The weekend ended without a deal between Greece and its creditors. The goal supposedly was to reach an agreement before markets open on Monday, but not surprisingly they didn't get there.

Sticking points seem to be items such as the value added tax (VAT) increases (on electricity for example) and cuts in pension pay.

The creditors are targeting sufficient fiscal improvements to achieve some hope of eventual debt repayment - even a partial one. But the Greek side would not budge.

Greek leadership may be hoping for a massive selloff on Monday that would force the creditor institutions to rethink their position. The markets are definitely reacting negatively, with DAX futures down 0.6%.

The euro is down 0.4%.

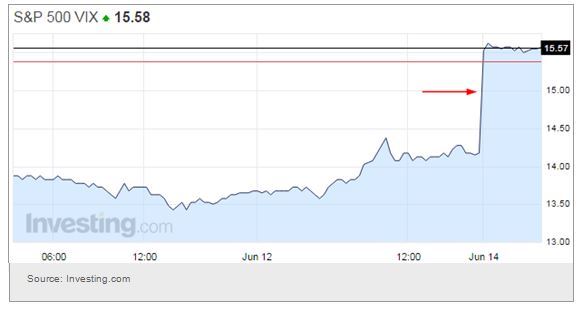

And the VIX futures are up about 1.4 (below).

While the markets have certainly turned cautious on the news, this is by no means the kind of reaction we would have seen in 2011/12. There is significant "deal fatigue" here and most market participants still believe that some sort of an "emergency" compromise will be reached at the last moment. We have two weeks left until the full June IMF payment is due.

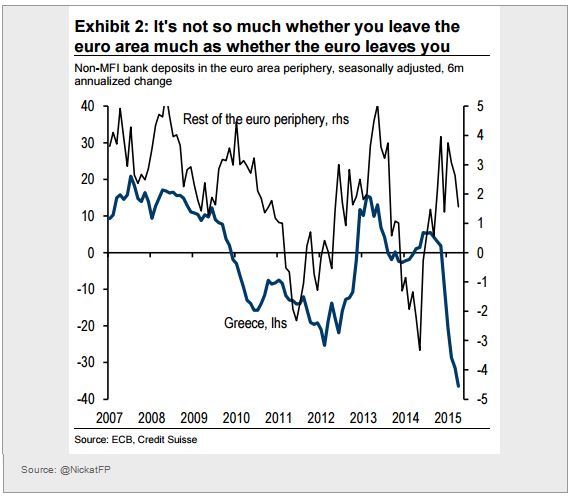

Also it's worth noting that unlike in 2011/12, the run on banks and the rising Target2 imbalances seems to be limited to Greece alone. Some interpret this as evidence that contagion from Greece to the rest of the Eurozone periphery can be contained. That should give the Eurogroup negotiators quite a bit of confidence to stay the course.

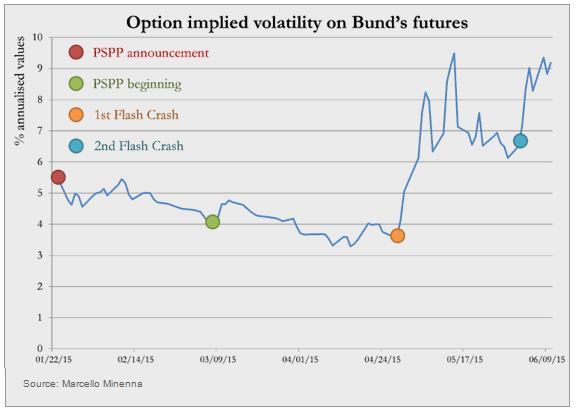

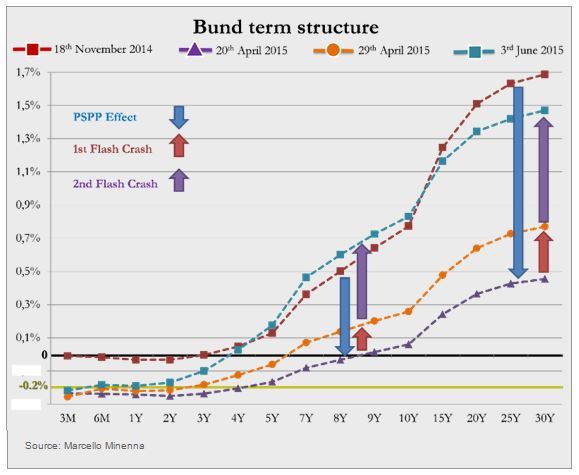

In other Eurozone developments, we had quite a sharp increase in fixed income volatility in recent weeks - particularly for Bunds.

This chart shows how implied volatility reacted to the announcement and the start of QE, the first and the second "flash crash" (the rapid selloff in German government bonds).

And here is how the Bund term structure moved during these events.

Switching to India, investors have been getting out of the nation's stock markets. This is partly due to the possibility of a weak monsoon this year and the lack of confidence in the strength of economic growth to support current valuations.

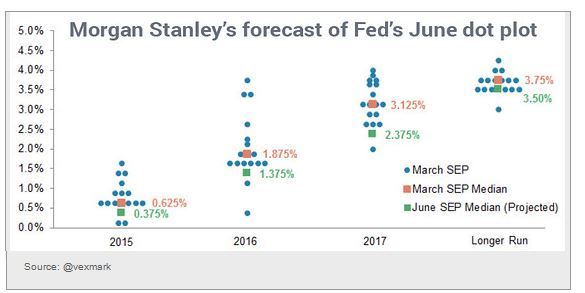

In the United States the expectations for the Fed's June "dot plot" shows significant reduction in the rate trajectory. The green squares below are Morgan Stanley (NYSE:MS) Morgan Stanley's forecast. That means the central bank is looking at the Fed Funds rate below 2.5% in 2017 - a rather mild pace of increases.

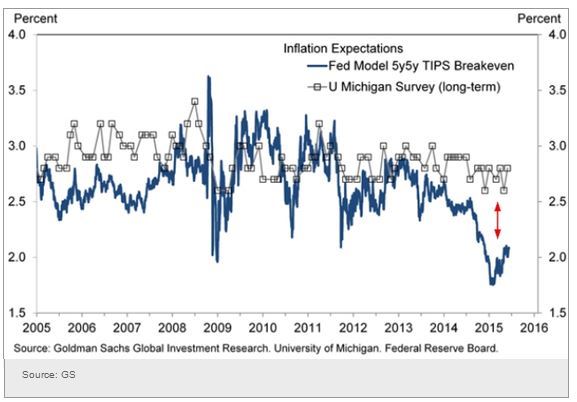

One metric that the Fed will be considering is inflation expectations. It's important to point out that the gap between how consumers perceive future inflation and where the markets are pricing it remains quite wide.

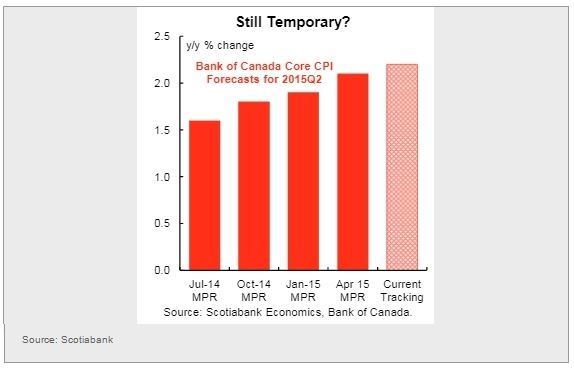

Speaking of inflation, is Canadian CPI increase, which had consistently surprised to the upside, still transient? It will be interesting to see how the BoC reacts to a slowing economy and rising inflation.

Now let's revisit the massive dislocation now taking place in the US coal industry. Coal futures gave up 2.3% on Friday alone.

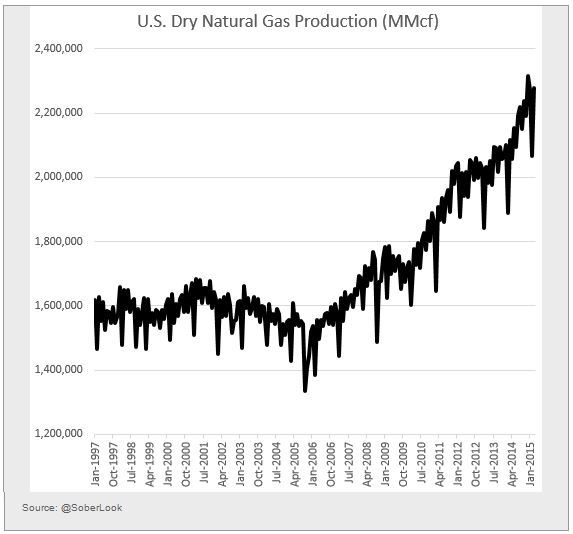

The biggest driver of this price correction is the rising US natural gas production (chart below). There is also the tougher EPA regulation. In particular the Mercury and Air Toxics Standards (MATS) is making it too expensive to refurbish some coal-based power plats.

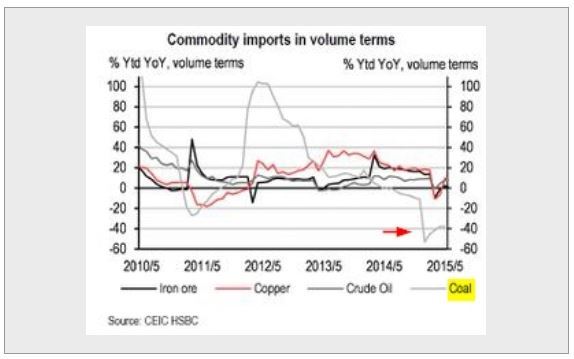

And then of course there is China, where coal imports have collapsed.

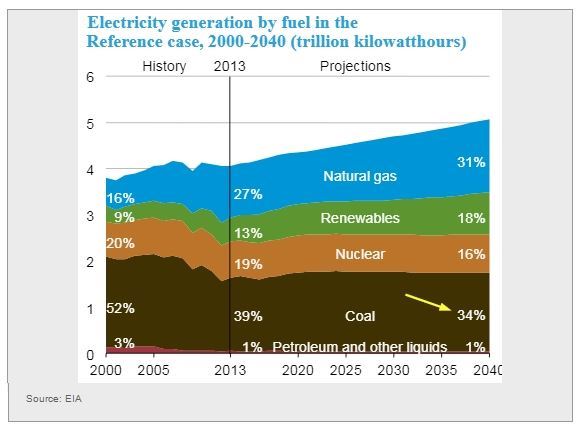

To be sure, coal will remain a major source of electricity production in the United States. Even if the EIA projection (chart below) is too optimistic on the future of coal usage, the survivors of the "coal crunch" stand to profit handsomely.

Moreover, some diversified energy firms are still making money on coal even at these prices.

Nevertheless, the industry is undergoing a historic shakeup, which a number of industry participants (particularly those who are highly leveraged) may not survive.

Disclosure: Originally published at Saxo Bank TradingFloor.com