Investing.com’s stocks of the week

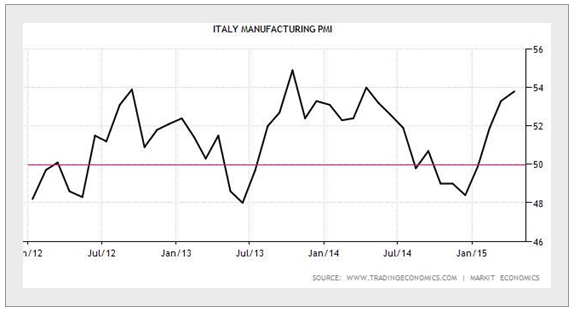

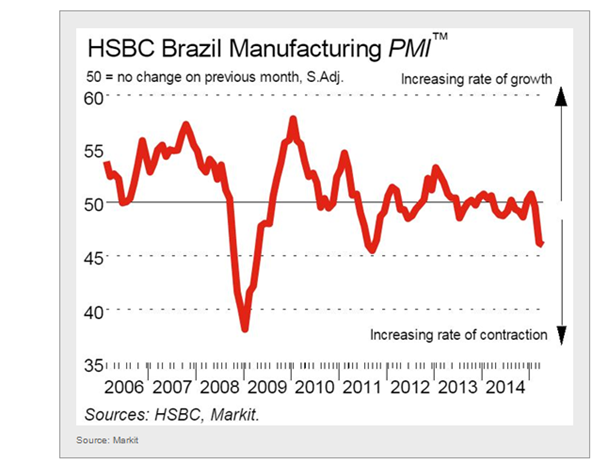

Let's start with some notable manufacturing PMI reports from around the world. For those who are not familiar with PMI, it stands for Purchasing Managers Index - a helpful early indicator of the manufacturing sector's health in each country/region. A measure below 50 indicates contraction, above 50 expansion. 1. Italy's manufacturing sector continues to strengthen.

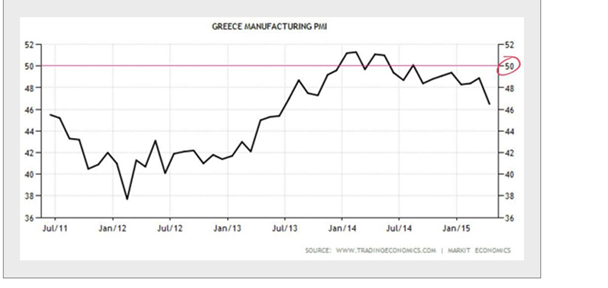

2. Greek manufacturing contraction accelerated again - the damage from political uncertainty has been done.

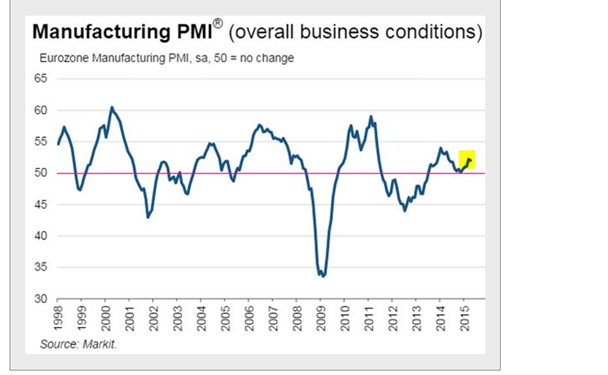

3. The Eurozone as a whole is hanging in there with tepid growth.

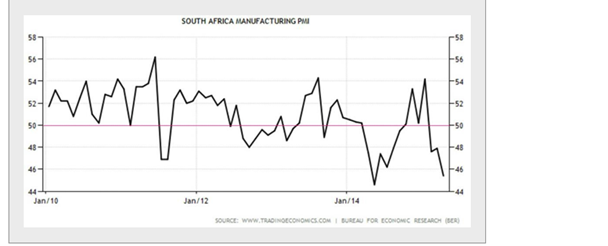

4. In emerging markets we see South Africa unable to sustain the recent recovery as contraction worsens again.

5. ... and Brazil's manufacturing continues to contract.

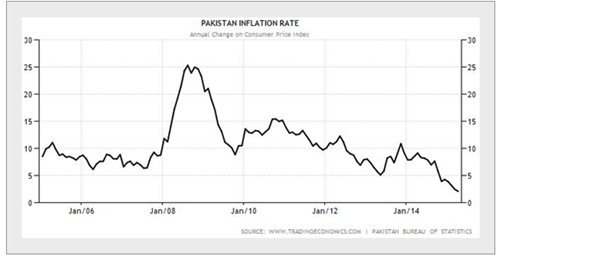

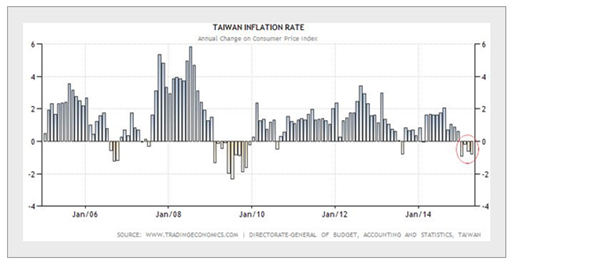

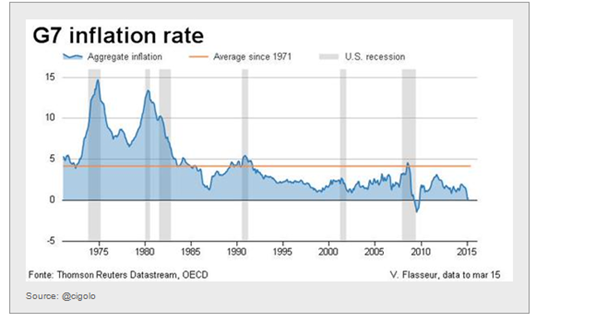

Inflation reports, particularly out of Asia seem to point to continuing disinflationary pressures.

1. Pakistan CPI headed toward zero.

2. Taiwan CPI (the country remains in deflation).

3. G7 inflation is near zero.

Global government bond yields continue to grind higher as the crowded long trade unwinds. Some are suggesting that this is a reaction to changed sentiment on inflation, as the markets begin to price in a turnaround in global inflation measures. Here are three examples. 1. The US 30 Year T-Bond treasury.

2. The New Zealand 10-Year.

3. The 10-Year Bund, which has seen a spectacular selloff.

Disclosure: Originally published at Saxo Bank TradingFloor.com