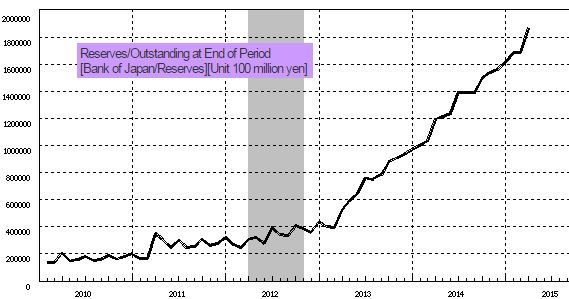

We begin with Japan where bank reserves (banking system accounts with the Bank of Japan) spiked recently, as the unprecedented QE continues.

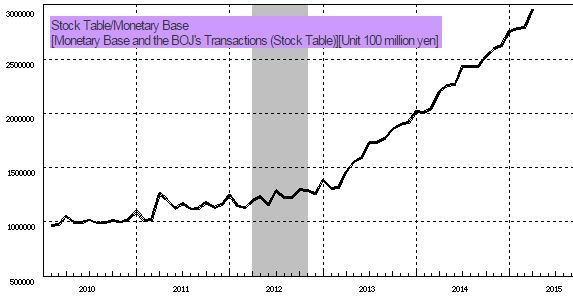

Japan's monetary base rose further as a result and is now triple what it was in 2010.

That's why I was a bit surprised to see short yen positions held by speculative futures accounts decline.  In fact dollar-yen has been relatively flat since late last year. The market doesn't believe all this "money printing" will have much of an impact on the currency. QE fatigue?

In fact dollar-yen has been relatively flat since late last year. The market doesn't believe all this "money printing" will have much of an impact on the currency. QE fatigue?

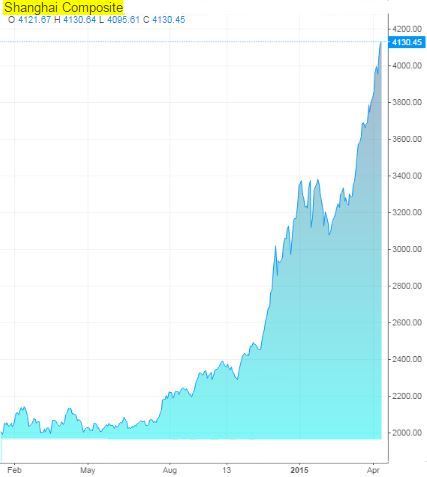

Turning to China, yesterday's export figures were quite poor relative to expectations. Nevertheless the stock market indices continue to rally - completely ignoring the barrage of negative economic data ...

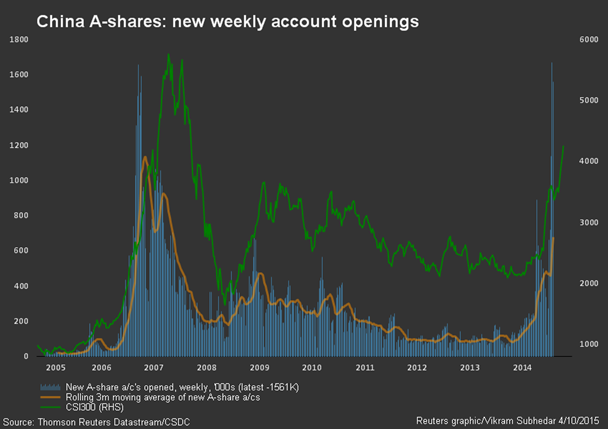

And the new account openings keep moving higher. Bet on fresh stimulus or simply a speculative frenzy with little regard for fundamentals?

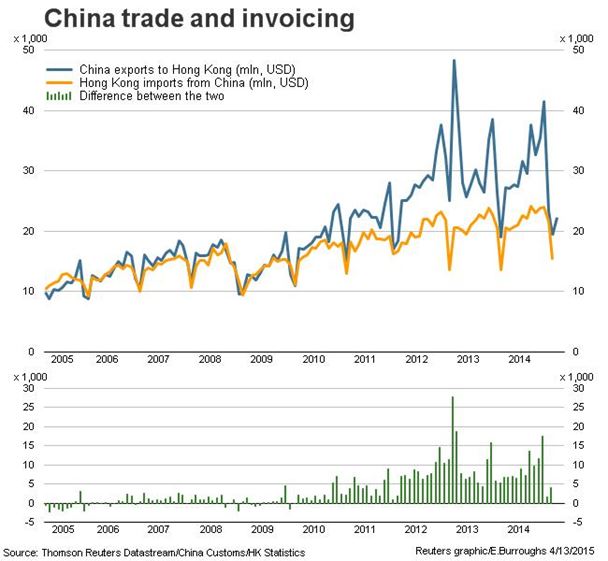

In another China-related development, the spread between mainland China's exports to Hong Kong and Hong Kong's imports from the mainland has shrunk. These exports were not real and instead represented long yuan positions that exporters were putting on through "invoicing".

But as the yuan appreciation was halted and the currency became more volatile, such practices fell out of favour.

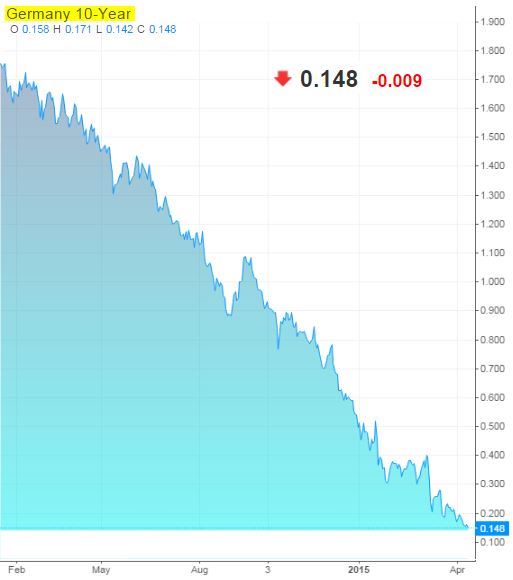

In the Eurozone, yield compression continues across several countries and maturities. 1. The German 10-Year Bund yield fell below 15 basis points. There are bets across some trading floors on when this is going negative.

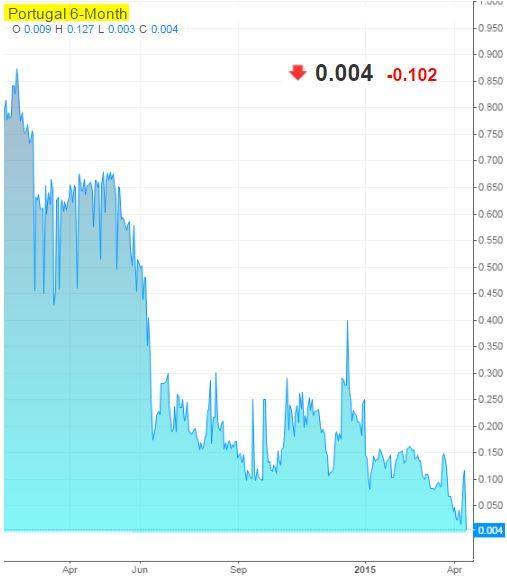

2. The Portuguese six-month government bill rate is approaching zero. It wasn't that long ago that Portugal was unable to access public markets and dependent on the bailout funds to keep the lights on. Amazing.  3.

3.

And the Irish 10-Year government bonds traded with a 70bp yield.

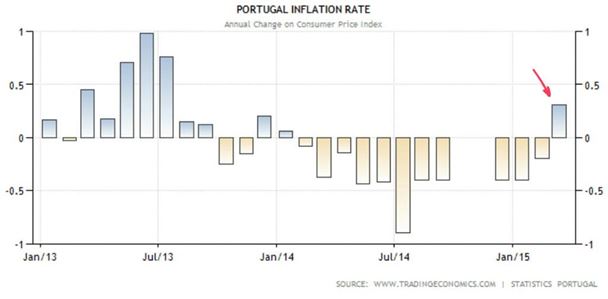

Speaking of Portugal, the nation's CPI (YoY) turned positive for the first time in over a year. Is inflation bottoming out across the Eurozone?

Disclosure: Originally published at Saxo Bank TradingFloor.com