- Fed statement cites emerging market concerns.

- Real facing new lows as Brazilian economy struggles.

- Bank of England may consider cutting rates.

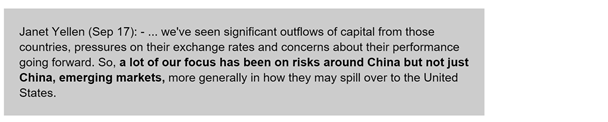

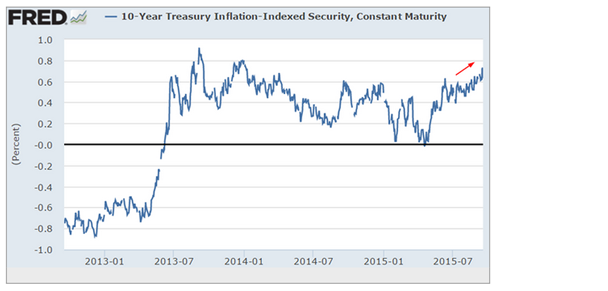

Once again we begin with the Federal Open Market Committee's decision to leave interest rates unchanged. Digging deeper into Fed chair Janet Yellen's statements, many market participants saw more than just dovishness and the unease with weak inflation. The Fed has reignited concerns about China and emerging markets in general.

Is there something the Fed is seeing that market participants may have missed?

That's why we saw VIX futures move higher after the announcement and credit spreads widen. On Friday, sentiment turned decisively negative.

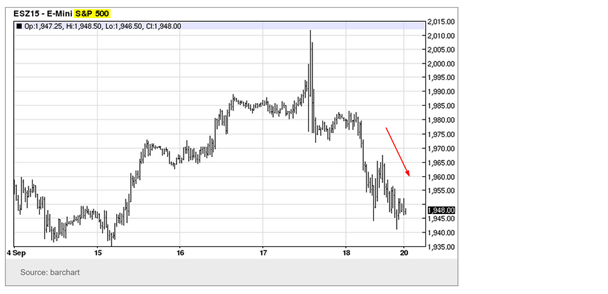

The various risk appetite measures continue to show that investors remain jittery. Here is the Morgan Stanley Global Risk Demand Index. For equity investors who have the ability to withstand some volatility, this is not a bad time to selectively accumulate.

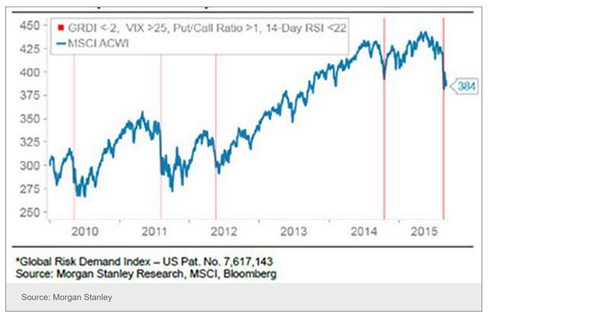

It's worth pointing out that monetary conditions in the US have tightened even without the rate hike. Longer dated real rates have risen as inflation expectations declined.

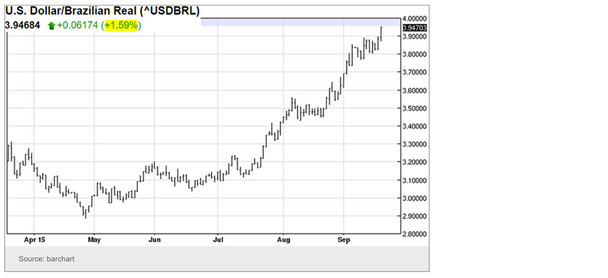

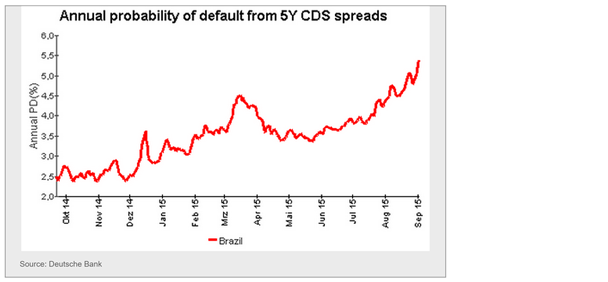

The Fed has reasons to be concerned about emerging markets beyond China. In particular, Brazil's economy continues to struggle. And the Fed's decision to keep rates on hold has not helped thus far.

1. The real hit a new low (not seen since 2002), as the currency approaches four reals to the dollar. Corporations who issued dollar-denominated debt will be in a world of pain.

2. Investors remain uneasy with the sovereign credit in spite of the government's recent efforts to raise revenue; CDS-implied probability of default continues to rise.

3. Brazilian 10-year domestic government bond yield breached 15.5%. At these interest rates, it's hard to imagine much activity in credit markets.

To be sure, Brazil has a large and a reasonably diversified economy, but the nation is facing severe headwinds of stagflation, austerity, and political uncertainty. It's also important to point out that the primary reason for Brazil's troubles is China – its largest trading partner.

Brazil is in effect a levered bet on China.

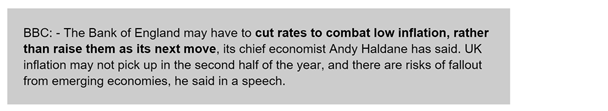

In the UK, some are talking rate cuts rather than increases as inflation remains uncomfortably low and risks from emerging markets are on the rise.

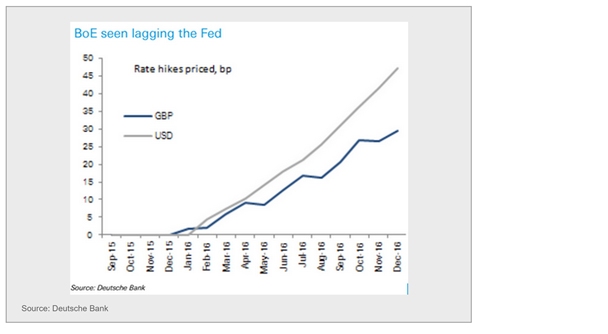

The UK rate expectations of the overnight rate shows gradual increases that are considerably below those in the US.

Turning to Food for Thought, we have two items this morning:

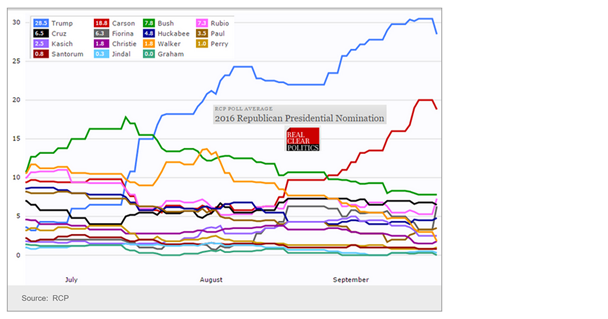

1. Here is the latest RCP 2016 Republican presidential nomination national poll average over time, including post-CNN-debate data.

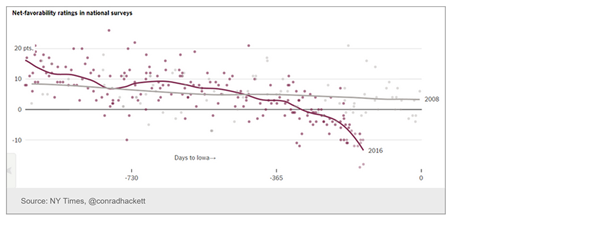

2. It seems that Hillary Clinton's favourability ratings are now at the lowest point in her political career.

Disclosure: Originally published at Saxo Bank TradingFloor.com.