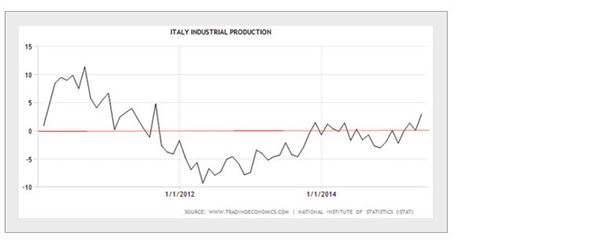

Outside of Greece, the Eurozone continues to show signs of economic recovery. Italy is now pulling out of its recession. The area's economy desperately needs to put the Greek crisis behind it.

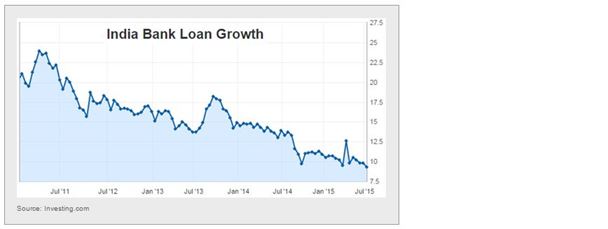

Leaving Europe for now, we see credit growth in India moderating. The banking system in India is in need of reform in order to support the brisk economic growth the nation is targeting. Further rate cuts from the RBI are likely.

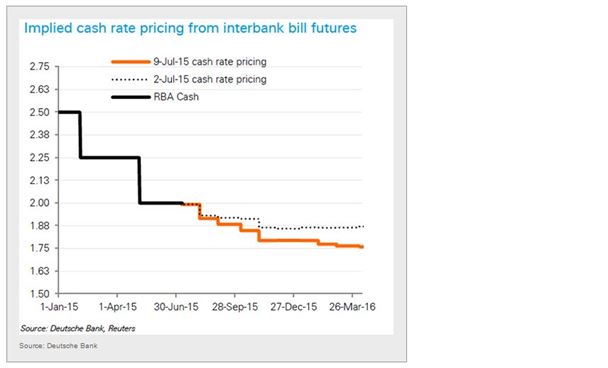

Turning to Australia, the markets now expect almost a full rate cut by early next year, taking the nation deeper into record-low interest rates.

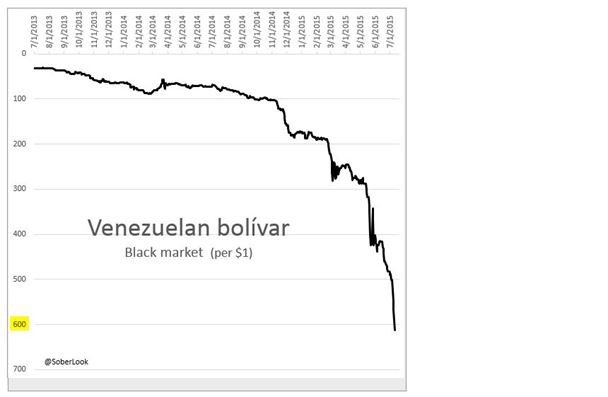

Now to Venezuela, where we see the bolívar continuing to collapse in the "unofficial" markets. One dollar now costs over 600 bolívares. Inflation measures are no longer meaningful (and not published any more), while food shortages are becoming acute.

Moreover, trade for this import-dependent nation is becoming more difficult as the viability of the nation's credit comes into question. Greece should be paying attention.

Back in the United States we have a number of developments I'd like to cover.

Deutsche Bank (XETRA:DBKGn) believes that the Fed's "liftoff" will not take place until next year.

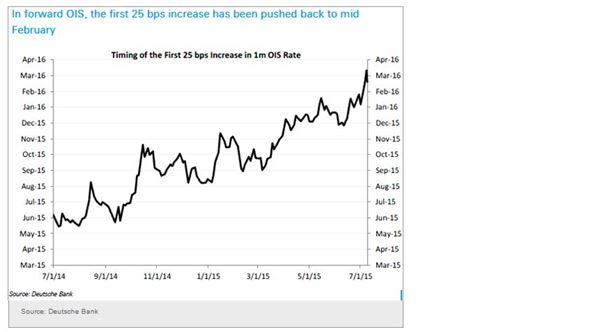

Here is the latest projection of timing to get to the full 25 basis points based on the overnight index swap curve (similar to Fed Funds futures).

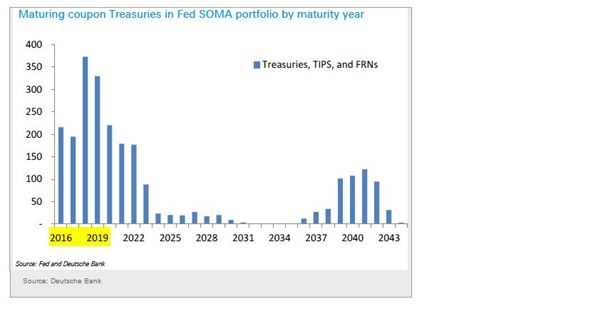

The Fed's approach to reinvestment of maturing treasuries will be a major component of the rate normalisation process. The Fed's decision on this topic will be perhaps just as important as the rate decision.

Should the Fed's balance sheet begin to naturally shrink or will it remain the same for longer?

Moreover, will the Fed buy longer dated treasuries to replace the maturing ones, creating what amounts to a mini-Operation Twist?

Given how dovish the Fed has been, maturing treasuries will likely be all replaced for now – although by short-term notes.

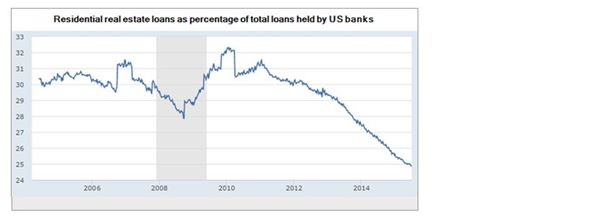

Speaking of the US economy, here is an important trend I'd like to point out. Below is the amount of residential real estate loans as percentage of total loans held by US banks. Mortgage lending continues to lag other credit growth.

Now some food for thought...

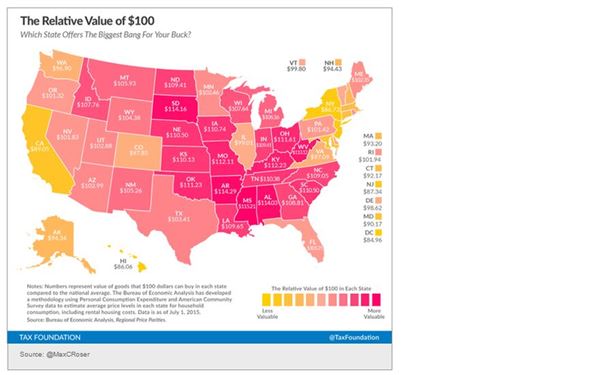

How far does $100 go in each state (relative to the national average)? Higher numbers indicate you can get more for your money. Buying power in NY is especially low, weighted down by NYC.

Disclosure: Originally published at Saxo Bank TradingFloor.com