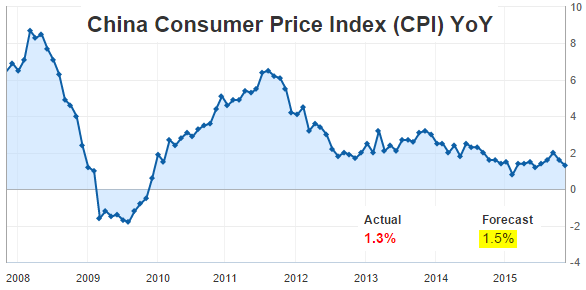

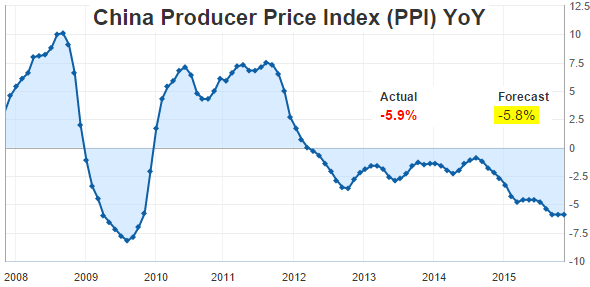

Let's start with China where inflation indicators came in weaker than expected. The latest CPI and PPI are shown below.

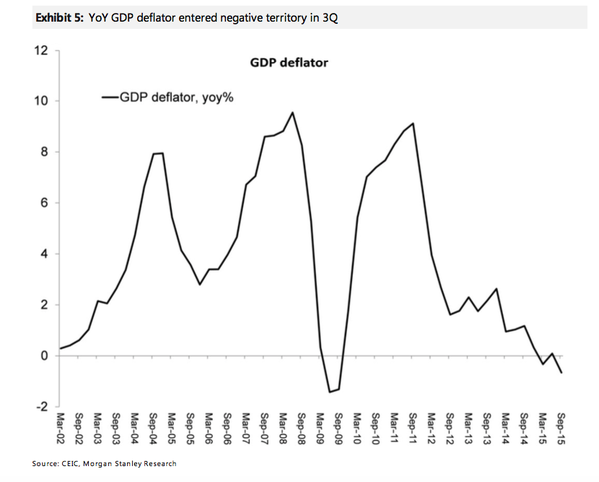

The GDP deflator (used to convert nominal GDP growth to real) has been in the red, which allowed for a better-than-expected real GDP growth report recently (discussed earlier).

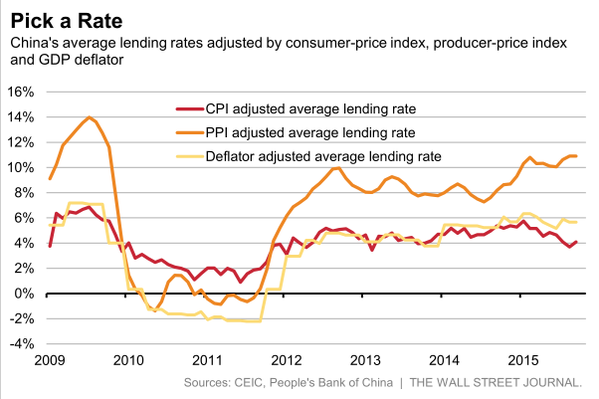

These low inflation measures are resulting in persistently elevated real rates which, at least in theory, are creating a drag on the economy.

Source: @alexfrangos

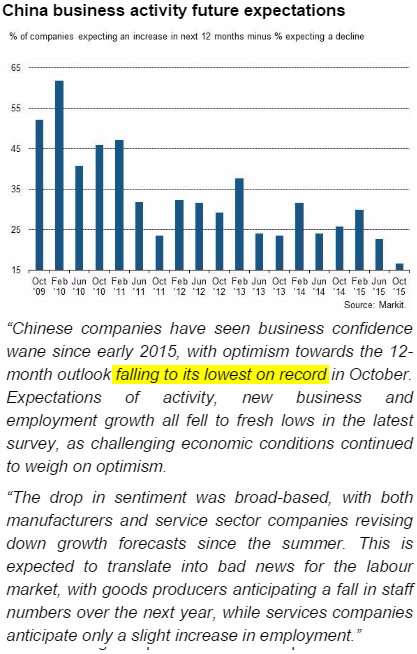

This tells us that more People's Bank of China easing is quite likely in the near-term. To add to PBoC's reasons for further stimulus, China's corporate sector 12-month outlook has collapsed. More fiscal stimulus from Beijing is also probable.

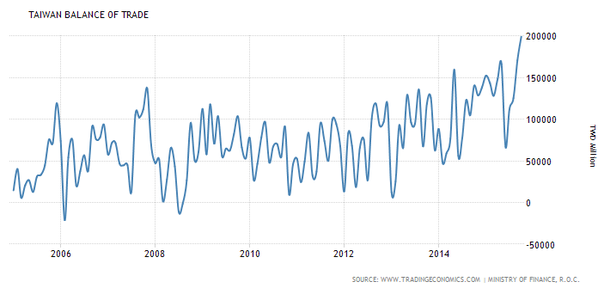

Taiwan's trade surplus hit a new record as weak domestic demand sent imports sharply lower. We've seen this trend in a number of export-focused nations.

Source: Tradingeconomics.com, Ministry of Finance R.O.C.

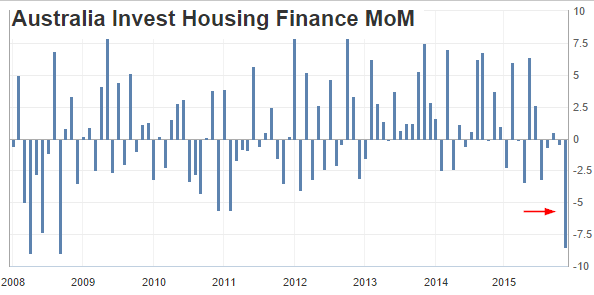

In Australia it seems that banks have become uneasy with speculative property activity. Banks pulled back lending for investment properties (rent and resale) with loan balances experiencing the biggest drop since 2008.

Source: Investing.com

On the other hand, business lending continues to expand. Will this keep the Reserve Bank of Australia from further easing?

Turning to the Eurozone, political risks continue to hound the currency union. Here are some headlines.

![]()

Source: BBC

![]()

Source: Reuters

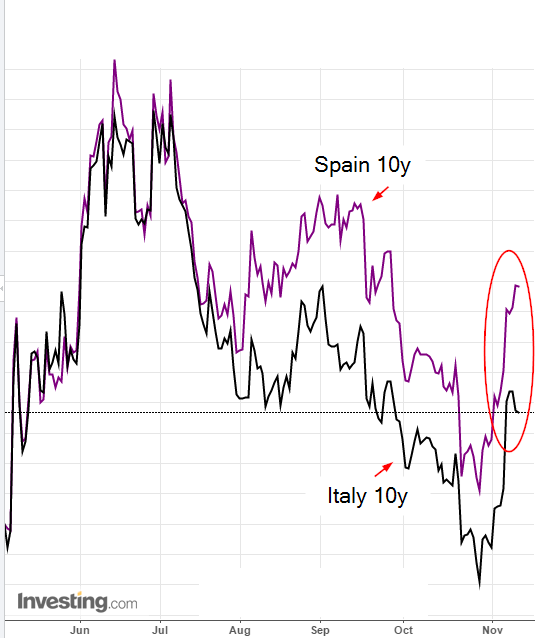

Spanish Spain 10-Year bonds underperformed Italian Italy 10-Year debt on the Catalonia-related risk (the chart below shows relative yield moves - apologies for the lack of axis).

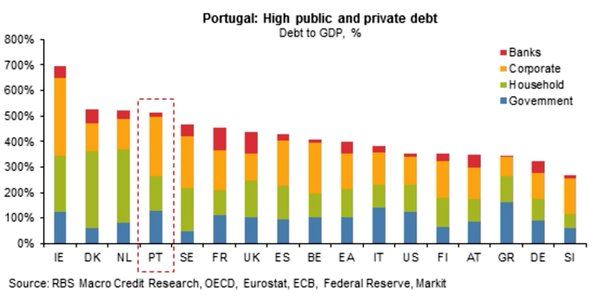

Purtugal's Portugal 10-Year government bond yields jumped in response to the political uncertainty. Additional unease related to Portugal comes from the fact that the nation's private and public debt levels remain elevated. These events will continue to make the ECB's job more difficult as all the uncertainty may have a material impact on corporate and consumer sentiment.

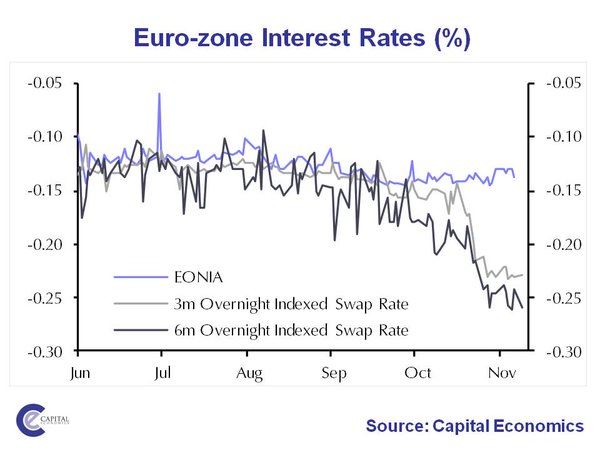

The markets are now pricing in a 10 basis points cut in the Eurozone's overnight rate (in addition to the QE expansion). Anything less could result in a nasty volatility spike.

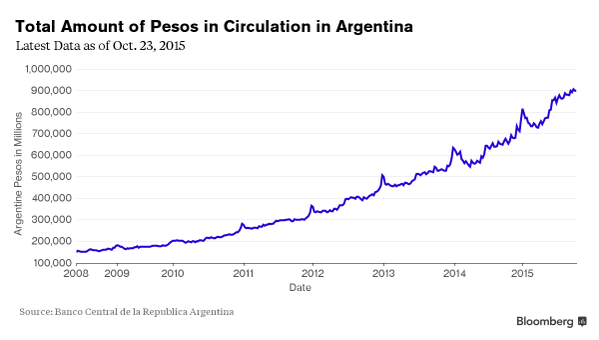

In emerging markets we see Argentina rapidly "printing" money, while maintaining tight control over the exchange rates. This is not going to end well.

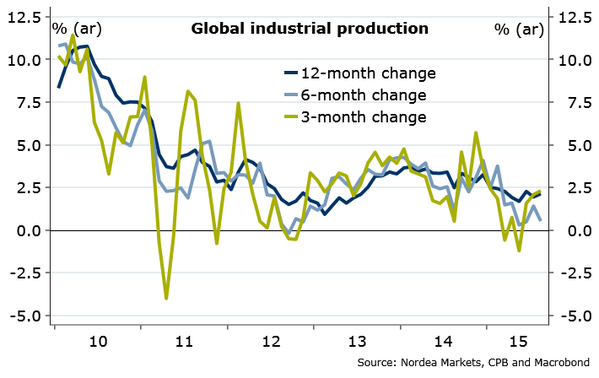

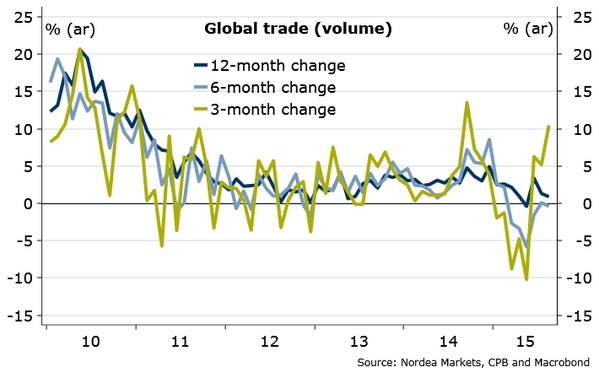

Globally some analysts are thinking that the worst of the deflationary environment is behind us. Folks from Nordea are suggesting that global industrial production has stabilized (albeit at a lower level) and global trade is starting to recover.

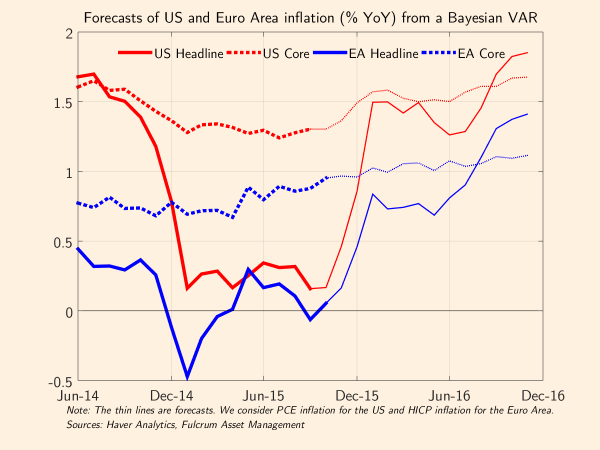

Speaking of easing deflationary pressures, with energy/commodity prices stabilizing (even at these low levels), forecasters are calling for inflation rates to turn sharply higher next year.

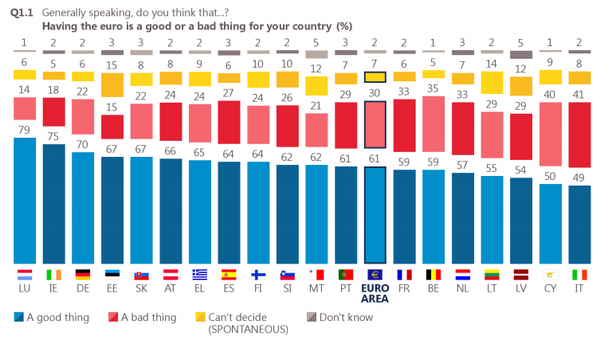

Turning to Food for Thought, in spite of all the political and market turmoil, folks in the Eurozone still love their euros.

Disclosure: Originally published at Saxo Bank TradingFloor.com