Investing.com’s stocks of the week

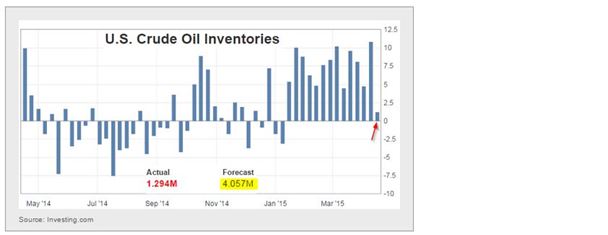

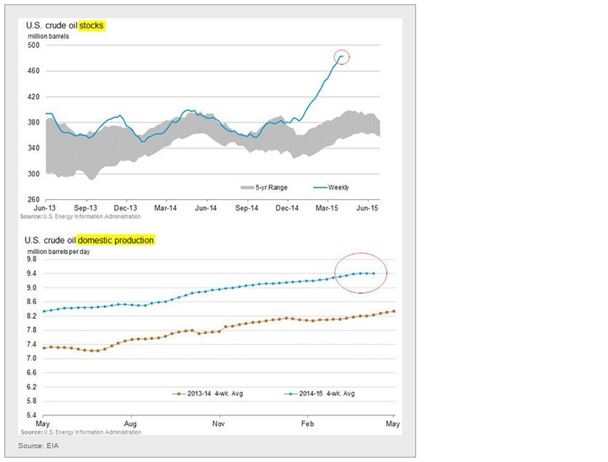

Let's start with the energy markets where the latest reports seem to indicate some stabilisation in inventory growth as well as flat production. The US crude oil stocks increase was the lowest in 14 weeks and well below consensus.

The nearly linear build of oil supplies held in storage seems to have paused, while production now looks flat.

WTI crude futures rose sharply in response.

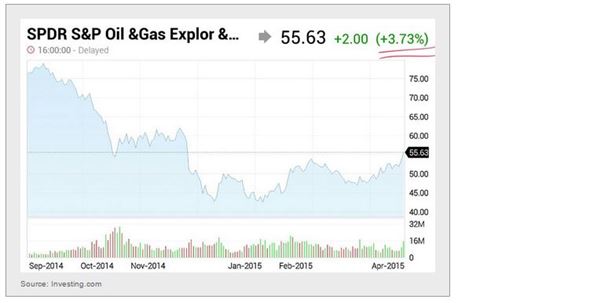

The equity markets cheered, as US upstream energy shares rallied nearly 4% (XOP).

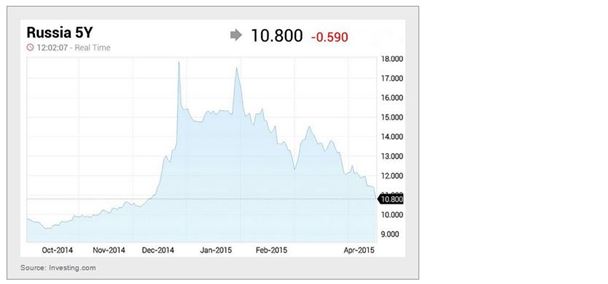

The Russian government bond market rallied as well, with yields falling to new 2015 lows.

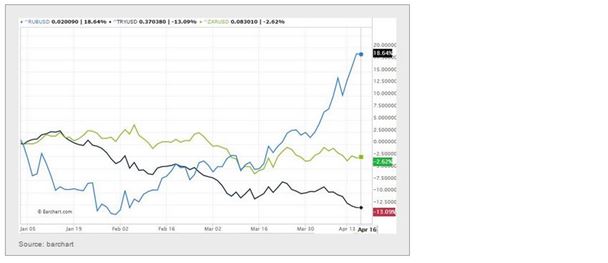

The ruble is now outperforming all major emerging market currencies. In the chart below, blue =Russian Ruble, green = South African Rand, black = Turkish Lira; versus the US Dollar; year-to-date.

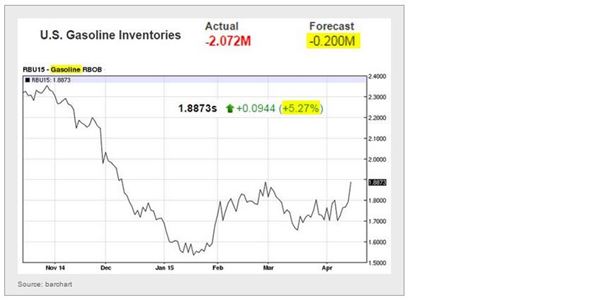

Gasoline inventories in the US also came in far below forecasts as demand picks up - particularly in the Northeast. Gasoline futures jumped over 5% (Sep-15 shown below). This will likely result in higher headline US CPI in the months to come.

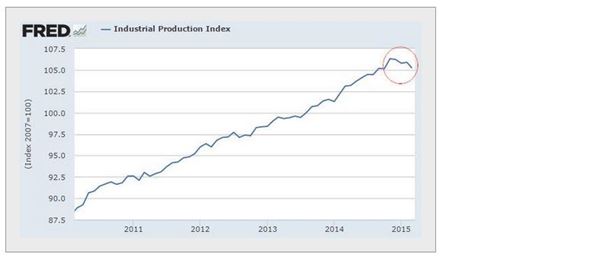

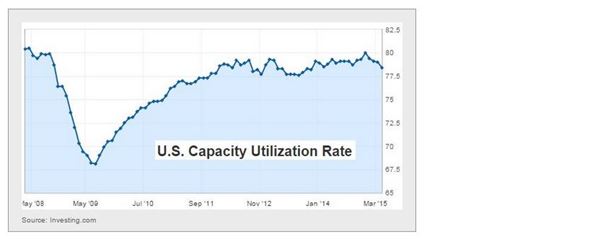

In the United States the latest economic data remain soft.

1. Industrial production stalled, declining by 0.64%, the largest percentage drop since May 2009.

2. ... and capacity utilisation fell more than expected.

The first rate hike is now priced Dec-15 to Jan-16. The critical data will soon start rolling in for April (PMIs). This will give us a glimpse into the second quarter, as the impact of the cold winter is removed/reversed.

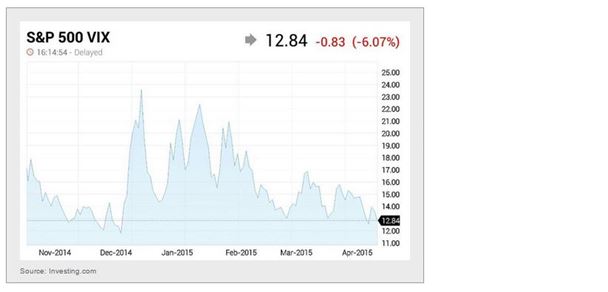

Ironically, by pushing out the first rate hike expectations, the soft economic data put downward pressure on volatility, with VIX now near the lowest point of the year.

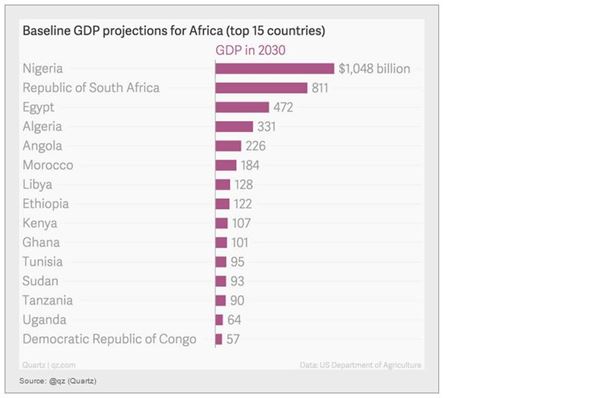

Now some food for thought... 2030 GDP projections for the largest African countries.

Disclosure: Originally published at Saxo Bank TradingFloor.com