Let's begin with Greece where the parliament voted by a significant majority to accept the austerity package including tax increases, pension reforms, spending cuts, and economic liberalisation in return for a third bailout from the Eurozone. Welcome to Syriza's "better future".

Needless to say the opposition to the deal is strong and is likely to keep growing.

The protests in the streets of Athens got ugly quickly.

The IMF remains opposed to the deal, viewing it as unsustainable.

The next step will be for the European Central Bank to increase its emergency liquidity assistance (ELA) financing to Greek banks. Currency controls will need to stay in place for weeks, possibly months in order to avoid a complete drain of liquidity from the Greek banking system. Given an opportunity to exit, who in their right mind will keep cash on deposit within Greece?

Equity markets love this deal. Here is a Greek ETF trading in the US (NYSE:GREK).

... and the S&P500 futures.

Once again, it won't be long before we are revisiting this mess again.

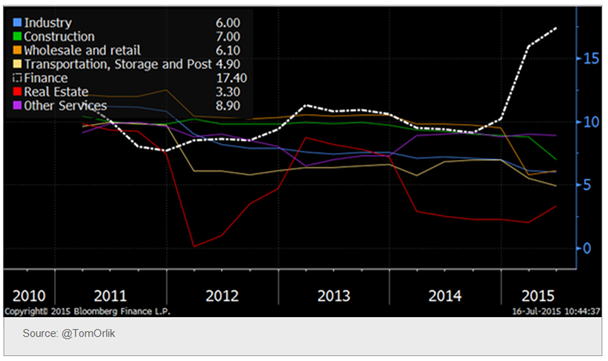

Now on to China where more evidence is emerging that the improved GDP report was driven by the massive wave of trading activity in the stock market. A reversal is coming.

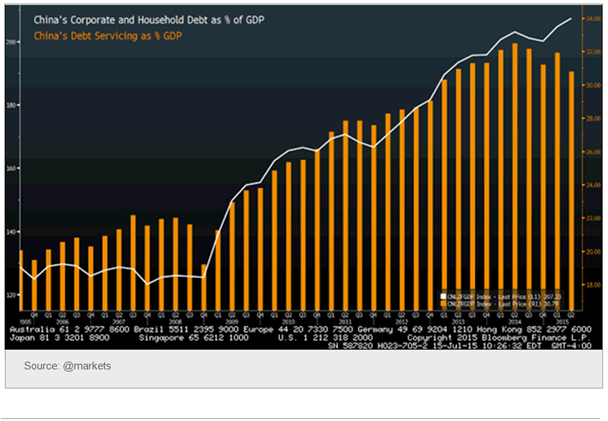

And just as we are about to see a further slowdown, China's total debt-to-GDP ratio hit a new record.

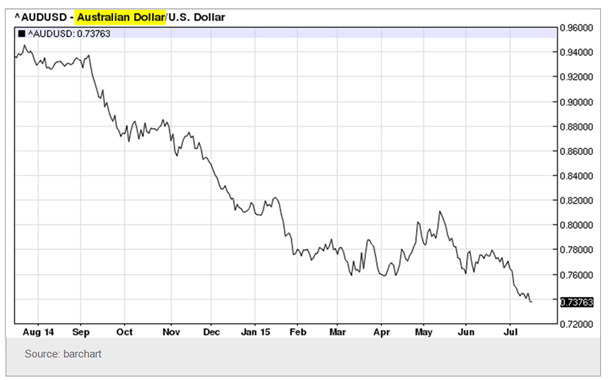

Turning to Australia, the Aussie dollar continues to deteriorate – to a large part driven by the developments in China (as well as rate hike expectations in the US).

By the way, here is the 5-year chart of the Australian dollar vs. USD.

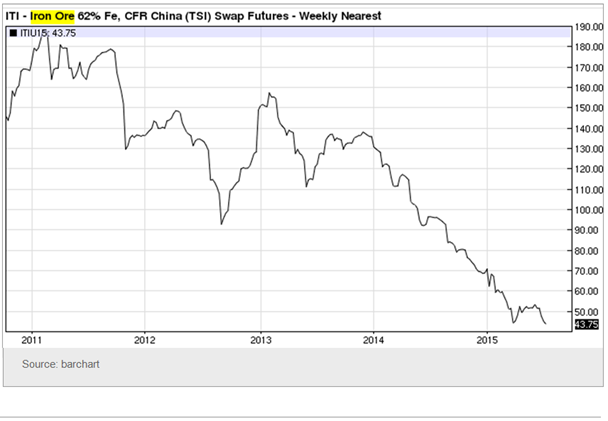

The end of the commodities super-cycle has been tough on the nation's economy. Chart below shows iron ore prices based on valuations at China's ports.

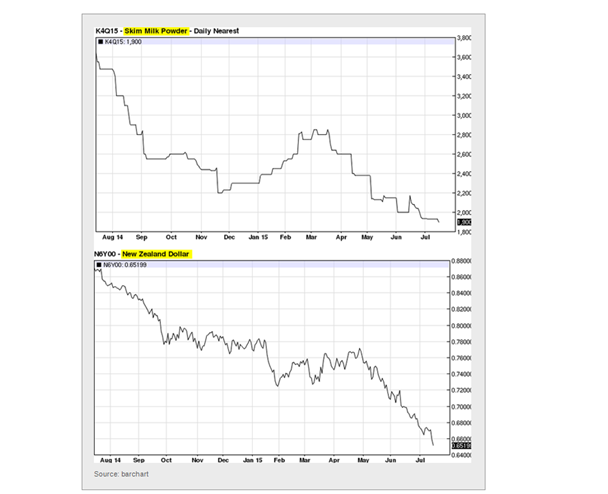

The decline in the New Zealand dollar has been even sharper recently, although driven by a different set of commodities.

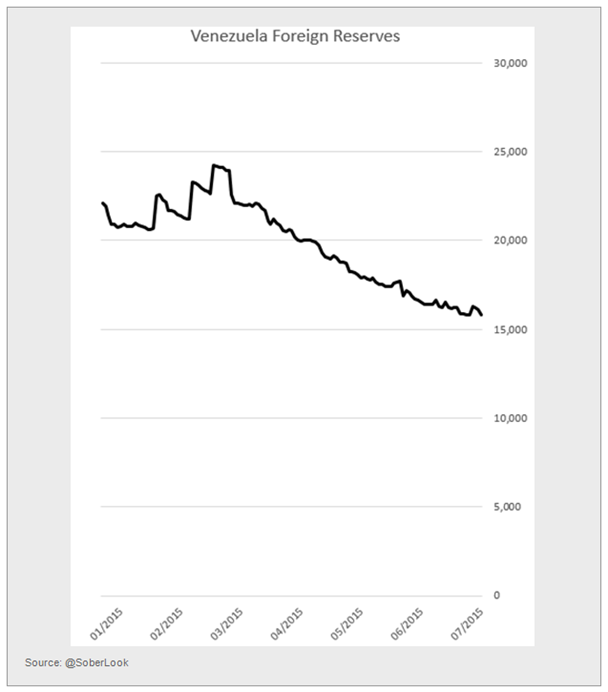

In the Americas we see the situation in Venezuela continue to deteriorate as foreign reserves hit a 12-year low.

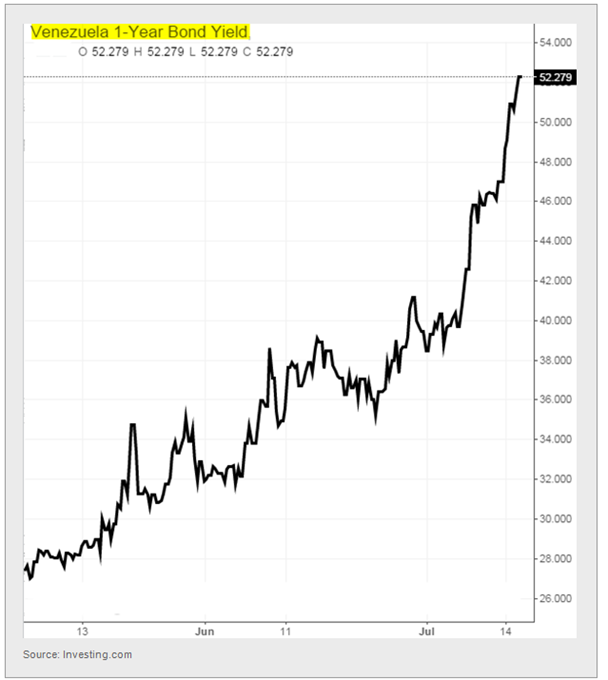

With no hope of improvement on the horizon, Venezuela's government bond yields spiked.

What's particularly painful for Venezuela is the persistent weakness in crude oil prices. With Brent futures below $58/barrel and production quite weak, access to hard currency is extremely limited. It's sad, given that Venezuela has the largest proven oil reserves of any country.

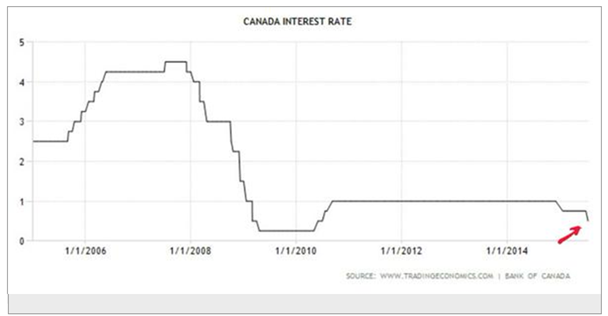

Shifting to Canada, the chart above isn't very helpful either. With crude oil prices projected to remain lower than originally thought, weakness in China, and non-commodity exports faltering, the Bank of Canada (BoC) chose to cut rates.

The Canadian dollar fell sharply on the news.

Canadian bonds and equities rallied. The market was clearly not prepared.

And just as the BoC chose to cut its benchmark rate, the Fed is preparing to raise rates in the US. Are the economic cycles of the two nations that much out of sync? Many economists certainly think so.

Fed chief Janet Yellen's testimony yesterday, combined with the Beige Book report, puts the futures-implied probability of a September rate hike back at 34%. It seems the Federal Open Market Committee just wants to get this done.

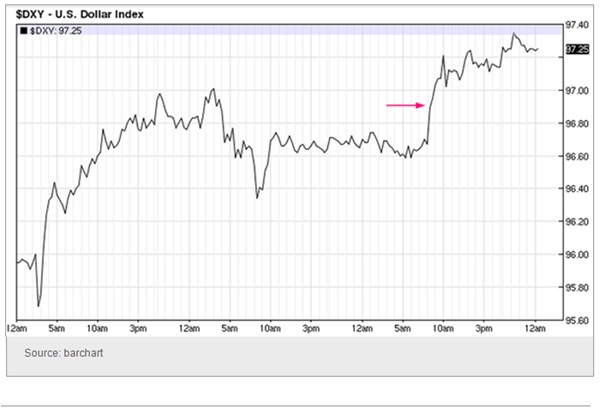

The US dollar index rallied in response to Yellen's comments.

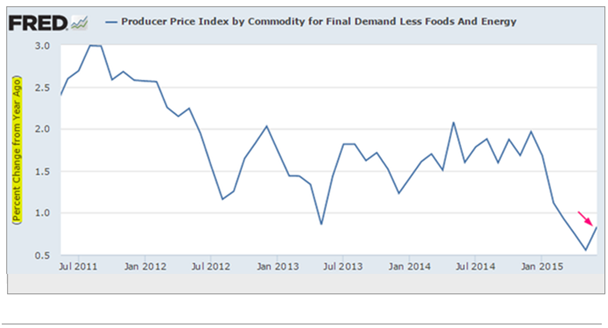

To add fuel to the fire, US core PPI came in stronger than consensus. To be sure, producer price growth is still incredibly weak, but this adds to the FOMC's argument for a 2015 hike.

Disclosure: Originally published at Saxo Bank TradingFloor.com