Investing.com’s stocks of the week

Bonds around the world again came under pressure on Tuesday. Here are the yields for the 30-Year treasury as well as the French and the German 10-year government bonds.

Bond prices stabilised later in the day but traders remain jittery. By the way, for those piling into the short Bund trade, consider the fact that the European Central Bank is only getting started.

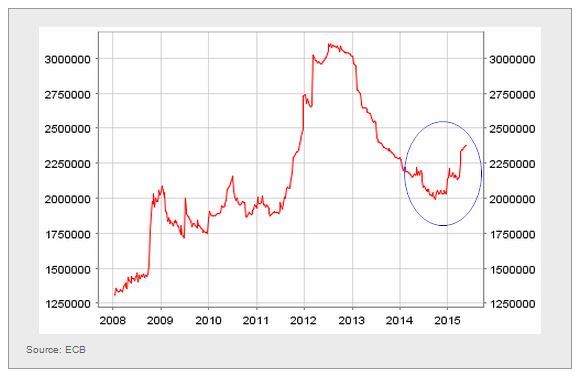

Here is the Eurosystem consolidated balance sheet:

The US dollar continues to drift lower on expectations of a delayed rate hike in the US.

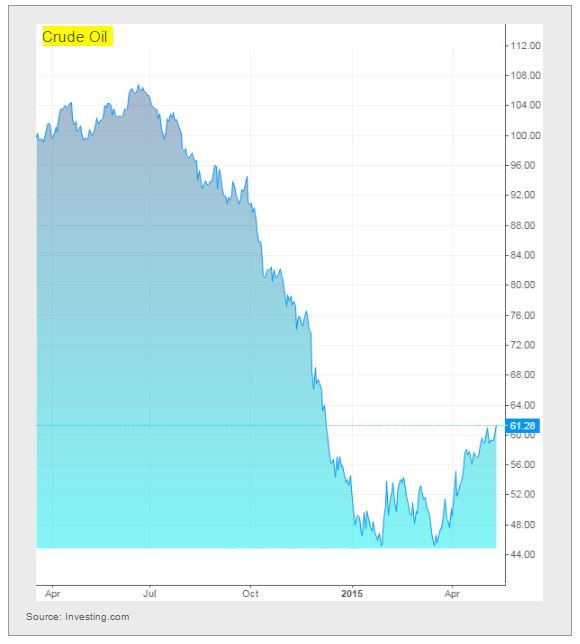

The weaker dollar and a minor 2015 demand increase in OPEC's latest projections sent crude oil higher, with WTI nearby futures trading above $61/bbl (chart below). Some are suggesting that the rise in global yields is linked to this rise in crude - as deflationary fears subside.

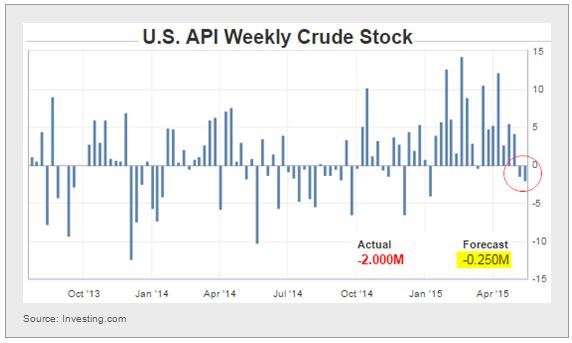

Another data point supporting crude prices was a bigger than expected draw from US crude inventories last week.

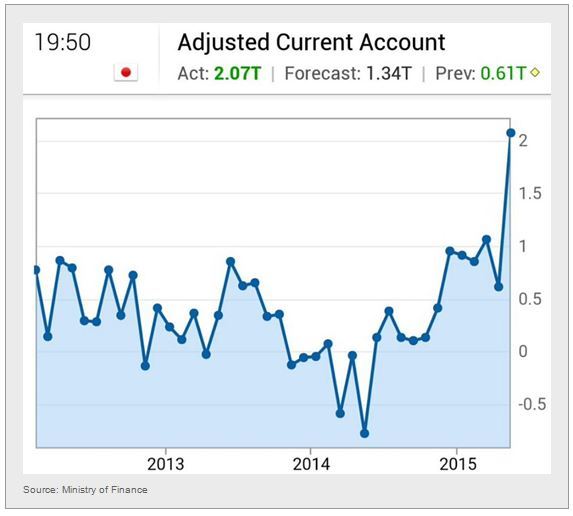

Switching to Asia, Japan's current account surplus beat expectations by a significant margin. The yen weakness is beginning to pay off.

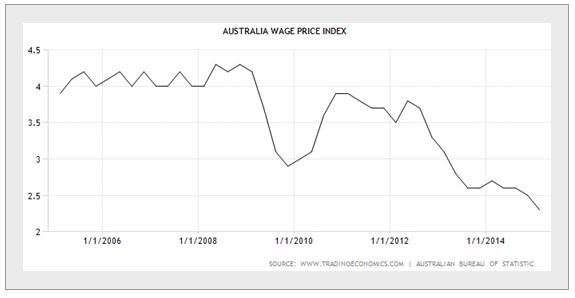

Australia's wage growth hit a new low (driven by export sector weakness), giving the Reserve Bank of Australia more flexibility.

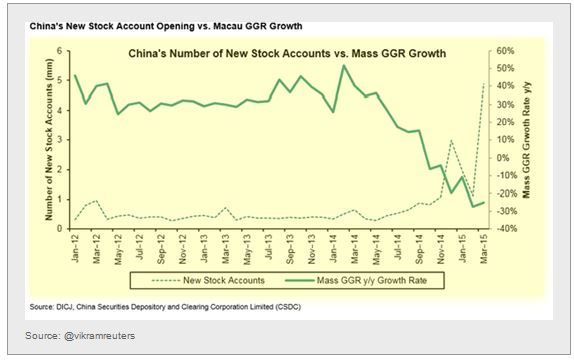

As I discussed before, China's appetite for gambling hasn't gone away with the Macau slowdown. It shifted into the stock market.

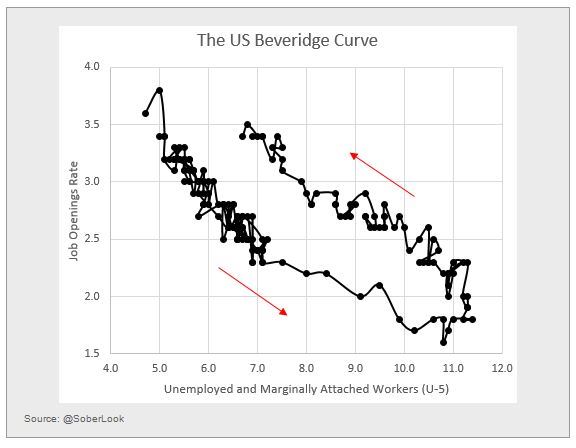

In the United States we continue to have the Beveridge Curve dislocation driven by the skills gap. The housing bubble used to absorb a great deal of low-skill labour - which does not meat the requirements for current job openings.

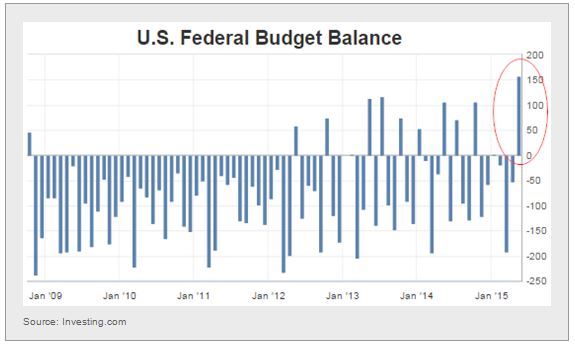

The US posted the biggest monthly budget surplus in seven years. Is this an indication of stronger growth?

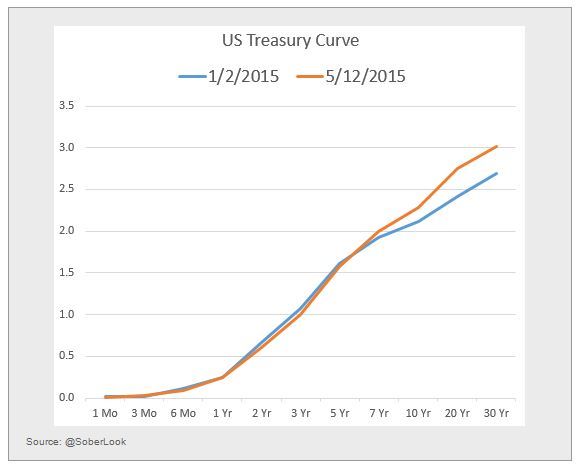

The treasury curve has steepened since the beginning of the year - with the longer dated maturities most impacted.

US banking shares have been outperforming materially as a result of the steeper yield curve.

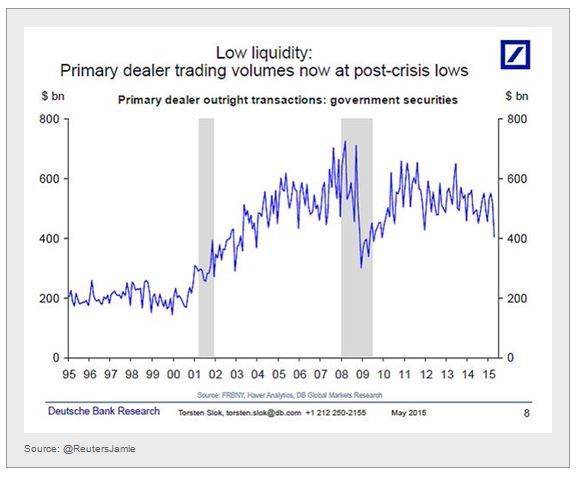

It seems that liquidity in treasuries declined materially this year. Will this trend continue?

Disclosure: Originally published at Saxo Bank TradingFloor.com