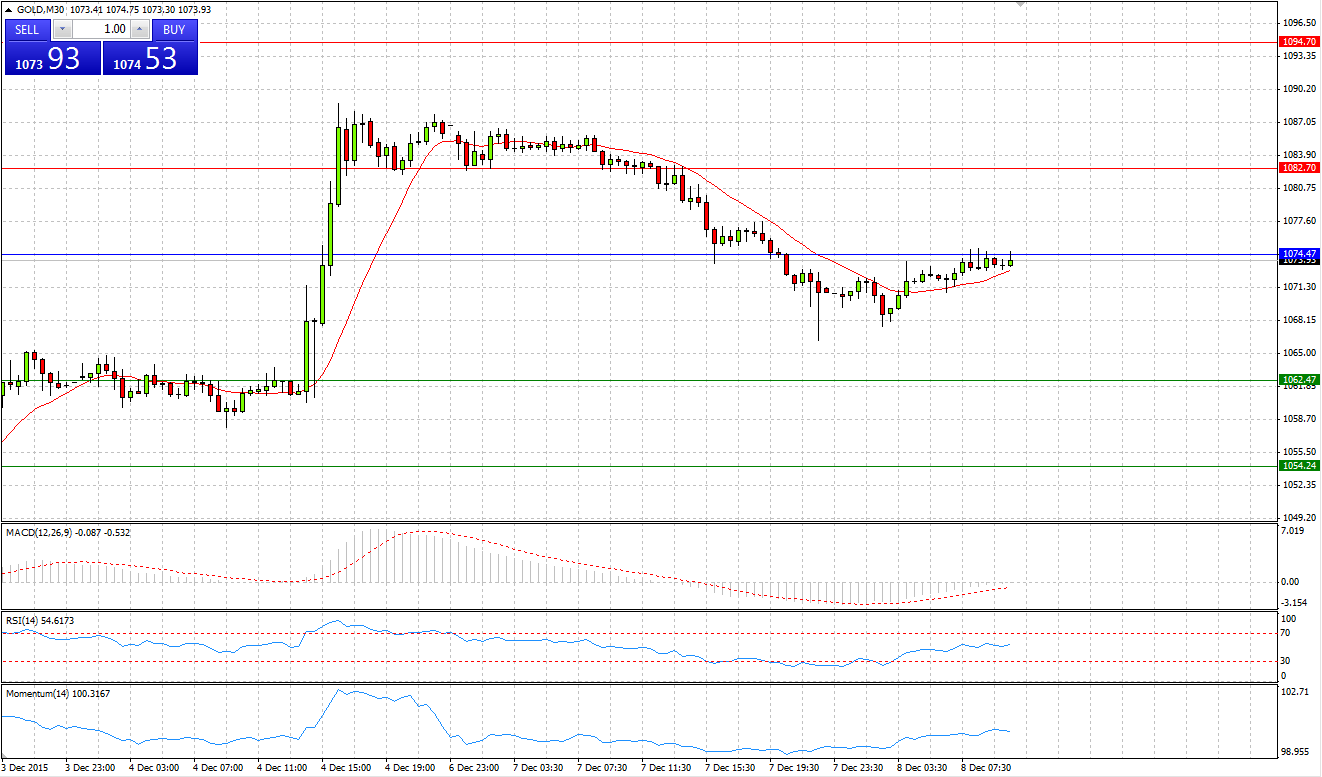

GOLD

Market Scenario 1: Long positions above 1074.47 with targets at 1082.70 and 1094.70

Market Scenario 2: Short positions below 1074.47 with targets at 1062.47 and 1054.24

Comment: Gold during yesterday’s session came under selling pressure and lost most of its gains earned on 4th of December, closing the session at 1070.70. Today gold is trading with a positive bias slightly below Pivot Point level.

Supports and Resistances:

R3 1114.93

R2 1094.70

R1 1082.70

PP 1074.47

S1 1062.47

S2 1054.24

S3 1034.01

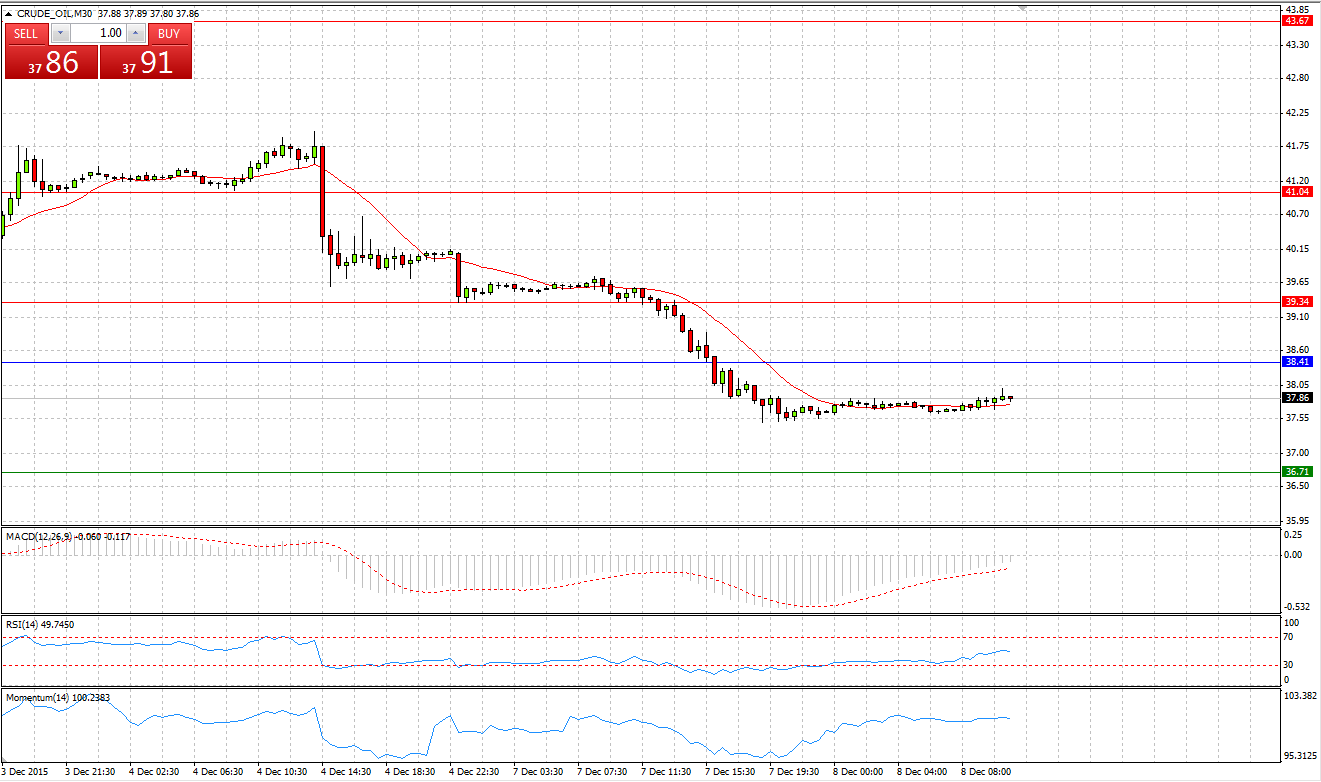

CRUDE OIL

Market Scenario 1: Long positions above 38.41 with targets at 39.34 and 41.04

Market Scenario 2: Short positions below 38.41 with targets at 36.71 and 35.78

Comment: After OPEC meeting, crude came under strong selling pressure and during yesterday’s session lost almost 2.5 USD closing the session at 37.64, the lowest level since February 2009. Today crude continues trading under pressure below Pivot Point level

Supports and Resistances:

R3 43.67

R2 41.04

R1 39.34

PP 38.41

S1 36.71

S2 35.78

S3 33.15

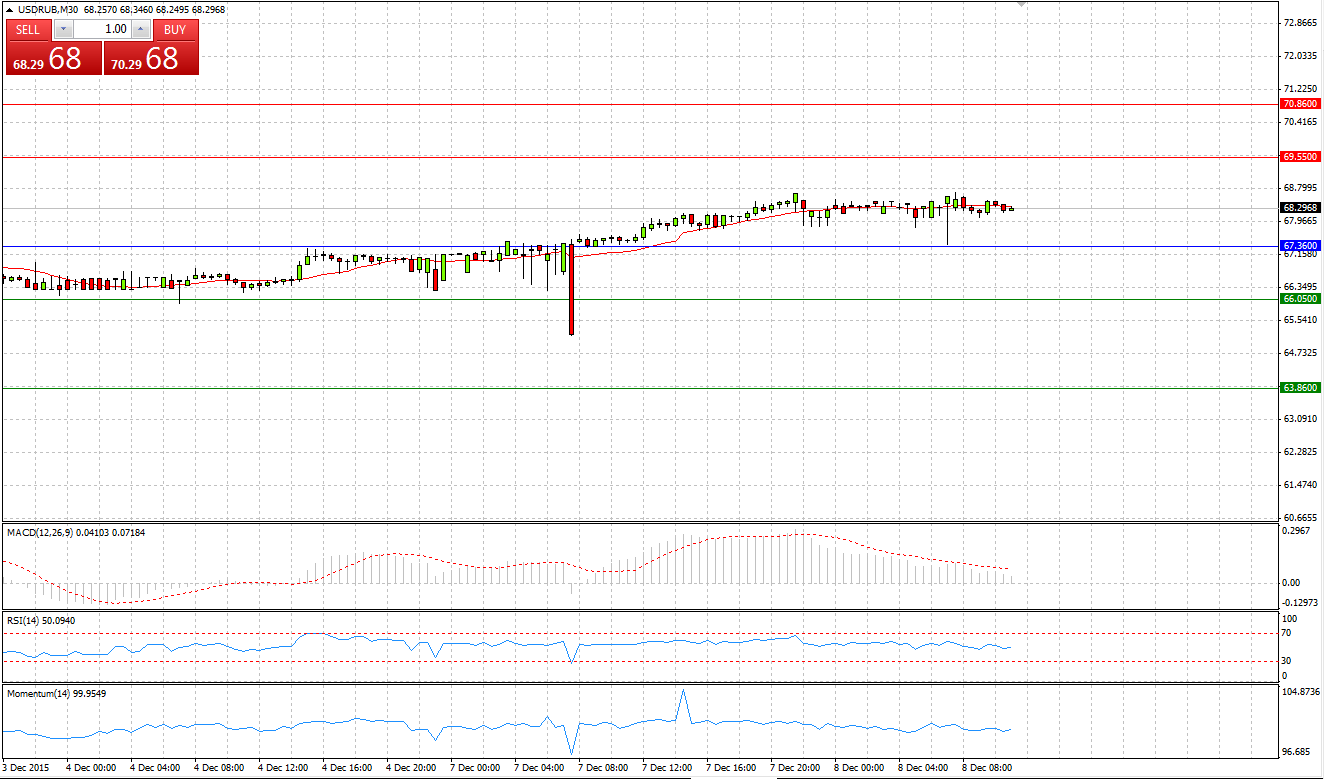

Market Scenario 1: Long positions above 67.36 with targets at 69.55 and 70.86

Market Scenario 2: Short positions below 67.36 with targets at 66.05 and 63.86

Comment: US dollar continues appreciating against Russian ruble amid depreciation of crude prices. US dollar during yesterday’s session reached a new high at 68.66 Russian rubles. By the end of this week the pair can reach up to 70 ruble pre US dollar.

Supports and Resistances:

R3 74.36

R2 70.86

R1 69.55

PP 67.36

S1 66.05

S2 63.86

S3 60.36