The forex markets opened the week in rather steady manner and major pairs and crosses are generally stuck in tight range. US and Canada are on holidays today and trading could remain subdued. Economic data released today triggered little reactions in the markets. Japan leading index dropped to 104.9 in July. German industrial production rose 0.7% mom in July. Eurozone Sentix investor confidence dropped to 13.6 in September. Swiss foreign currency reserves rose to CHF 540b in August. The US economic calendar is light this week and the greenback would likely stay firm as markets await FOMC rate decision next week. Focus will but turned to other countries as there will be three major central bank meetings scheduled, including BoC, RBNZ and BoE.

Canadian dollar was supported by rebound in crude oil recently. WTI is trading above 45 for the moment, 20% above last month's low of 37.75. However, recent data showed that Canada is now technically in recession. Real GDP contracted an annualized -0.5% in 2Q15, following a -0.8% decline in 1Q15. BoC is expected to keep policy rate unchanged at 0.50% this week. The accompanying statement would be an interesting one. The central bank could either sound dovish on the prospect of the economy. Or it could sound having worries eased by recent rebound in energy prices.

BoE policy decision is another key focus. The pound was one of the biggest gainer back in August but sentiments had a sharp turn recently. Ian McCafferty voted for a rate hike last month as BoE left interest rate unchanged. Markets are expecting the same voting pattern this week. However, if Ian McCafferty changes his mind in this week's vote, Sterling would be under some heavy selling pressure.

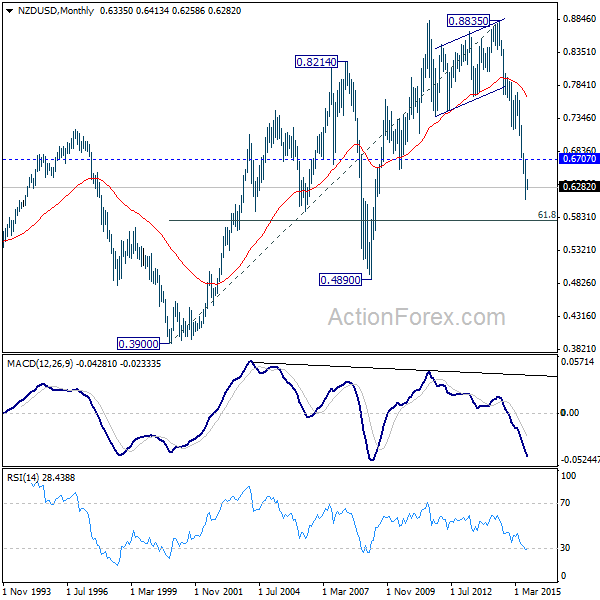

RBNZ is expected to cut OCR by -25 bps to 2.75% this week. New Zealand dollar has been one of the weakest on risk aversion as well as concern over slowdown in China. Bearishness in NZD/USD would likely continue in near term with 0.6707 resistance intact. From a larger perspective, the fall from 0.8835 is seen as a corrective move of the same degree as the up trend from 0.3900. There is no clear sign of bottoming yet. Deeper decline would be seen to 61.8% retracement of 0.3900 to 0.8835 at 0.5785.