Crude oil prices remain stable as of Sunday evening (as is the US dollar). According to Reuters (from last week), the Saudis “will accept oil prices below $90 per barrel, and perhaps down to $80, for as long as a year or two”. Their goal is to shake out some of the high-cost competition (such as the US).

The Saudis also do not want to choke off the economies of their customers by cutting production, so current production levels are likely to stay unchanged. Both OPEC and non-OPEC producers are not particularly happy with them right now (particularly Russia, Iran and Venezuela) as these countries all want to see production cuts. But crude is holding right in the middle of the Saudis’ preferred range (Saudi Arabia is now the de facto “central bank” of crude oil).

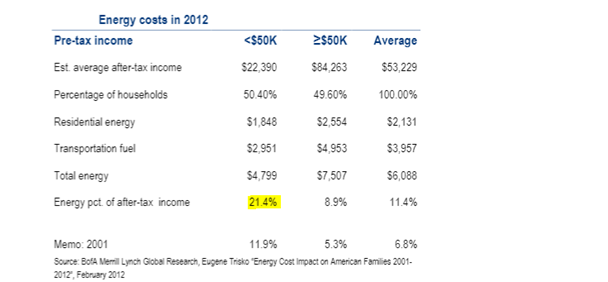

In the United States, crude oil price declines will deliver immediate relief to consumers in the form of cheaper gasoline and heating oil. Other benefits include cheaper transport (potentially lower travel costs) and shipping costs (lower UPS/Fedex surcharges), as well as cheaper PVC, nylon, polyester, foam, etc. And it will be the households in the lower wage bracket that will benefit the most.

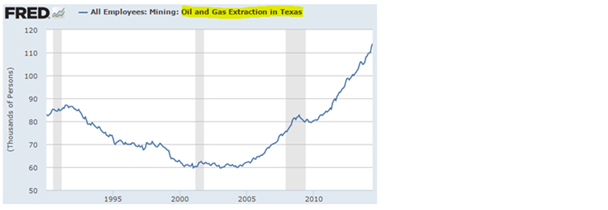

But there are also risks associated with the correction. To put it into perspective, here are the jobs directly generated from Texas oil and gas extraction in recent years. And this does not include the thousands of jobs that support this industry. This trend is unlikely to continue if oil prices remain at current levels or fall further. Source: Federal Reserve Economic Data

Source: Federal Reserve Economic Data

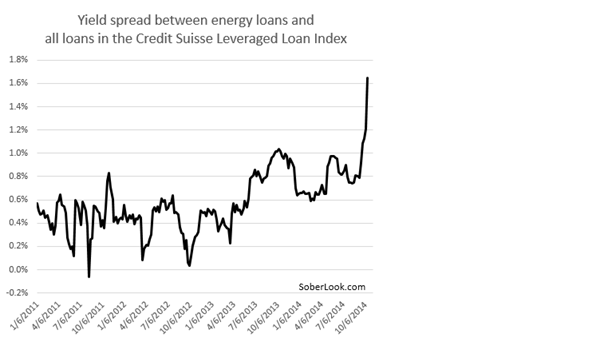

Restructurings, layoffs and cancelled projects in the energy space may be in store in the near-term.

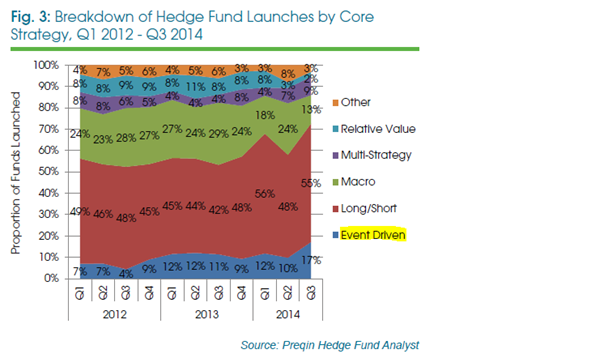

Potentially related to the over-leveraged middle-market firms in the US as well as tight credit conditions in Europe, event-driven hedge funds are ramping up. Some of these are preparing for new "stressed/distressed opportunities".

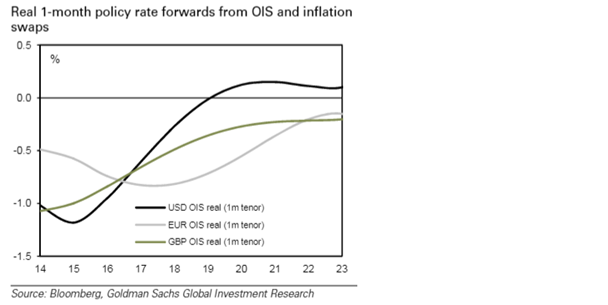

In response to global disinflationary pressure, the market is pricing negative real short-term rates for the next six years in the US and 10 years in the Eurozone and UK.

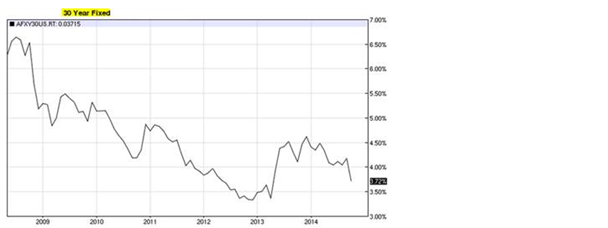

And with the longer-term rates suppressed as well, US 30-year mortgage rates are now below 4%. We may even see some fresh refinancing activity. Source: Barchart.com

Source: Barchart.com

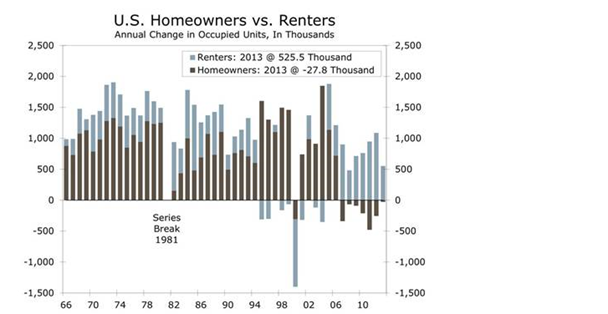

Will this stimulate more home purchases? Unlikely, as mortgage credit remains relatively tight and demand is still soft. All the action is now in rental units. Source: @PlanMaestro

Source: @PlanMaestro

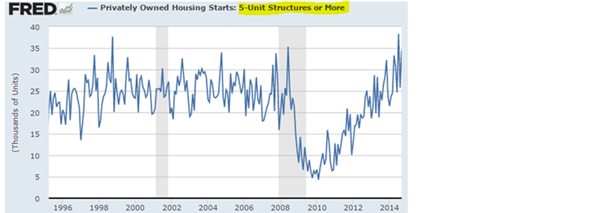

The chart below is the response to the one above…

Five-unit or more apartments started in the US Source: Federal Reserve Economic Data

Source: Federal Reserve Economic Data

Speaking of real estate, take a look at Real Estate Investment Trust (red) vs. Business Development Company (blue) performance for this year. Commercial real estate is in favour again... Source: Barchart.com

Source: Barchart.com

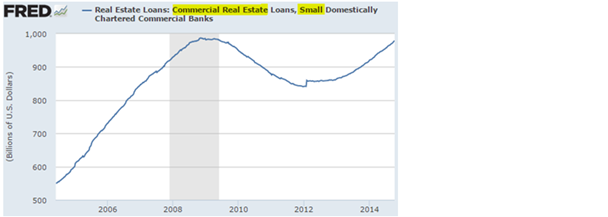

...and small US banks are getting back into commercial real estate lending. Source: Federal Reserve Economic Data

Source: Federal Reserve Economic Data

On the commodities front, here is the CRB BLS Spot Commodity index over the past few years. The rally earlier this year could not be sustained. Source: Barchart.com

Source: Barchart.com

*********

Here are a couple of “food for thought” items...

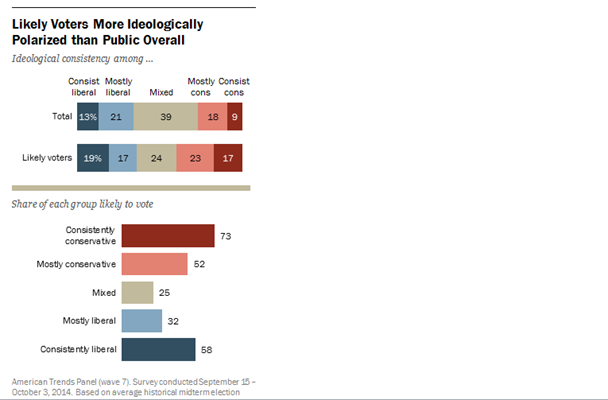

1. Back to the theme of US political polarisation: the voters who are most polarised are the ones far more likely to vote. And people wonder why the US government is in a constant state of impasse. ..

Source: Pew Research

Source: Pew Research

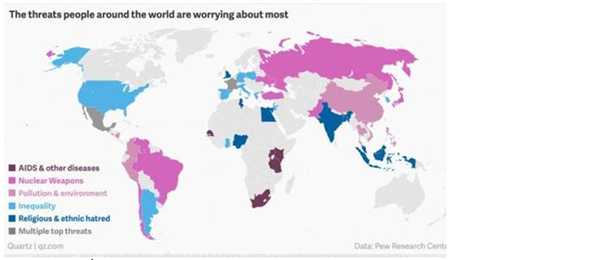

2. Here is what people around the world are most concerned about.

Disclosure: To subscribe to the Daily Shot letter by e-mail please enter your e-mail address here: Subscribe to the Daily Shot