Investing.com’s stocks of the week

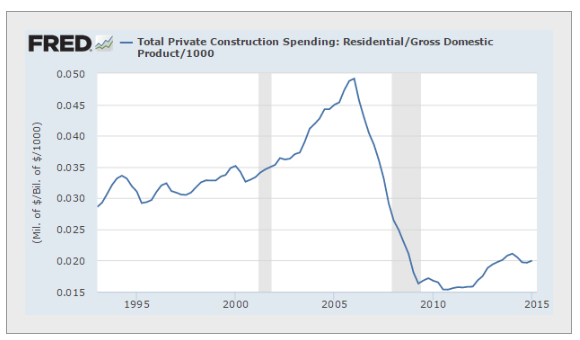

I'd like to start with showing that the US rental shortage is quickly becoming a major problem for the nation. As a whole, the US is not building enough homes to meet the nation's housing demand. Residential construction spending as a fraction of the GDP remains suppressed.

Furthermore, housing starts also remain extremely low, especially considering US population growth. This market has never recovered after the housing crisis - even to "pre-bubble" levels.

Part of the issue of course is the nagging tightness in the mortgage market, as homeownership rate continues to decline.

This is funneling more people into the rental market, rapidly tightening the availability of rentals across the United States.

Some view this as a bicoastal issue - of course the rental market is tight in Silicon Valley or New York City. Unfortunately that is not the case. Vacancy rates in Ohio and Michigan for example are falling as well.

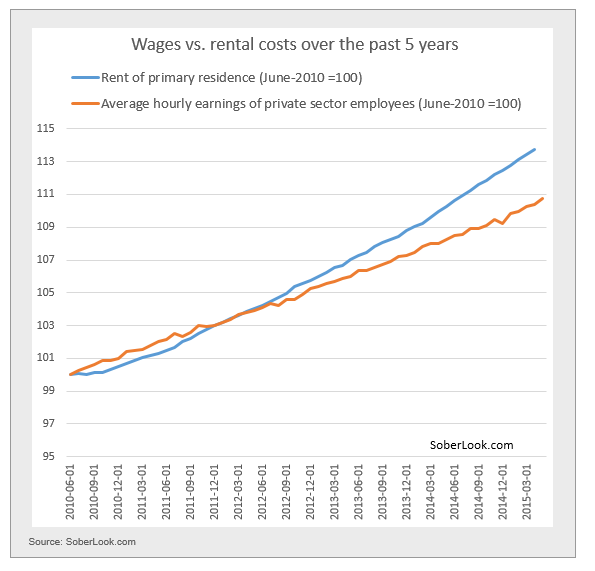

As I discussed last time, wage growth in the US remains subdued. In spite of a slight improvement last month (to 2.3% YoY), rental costs continue to rise faster than wages. The chart below describes the situation over the past five years.

This leaves an increasing number of households "behind", with millions more now spending over half of their income on rent.

The WSJ published an infographic showing that family formation is expected to be driven by minorities who are less likely to own homes. That will push homeownership rates lower, funneling even more people into an increasingly tight and expensive rental market. Unless construction ramps up materially over the next few years, the rent/wage gap will widen to crisis levels, putting significant pressure on family formation, raising homelessness, and dampening economic growth.

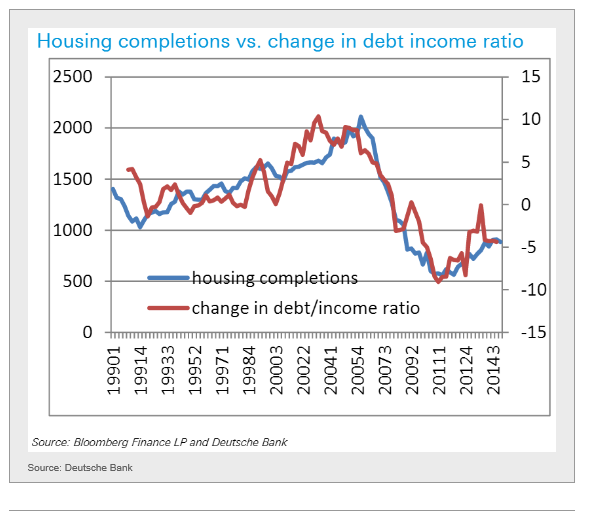

Related to the above, it seems (based on the chart below) that construction activity may not pick up substantially until households begin re-leveraging.

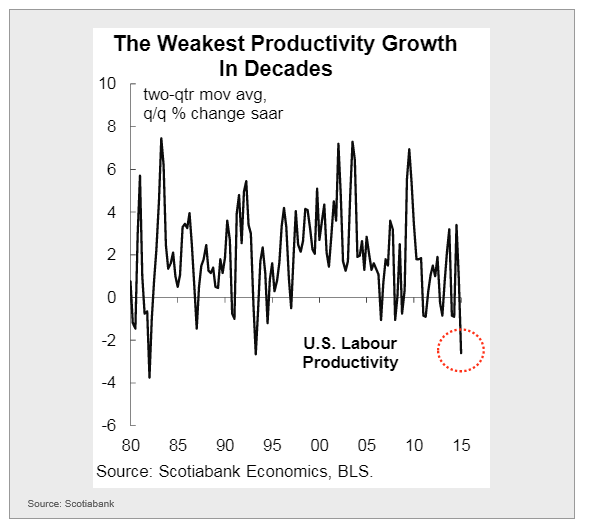

US productivity growth is the weakest it has been in decades. If this continues, there really are only two ways it can end. Either CAPEX will pick up or hiring will slow.

In the Eurozone, Greece will dominate the new this week. While the Eurogroup desperately wants to keep Greece from exiting (particularly in an "uncontrolled" manner), a "debt forgiveness" deal is not on the table. The media seems to suggest that the hard-line stance emanates from Germany. That's simply not true. It's about the smaller Eurozone states (such as Slovenia, Slovakia, Finland) that are refusing to go along with Greece's demands. Slovakia's finance minister Peter Kažimír said this over the weekend: "Greece has to focus on completion of programme - that's mutual priority, debt restructuring is not on the table."

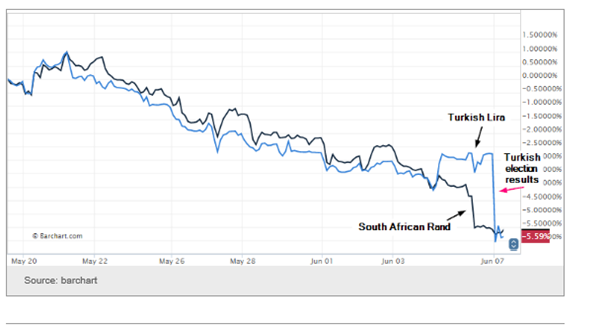

Turkey's election turned out to be a shocker this weekend. It will be interesting to see how this will play out now that the Kurds find themselves with new political powers.

The Turkish lira, which hit an all-time low as a result of the election (down almost 3% overnight), is now in a tight race with the South African rand to the bottom.

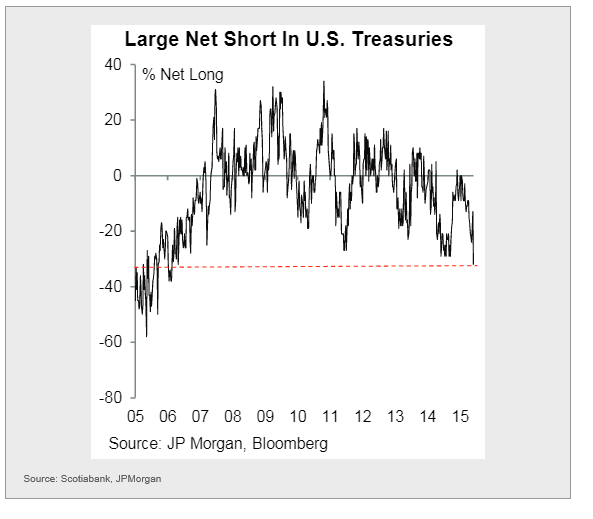

Turning to fixed income markets, speculative accounts' net short treasuries positions are the largest since 2006. Have US yields risen too much? A bad US economic report could create a bit of a short squeeze.

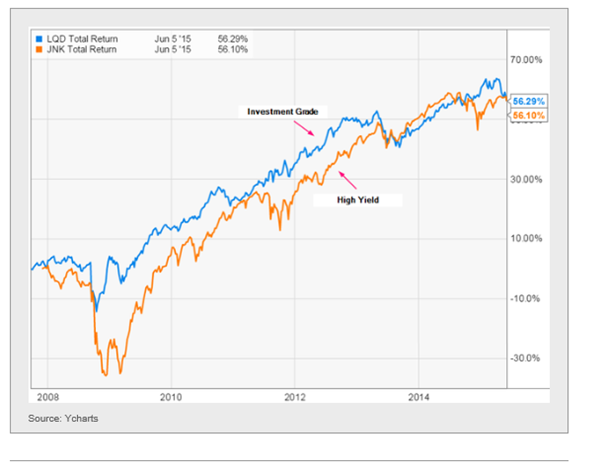

Whether one invested in US high yield bonds or US investment grade bonds right before the financial crisis, the total return through today would have been nearly identical.

Now some Food for Thought - 4 items:

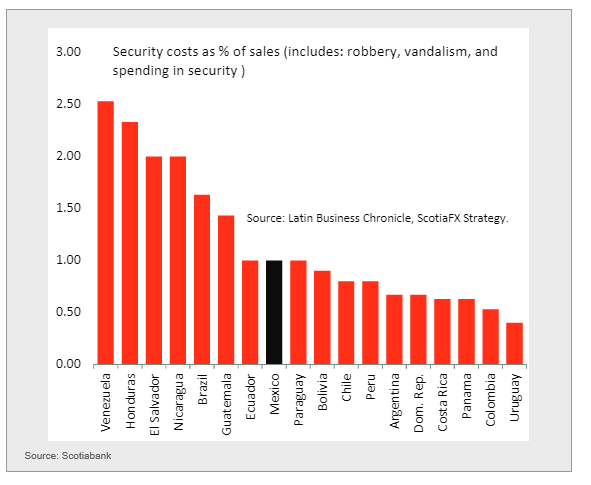

1. Security costs across Latin America as % of sales (robbery, vandalism, and spending on security).

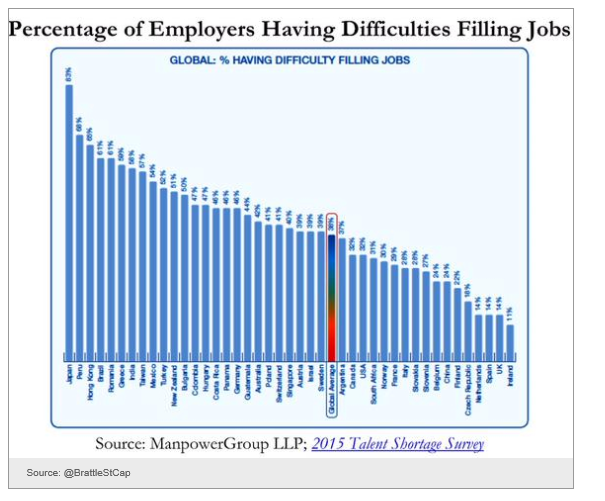

2. Global labor markets are tightening. Here is the situation by country.

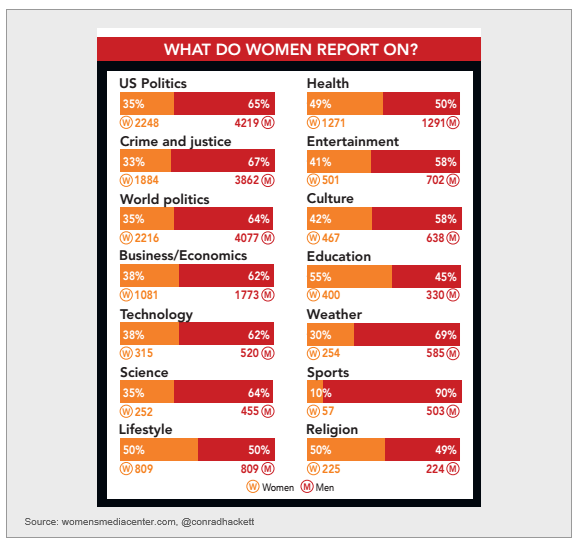

3. The status of women in media - what are women reporting on?

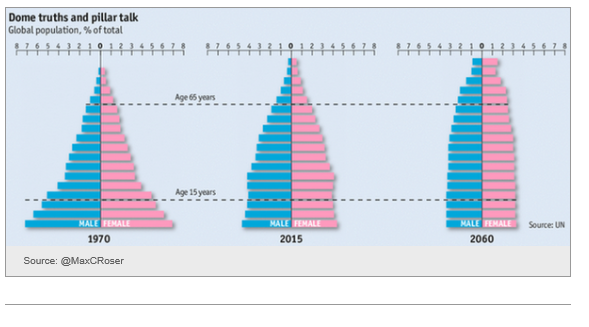

4. The changing shape of the global population pyramid as the world ages

Disclosure: Originally published at Saxo Bank TradingFloor.com