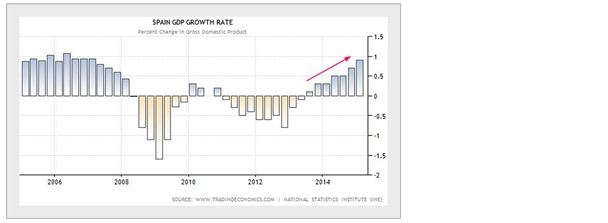

Let's begin with Spain, where economic growth continues to pick up steam. How is that possible with nearly a quarter of the population listed as unemployed? This is a "jobless recovery" on steroids. Here is Spain's quarter-over-quarter GDP growth, which beat consensus.

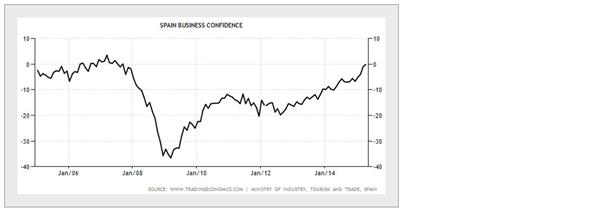

Moreover, Spain's business sentiment is at pre-2008 levels. This bodes well for Eurozone's ongoing recovery.

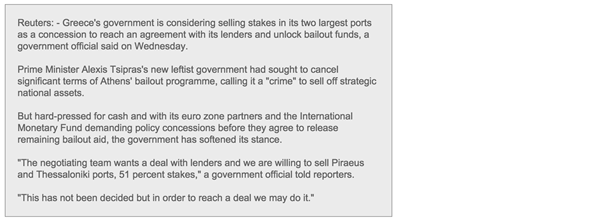

In another positive Eurozone development, there is talk of a potential deal with Greece this Sunday. Supposedly the sales of Greek ports could be part of the deal.

Greek bond yields fell sharply in response in recent days.

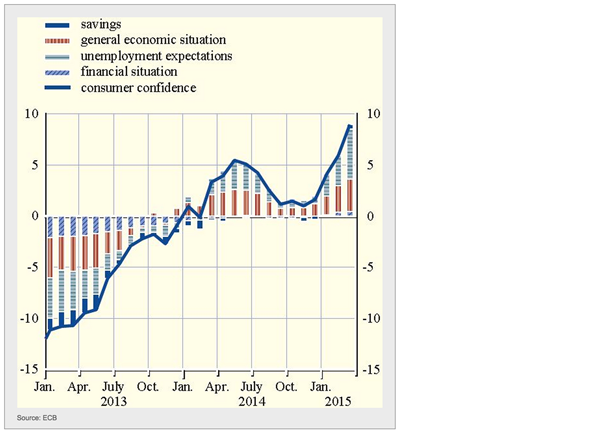

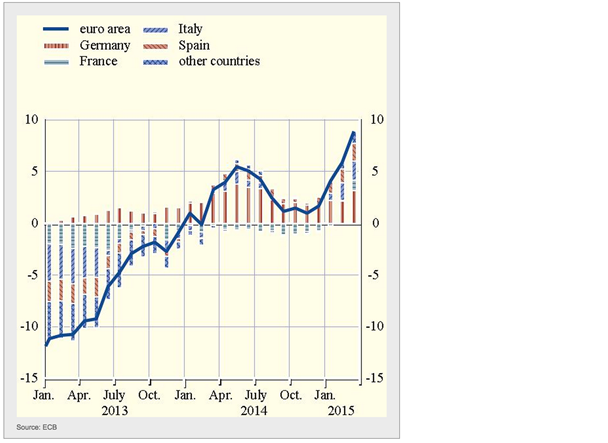

What has been driving the improvements in euro area's consumer sentiment? Here is a breakdown by sub-component and by country. There seems to be quite a bit of optimism about labour market improvements – something the Eurozone desperately needs.

The euro rally continued, as speculative accounts that are short the euro got caught by surprise (by weak data from the US). As discussed yesterday, that wasn't the case for the yen. The euro-yen cross moved sharply higher.

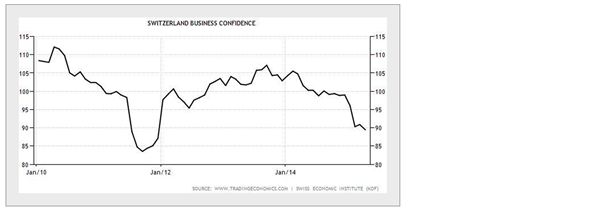

Switzerland business confidence turns lower as currency strength hurts exporters. Giving up on the Swiss franc cap is turning out to be costly.

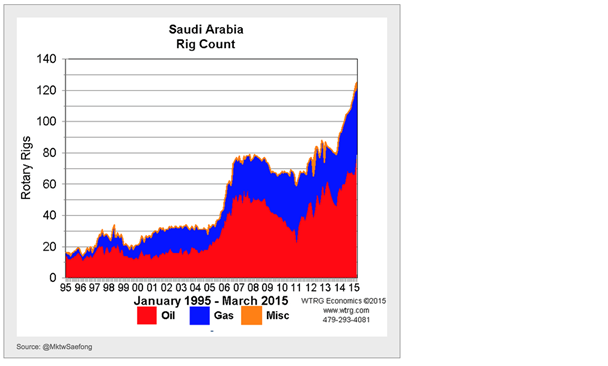

Now a couple of energy-related developments:

1. Leading economic index for Texas continues to fall.

2. And while they are rapidly cutting the number of operating rigs in Texas, rig count in Saudi Arabia is at record highs.

Now some food for thought...

Borscht inflation in Russia shows the real cost of a weak ruble.

Disclosure: Originally published at Saxo Bank TradingFloor.com.