The U.S. Dollar plunged against most of the majors as investors shied away from the greenback in anticipation of today’s Non-Farm Payroll reports, and as the market remains uncertain on whether the Federal Reserve will scale back on its monthly asset purchases. On the data front, the Labor Department reported that the number of people who filed for Unemployment benefits last week dropped by 11,000 to 346,000 while economists had anticipated a decline of 12,000. Furthermore, Unemployment Claims for the previous week were revised up to 357,000. Gold prices climbed after the European Central Bank indicated it will leave the benchmark interest rates unchanged and suggested the region’s economy will expand more than predicted in 2014. Comments by the European Central Bank’s President, Mario Draghi, bolstered the Euro’s value and prompted the greenback to weaken, a factor that boosted the price of the precious metal. Gold Futures for August delivery rose 1.20 percent and settled at $1,415.35 a troy ounce on the Comex Division of the New York Mercantile Exchange.

The Euro rallied after the European Central Bank decided to leave the interest rates at 0.50% and as Central Bank President Draghi issued positive statements which pushed the currency close to a four-week high. However, Mr. Draghi did not rule out the likelihood the bank may opt for negative deposit rates and stated that this option is being extensively discussed. Investors anticipate that the optimistic tone of the speech may be indicative of the fact that the ECB will refrain from expanding stimulus. The British Pound climbed the most since October of 2009 versus the U.S. Dollar after the Bank of England announced it won’t engage in additional easing as the economy has shown signs of improvement. The Sterling advanced against the majority of its counterparts after economic releases confirmed that House Prices went up for a fourth month in May.

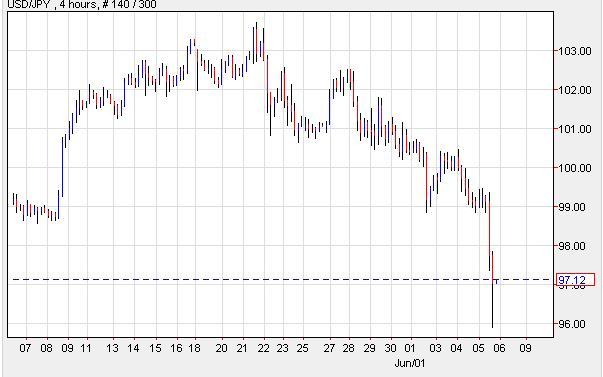

The Yen gained the most in more than 12 months versus the greenback and traded at a seven-week high as market investors reduced speculation on a weaker Japanese monetary unit following statements by Prime Minister Shinzo Abe. The Yen had begun to appreciate after the Prime Minister failed to offer details on further stimulus measures.

Lastly, in the South Pacific, Australia’s Dollar tumbled to the lowest price since 2011 as the country’s interest-rate differential contracted, dampening the appeal of the currency. The Aussie remained under pressure as investors predict the Reserve Bank may cut the costs of borrowing money by 41 basis points within the next year. New Zealand’s Dollar reached close to 11-month lows, despite the fact that demand for the U.S. currency was down in anticipation of today’s Non-Farm Payroll reports and a decision by the Federal Reserve on further asset purchases.

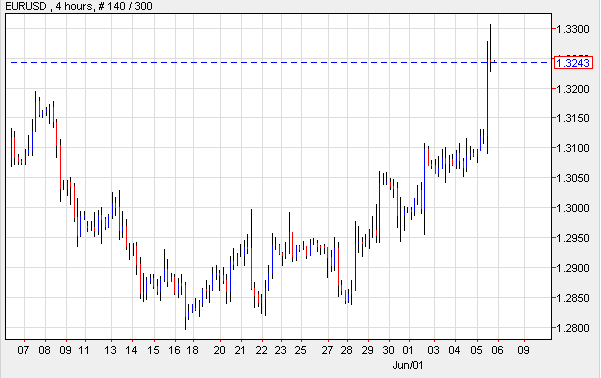

EUR/USD- ECB Leaves Rates At 0.50%

The Euro surged to three-month highs against the U.S. Dollar as the region’s central bank announced its decision to leave the benchmark interest rate at 0.5 percent. The shared currency benefitted further from comments by European Central Bank President Draghi in which he indicated that the E.U.’s economy is expected to contract 0.6 percent this year, but added that the region is forecast to expand 1.1 percent in 2014, rather than the previously predicted 1.0 percent. Today, Germany will issue data on Industrial Production and the Trade Balance.

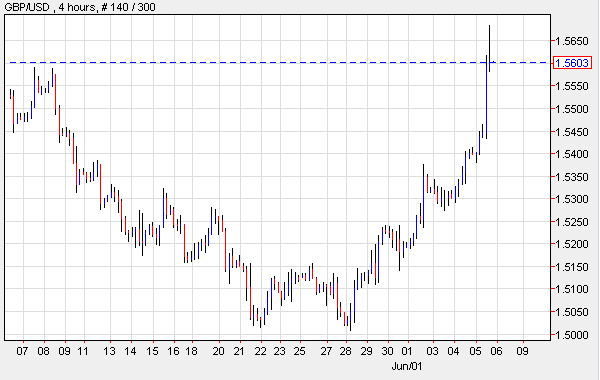

GBP/USD- Pound Rallies Most Since 2009

Britain’s Pound advanced the most in 4 years against the greenback after the Bank of England indicated it won’t expand the current asset purchasing program. The BOE kept the target for asset purchases at 375 billion Pounds; and policy makers held the country’s interest rate at 0.5 percent. In addition, Halifax, the Mortgage division of Lloyd’s Banking Group Plc stated that Home Prices climbed 0.4 percent last month to an average of 166,898 Pounds. Homes in the U.K. have reached their highest value since August of 2010.

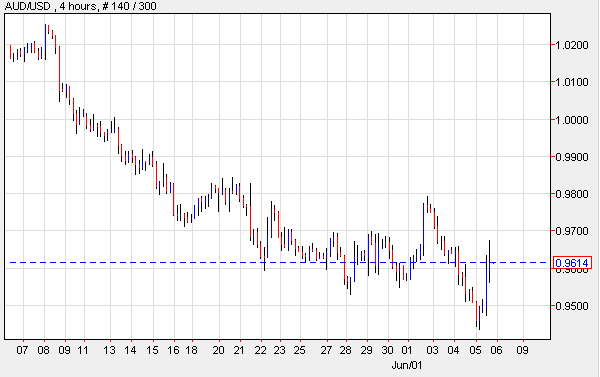

AUD/USD-Aussie Plunges Most Since 2011

Australia’s Dollar plummeted to the lowest since 2011 as the nation’s interest rate advantage shrunk, ebbing the currency’s appeal. The Aussie was also weighed down by a drop in Asian stocks, and a dip in demand for risk currencies. The South Pacific currency fell further, reaching 20-month lows after domestic data indicated that the nation’s Trade Surplus contracted more than anticipated. According to official figures, the Trade Surplus went from AUD0.56 billion to AUD0.03 billion in April. The figures were issued one day after Australia reported that Gross Domestic Product increased 2.5 percent in the initial quarter of 2013, denoting it grew at the slowest rate in 24 months.

USD/JPY- Yen Touches Seven-Week Highs

The currency markets were quite volatile as the President of the European Central Bank held a press conference. Meanwhile, the Nikkei dropped another 0.85 percent which means it has now declined close to 20 percent from its highs. But this didn’t prevent the Yen from surging against the U.S. Dollar, or from rallying the most in 3 years. This took place a day after the country’s Prime Minister, Shinzo Abe indicated the legislature is working on loosening rules for businesses; however, he failed to offer clues on whether the central bank will expand stimulus. At this time, investors anticipate the Yen won’t weaken further, especially since the Bank of Japan has not signaled it will engage in additional easing.

Today’s Outlook

Today’s economic calendar shows that the U.K. will report on the Trade Balance and Inflation Expectations. Japan will issue the Leading Index. The U.S. will announce Non-Farm Payrolls, Private Non-Farm Payrolls, Unemployment Rate, Average Weekly Hours and Average Hourly Earnings. Lastly, China will publish the Trade Balance.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Daily Report: US Dollar Plunges In Anticipation of Jobs Report

Published 06/07/2013, 04:49 AM

Updated 09/16/2019, 09:25 AM

Daily Report: US Dollar Plunges In Anticipation of Jobs Report

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.