The U.S. Dollar strengthened against the majority of its trading counterparts as more positive data continued to flood in, and as China disappointed investors with lackluster economic reports revealing that Industrial Production advanced 9.3 percent last month, which was less than forecast. In the U.S., Retail Sales climbed 0.1 percent in April, prompting the greenback to trade at new highs against the Euro, Yen and Australian Dollar. And while the rate of increase seemed to be rather small, other releases confirmed that the U.S. economy expanded at 8 times the pace of the U.K.’s. According to analysts, improvements in the employment sector and in the equities markets raised confidence amidst American consumers. The fact that Retail Sales climbed also raised speculation that the Federal Reserve may start reducing the monthly asset purchases. Meanwhile, gold extended losses after the U.S. announced an increase in Retail Sales, bolstering demand for the U.S. monetary unit. Gold Futures for June delivery dropped 0.21 percent and settled at $1,433.65 a troy ounce on the Comex Division of the New York Mercantile Exchange.

Surprisingly better than expected Retail Sales figures out of the U.S. prompted the Euro to decline, especially as market investors speculated that the Federal Reserve will begin to taper off stimulus as the U.S. economy is showing a strong recovery. The shared currency remained under pressure as Friday’s reports indicated that Italy’s Industrial Production fell 0.8 percent in March, and Unemployment in Greece and Portugal surged dramatically. Continued talk suggesting the European central bank may lower the benchmark interest rate also weighed on the 17-nation currency. Today, investors will pay close attention to data on German Economic Sentiment as it’s a valuable indicator of the region’s overall health. The British Pound traded at a two-week low versus the greenback after the U.S. reported increases in Retail Sales, prompting investors to buy the currency. The Sterling weakened against 12 of its most traded 16 peers despite that the U.K.’s business lobby stated that company sentiment rose.

The Yen extended losses against the U.S. Dollar on economic data showing that Retail Sales beat predictions, and remained low as speculators anticipate the Federal Reserve will reduce the amount of monthly asset purchases. The Yen rebounded slightly after it became apparent that the G-7 refrained from focusing on Japan’s stimulus measures and agreed to accept the currency’s depreciation for the time being. The wealthy industrialized G-7 nations concluded that the Bank of Japan implemented such measures in an effort to bolster economic growth.

Lastly, in the South Pacific, Australia’s Dollar slipped toward 11-month lows versus the greenback after a release revealed that Business Confidence in the South Pacific nation declined, increasing the possibility the Reserve Bank may lower the key cash rate. The Aussie fell against most of the majors as Barclay’s Plc reduced its forecast for the monetary unit explaining this was due to the Aussie’s falling yield advantage. The New Zealand Dollar reached a five-week low versus the greenback after the country’s 10-year note rate over Treasuries came close to a four-year low.

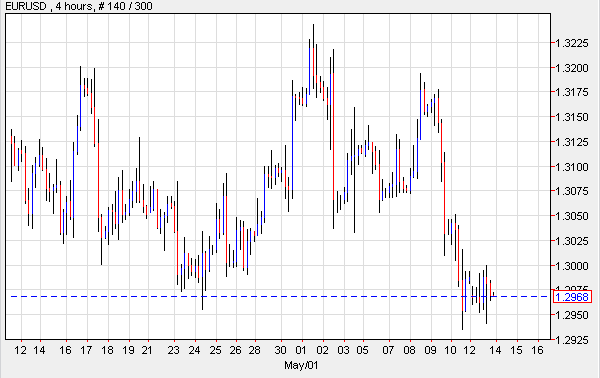

EUR/USD- E.U. Recession Is Longer Than Expected

The Euro traded mixed against the greenback but declined after the U.S. reported surprisingly higher Retail Sales for the month of April. The shared currency remained under pressure as investors anticipate this week’s data will show that the Euro region is experiencing the longest recession since the creation of the Euro monetary currency. Analysts believe this is the result of the sovereign debt crisis and current austerity measures. The Euro-zone’s Finance Ministers met yesterday in Brussels to talk about the situation, especially since the European Commission lowered the forecast for this year and said that the region’s economy will contract by 0.4 percent. The area’s Ministers also spent time reviewing the bailout programs for Greece, Spain and Cyprus. EUR/USD" title="EUR/USD" width="600" height="378">

EUR/USD" title="EUR/USD" width="600" height="378">

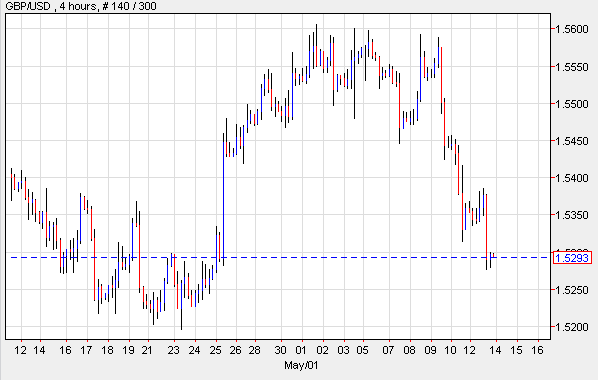

GBP/USD- Sterling Drops On U.S. Sales

The British Pound traded at two-week lows against the U.S. currency after the Commerce Department stated that U.S. Retail Sales climbed 0.1 percent last month, even as economists predicted a 0.3 percent drop. The report bolstered optimism the Federal Reserve will put an end to the current easing program earlier than anticipated. Meanwhile, the Confederation of British Industry indicated that the country’s economy will expand 1 percent in 2013 and 2 percent in the coming year. GBP/USD" title="GBP/USD" width="598" height="380">

GBP/USD" title="GBP/USD" width="598" height="380">

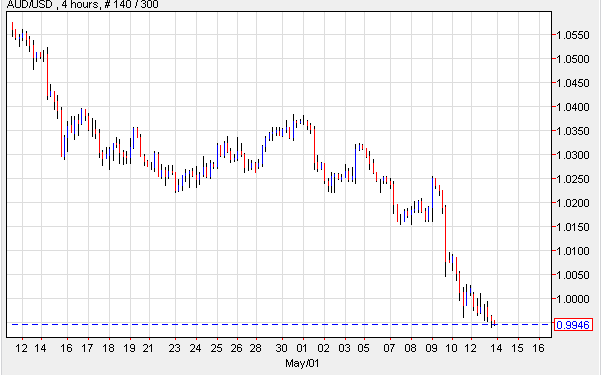

AUD/USD- Aussie Falls to 11-Month Lows

Australia’s Dollar traded close to 11-month lows following the release of the National Australia’s Bank private reports which showed that Business Confidence dipped to -2 in April, the lowest since November of 2012. The currency remained under pressure despite positive data showing that Home Loan Approvals climbed 5.2 percent, the most in four years. Economists anticipate the Reserve Bank will hold off from cutting the benchmark interest rates; however, speculators believe Business Confidence ebbed on the possibility the central bank will cut the key cash rate to prevent the currency from appreciating. Demand for the so-called Aussie improved slightly upon the release of Chinese data which revealed that Industrial Production rose 9.3 percent last month. AUD/USD" title="AUD/USD" width="601" height="375">

AUD/USD" title="AUD/USD" width="601" height="375">

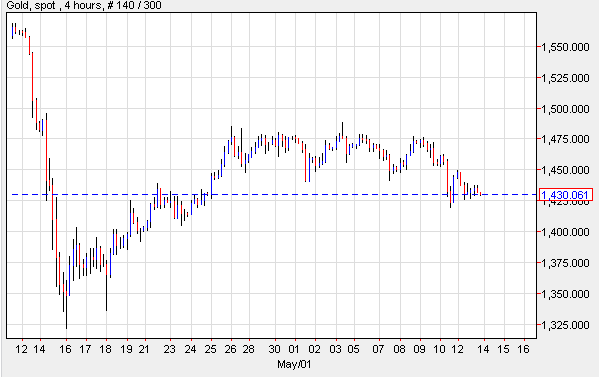

XAU/USD-Gold Drops As Sales Firm Up

Gold futures dropped, capping their longest decline in over one month, as holdings which are backed by the precious metal in the Comex Division of the New York Mercantile Exchange also fell to the lowest since the summer of 2011. Gold prices extended losses after the U.S. Commerce Department reported a surprising advance in Retail Sales for April, bolstering speculations the Federal Reserve will begin to taper the monthly asset purchases. Gold Futures for June delivery settled at $1,433.65 a troy ounce. XAU/USD" title="XAU/USD" width="600" height="377">

XAU/USD" title="XAU/USD" width="600" height="377">

Today’s Outlook

Today’s economic calendar shows that the Euro region will report on German, Italian and Spanish CPI, Industrial Production, ZEW Economic Sentiment and German ZEW Economic Sentiment. The U.S. will release the Import Price Index. Japan will issue the Tertiary Industry Activity Index. And Australia will publish the Wage Price Index.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Daily Report: US Dollar Strengthened Against Majority Of Its Peers

Published 05/14/2013, 06:13 AM

Updated 09/16/2019, 09:25 AM

Daily Report: US Dollar Strengthened Against Majority Of Its Peers

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.