We begin with the Federal Open Market Committee announcement that took the markets by surprise. The initial focus was on the fact that the FOMC dropped the sentence "can be patient in beginning to normalise...", but it quickly shifted to an added phrase in the statement: "export growth has weakened".

This means that the Fed is indeed uneasy with the dollar strength that has been creating headwinds for manufacturing and may proceed with caution.

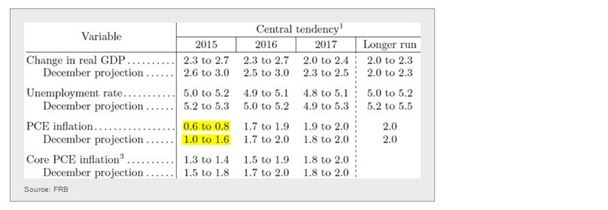

Furthermore, the forecasts for GDP growth and inflation have been lowered materially. In fact the FOMC does not expect the PCE inflation to hit the 2% target until 2017. The projections shown below are compared to what the FOMC had in December.

Treasury markets experienced a large move – the five-year yield shown below. One can see the markets first viewing the statement as hawkish and then realizing that the FOMC has actually shifted to a more dovish stance.

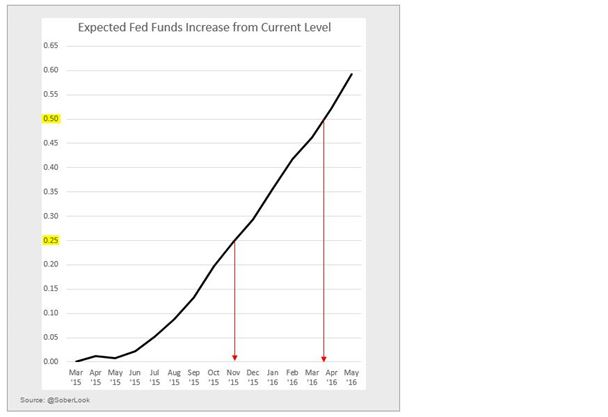

The first Fed hike expectations have shifted to middle of Q4'15, while the second to the end of Q1'16.

*********

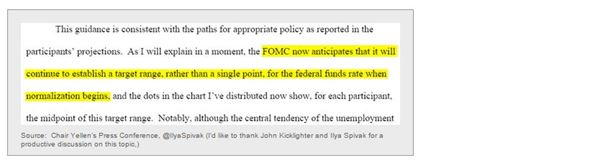

As a technical note, the Fed is not expected to set a target Fed Funds rate but instead to shift the range from 0-25 basis points to 25-50bp when it does hike rates.

*********

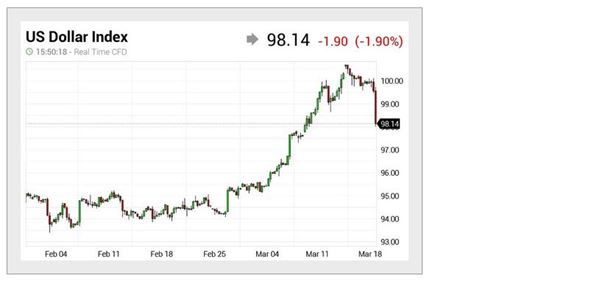

The dollar declined sharply in reaction to this statement from the FOMC (it was one of the largest intraday moves I've seen in a while). Speculative accounts are very long the dollar and such violent corrections could occur again.

*********

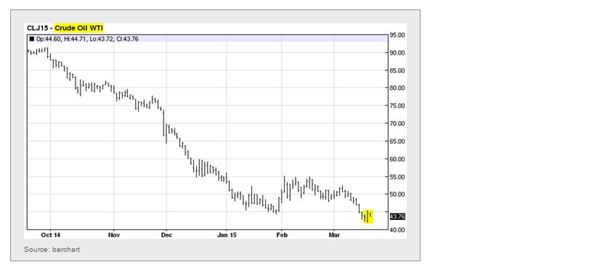

The reaction in the oil markets to this dollar decline was quite muted. April WTI contract is still below $44/barrel.

*********

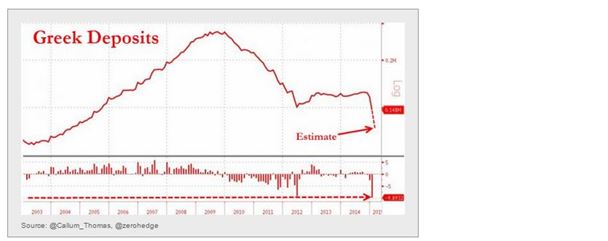

As the markets push the risks of the first Fed hike further out in time, attention turns to Greece. With tons of rhetoric and not much to show for on a potential compromise, the situation remains fluid. The Greek banking system is in trouble as deposits continue to flee.

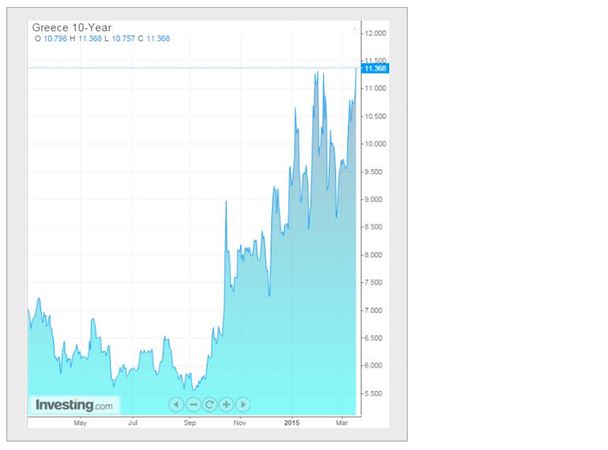

Greek government bond yields have jumped, with the Greek 10-Year yield above 11% again.

And Greek sovereign CDS rose above recent highs as well. While the Eurozone is known for coming up with last minute solutions as it faces each crisis, this one feels different. The parties are just too far apart. And as I discussed before, a Grexit and the loss of confidence it will generate could be devastating for the area's nascent economic recovery.

*********

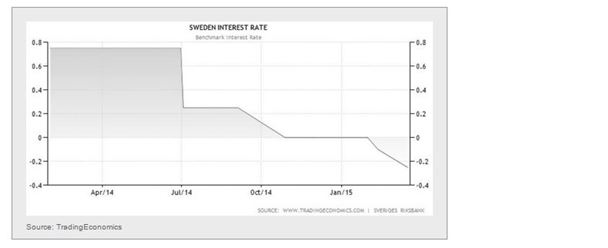

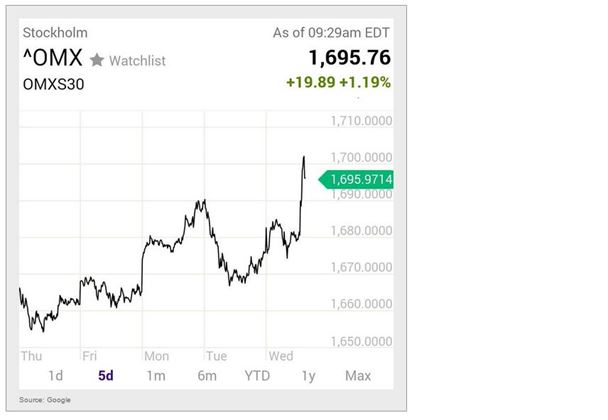

Elsewhere in Europe, Sweden's central bank cut rates deeper into negative territory as it fights deflation. The concept of Zero Nominal Lower Bound does not seem to be a problem these days.

Sweden stock market cheered.

*********

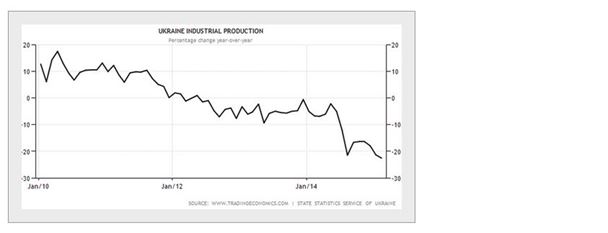

Finally, the situation in Ukraine is turning from bad to worse. Industrial production is collapsing and the help from the International Monetary Fund will be too little too late.

*********

Now some food for thought – two items:

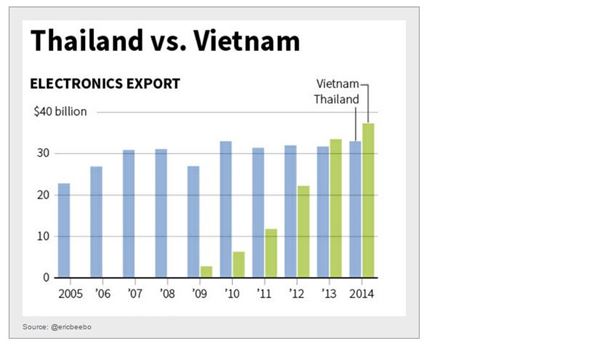

1. Vietnam is becoming one of the next destinations of choice for cheap electronics manufacturing as it overtakes Thailand.

2. Nations where people drive on left side of the road: blue, on right side of the road: red