The U.S. Dollar traded mixed over the course of last week and rallied versus the majority of its trading peers Friday on speculation the Federal Reserve may put an early end to the current stimulus program. While reports showed that Durable Goods Orders rose 3.3 percent in April, investors disregarded the positive news while awaiting any signs that the central bank may begin to scale back on the monthly asset purchases. According to the figures, Orders excluding transportation were strong, although shipments declined 1.5 percent, offsetting the buoyancy in the market. For now, analysts expect the Fed will leave monetary easing unchanged for at least three months as they believe that China’s economy is losing momentum which could pose severe risk for global growth. If this turns out to be true, the Fed is expected to leave monetary policy unchanged until the end of the year. Trading will be light today as the U.K. and U.S. markets are closed for a holiday. Meanwhile, Gold Futures dipped slightly on Friday despite the fact that traders turned the most bullish in a month after central bank chairman Ben Bernanke suggested the bank would adhere to the current stimulus program. Gold prices slipped after the Commerce Department indicated that Core Durable Goods went up by a seasonally adjusted 1.3 percent last month, surpassing forecasts for a 0.5 percent hike.

In the Euro region, better than forecast economic data boosted the value of the Euro; however, demand for safe havens benefitted the greenback. Recent E.U. Gross Domestic Product metrics revealed that the recession is still prevalent but the increases in German Business Confidence and Germany PMI eased the pressure on the European Central Bank. In the days to come, investors will pay close attention to an upcoming announcement on German Retail Sales and Unemployment. The British Pound slipped versus the Euro and the U.S. Dollar on speculation the Bank of England may expand quantitative easing, and on the possibility the Federal Reserve may end stimulus early. Demand for the Sterling has dropped on signs the economic recovery may be slowing down given the lackluster data which showed that Retail Sales fell.

In Japan, the Nikkei’s erratic moves made investors very nervous and this prompted the Yen to experience crazy swings. The Yen rallied versus the U.S. Dollar for a second consecutive day making market investors wonder whether the pullback will turn into a reversal. This week, Japan will release a flurry of significant economic reports which will offer insight into Inflation, Unemployment, Industrial Production and Manufacturing activity.

Lastly, in the South Pacific, the Australian and New Zealand Dollars traded at multi-month lows as risk appetite ebbed amidst uncertainty over the Federal Reserve’s next policy actions. The two monetary units failed to rebound even as the greenback erased gains towards the end of the week. The main release over the past few days was China’s HSBC PMI report which bolstered fears about the outlook for the world’s second largest economy.

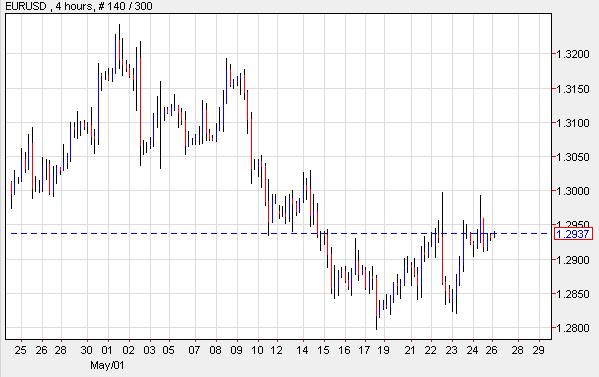

EUR/USD- Euro Finishes Little Changed

The Euro concluded the week practically little changed against the greenback amid speculations the Federal Reserve may scale back stimulus, but it advanced versus the greenback on Sunday throughout the Asian market hours. The 17-nation currency traded at session highs on Friday following the release of Germany’s IFO Index which showed that the Business Climate went from 104.4 to 105.7. Today’s trading volume is expected to be light as the markets in the U.S. and the U.K. are closed due to major holidays. In the coming days, the Euro region will issue reports on Consumer Inflation and Employment. EUR/USD" title="EUR/USD" width="599" height="377">

EUR/USD" title="EUR/USD" width="599" height="377">

GBP/USD- BOE May Consider More Stimulus

The British Pound dipped against the greenback as lackluster Retail Sales metrics increased speculations the Bank of England may opt for additional stimulus to bolster economic growth. The Pound benefitted temporarily from positive data which revealed that the nation’s economy expanded by 0.3 percent in the first three months of the year, and it expanded 0.6 percent from the year before. The British currency remained under pressure amid releases confirming that Inflation slowed more than predicted, another factor that may prompt the central bank to provide further support for the economy. GBP/USD" title="GBP/USD" width="600" height="378">

GBP/USD" title="GBP/USD" width="600" height="378">

USD/JPY-Trade Deficit Extended

The U.S. Dollar dropped sharply versus the Yen after the Federal Reserve’s Chairman suggested the central bank may cut back the monthly $85 billion dollar asset purchases, depending on what future economic data reveals. The Yen rallied versus the greenback on Friday after a release showed that U.S. Durable goods Orders climbed 3.3 percent in April. Last week’s metrics confirmed that Japan’s Trade Deficit extended for a tenth consecutive month as exports climbed 3.8 percent from the year before, but imports advanced 9.4 percent. The Yen continued to move higher versus the U.S. Dollar as the Nikkei fell 7 percent on Thursday, the Index slipped 3 percent and settled at 1 percent at the end of the Tokyo session. These wild movements worried investors and brought on dramatic Yen swings. USD/JPY" title="USD/JPY" width="600" height="378">

USD/JPY" title="USD/JPY" width="600" height="378">

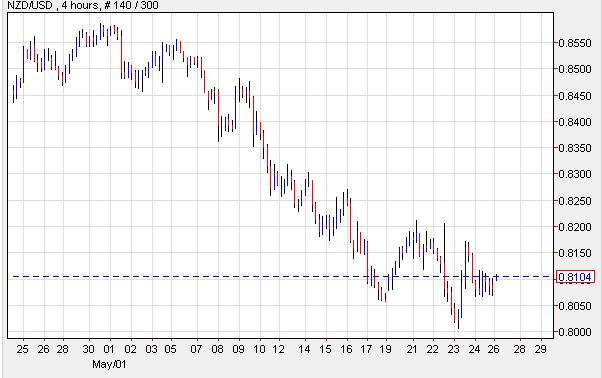

NZD/USD- Nation Posts Trade Surplus

New Zealand’s Dollar traded lower against its U.S. counterpart as investors grew concerned over China’s growth outlook as recent Manufacturing metrics denoted a slowdown in the world’s second biggest economy. According to the HSBC PMI, the Chinese indicator of Industrial Activity revealed a decline from 50.4 to 49.6 which means it entered into contraction territory. This has raised further concerns as China is New Zealand’s main trade partner. In the South Pacific nation, other releases pointed to a Trade Surplus of NZD157 million in April, but the surplus narrowed from NZD718 million in the prior month. NZD/USD" title="NZD/USD" width="602" height="378">

NZD/USD" title="NZD/USD" width="602" height="378">

Today’s Outlook

Today’s economic calendar shows that the U.S. markets are closed in observance of Memorial Day. The U.K. markets are close for a Bank Holiday. There are no economic releases scheduled for the day, but economists anticipate the currencies will continue to respond to speculations about growth and monetary policy.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Daily Report: US Dollar Traded Mixed, Rallied Vs. Trading Peers

Published 05/27/2013, 04:05 AM

Updated 09/16/2019, 09:25 AM

Daily Report: US Dollar Traded Mixed, Rallied Vs. Trading Peers

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.