New Zealand dollar stays soft today in spite of better than expected data. GDP grew 1.1% qoq in Q3, up from prior quarter's 0.7% qoq, and beat expectation of 0.8% qoq. Statistics New Zealand noted that the data points to "broad-based growth" with 13 of 16 industries up. Main weakness came from agriculture. Household spending "continued its strong growth" and jumped 1.6%. Exports volumes "remain high" even though growth fell over the quarter. Manufacturing activity also rose "on the back of food beverage, and tobacco manufacturing; and transport equipment, machinery and equipment manufacturing." Also from New Zealand, current account deficit widened to NZD -4.89b in Q3.

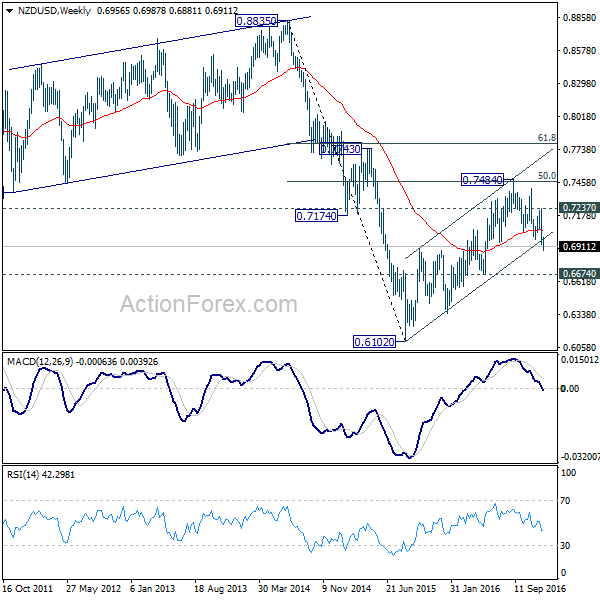

NZD/USD is staying in tight range of 0.69 at the time of writing. The medium term outlook ins the pair is cautiously bearish. The break of the channel support from 0.6102 argues that corrective rise from there is completed at 0.7484. This is supported by the rejection from 50% retracement of 0.8835 to 0.6102 at 0.7484, and break of 55 weeks EMA. Deeper decline is expected as long as 0.7237 resistance holds. Firm break of 0.6674 support will likely resume the larger down trend through 0.6102 low.

In UK, Gfk consumer confidence rose to -7 in December, above expectation of -8. Gfk noted that consumers "remain relatively confident about their personal financial situation." However, "confidence in the general economic situation...has collapsed in the face of uncertainty about the future both at home and abroad." And, "looking ahead to 2017, against a backdrop of Brexit negotiations, the decline in the value of sterling, and the prospect of higher inflation impacting purchasing power, we forecast that confidence will be tested by the storm and stress...of the year to come."

Elsewhere, the economic calendar in US is rather busy today ahead of holidays. US Q4 GDP, house price index, leading indicators and personal income will be featured. Canada will also release retail sales and CPI.