The U.S. Dollar rallied against the majority of its trading peers despite a lack of U.S. economic data, as investors await the Federal Reserve Chairman Ben Bernanke’s testimony on the country’s economic outlook before Congress, set later for today. The currency traded lower versus several of the majors after the President of the Federal Reserve Bank of Sr. Louis, James Bullard suggested that the central bank ought to continue with the monthly asset purchasing program in order to bolster economic growth. Meanwhile, gold prices resumed their decline on the possibility the Federal Reserve may cut back on the monthly bond purchases.

The Euro reversed early session losses and advanced versus the U.S. Dollar as market investors opted for risk assets ahead of the Federal Reserve Chairman’s testimony regarding the U.S. economy. The shared currency remained strong amidst talk suggesting that the improvements in the U.S. employment sector may convince the central bank to scale back stimulus. The British Pound plunged to a six-week low versus the greenback following the release of official government metrics which revealed that Inflation slowed more than predicted, providing the Bank of England with scope to expand stimulus. The Swiss Franc declined against the Euro and the U.S. monetary unit as the International Monetary Fund stated that negative interest rates on excess bank deposits may hurt Switzerland’s real estate market.

The U.S. Dollar pared gains against the Yen on comments by James Bullard, the President of the St. Louis Federal Bank, in which he indicated that the central bank ought to continue with the current level of quantitative easing. The Yen had declined earlier, after Economy Minister, Akira Amari retreated from previous comments issued over the weekend which caused the Japanese currency to rally. Mr. Amari has stated that a weak Japanese currency could hurt “people’s lives.”

Lastly, in the South Pacific, the Australian Dollar sustained the biggest hike in two months versus its U.S. peer in anticipation of today’s testimony before Congress by the Federal Reserve Chairman Bernanke. The Aussie recouped after two weeks of losses on speculations U.S. policy makers may cut the amount of monthly bond purchases. New Zealand’s Dollar reached three-day highs versus the greenback as investors remained jittery ahead of the Fed Chairman’s testimony, and was also supported as the Reserve Bank announced that its Inflation forecasts dropped from 2.2 to 2.1 percent in the initial quarter of 2013.

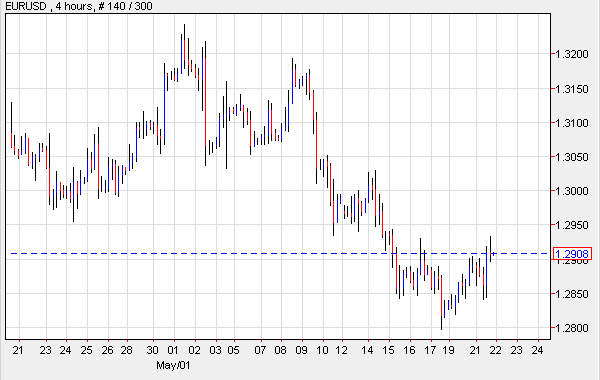

EUR/USD- Euro Gains Amid Fed Speculation

The Euro traded mixed against the U.S. Dollar throughout the day. First, it gained on the possibility the Federal Reserve’s Chairman, Ben S. Bernanke may maintain the current level of monthly asset purchases. It declined later on as investors began to speculate the improvements in the employment market may convince policy makers to scale back on the asset purchases. Meanwhile, newspaper reports in the Euro region indicated that Germany is preparing to implement treaty changes to make the decision-making process easier. EUR/USD" title="EUR/USD" width="600" height="380">

EUR/USD" title="EUR/USD" width="600" height="380">

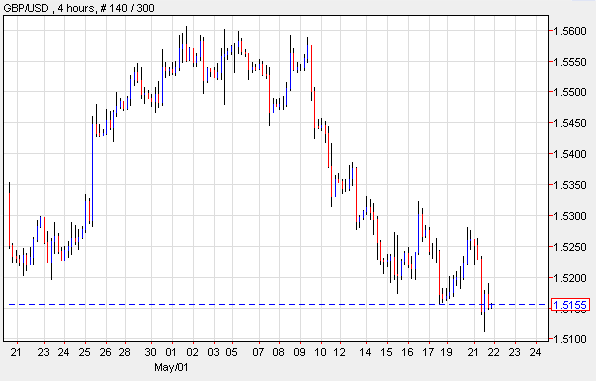

GBP/USD-Inflation Slows

The British Pound traded at a six-week low versus the greenback after government reports indicated that inflation slowed more than predicted. According to the Office for National Statistics, Consumer Prices rose 2.4 percent in April from the year before. The Sterling fell against all of its counterparts before the Bank of England releases the Minutes of the most recent Monetary Policy meeting. These are expected to confirm that policy makers voted to expand quantitative easing. GBP/USD" title="GBP/USD" width="597" height="381">

GBP/USD" title="GBP/USD" width="597" height="381">

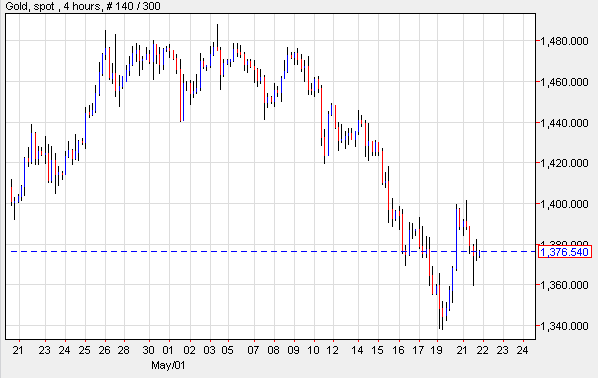

XAU/USD- Gold Dips Ahead OF Testimony

Gold Futures resumed their decline on the likelihood the Federal Reserve may reduce its monthly debt purchases, a factor that dampened demand for the precious metal. Gold prices edged lower during the U.S. trading session as speculations regarding the Fed Chairman’s testimony fueled a flight to safety. Gold Futures for June delivery slipped 0.50 percent and settled at $1,377.15 a troy ounce on the Comex Division of the New York Mercantile Exchange. XAU/USD" title="XAU/USD" width="599" height="378">

XAU/USD" title="XAU/USD" width="599" height="378">

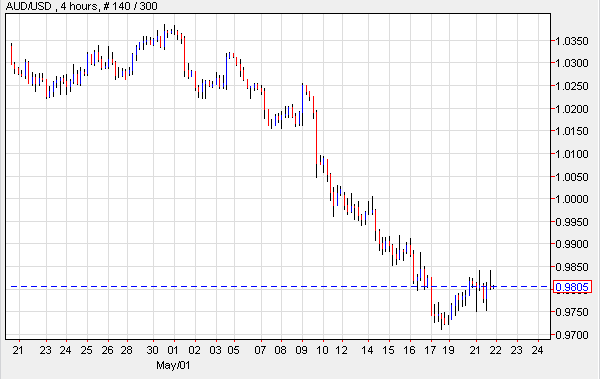

AUD/USD- Aussie Gains On RBA Comments

The Australian Dollar experienced the biggest increase versus the U.S. monetary unit as investors await for testimony by the Federal Reserve’s Chairman wherein he will provide the outlook for the U.S. economy. The Aussie retreated from two-week lows amidst speculations American policy makers may reduce stimulus. However, the currency dipped earlier before the Reserve Bank issued the Minutes from May’s Monetary Policy meeting. These showed the bank’s decision to cut the benchmark interest rate to a record low. The RBA also indicated that economic expansion may be slow in 2013 and could pick up momentum in 2014. Furthermore, the Conference Board showed that the Australian Leading Index climbed 0.1 percent in March after posting a 0.3 percent advance the prior month. AUD/USD" title="AUD/USD" width="601" height="379">

AUD/USD" title="AUD/USD" width="601" height="379">

Today’s Outlook

Today’s economic calendar shows that Japan may issue the Interest Rate Decision. The Euro region will report the Current Account. The U.K. will release data on Retail Sales, CBI Industrial Trend Orders, and the MPC Meeting Minutes. The U.S. will announce Existing Home Sales and the FOMC Meeting Minutes. Lastly, China will publish HSBC Manufacturing PMI.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Daily Report: Investors Await Bernanke's Testimony

Published 05/22/2013, 05:51 AM

Updated 09/16/2019, 09:25 AM

Daily Report: Investors Await Bernanke's Testimony

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.