Investing.com’s stocks of the week

Once again we begin with the Eurozone which seems to be the epicenter of global market volatility. One report in particular sent shock waves through the fixed income markets.

Yesterday I talked about the end of deflation in the Eurozone as German CPI rose sharply in recent months into positive territory. Also last week we had evidence that Spain is about to exit its deflationary period.

Now we have inflation data from the euro area as a whole - and it was stronger than consensus.

In particular the "core" CPI (excluding food and energy) jumped 0.9% (year-on-year). While this is still quite low, the deflation thesis that resulted in the European Central Bank's quantitative easing and the unprecedented yield compression can be called into question.

Bunds sold off sharply and Treasuries followed. Here are the 10-year Bund and Treasury futures contracts:

Spanish, Italian longer-dated bond yields jumped to the highest levels since November.

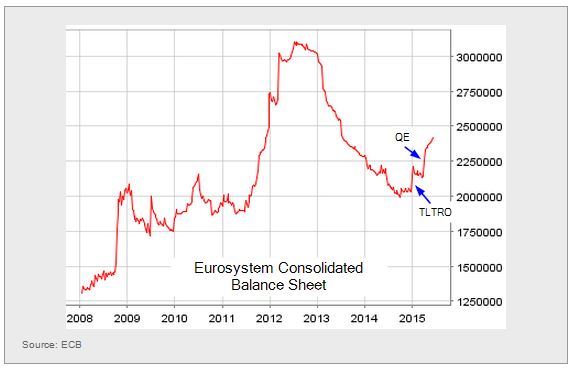

Are we looking at another global bond rout? Are investors becoming concerned that the ECB could terminate the bond buying programme earlier than projected? Is EUR3 trillion+ still the target for the central bank's balance sheet?

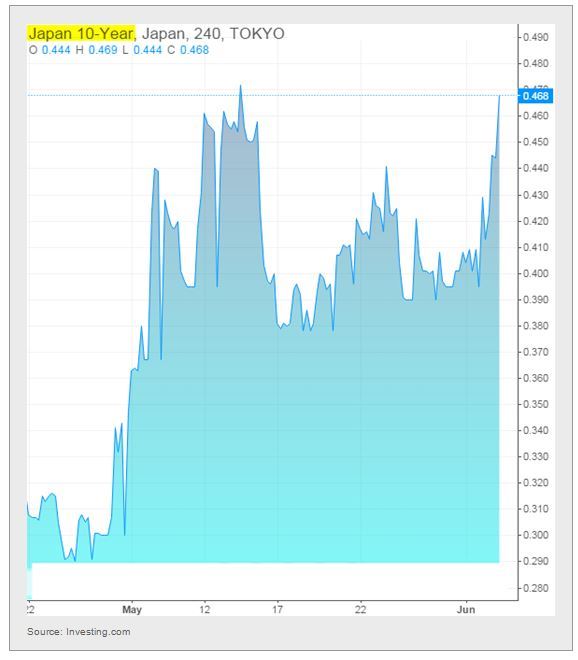

What I find particularly unusual about these moves in government bonds is the magnitude of intraday volatility and the strong correlation across global markets. Here, for example, is the 10-year JGB yield. Clearly, Japan has little to do with inflation measures in the Eurozone. Or maybe it does?

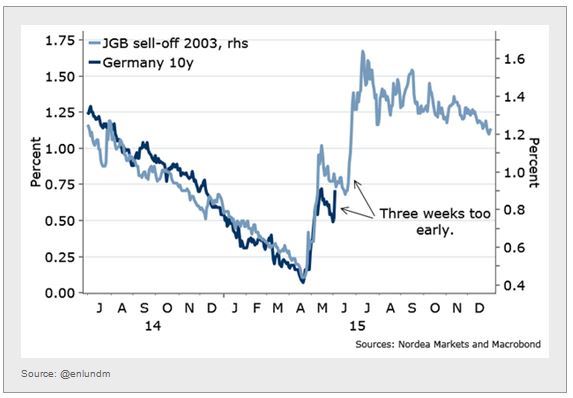

By the way, the pattern of current Bund yields remains eerily similar to JGB yields in 2003 when JGBs sold off sharply.

The euro jumped some 2% on the CPI report. With speculative accounts still very short the euro, short-covering ensued.

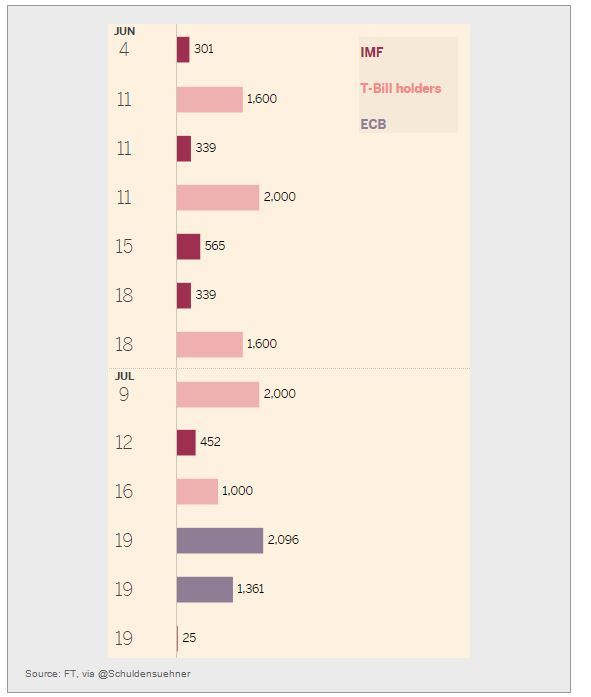

The euro was also helped by the intensifying efforts to address the Greek situation. It seems unlikely that a deal will be struck in time for the payments due to the IMF. The Greek government will therefor "bunch" the payments together to pay them in one shot later in the month - which is allowed under the credit agreement.

Greece will also force its banking system to roll the maturing T-bills. Here is the full liability calendar for the next two months.

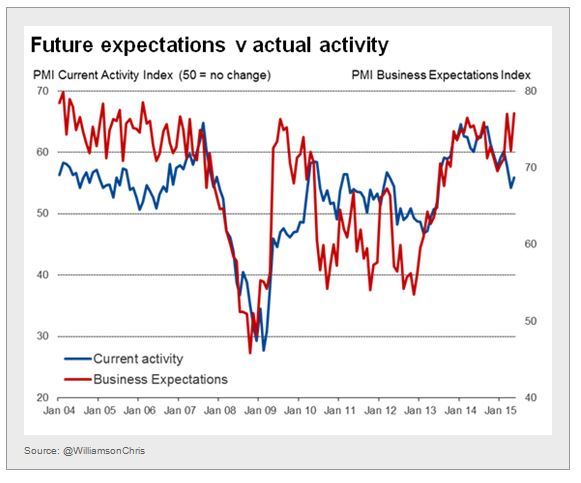

In the UK, as the election related uncertainty passes, construction activity may start accelerating again.

Similarly, mortgage approvals beat consensus. Is the housing boom about to take off once more?

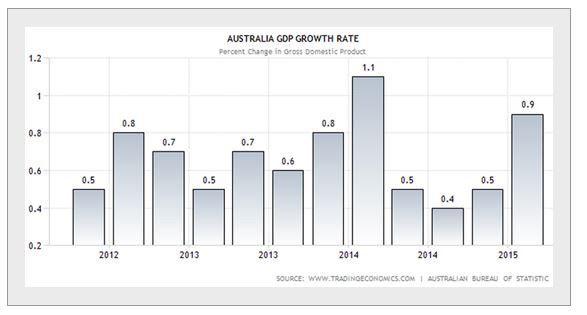

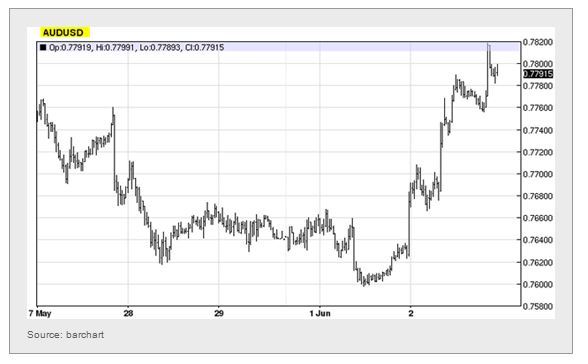

The Australian GDP came in stronger than expected (0.9% vs. 0.7% consensus). It's interesting to see the Australian dollar rally sharply prior to the release. Either this is in sympathy with the euro or someone is a very good Australia GDP estimator. Hopefully the numbers weren't leaked.

Not surprisingly, Australian government yields rose sharply.

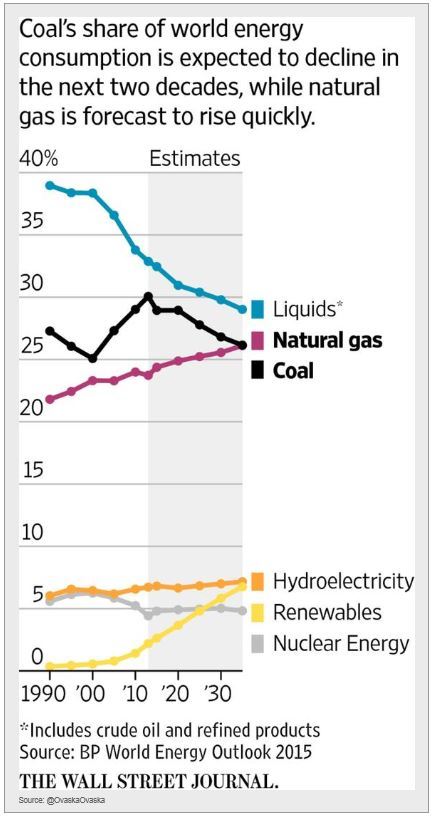

Finally some food for thought...natural gas vs. coal - a global phenomenon.

Disclosure: Originally published at Saxo Bank TradingFloor.com