The U.S. Dollar weakened against most of the majors, including the Yen, after Japan’s Economy Minister, Akira Amari, stated that further declines in the currency could have a negative impact on the country’s economy. Demand for the greenback remained low after Friday’s economic reports indicated that Consumer Sentiment surged, increasing speculation that the Federal Reserve may begin to scale back on its monthly asset purchases. Federal Reserve Chairman Ben Bernanke is set to issue a statement this week. Anticipation over the announcement also contributed to the weakening of the Dollar even though trade volume was subdued as many European investors were off for the Whit Monday Holiday. Analysts predict this will be a nail-biting week in the foreign currency exchange, especially as Fed Chairman Bernanke is expected to drop some clues on whether the central bank is ready to cut back on the current asset purchasing program. Meanwhile, gold prices rose during the U.S. trading session after the Japanese Economy Minister warned about the effects a weak Yen could have on the country’s economy. Mr. Amari’s comments bolstered demand for the Yen which came about at the greenback’s expense, thereby causing the value of gold to rise even as there were few economic reports to sway the markets.

The week started out slow for the Euro, especially as most traders sat on the sidelines due to Whit Holiday. Most of the action was brought on by comments from Japanese Economy Minister Amari who suggested that further depreciation of the Yen could negatively impact people’s lives. Reports indicated that Moody’s Investment Services is maintaining Italy’s credit rating one notch above that of Spain’s. Officials explained that this was due to the fact that Italy’s public finances were somewhat stronger than in the recent past. The British Pound, on the other hand, rebounded after having traded at a six-week low against the U.S. Dollar after official releases indicated that Home Prices in the U.K. reached a record high, sparking optimism that the nation’s economy was on the path to recovery. The Sterling lost some of its momentum and moved in tandem with the EUR/USD after the Bank of England’s Governor, Mervyn King, suggested that “more needs to be done” for the economy to expand.

The Yen took center stage at the start of the week, as it climbed the most in three weeks after having traded at the lowest rate since 2008 versus the U.S. Dollar. The Japanese monetary unit advanced on comments by Economy Minister Amari in which he emphasized the effects a weak Yen could have on the economy and went on to say that it could have a negative impact on people’s lives. The Yen rallied versus all of its counterparts as Mr. Amari reiterated that market investors believe any strength the currency shows was perhaps the result of a number of corrections.

Lastly in the South Pacific, the Australian and New Zealand Dollars rose for the first time in three days versus their U.S. peer as technical indicators pointed to the possibility that the two currencies may have been oversold.

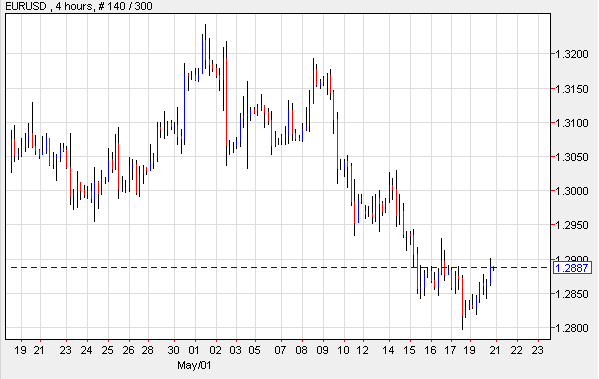

EUR/USD- Euro Bolstered By Currency Concerns

The Euro climbed against the U.S. Dollar after the Economy Minister of Japan, Akira Amari expressed concerns over the possibility that a weaker Yen could hurt the nation’s economy. His comments weighed on the greenback and this prompted other risk currencies to trade higher. On the data front, polls showed that the Italian people are losing confidence in their government and the approval rating dipped from 43 to 34 percent. The economic calendar was extremely light due to the Whit Monday Holiday. Today, Germany will issue the Producer Price Index which is considered a major inflation indicator. EUR/USD" title="EUR/USD" width="600" height="379">

EUR/USD" title="EUR/USD" width="600" height="379">

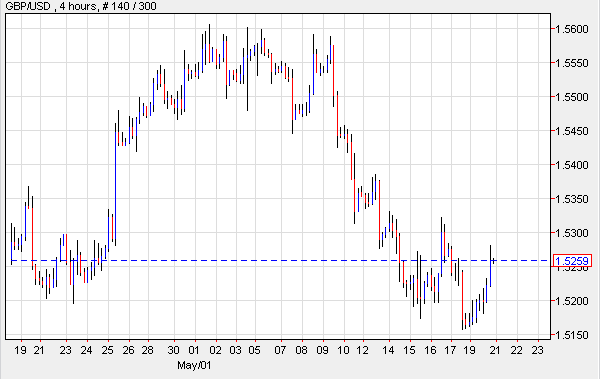

GBP/USD- Pound Rebounds From Previous Lows

The British Pound regained its footing after it traded at six-week lows versus the U.S. Dollar. The increase was brought on by economic reports which showed that sellers raised their home prices, boosting optimism the economy is improving. According to industry data, Home Prices climbed 2.1 percent this month to an average 249,841 Pounds, which means that the prices have risen 9.1 percent in the initial five months of 2013. Meanwhile, traders look forward to a release which they anticipate will reveal a decline in Consumer Price Inflation. The Sterling extended gains versus the greenback after the Bank of England’s Governor, Mervyn King said that the economy is experiencing “modest recovery;” but it dipped later as he remarked that much still needs to be done for true recovery to take place. GBP/USD" title="GBP/USD" width="600" height="379">

GBP/USD" title="GBP/USD" width="600" height="379">

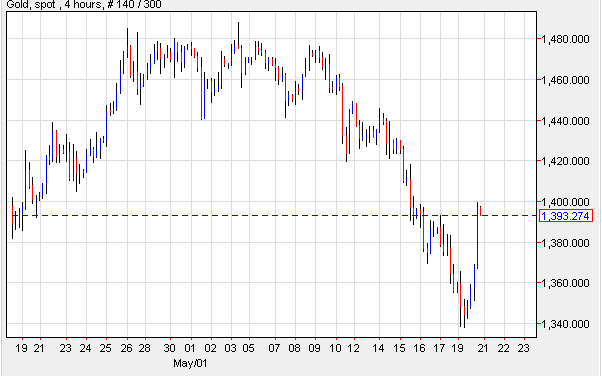

XAU/USD- Gold Gains On Moody’s Comments

Gold prices went up after Moody’s Investors Service warned U.S. lawmakers to address the debt issues in order to avoid having the nation’s credit rating downgraded this year. This prompted speculators to seek refuge in the precious metal. Gold Futures remained strong as the U.S. Dollar was weakened by comments from Economy Minister, Akira Amari wherein he suggested the Yen’s depreciation may impact Japan’s economy in a negative way. Gold Futures for June delivery advanced 1.4 percent and settled at $1,384.10 a troy ounce on the Comex Division of the New York Mercantile Exchange. According to analysts, Gold Futures were also buoyed by escalating tensions in the Middle East as these also influenced the greenback. XAU/USD" title="XAU/USD" width="602" height="376">

XAU/USD" title="XAU/USD" width="602" height="376">

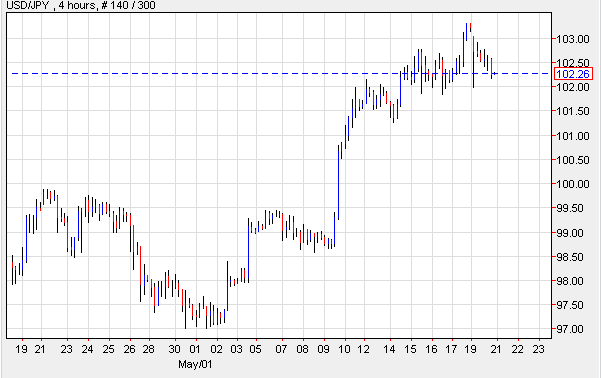

USD/JPY- Yen Climbs Most

The Yen sustained the biggest hike in three weeks versus the U.S. currency as Japanese Economy Minister Amari suggested that further declines in the nation’s monetary unit could dampen economic growth. In Japan, data issued last week indicated that Core Machinery Orders increased; and the main Manufacturing Indicators climbed from 7.5 to 14.2 percent, reaching well above the forecasts. In addition, Gross Domestic Product advanced to a four-month high. All these metrics gave speculators reason to believe “Abenomics” is working well. However, investors will still keep an eye on any announcements due tomorrow, as the Bank of Japan’s policy makers are scheduled to meet, and the greenback has traded beyond 103. USD/JPY" title="USD/JPY" width="601" height="378">

USD/JPY" title="USD/JPY" width="601" height="378">

Today’s Outlook

Today’s economic calendar shows that Japan will report on the All Industries Activity Index and Trade Balance. The Euro region will release data on German PPI. The U.K. will announce CPI, Core CPI, The House Price Index, PPI Input and PPI Output. Lastly, Australia will publish the Westpac Consumer Sentiment.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Daily Report: US Dollar Weakened Against Most Of Majors

Published 05/21/2013, 04:58 AM

Updated 09/16/2019, 09:25 AM

Daily Report: US Dollar Weakened Against Most Of Majors

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.