The U.S. Dollar rallied to nine-month highs versus most of the majors, but struggled to retain its strength following a flurry of disappointing economic data. Official metrics showed that Manufacturing slowed down and Industrial output declined. Other releases showed that according to Producer Price gauges, inflation eased while foreign investors purchased fewer U.S. Dollars during the month of March. Metrics issued by the government revealed that Industrial Production in the U.S. dipped more than predicted in April and contracted 0.5 percent. The U.S. Department of Labor indicated that the Producer Price Index dropped 0.7 percent last month while analysts had anticipated a 0.6 decline. Further announcements confirmed that Consumer Price Inflation, which doesn’t include food and energy, climbed 0.1 percent in April. The regional Manufacturing gauge also disappointed; the Federal Reserve Bank of New York’s Empire State Manufacturing Index went from 3.1 to -1.4 in May. But despite the lackluster string of announcements, weak data out of the Euro-zone helped bolster demand for the U.S. Dollar. Meanwhile, Gold Futures slipped beneath $1,400 a troy ounce as the precious metal extended losses and sustained the longest decline in close to three months as the greenback’s advance reduced demand for gold as an alternate investment. Gold Futures for June delivery settled at $1,396.20 on the Comex Division of the New York Mercantile Exchange.

The Euro plunged against the U.S. Dollar after economic reports disappointed market investors. The shared currency sustained a major decline as risk appetite ebbed on speculation the European Central Bank may loosen monetary policy and as official figures revealed that the E.U. recession extended into another quarter while Germany’s economic growth slowed down. The British Pound rallied the most in two weeks versus the 17-nation currency after the Bank of England stated that the U.K.’s economic growth may accelerate this quarter. The Sterling rallied against the majority of its counterparts on headlines confirming lower inflation and slight growth, which helped fuel optimism that recovery was now a possibility.

The greenback traded close to four-and-a-half year highs versus the Yen as investors anxiously awaited the release of important U.S. economic data later in the day. In Japan, Tertiary Industry Activity fell more than expected –another factor that weighed on Japan’s monetary unit.

Lastly, in the South Pacific, Australia’s Dollar traded at 11-month lows after the nation’s bond’s premium contracted the least in one year over that offered by U.S. Debt. This reduced demand for the Aussie as a high-yield currency.

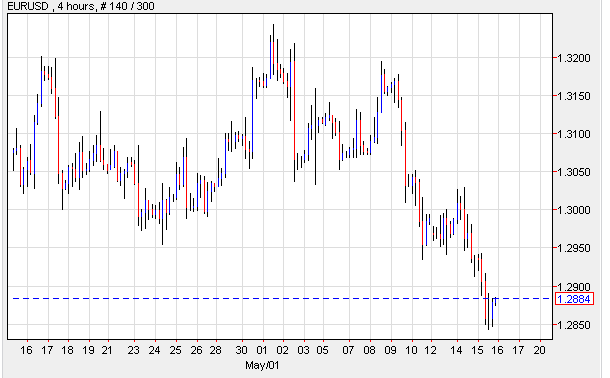

EUR/USD- Data Disappointed

The 17-nation currency traded lower against the greenback after a flurry of economic indicators left market investors disappointed and concerned over whether the European Central Bank may opt for further loosening of the current monetary policy. In the Euro-zone, preliminary releases indicated that Gross Domestic Product shrank 0.2 percent in the first three months of the year, while analysts called for a 0.1 percent contraction. Furthermore, Germany’s Gross Domestic Product climbed less than forecast and only expanded 0.1 percent, while economists expected the region’s biggest economy to grow 0.3 percent in the initial quarter of 2013. YoY, Germany’s economy grew less by 1.7 percent. All these metrics fueled speculations the central bank may cut the benchmark interest rate as the region continued in a recession. Today, investors will pay close attention to data releases on Consumer Price Inflation and French Non-Farm Payrolls. EUR/USD" title="EUR/USD" width="610" height="378">

EUR/USD" title="EUR/USD" width="610" height="378">

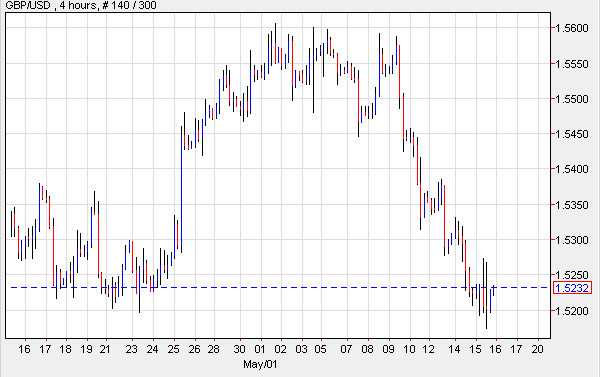

GBP/USD-BOE Sees Recovery In Sight

The British Pound rallied against the greenback after U.S. economic data disappointed investors, and as the Bank of England issued the Inflation report wherein it forecast that the country’s economic growth may accelerate to 0.5 percent in the second quarter of the year. The central bank also indicated that in the next three years, inflation may reach a maximum of 3.1 percent. Other official metrics revealed that the number of unemployed individuals fell by 7,300 in April, which is more than predicted, and the Unemployment Rate dropped from 7.9 to 7.8 percent in March. The Sterling’s gains were limited as market investors shunned high risk assets in search of refuge. GBP/USD" title="GBP/USD" width="601" height="377">

GBP/USD" title="GBP/USD" width="601" height="377">

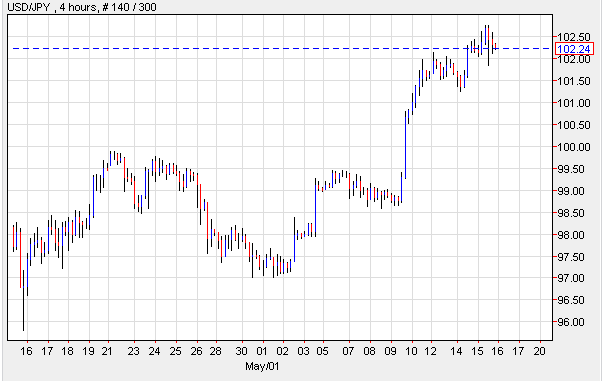

USD/JPY-Tertiary Industry Activity Drops

The U.S. Dollar rallied against the Yen and reached close to four-and-a-half year highs as previous strong economic data bolstered speculations the Federal Reserve may put an early end to the current easing program. In Japan, data showed that Tertiary Industry Activity fell 1.3 percent in March, which is more than the predicted 0.6 percent decline. The greenback was again the main driver, and it advanced after the S & P posted gains. USD/JPY" title="USD/JPY" width="606" height="381">

USD/JPY" title="USD/JPY" width="606" height="381">

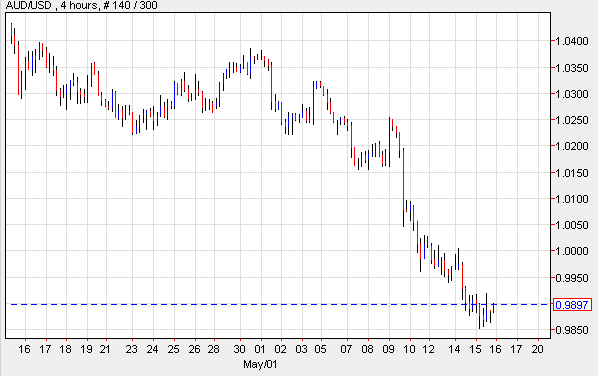

AUD/USD-Aussie Falls On Weak Metrics

Australia’s Dollar dropped to 11-month lows versus its U.S. peer subsequent to the release of lackluster domestic economic data, and as risk appetite ebbed in the market amid worries over the Euro-zone’s economic outlook. In Australia, reports showed that New Motor Vehicle Sales fell 1.6 percent last month, after posting a 0.5 percent decline in the prior month. Further releases revealed that the country’s Wage Price Index climbed 0.7 percent in the initial quarter of 2013 which is less than the predicted 0.8 percent. AUD/USD" title="AUD/USD" width="599" height="376">

AUD/USD" title="AUD/USD" width="599" height="376">

Today’s Outlook

Today’s economic calendar shows that Japan will release Industrial Production. The Euro region will report on Core CPI, CPI and Trade Balance. The U.S. will issue data on Building Permits, Initial and Continuing Jobless Claims, Core CPI, CPI, Housing Sales and the Philadelphia Fed Manufacturing Index. Lastly, New Zealand will announce PPI Input and Output.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Daily Report: US Dollar Rallied To Nine-Month Highs Vs. The Majors

Published 05/16/2013, 06:48 AM

Updated 09/16/2019, 09:25 AM

Daily Report: US Dollar Rallied To Nine-Month Highs Vs. The Majors

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.