The U.S. Dollar weakened across the board early in the day after the U.S. Institute for Supply Management Factory Index showed the quickest contraction in four years. And while this factor usually doesn’t affect risk appetite in the market, analysts believe the data is an indication of how the economy is doing, which could influence the Federal Reserve’s monetary policy decisions. According to official figures, Manufacturing activity went from 50.7 to 49.0 in May. Economists believe that if Non-Farm Payrolls disillusion investors on Friday, the central bank may leave stimulus unchanged. Meanwhile, Gold Prices rallied after the U.S. Factory gauge disappointed investors as it reignited concerns the Federal Reserve may take more time to cut back on monthly asset purchases.

In the Euro region, economic releases showed that Manufacturing PMI improved, prompting the President of the European Central Bank, Mario Draghi, to suggest it may be a sign of “possible stabilization.” On Sunday, Mr. Draghi indicated that policy makers expect the E.U. to show “gradual recovery” in the latter part of 2013. Meanwhile, the possibility the bank may opt for negative deposit rates remains a reality. The Euro was not affected by the volatility in the Nikkei, which once again traded erratically and dropped 3.7 percent overnight. The British Pound traded at two-week highs versus the greenback following lackluster U.S. economic releases and as the U.K. announced expansion of the Manufacturing PMI. The figures increased speculation that the Bank of England may hold off on increasing its quantitative easing measures.

The Yen strengthened and traded beyond 100 against the U.S. Dollar for the first time in close to one month after the U.S. confirmed that its Manufacturing activity contracted last month, reducing the likelihood the Federal Reserve will cut stimulus. Japan’s monetary unit remained strong as the Bank of Japan indicated that it wouldn’t make changes to the current unprecedented monetary policies. The Yen also rallied versus the Euro and the British Pound while market investors anticipate the release of data on Cash Earnings as it’s closely linked to Consumer Spending.

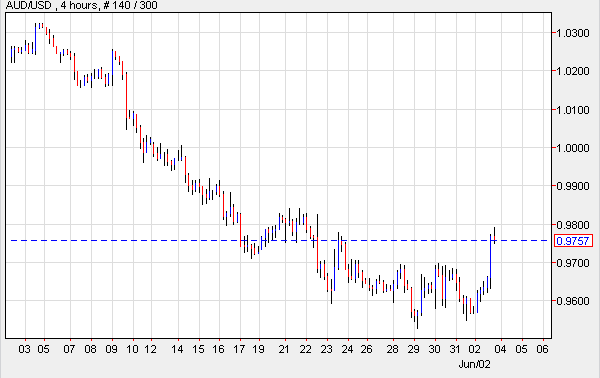

Lastly in the South Pacific, Australia’s Dollar rebounded on signs that China’s economy is picking up momentum, thereby easing worries that demand for Aussie commodities will ebb in Asia’s largest economy. The Aussie rose against all of its peers after Chinese data showed that Manufacturing advanced while the Yuan’s decline happened too fast. New Zealand’s Dollar also traded higher versus the greenback after China issued solid Manufacturing PMI data. However, its advance was limited when earlier in the day China indicated that its HSBC Manufacturing PMI slipped from 49.6 in April to 49.2 in May.

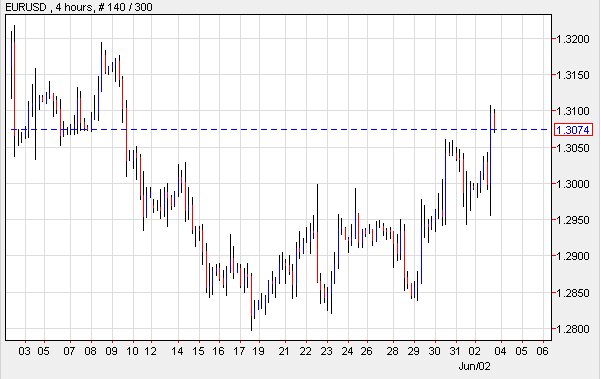

EUR/USD- Euro Rallies On U.S. Output

The Euro advanced against the greenback after the U.S. announced the contraction of its Factory gauge for the first time in six months. In the Euro region, metrics issued by Markit Economics confirmed that PMI went from 47.8 to 48.3 in May, suggesting that the drop in Manufacturing is easing. In addition, Germany reported that PMI was revised to 49.4 last month, surpassing prior forecasts. Today, Spain is scheduled to release Employment figures. EUR/USD" title="EUR/USD" width="601" height="379">

EUR/USD" title="EUR/USD" width="601" height="379">

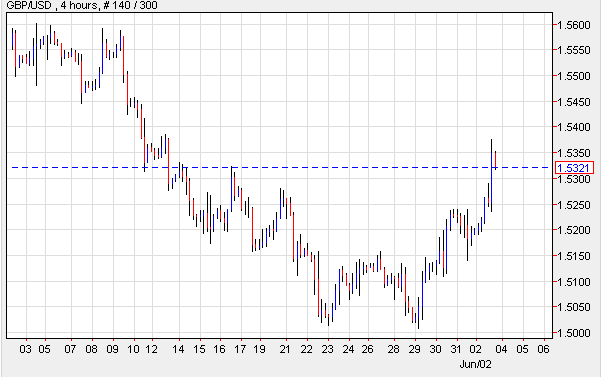

GBP/USD- U.K. PMI Expands

The British Pound reached the highest price in three weeks against the greenback on reports which indicated that Manufacturing in the U.K. expanded more than predicted. According to the Chartered Institute of Purchasing and Supply, Manufacturing advanced from a revised 50.2 in April to 51.3 last month. This reignited speculation the Bank of England will leave the asset purchases at 375 billion Pounds, and policy makers will maintain the current benchmark interest rate which sits at a record 0.5 percent. GBP/USD" title="GBP/USD" width="602" height="377">

GBP/USD" title="GBP/USD" width="602" height="377">

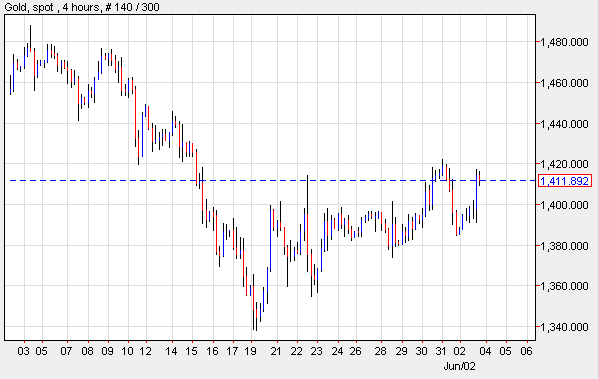

XAU/USD- Gold Rallies On Weak Data

Gold prices surged at the start of the week after the U.S. Institute for Supply Management indicated that Manufacturing Purchasing Manager’s Index dropped from 50.7 9 in April to 49.0 in May. Gold Futures for August delivery increased 1.37 percent and settled at $1,412.15 a troy ounce after reaching a session low of $1,388.55. XAU/USD" title="XAU/USD" width="599" height="379">

XAU/USD" title="XAU/USD" width="599" height="379">

AUD/USD- Aussie Gains On Chinese Data

Australia’s Dollar climbed against its U.S. peer after China released official data which showed that its Manufacturing Purchasing Manager’s Index increased from 50.6 in April to 50.8 in May. The Aussie’s rally was somewhat limited as Monday’s reports indicated that China’s Final HSBC Flash Purchasing Manager’s Index dipped to 49.2 in May after it posted at 49.6. In Australia, domestic announcements revealed that Retail Sales climbed 0.2 percent in April, which is less than anticipated; and Advertisements for Jobs slipped 2.4 percent last month. The latter releases weighed on the so-called Aussie. AUD/USD" title="AUD/USD" width="600" height="378">

AUD/USD" title="AUD/USD" width="600" height="378">

Today’s Outlook

Today’s economic calendar shows that Australia will issue the Interest Rate Decision, the RBA Statement, and GDP. The U.K. will release Construction PMI. The Euro region will report on PPI. The U.S. will announce the Trade Balance.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Daily Report: US Dollar Weakened Across The Board On Data

Published 06/04/2013, 05:54 AM

Updated 09/16/2019, 09:25 AM

Daily Report: US Dollar Weakened Across The Board On Data

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.