Investing.com’s stocks of the week

In China, economic reports continue to suggest persistent weakness in growth. Imports have weakened far more than expected, an alarming trend for those who rely on exports to China.

The nation's trade surplus spiked to record numbers as a result.

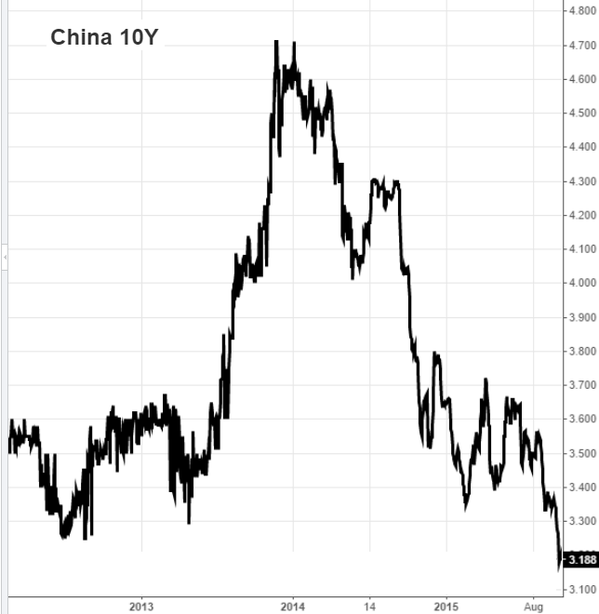

China's 10-year government bond yield is near the lowest level in five years.

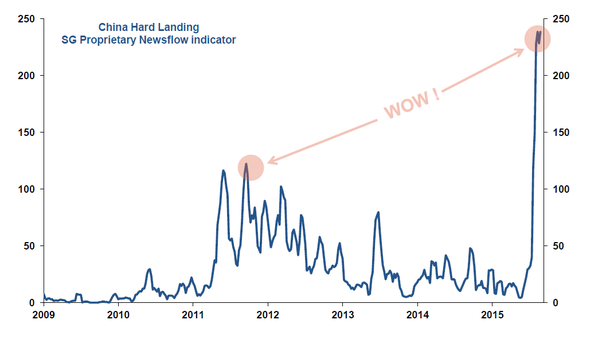

As a result of some of these trends, market fears around a "hard landing" in China remain elevated. Here is SocGen's index of hard landing news flow.

However, for a number of reasons, a recession in China remains unlikely. I've discussed the monetary and fiscal stimulus from Beijing. The economic "rebalancing" is also quite real, making some of the traditional indicators of economic activity less relevant. Here we have the various indicators of China's economic health from Reuters - broken out into some of the "old" and the "new" economy components.

"Old economy"

"New economy"

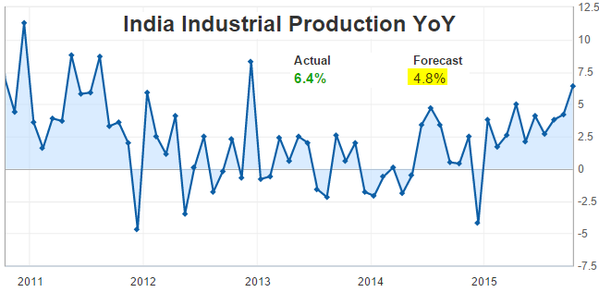

In contrast, India is showing signs of robust economic momentum. The nation's industrial production was significantly stronger than consensus.

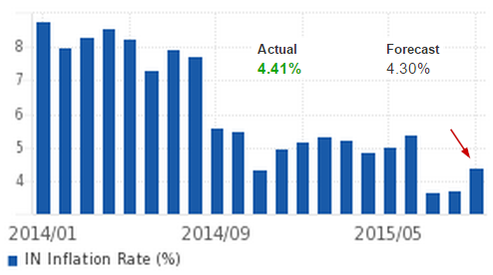

There was also an uptick in India's CPI as a result of higher prices on pulses (beans, peas, and lentils) and vegetables.

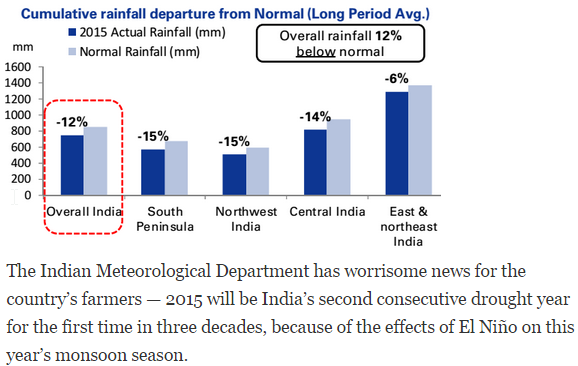

The primary reason for elevated food prices in India is the persistent drought in many parts of the country as El Nino takes its toll.

Staying with BRICs for a moment, Russia's balance of trade deteriorates further on weak energy prices. It's a tough road ahead for the nation.

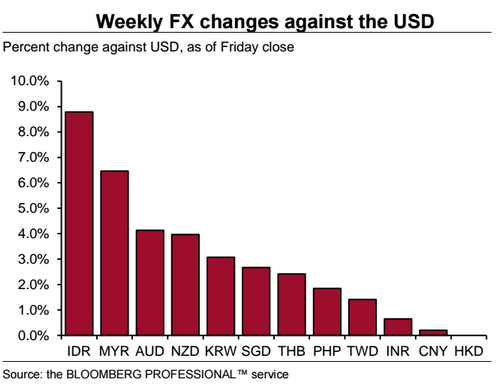

A number of currencies in Asia have experienced a sharp bounce from the lows. These gains will be quickly reversed if the US Federal Reserve decides to go ahead with an early liftoff.

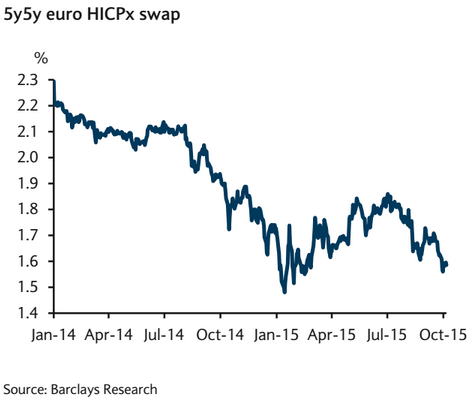

Switching to the Eurozone, forward inflation expectations there remain weak. Many expect Mr. Draghi to roll out the QE programme expansion in the next few months.

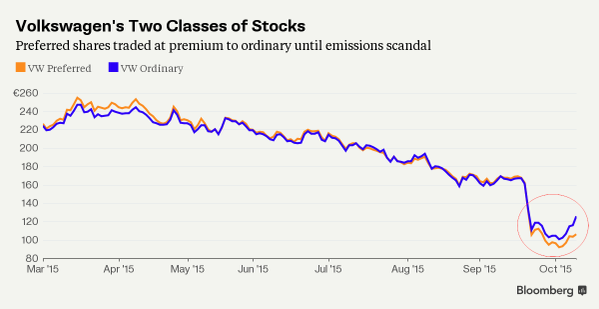

According to Bloomberg, Volkswagen (OTC:VLKAY) will need to issue a great deal of new stock in order to pay for the mess it created. It will have to issue the preferred shares (non-voting), thus diluting the existing public shareholders. That's why the preferred now trades at a discount to the ordinary - with the gap between the two widening.

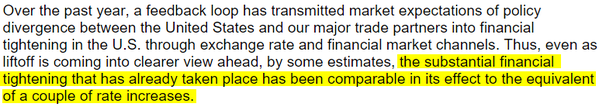

In the United States, the Fed's Lael Brainard suggested that the recent tightening in financial conditions is equivalent to two rate hikes. And yet many still expect liftoff this year.

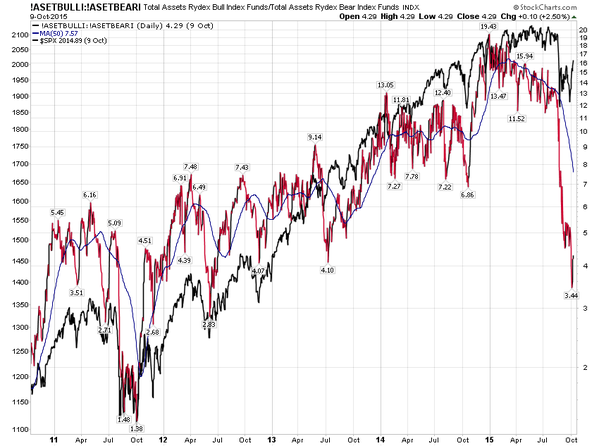

Sentiment in US equity markets remains terrible as seen in this ratio of bullish to bearish funds in terms of assets under management.

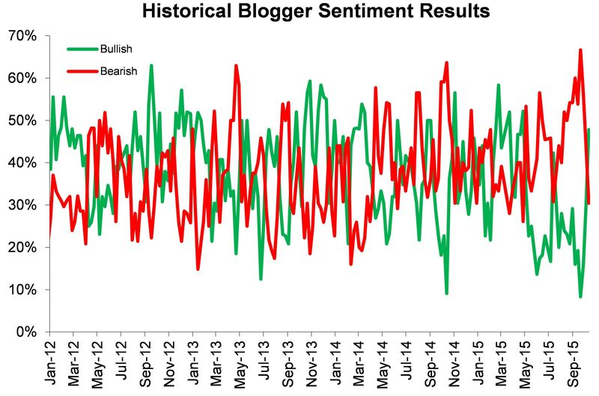

However, it seems that financial bloggers are now becoming bullish again.

Now, lets look at some developments in commodities markets.

Crude oil took a pummeling on Monday in thin trading (US holiday).

While there were multiple reasons for this selloff (including bearish reports from some sell-side institutions), the latest OPEC production data has not been helpful. Saudi Arabia will hold output above 10 million barrels/d until the end of the year.

Disclosure: Originally published at Saxo Bank TradingFloor.com