Investing.com’s stocks of the week

Let's start with China where we continue to see more evidence of economic deceleration:

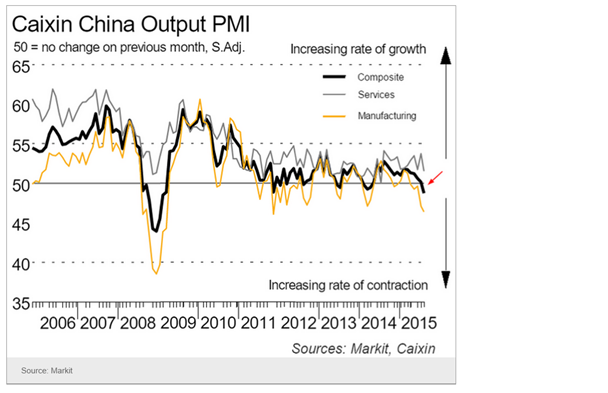

1. China's overall (composite) output entered contraction mode, dragged down by a sharp slowdown in the manufacturing sector.

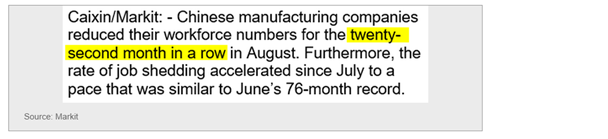

2. Factory layoffs have been a particularly troublesome and persistent trend. This could further worsen social tensions in China as the number of protests/strikes increases.

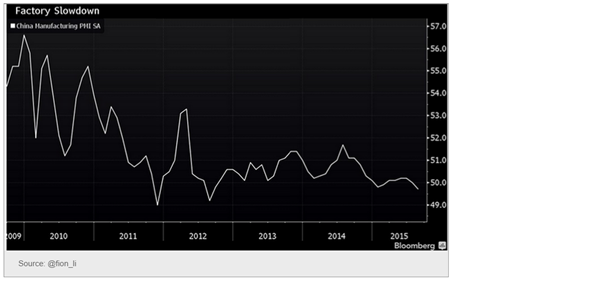

3. The official manufacturing PMI (chart below) declined to a three-year low and now shows contraction (PMI < 50). This supports the data above.

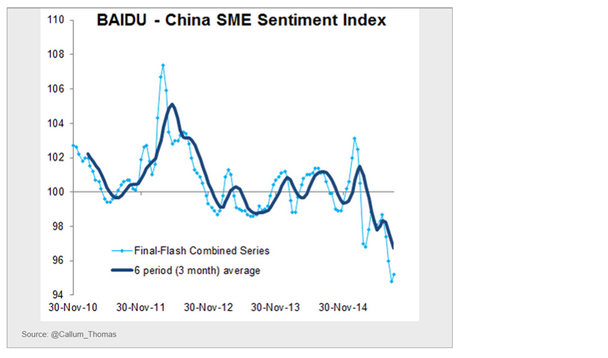

4. The Baidu SME sentiment index shows the nation's smaller firms remain under pressure.

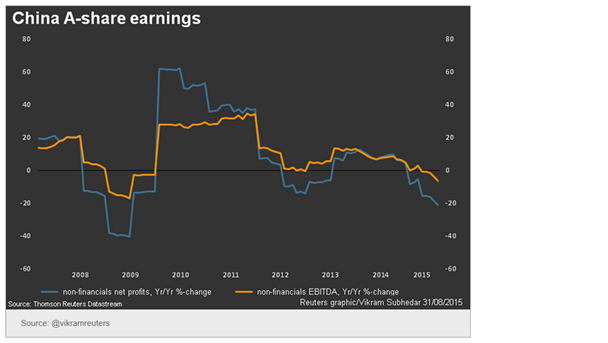

5. Public firms' earnings are declining again (profits and EBITDA shown).

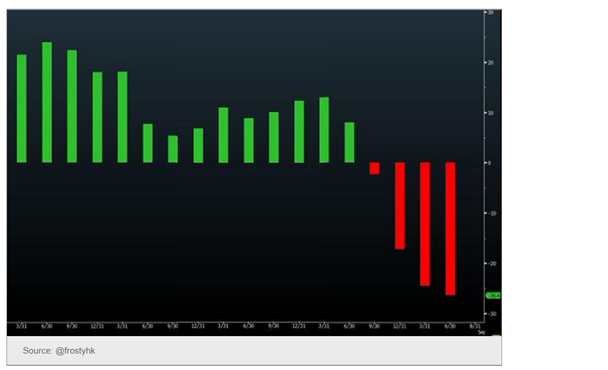

6. Macau's GDP declined by 26% in a single quarter on the latest slowdown in gambling revenues.

7. The government is realising it botched the latest stock market bailout as the public loses confidence. Instead of buying more shares, the government has supposedly set out to find scapegoats to take the blame for the selloff.

8. To make matters worse, there was another chemical facility explosion late Monday. While the direct impact of such events on the overall economy is minimal, it's the diminished confidence in the authorities that could become an issue.

Finally, S&P 500 futures are sharply lower in after-hours trading on China concerns.

Disclosure: Originally published at Saxo Bank TradingFloor.com