- Chinese consumer demand shows signs of life

- Forecasts continue to call for mainland industrial decline

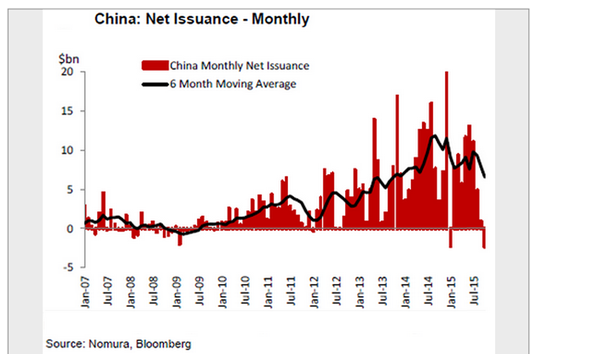

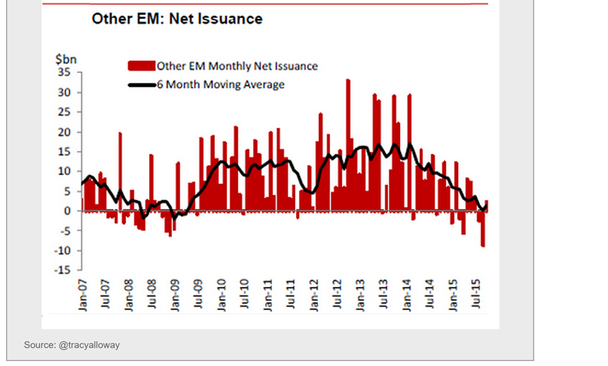

- Emerging market bond issuance at record lows

We begin with China, where indicators point to weakening industrial and construction activity. However we may also be seeing a potential improvement in consumer demand.

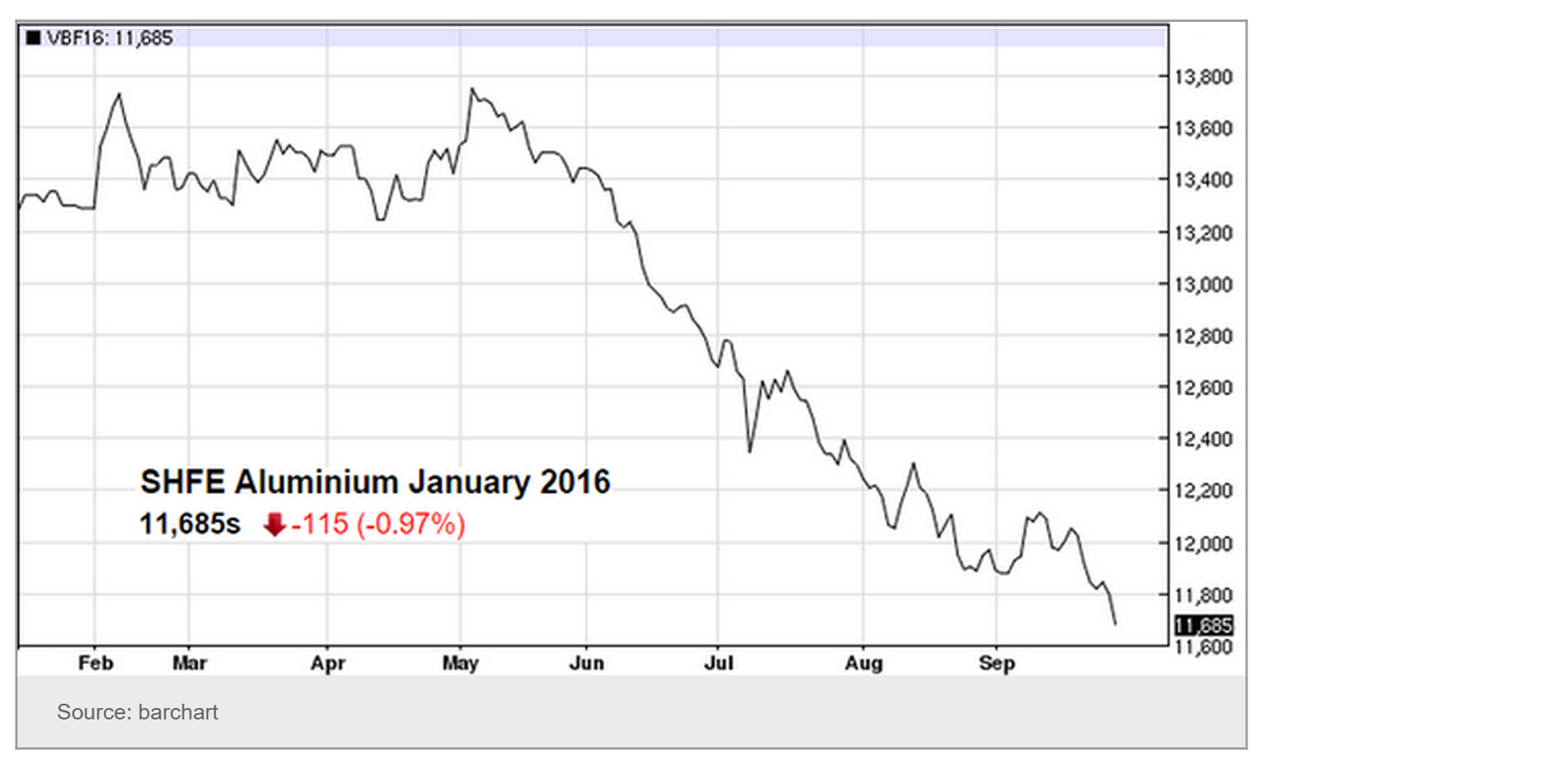

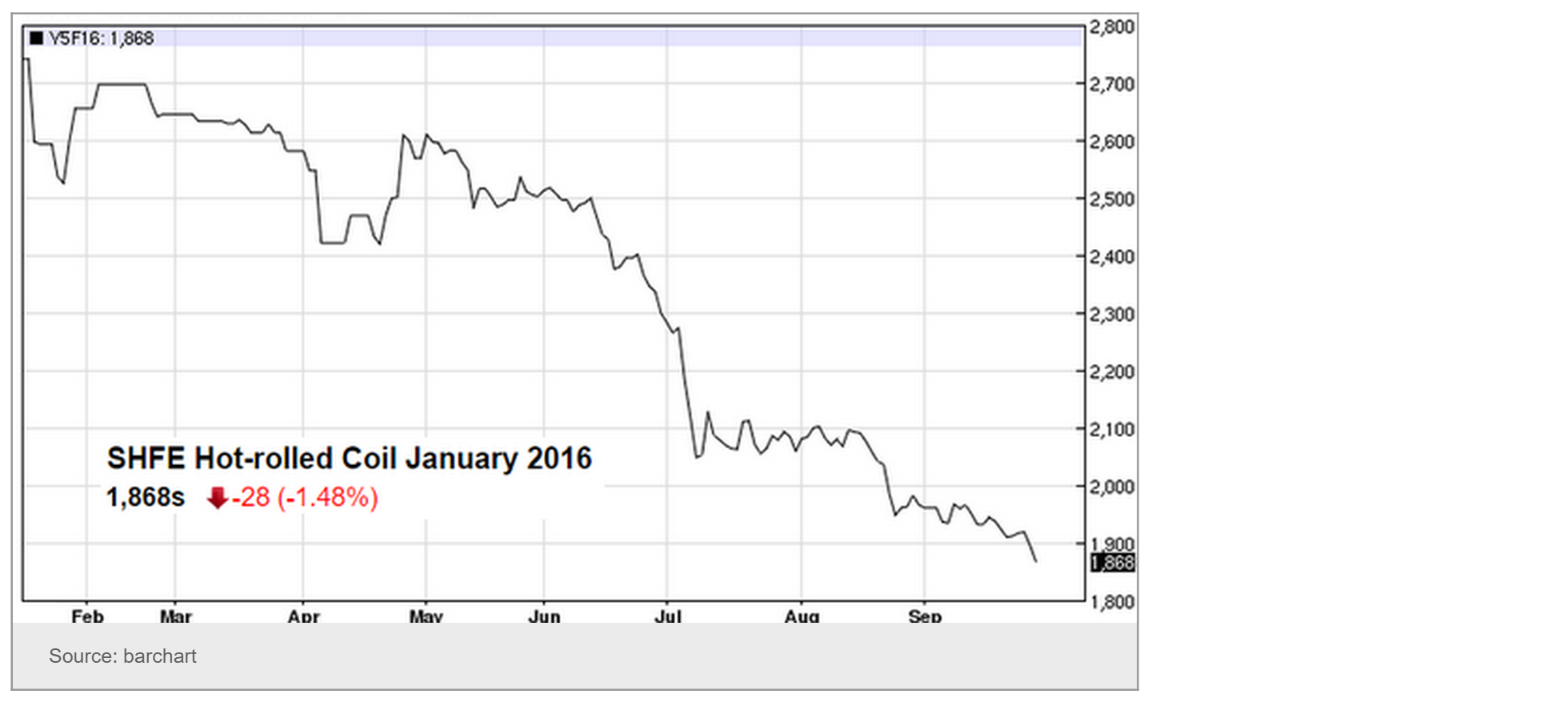

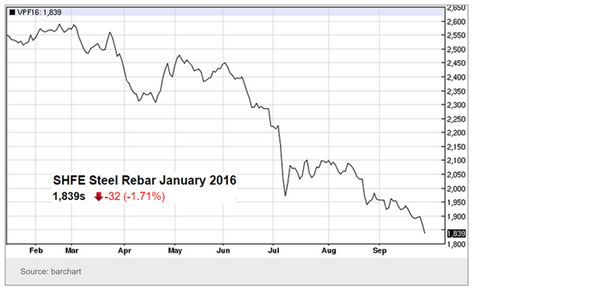

The aluminum, steel rebar, and steel coil January futures on the Shanghai Futures Exchange are hitting multi-year lows, showing diminishing confidence in next year's industrial/construction demand.

Moreover, China's industrial profits are under pressure.

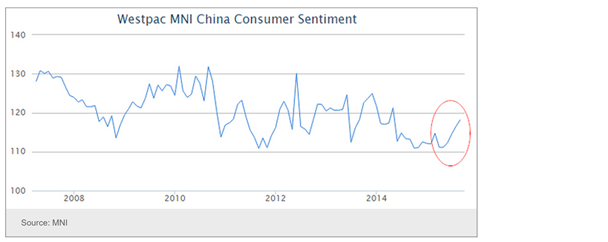

On the other hand, consumer sentiment continues to improve in spite of the recent stock market rout. We saw some signs of that in Nike's (NYSE:NKE) profit report recently. It's unlikely that consumer demand will offset the slowdown in manufacturing and construction, but together with fiscal stimulus it should keep the economy from a "hard landing".

Now let's look at a few developments in other emerging markets:

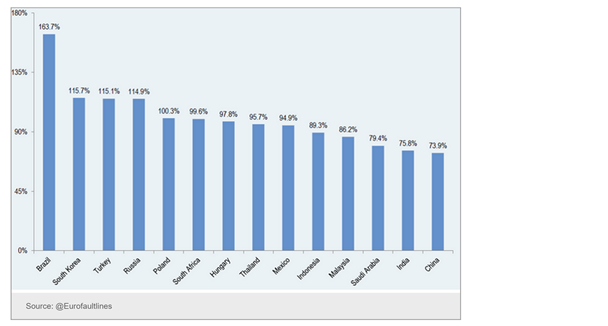

1. Here we have the loan-to-deposit ratio for EM banking systems. Brazil stands out, with banks there using more debt (rather than deposits) to finance their assets.

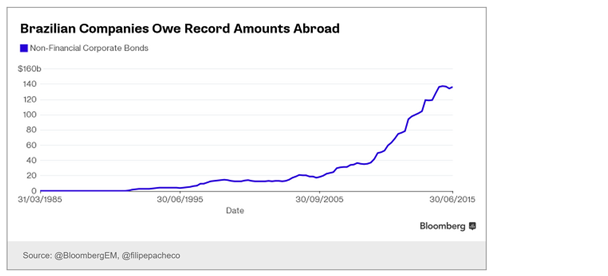

2. Brazil's corporate foreign currency borrowing in recent years is going to be extraordinarily painful going forward due to the real depreciation, especially for firms with revenues in reals.

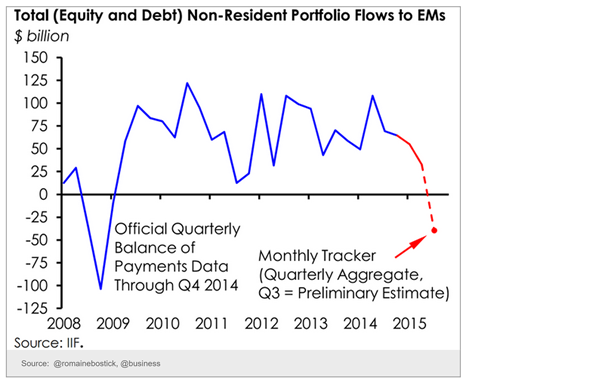

3. Q3 saw tremendous outflows from emerging markets – both bonds and stocks.

4. Bond issuance in emerging markets is now at the lowest level in years.

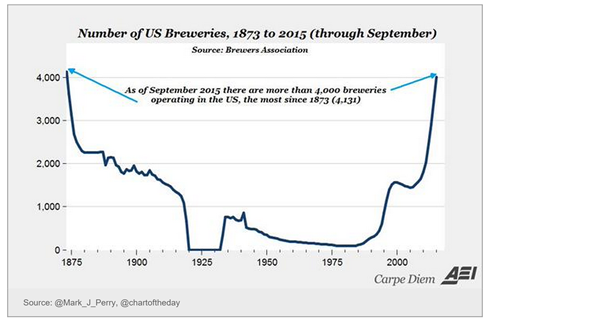

Turning to Food for Thought, below is the latest count of US breweries, with data going back to 1873.

Disclosure: Originally published at Saxo Bank TradingFloor.com