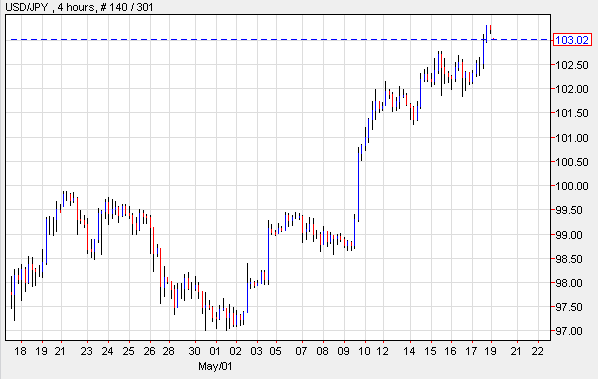

Friday’s economic reports indicated that U.S. Consumer Sentiment climbed to the highest level since 2007 while the index of Leading Indicators more than doubled economists’ forecasts, two factors that caused the U.S. Dollar to rally versus the majority of its trading counterparts and prompted it to trade above 103 per Yen. The greenback remained strong amid speculation these signs of recovery could result in the Federal Reserve reducing monthly asset purchases. According to the University of Michigan, Consumer Sentiment climbed from 76.4 to 83.7 in May; and separate releases by the Conference Board showed that the Index of Leading Economic Indicators rose 0.6 percent last month. In addition, the Dollar Index reached record highs for the current year. The metrics followed lackluster announcements issued on Thursday which bolstered concerns over the U.S. economic recovery.

In the days to come, market investors will shift their focus to the release of the Federal Reserve’s minutes and any remarks that Fed Chairman, Ben Bernanke, will issue regarding monetary policy. In the meantime, gold prices headed for the longest decline in four years as the greenback rallied to a 34-month high and the President of the Federal Bank of San Francisco, John Williams, suggested that the central bank may begin reducing its asset purchases by as soon as this summer. Gold Futures for June delivery slumped 1.6 percent and settled at $1,364.70 a troy ounce on the Comex Division of the New York Mercantile Exchange. According to analysts, gold prices dipped 19 percent in 2013 and have fallen into a dovish market as investors lost faith in the precious metal while stocks have appreciated on signs the U.S. economy is gaining momentum.

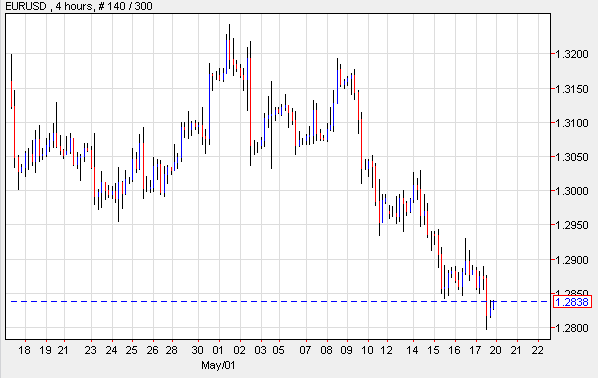

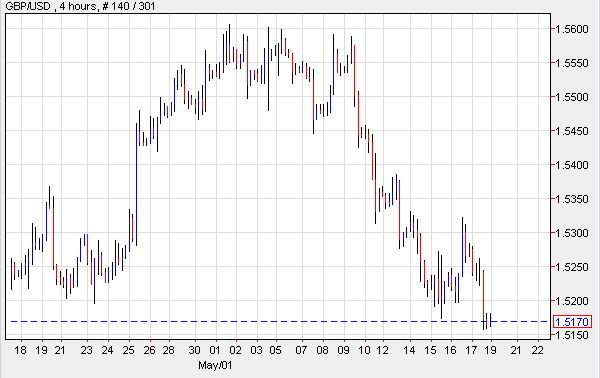

The Euro depreciated as the U.S. Dollar advanced; however, its decline was somewhat due to the fact that investors remained concerned over ECB policies and the continuation of the recession. The 17-nation currency was also weighed down by the possibility the European Central Bank may cut the rates on overnight deposits made by the region’s banks; these cuts may cause the rate to go into negative territory. And while there were no economic releases out of the U.K. at the end of last week, the British Pound traded at six-week lows against the greenback on speculation the Federal Reserve may be close to putting an early end to stimulus, The Sterling reached six-week lows on comments made by the President Williams of the Federal Bank of San Francisco in which he indicated that the central bank may start tapering off its asset purchases within the next few months. However, the Pound remained more or less unchanged versus the Euro as the Bank of England’s Committee increased the growth forecasts for the U.K.

The greenback not only gained versus the Yen, but traded beyond 103 per Yen for the first time in five years following the release of metrics which confirmed U.S. Consumer Confidence went up more than anticipated in May. The stellar figures raised the possibility the Federal Reserve could start to scale back its quantitative easing measures in the near future.

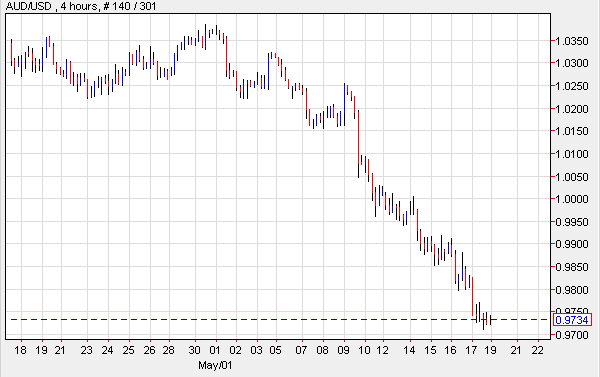

Lastly, Australia’s and New Zealand’s Dollars traded lower against the U.S. currency on Friday amid speculations over the Federal Reserve’s next monetary policy decisions. The Aussie dipped to 11-month lows on data which showed the country’s economy has deteriorated. This week, investors will pay close attention to reports on Australia’s Index of Leading Economic Indicators and the central bank’s Monetary Policy Minutes.

EUR/USD- ECB May Lower Rates

The shared currency fell against the greenback and traded at six-week lows after the gauge which measures U.S. Consumer Sentiment rose above forecasts. The currency was unable to rebound as investors continued to speculate the European Central Bank may be ready to cut the deposit rates. The shared currency faced major headwinds throughout the week, especially as the region issued lackluster Gross Domestic Product data; and its weakness prevailed given the low inflation metrics posted. Today, the market will pay close attention to reports on German Producer Price Inflation, an indicator that offers valuable information on consumer inflation. EUR/USD" title="EUR/USD" width="599" height="378">

EUR/USD" title="EUR/USD" width="599" height="378">

GBP/USD- Pound Drops Despite Recovery Outlook

The British Pound reached six-week lows against the greenback on the possibility the recent strong data out of the U.S. may prompt the Federal Reserve to start scaling down its monthly bond purchases as soon as this summer. The Sterling traded low despite comments by the Bank of England’s Governor, Mervyn King, wherein he suggested the country’s “recovery is in sight.” Mr. King indicated that the bank’s committee reduced its forecasts for inflation and increased its growth predictions. GBP/USD" title="GBP/USD" width="600" height="378">

GBP/USD" title="GBP/USD" width="600" height="378">

USD/JPY- Dollar Goes Beyond 103 Yen

Better than anticipated U.S. Consumer Sentiment data bolstered the greenback causing it to trade beyond 103 per Yen. Meanwhile, in Japan, reports revealed that the economy grew 0.9 percent in the initial quarter of 2013 while economists predicted it would only expand 0.7 percent. The annual rate of growth posted at 3.5 percent. The figures suggested the unprecedented easing measures are increasing consumer spending. Furthermore, the country’s exports improved as a result of the weak Yen. In the days ahead, the country will report on Trade Balance, and the Bank of Japan will issue the Interest Rate decision. USD/JPY" title="USD/JPY" width="599" height="379">

USD/JPY" title="USD/JPY" width="599" height="379">

AUD/USD-Aussie Ends Lower

Australia’s Dollar traded lower against the greenback at the end of last week as market investors continued to speculate the Federal Reserve may end stimulus earlier as the U.S. economy is showing signs of improvement. Meanwhile, Australia’s Treasurer, Wayne Swan suggested that the Aussie economy may expand 2.75 percent in the next 12 months which is below the predicted 3 percent. This week, the Reserve Bank will issue the Minutes from the most recent Monetary Policy meeting. AUD/USD" title="AUD/USD" width="600" height="377">

AUD/USD" title="AUD/USD" width="600" height="377">

Today’s Outlook

Today’s economic calendar is light. It shows that Australia will issue the Monetary Policy meeting Minutes and New Zealand will report on Inflation Expectations.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Daily Report: US Consumer Sentiment At Highest Level Since 2007

Published 05/20/2013, 05:50 AM

Updated 09/16/2019, 09:25 AM

Daily Report: US Consumer Sentiment At Highest Level Since 2007

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.