Yesterday’s subdued trading brought on minor movements in the currency exchange while the U.K. and U.S. markets were closed for holidays. The U.S. Dollar traded lower against the Yen and the Euro and remained range bound versus monetary units from the South Pacific. It advanced higher versus the British Pound and Switzerland’s Franc. Gold Futures edged higher on reports indicating that central banks were purchasing more gold and on signs that demand for the precious metal has increased. Trading volume on the Comex was light as the floor was closed in observance of Memorial Day. Nonetheless, Gold prices inched higher after the International Monetary Fund revealed that Russia and Kazakhstan purchased gold to add to their reserves.

The Euro advanced versus the U.S. Dollar, but its movements were small given the fact that two major markets were closed for holidays. The shared currency remained under pressure as speculators traded cautiously amid concerns the Federal Reserve may scale back its monthly asset purchases should Consumer Confidence post an increase. The Euro benefitted from comments issued by one of the European Central Bank’s Board member, Joerg Asmussen, who suggested that the central bank ought to tread lightly when it comes to reducing the deposit rate beneath zero while adding that “monetary policy” wasn’t the main focal point of economic policy. Britain’s Pound declined against the greenback despite positive releases which confirmed that House Prices climbed at the quickest pace in over six years as the shortage in properties in the English capital and the new credit programs bolstered values.

In Japan, investors grew concerned over the fact that government bond yields reached the highest in over 12 months, prompting the Yen to rally for a third day versus the U.S. Dollar. The Yen also went up against the majority of its counterparts after the central bank’s Governor, Haruhiko Kuroda, indicated that the bank may be able to handle a hike in interest rates.

Lastly in the South Pacific, the Australian and New Zealand Dollars weakened as a slowdown in the Chinese economy has raised speculations demand for commodity exports may drop. The Aussie extended losses versus the greenback in anticipation of U.S. reports which are likely to indicate that Consumer Confidence improved, a factor that may convince the Federal Reserve to slow stimulus.

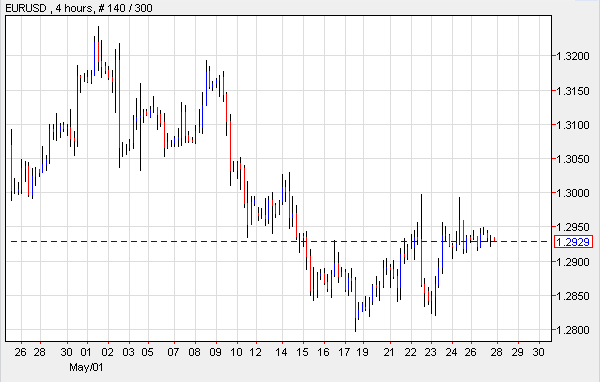

EUR/USD- Euro Settles Little Changed

An absence of market investors due to the holidays in the U.S. and in the U.K. caused the Euro to settle with little change made against the greenback at the start of the week. Meanwhile, releases showed that the Premier of China, Li Keqiang, indicated that the Euro’s stability would benefit China and the rest of the world, and the Troika suggested there are no reasons to ease Portugal’s deficit goals at this time.

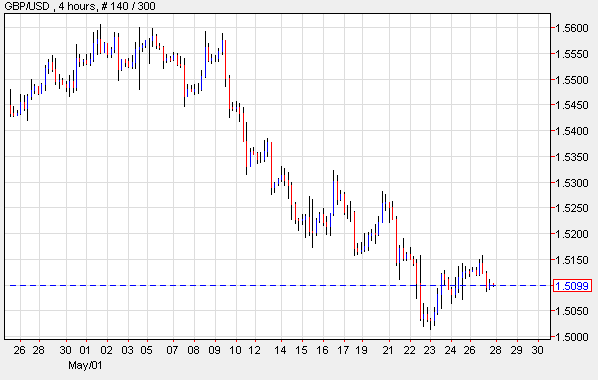

GBP/USD- Hone Prices Climb

The British Pound settled little changed after dropping slightly as investors remained on the sidelines to avoid the sporadic bouts of volatility in the market. The Sterling weakened despite economic reports which showed that House Prices in the U.K. climbed the most in six years. According to analysts, the shortage of properties in the English capital boosted values. And according to Hometrack Ltd., the average prices in Wales and England rose 0.4 percent, while in London, the property values went up 0.9 percent. Economists explained that the credit programs instituted by the Bank of England helped bolster lending conditions.

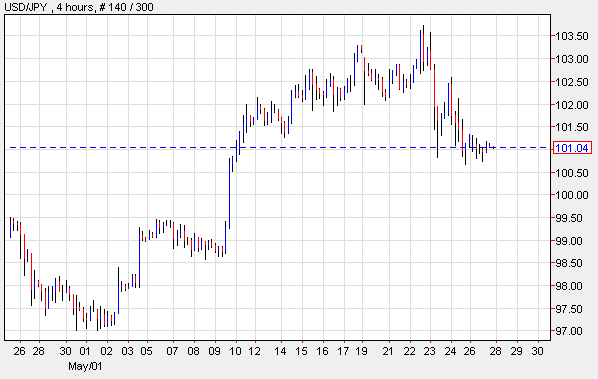

USD/JPY-Yen Rallies For Third Day

The Yen advanced for a third day in a row versus the U.S. Dollar on speculations the Bank of Japan is having a tough time controlling the increase in government bond yields. Officials from the central bank tried to ease investors especially after the Nikkei dropped over 7 percent; but the equity index continued to fall, losing a tad over 3 percent at closing. This dampened the allure of selling off the Yen to invest in higher yields abroad.

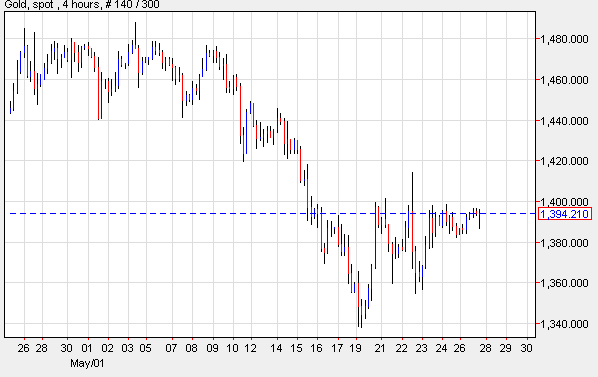

XAU/USD-Gold Edges Higher In Thin Trading

Gold Futures moved slightly higher on Monday as central banks increased purchases of the shiny metal. Futures for August delivery settled at $1,394.25 a troy ounce on the Comex Division of the New York Mercantile Exchange. Sentiment towards the precious commodity went up after reports from the International Monetary Fund revealed that Russia increased its holdings by 8.4 metric tons up to 990 tons, and Kazakhstan bought 2.6 tons to raise their total to 125.5 tons.

Today’s Outlook

Today’s economic calendar reveals that Switzerland will issue the Trade Balance. The Euro Region will release German Import Price Index and French Consumer Confidence. The U.S. will report on CB Consumer Confidence. Japan will announce Retail Sales; and Australia will publish data on HIA New Home Sales.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Daily Report: US Dollar Traded Lower Against Yen, Euro

Published 05/28/2013, 03:22 AM

Updated 09/16/2019, 09:25 AM

Daily Report: US Dollar Traded Lower Against Yen, Euro

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.