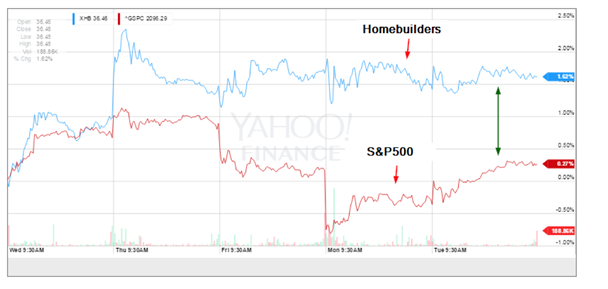

I'd like to start with an update on the US housing market. Yesterday's Daily Shot showed that homebuilders have turned more optimistic. Given the recent weakness in construction spending, some have dismissed this survey data. Recently, we did, however, see some signs of improving homebuilder activity in the markets as lumber futures stabilized in mid-May after months of declines. Moreover, homebuilder shares have outperformed the broader market over the last few days.

On Tuesday, we learned the reason for the renewed builder optimism. They are going to have a busy year as new home construction permits spiked to levels not seen since 2007.

Does this mean US families are finally getting mortgages and buying new homes? Not exactly. While demand for new homes continues to gradually improve, it is concentrated in the "luxury" sector (larger and more expensive homes). In general single-family housing as a percentage of the overall homebuilding activity continues to decline.

Instead, most of the demand is coming from multifamily housing as the need for rental units continues to increase. This is the sector that has been boosting builder optimism, and where we are about to see increased construction activity.

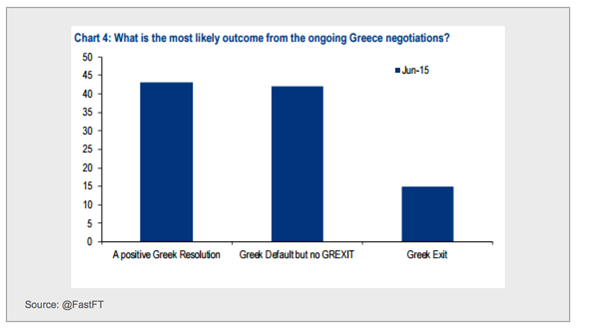

The Eurozone remains preoccupied with Greece. Here is the latest poll of fund managers on potential outcomes.

There doesn't seem to be much progress on the negotiations, as the markets once again point to a significant risk of default. The 2-year Greek government bond yield is approaching 30% - again.

There are signs of rising contagion risk, although those who were in the markets in the 2011-12 period would consider this child's play. We see the Portuguese 10-year bond yield move up another 6 bp. And French sovereign spreads to Germany widen, as shorting French bonds becomes a low-cost bet on Grexit.

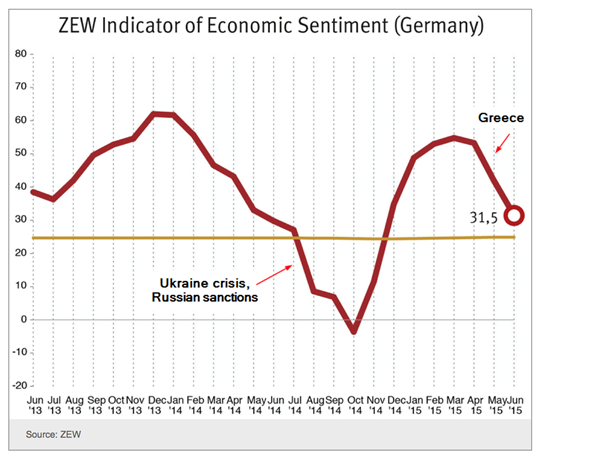

The Greek crisis is starting to take its toll on sentiment, as the German ZEW index declines further.

Clearly, the impact of Grexit will spread beyond the actual losses on debt holdings - impacting consumer, business, and investor confidence, as well as potentially slowing credit expansion.

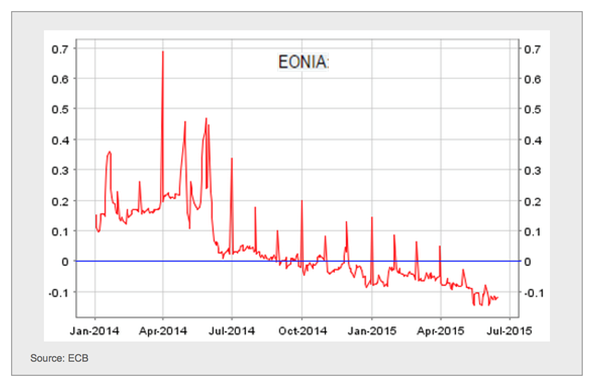

For now, the banking system (outside of Greece) remains awash with liquidity and the overnight rate at which banks lend to each other (EONIA) moves deeper into negative territory.

Deflationary pressures have eased for now, with German CPI bouncing from the lows. This also should help absorb the shock of a major problem with Greece.

We have a week and a half left until the IMF bundled payment from Greece is due.

Now, I'd like to look at a couple of trends in US equity markets I am tracking.

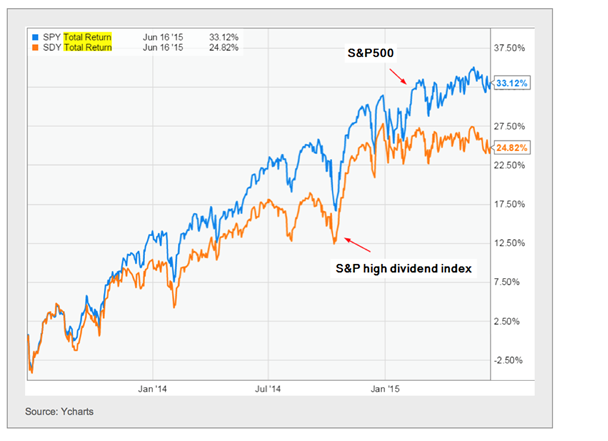

1. High dividend shares underperformance widens as interest rates rise. Take a look at the S&P.

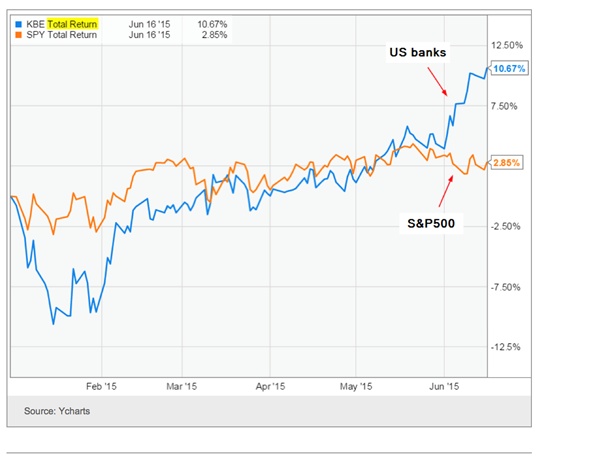

2. US bank shares are outperforming as the yield curve steepens (widening bank lending margins).

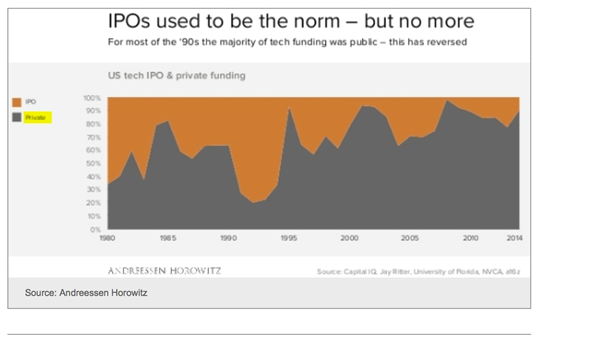

Finally, a note on tech funding in the US. Unlike in the 90s, the bulk of funding for late stage tech firms is now coming from the private markets.

Now some food for thought - 5 items:

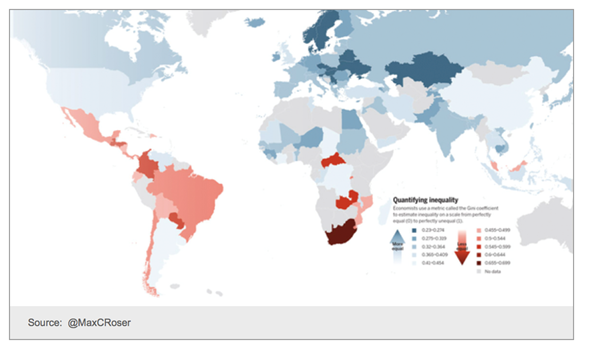

1. Income inequality map (based on the Gini coefficient). South Africa stands out?

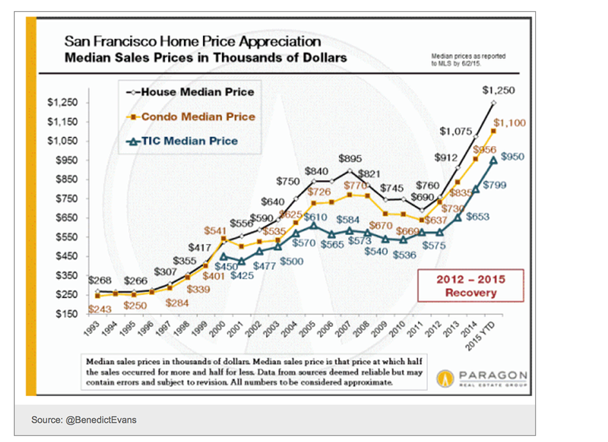

2. Home prices in San Francisco. Ouch!

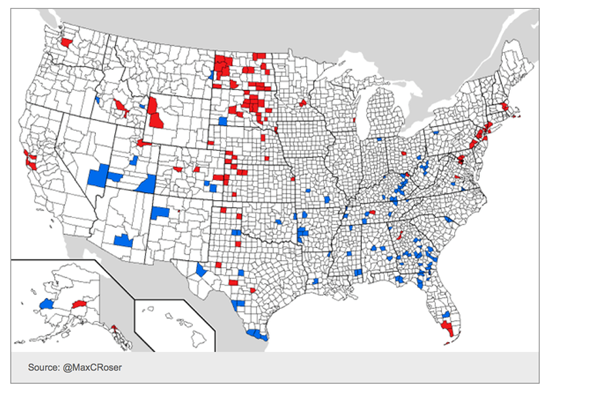

3. Wealthiest (red) and poorest (blue) counties in the US. The North Dakota energy boom really stands out.

Disclosure: Originally published at Saxo Bank TradingFloor.com