Investing.com’s stocks of the week

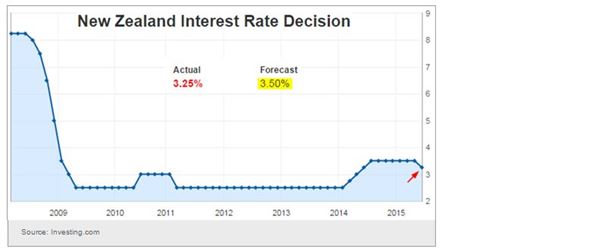

Let's start with New Zealand where the central bank unexpectedly cut the benchmark rate. As discussed a couple of days back, the nation's manufacturing activity showed weakness but it was the commodity price declines (especially meat and dairy) that were the driver behind this cut.

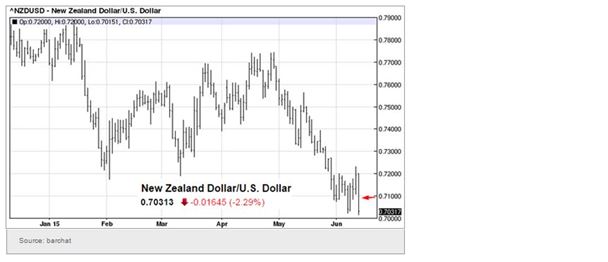

The New Zealand dollar dropped 2% against the Australian dollar and 2.3% against the US dollar on the news (the lowest since 2010). These are significant intraday moves.

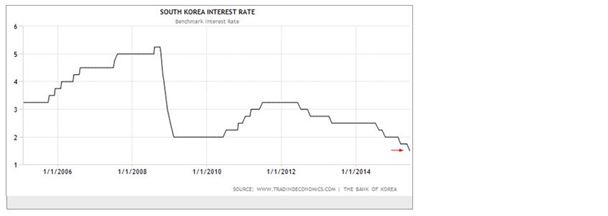

South Korea's central bank cut the benchmark rate as well, although this move was widely expected. The nation has similar concerns – weaker exports, slower manufacturing growth, and disinflationary pressures.  *********

*********

The Bank of Japan once again expressed unease with the yen's weakness, suggesting that further declines do not make sense. The yen had the largest one-day jump of 2015.

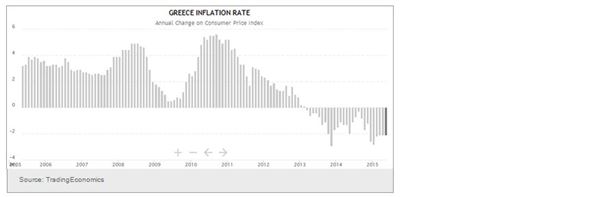

In the Eurozone, Greece continues to dominate the headlines. A Greek stock market ETF rallied on rumours of a piecemeal German aid package. Such a deal would supposedly involve some amount of funds released for each reform. That sounds like handing out a lollipop for doing each chore. Unrealistic, patronising, and hopefully not true.

The Greek economy remains in deflation. The problem with deflation is that while wages and asset prices fall, Greek liabilities remain the same. To put it another way, the real value of Greek liabilities is rising, making them increasingly difficult to repay.

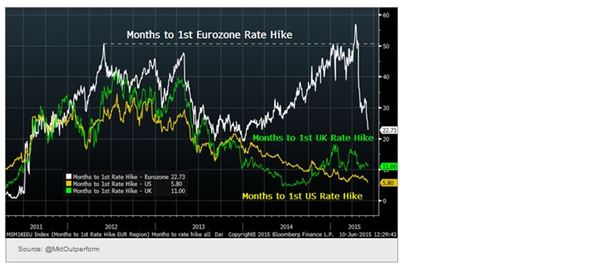

In other euro area developments, the market-expected timing to the first European Central Bank rate hike has declined to 22 months from 56. This does not seem consistent with what the ECB has been communicating, but here we have it.

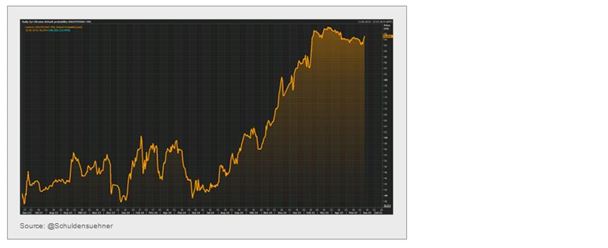

In another European disaster, Ukraine is quickly approaching default. The International Monetary Fund is asking private creditors to take a haircut before it provides aid. A smart decision. Otherwise there is little chance the IMF will ever get repaid.

Default probability jumped on the news.

Now for some food for thought...

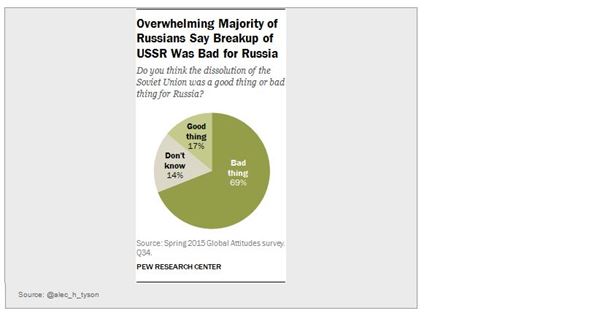

The majority of Russians believe that the breakup of the USSR was bad for Russia.

Disclosure: Originally published at Saxo Bank TradingFloor.com