The U.S. Dollar traded erratically, as uncertainty over what the Federal Reserve will do in regards to the monthly asset purchases intensified, especially after the Beige Book indicated that the U.S. economy grew at a “modest to moderate” pace in the majority of the Federal Reserve districts. The central bank is scheduled to meet on the 18th and 19th of June to assess whether the increases in payrolls are sufficient to warrant scaling back on stimulus. The greenback dipped versus the Yen and the British Pound, but it traded steady against the Euro and rallied versus the South Pacific monetary units. Investors continued to focus on U.S. employment while anxiously awaiting the results for Friday’s Non-Farm Payroll reports.

On the data front, the ISM Non-Manufacturing Index climbed from 53.1 to 53.7 last month, suggesting that the sector has improved slightly. But optimism ebbed quickly, as one release confirmed that employment slipped from 52 to 50.1 in the same period. The Payroll Processor ADP announced that Non-Farm Private Payrolls surged by 135,000 in May, while economists had predicted they would rise by 165,000. Separate reports from the Commerce Department denoted that U.S. Factory Orders climbed 1 percent in April, rather than the anticipated 1.6 percent. Gold Prices inched higher after private news showed that the Job’s sector missed forecasts, reigniting the possibility the Federal Reserve may leave stimulus unchanged while continuing to purchase $85 billion in assets per month. Gold Futures for August delivery settled at $1,403.05 a troy ounce on the Comex Division of the New York Mercantile Exchange.

The Euro traded mixed against the greenback subsequent to private data which showed that hiring by U.S. companies trailed predictions in the month of May. Lackluster metrics rekindled speculation that the Federal Reserve may leave the current stimulus measures in place. The shared currency came under pressure when official figures out of the E.U. revealed that the Services Sector slowed down and Retail Sales declined. Today, the European Central Bank will issue its decision on the key cash rate while its President, Mario Draghi, readies to hold a press conference. The British Pound touched three-week highs against the greenback as domestic industry reports showed that the U.K.’s Services Output rose more than expected, thereby suggesting the economy is gaining strength. The Sterling traded at the highest price in two weeks versus the Euro on data which supported the likelihood the Bank of England will refrain from expanding its quantitative easing program at this time.

The Yen advanced against the greenback while market investors were disappointed by weak private sector job reports which bolstered speculation that the Federal Reserve will leave stimulus at the same level. The Yen remained strong as Japan’s Prime Minister, Shinzo Abe, refrained from offering clues on whether the bank will increase monetary stimulus.

Lastly, in the South Pacific, the Australian and New Zealand Dollars dipped versus their U.S. counterpart as investors await Friday’s employment releases. In Australia, data showed that the economy advanced at the slowest pace in close to two years.

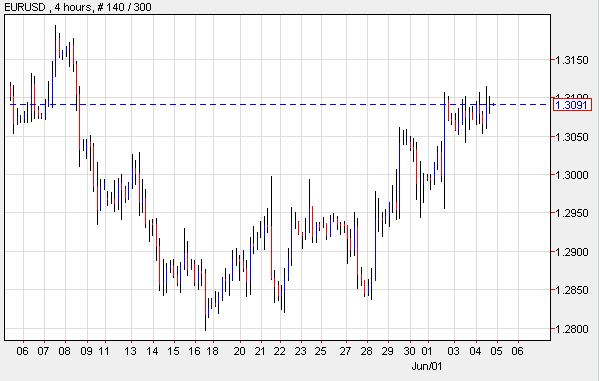

EUR/USD-Euro Region Experiences Declines

The Euro traded mixed but hit session lows against the greenback after data revealed that the Euro-zone’s Purchasing Manager’s Index slipped from 47.5 to 47.2 in May, denoting that the Services sector has slowed down. The shared currency slipped further after a release indicated that Retail Sales plunged 0.5 percent in April, surpassing forecasts for a 0.1 percent drop. For now, investors are keeping an eye on bond auctions to be held in Spain and France, and on the ECB’s decision regarding the benchmark interest rate. Uncertainty over the European Central Bank’s decision weighed on the currency throughout the day. EUR/USD" title="EUR/USD" width="599" height="381">

EUR/USD" title="EUR/USD" width="599" height="381">

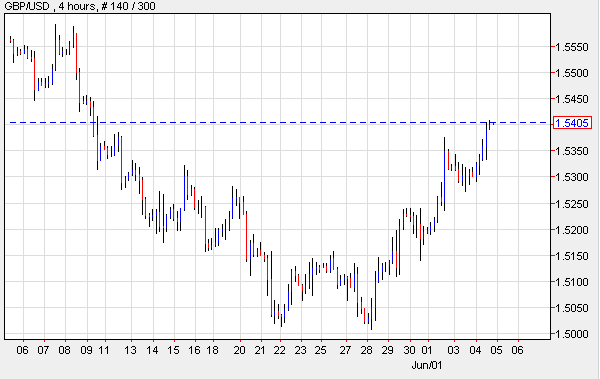

GBP/USD-Services Output Boosts Pound

The British Pound reached a three-week high versus the greenback after the U.K. releases positive data from Markit Economics and the Chartered Institute of Purchasing and Supply, indicating that the Index of Service Industries expanded from 52.9 to 54.9 in May, surpassing forecasts for gains of 53; it also denoted that it grew the most since spring of 2012. Other Markit releases issued earlier in the week showed that Manufacturing and Construction advanced. Yesterday’s data increased speculation the Bank of England may not opt for expanding easing. GBP/USD" title="GBP/USD" width="600" height="379">

GBP/USD" title="GBP/USD" width="600" height="379">

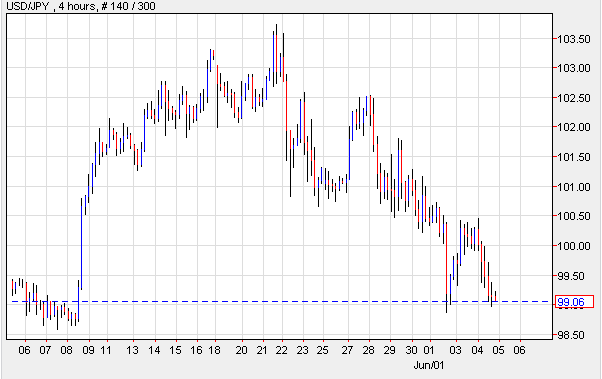

USD/JPY- Yen Gains On Speech

The Yen advanced against the U.S. Dollar after the Prime Minister of Japan, Shinzo Abe issued a speech wherein he refrained from offering clues as to whether the central bank will increase stimulus. Mr. Abe spoke of the bank’s plans to fight deflation and delineated his program to accomplish 2 percent growth per year over the next ten years. The Yen remained strong after the U.S. released lackluster data which prompted investors to speculate the Federal Reserve may leave stimulus unchanged; and it rallied further as the Nikkei plunged 3.8 percent after the Premier’s speech. USD/JPY" title="USD/JPY" width="602" height="379">

USD/JPY" title="USD/JPY" width="602" height="379">

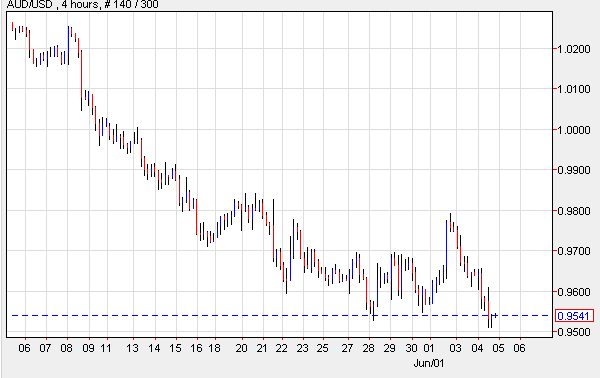

AUD/USD- Aussie Dips On Growth

Australia’s Dollar weakened against its U.S. counterpart after domestic reports indicated that the country’s economy expanded at 0.6 percent in the initial three months of 2013, while economists predicted 0.8 percent growth. The lackluster metrics indicated that the economy slowed to the least in close to 24 months, increasing the possibility the Reserve Bank will lower the borrowing costs. For now, the RBA left the benchmark rate unchanged at a record low of 2.75 percent and suggested that the current inflation outlook has left room for future easing. AUD/USD" title="AUD/USD" width="600" height="378">

AUD/USD" title="AUD/USD" width="600" height="378">

Today’s Outlook

Today’s economic calendar shows that the U.K. will report on the Halifax House Price Index, the Interest Rate Decision and the BOE Q.E. Total. Switzerland will release CPI. The Euro region will announce the ECB’s Rate Decision. And the U.S. will publish Initial and Continuing Jobless Claims.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Daily Report: US Dollar Traded Erratically On Fed's Purchase Policy

Published 06/06/2013, 06:44 AM

Updated 09/16/2019, 09:25 AM

Daily Report: US Dollar Traded Erratically On Fed's Purchase Policy

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.