The Forex market experienced a burst of activity following the long holiday weekend in the U.S. and the U.K. The U.S. Dollar advanced against most of its peers as reports confirmed that Consumer Confidence for the world’s biggest economy jumped to the highest level in five years while Home Prices climbed the most in seven years. Due to the recovery of the employment sector and a consistent increase in the equities market, confidence by consumers went from 69 to 76.2 in May. Furthermore, the Richmond Fed Manufacturing Index went from -6 to -2. And while this marked a second decline in manufacturing, the improvement was encouraging. Furthermore, House Prices rose 1.12 percent in March, posting a hike of 10.17 for the quarter.

The line-up of economic metrics raised speculation that the Federal Reserve may scale back its monthly asset purchases in the near future. In the meantime, the International Monetary Fund’s morning report took center stage as it revealed that central banks have purchased more gold to add to their reserves. As a matter of fact, the report indicated that Russia increased its holdings by 75 percent while affirming its position as the number one buyer of the precious metal. However, gold prices declined after they reached $1,400.00 a troy ounce amid speculation the Federal Reserve may put an early end to stimulus. Gold Futures for August delivery settled at $1,379.70 a troy ounce on the Comex Division of the New York Mercantile Exchange.

The Euro depreciated versus the U.S. Dollar after official industry releases showed that U.S. Consumer Confidence surged, rekindling the possibility the Federal Reserve may cut back stimulus. The shared currency weakened against the Sterling and the Yen as investors await today’s economic reports on Germany’s Consumer Price Inflation and Changes in Employment. The Euro remained under pressure as private releases denoted that Housing Costs in Germany’s biggest towns rose at the quickest rate since 1990, a factor that’s said to be a threat to Chancellor Angela Merkel’s chances for re-election. The British Pound dipped versus the greenback following the announcement of strong U.S. economic data, and it remained low on news that four of the largest banks in the U.K. will cut 189,000 payrolls by the end of 2013.

In Japan, the Yen slumped against the greenback subsequent to the release of industry figures which revealed a substantial increase in U.S. Consumer Confidence. Japan’s monetary unit fell against the majority of its counterparts after a close advisor to the country’s Prime Minister, Shinzo Abe, indicated that the central bank may consider expanding stimulus should the need arise.

Lastly, in the South Pacific, Australia’s Dollar traded very close to 1 ½ year lows as investors looked forward to reports out of the U.S. and as they predicted Consumer Confidence and Manufacturing would show improvements. The Aussie managed to rebound against the Yen on indications the currency’s four-day decline happened at an excessive pace. And New Zealand’s Dollar rose versus the greenback amid increasing speculation that the Federal Reserve may end its bond-purchasing program early.

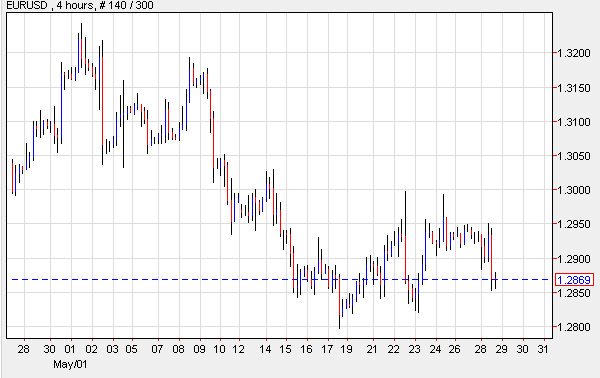

EUR/USD- Euro Trades Quietly

The Euro traded quietly and dipped against the U.S. Dollar after the U.S. reported stellar economic data which showed a remarkable increase in Consumer Confidence. The Euro has remained under pressure especially as the European Central Bank issued comments regarding the possibility of implementing negative interest rates. At this time, the deposit rate is at zero and the bank plans to continue with its expansive monetary measures to bolster the region’s economic growth. At the start of the week, Joerg Asmussen suggested that the ECB isn’t meant to change monetary policy in order to fix all economies. EUR/USD" title="EUR/USD" width="560" height="323">

EUR/USD" title="EUR/USD" width="560" height="323">

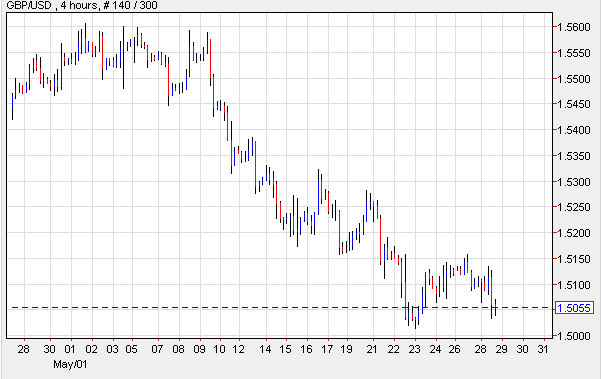

GBP/USD- Banks Will Cut Payrolls

The British Pound extended losses against the U.S. Dollar following the release of positive economic data which confirmed that Consumer Confidence surged the most in five years. And while the banking sector is under pressure to lower fixed costs because the debt crisis in the Euro region has dampened income from investments, four major U.K. banks announced they’ll be cutting 189,000 jobs by the end of this year. This suggests that employment will hit nine-year lows or perhaps lower, as further cuts may take place. According to economists, bond sales and firings have contributed to the decision regarding payrolls. GBP/USD" title="GBP/USD" width="601" height="379">

GBP/USD" title="GBP/USD" width="601" height="379">

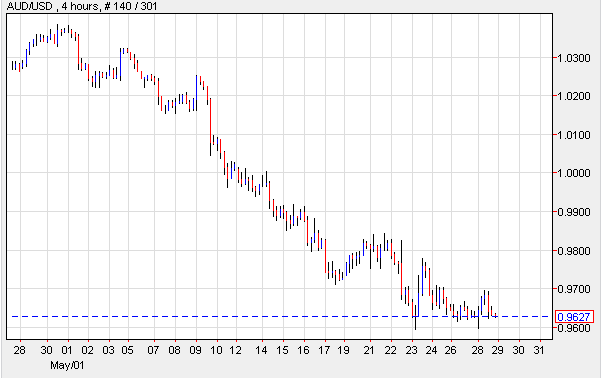

AUD/USD- Aussie Close To 1 ½ Year Lows

Australia’s Dollar traded close to 1 ½ year lows against its U.S. counterpart as investors awaited the announcement of significant economic data on Consumer Confidence and Manufacturing and they speculated the Federal Reserve may trim stimulus should the economy show signs of improvement. In the prior week, lackluster reports out of China raised the possibility demand for commodity exports from Australia may drop, and prompted the currency to depreciate. AUD/USD" title="AUD/USD" width="601" height="378">

AUD/USD" title="AUD/USD" width="601" height="378">

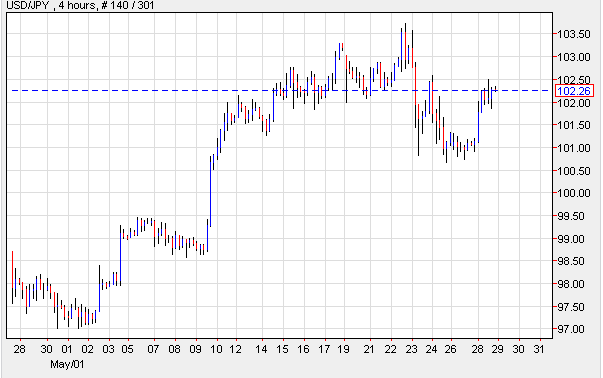

USD/JPY-Greenback Rebounds

The U.S. Dollar rebounded against the greenback on the possibility the Federal Reserve may trim stimulus. The Yen extended losses against the greenback once the Nikkei stabilized following very volatile days, and remained weak despite the fact that the yields on 10-year government bonds climbed, coming close to a 1 percent high. Today, Japan will issue reports on Retail Sales. USD/JPY" title="USD/JPY" width="603" height="378">

USD/JPY" title="USD/JPY" width="603" height="378">

Today’s Outlook

Today’s economic calendar shows that the Euro region will report on Private Loans, German CPI and M3 Money Supply. The U.K. will announce data on the CBI Distributive Trades Survey. New Zealand may issue metrics on Building Consents. Australia will publish Building Approvals and Private New Capital Expenditures. And Japan will provide information on Foreign Bonds Buying.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Daily Report: US Dollar Advanced Against Most Of Its Peers

Published 05/29/2013, 05:26 AM

Updated 09/16/2019, 09:25 AM

Daily Report: US Dollar Advanced Against Most Of Its Peers

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.