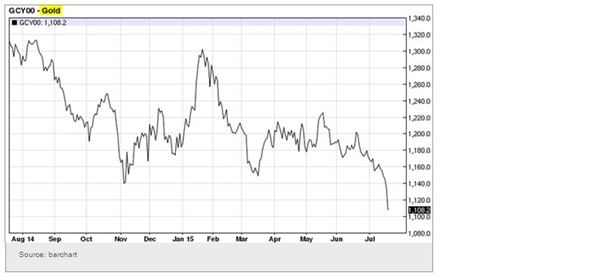

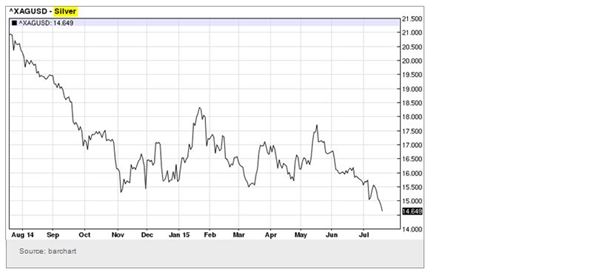

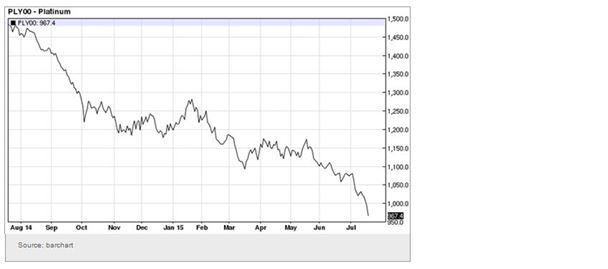

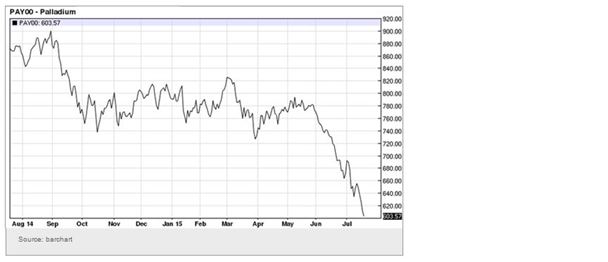

Let's begin with the precious metals markets where we continue to see weakness across the board.

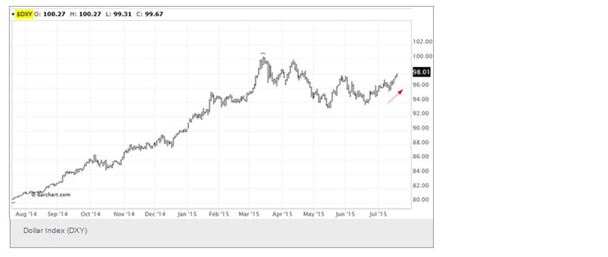

A stronger dollar and expectations of rising rates in the US is one reason. The "stabilisation" of the Greek crisis and the resumption of equity markets rally is another. Moreover, lower than expected gold demand from China had sent investors for the exits.

On Friday, China disclosed the amount of gold it has bought over the past six years (now 1,658 tonnes). That's significantly lower than analysts had predicted. Some argue that the gold is in China but simply not disclosed by the central bank. Perhaps.

Whatever the case, here is the market reaction:

The selloff spilled over into platinum and palladium. Platinum prices fell below $1,000/oz for the first time in years.

Indeed the US dollar continues to march higher as most economists now expect a rate hike in September – and the message from the Fed seems to be "yes". Futures markets are not as optimistic, with a less than 40% probability of a September hike.

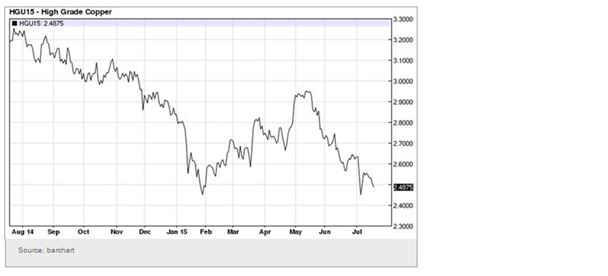

Precious metals are not the only commodities impacted. The chart below shows copper futures.

In fact the whole commodities complex is once again under pressure.

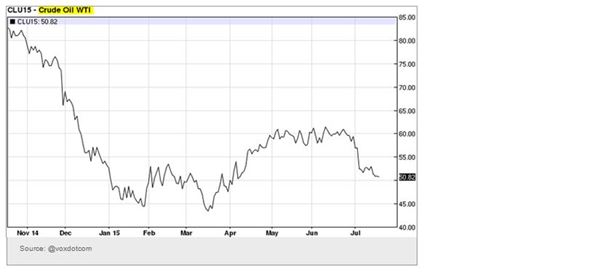

Staying with the commodities theme, WTI crude oil futures are now below $51/barrel. While at $60/b a number of US producers could eke out a profit, at these levels the situation gets more difficult. Many firms held out in hopes they are going to see $70/b soon, but that may be a while.

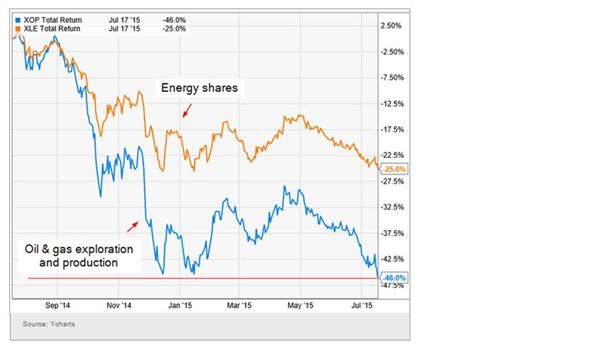

With the 2015 crude oil rally fading, investors are giving up on upstream (production and exploration) energy shares.

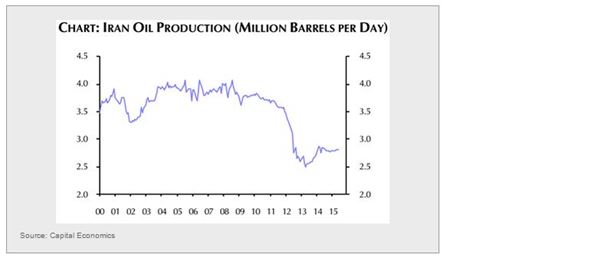

To make matters worse for the oil market, Iran is unleashing its massive crude oil inventories (in storage). It will take it some time to return to production levels that existed prior to the sanctions, but when it does, the markets are going to be even more oversupplied.

Now some Food for thought...

North and South Korea from space - at night. North Korea remains "dark".

Disclosure: Originally published at Saxo Bank TradingFloor.com